Indian equities are expected to be range-bound on Friday, with a resistance level of 24,460. If the index holds at these levels, then they could see an extended rally.

If the NSE Nifty 50 falls below the 24,460 levels, then 24,170 and 24,000 will act as good support levels, according to Hrishikesh Yedve, AVP technical and derivatives research at Asit C Mehta Investment Intermediates Ltd.

"The next directional move is likely to come once this range is broken, and traders are awaiting a trigger for this momentum move," said Rajesh Bhosale, equity technical analyst at Angel One. However, looking at the overbought scenario across various parameters and the upcoming budget, he urged traders to book profits at higher levels.

Markets are also expected to react to U.S. inflation data that was released after trading hours on Wednesday. However, sector- and stock-specific actions continue as we enter the first quarter results season and ahead of the union budget, according to Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services Ltd.

"The IT sector will also be in focus as Tata Consultancy Services Ltd.'s results came in line with expectations," Khemka said. Overall strength is seen in the market as every dip is being bought, supported by strong domestic flows aided by foreign investor buying in the last few days, he said.

Nifty's fall below the support level could also trigger a price correction that could be "healthy" for the market ahead of earnings, Bhosale said.

Analysts also expect the Nifty Bank index to rise from its current levels.

"Bank Nifty has formed a Doji candlestick pattern on the daily chart," said Ruchit Jain, Lead Research, 5paisa.com. 51,750 will act as a support level for the index and if that stays intact, then the Nifty Bank index will witness an up move again from the current levels.

The GIFT Nifty was trading 12.5 points, or 0.05%, higher at 24,470.5 as of 07:13 a.m.

F&O Action

The Nifty July futures are up 0.11% to 24,382.65 at a premium of 66.7 points, with open interest down 3.08%.

Nifty Bank July futures are up by 0.23% to 52,439.45 at a premium of 168.8 points, while its open interest is down by 7.2%.

The open interest distribution for the Nifty 50 July 18 expiry series indicated most activity at 25,000 call strikes, with 23,500 put strikes having maximum open interest.

For the Bank Nifty options July 16 expiry, the maximum call open interest was at 54,000 and the maximum put open interest was at 52,000.

FII/DII Activity

Overseas investors turned net sellers of Indian equities on Thursday after being buyers for six days. Foreign portfolio investors offloaded stocks worth Rs 1,137 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors stayed net buyers for the fourth session and bought equities worth Rs 1,676.5 crore, the NSE data showed.

Market Recap

The benchmarks opened positively but relinquished all gains within the first hours of trading. Under pressure from selling, the Nifty fell below 24,200. However, it recovered all losses during the second half of the session, ultimately closing nearly unchanged.

The NSE Nifty 50 settled at 8.50 points or 0.04%, lower at 24,315.95, and the S&P BSE Sensex closed at 27.43 points or 0.03%, lower at 79,897.34.

During the day, the Nifty fell as much as 0.54% to 24,193.75, and the Sensex declined 0.58% to 79,464.38.

Only three out of the 12 sectors on the NSE declined. The Nifty Realty was the worst-performing sector, while Oil & Gas emerged as the top gainer.

The broader markets managed to hold their opening gains and outperform the benchmark indices, as the BSE MidCap and the SmallCap were trading 0.34% and 0.57% higher, respectively.

Fifteen out of the 20 sectors on the BSE advanced, with Oil & Gas rising the most and Realty declining the most.

Major Stocks In The News

Hindustan Zinc: The company received renewable power from Serentica's 180 MW solar project.

Prestige: The company recorded a 22.6% year-on-year dip in sales at Rs 3,030 crore in the first quarter of this fiscal due to a lag in approvals and project launches amid the election season. The total sales volume during the quarter also fell to 2.86 million sq ft. The average realisation rose 16% year-on-year to Rs 11,934 per sq. ft. for apartments, villas, and commercial spaces, and the average realisation for plots also rose 46% year-on-year to Rs 7,285 per sq. ft. The real estate firm reported a 6% jump in sales collection in the quarter ended June at Rs 2,916 crore. Prestige Estates sold 1,364 units in the first quarter.

Mahindra and Mahindra: The company reported total production at 69,045 units, up 8% year-on-year, total sales up 11% at 66,800 units, and total exports up 4% at 2,597 units for the end of Q1 FY25. The company reduced its stake in Switzerland's Gamaya from 15.04% to 4.33% due to a shareholding reorganisation.

Aditya Birla Fashion: The company raised its stake in Goodview Fashion to 51% from 33.5% for Rs 127 crore. Goodview Fashion manufactures and sells ethnic couture under the Tarun Tahiliani brand.

Adani Wilmar: The company is to acquire a 67% stake in specialty chemical company Omkar Chemical Industries at an enterprise value of Rs 56.25 crore.

Rashtriya Chemicals: The company places a purchase order worth Rs 514 crore. The order is to revamp its ammonia plant in Thal, Maharashtra.

Allcargo Terminals: The company reported CFS volumes for the month of June at 55.9 '000 TEUs, up 20% year-on-year.

Vodafone Idea: Shareholders approved the issuance of preferential shares. The company received notice from ATC Telecom Infra for the conversion of OCDs worth Rs 160 crore into shares.

Azad Engineering: The company received a five-year contract from Germany's Siemens Energy Global for the supply of rotating components for Siemens' gas and thermal turbine engines.

Infosys: The company received a contract from the Delaware Department of Labour for upgrading its legacy systems.

Global Cues

Stocks in the Asia-Pacific region were trading mixed on Friday after a better-than-expected US inflation data reinforced rate cut bets by the Federal Reserve. Traders will also eye the release of the key inflation and the industrial production print in India after market hours today.

Shares in Japan and South Korea slipped in earlier trade while those of Australia rose. The S&P ASX 200 was 77 points or 0.98% higher at 7968 while the Kospi was 36 points or 1.24% down at 2,855.6 as of 07:03 a.m.

Japanese Yen remained volatile as local media reported that the Bank of Japan was conducting rate checks in the market, Bloomberg reported.

Meanwhile, the US treasury yields plunged with traders eying rate cut as earlier as September after the latest data pointed to slowing signs of inflation in the US. The equities in the region ended mixed as the S&P 500 Index and Nasdaq Composite declined 0.88% and 1.95%, respectively, while Dow Jones Industrial Average also rose 0.08%.

Brent crude was trading 0.15% higher at $85.53 a barrel. Gold was 0.30% down at $2,408.33 an ounce.

Key Levels

U.S. Dollar Index at 104.45

U.S. 10-year bond yield at 4.21%

Brent crude up 0.15% at $85.53 per barrel

Bitcoin was down 0.03% at $57,535.34

Gold spot was down 0.30% at $2,408.33

Money Market Update

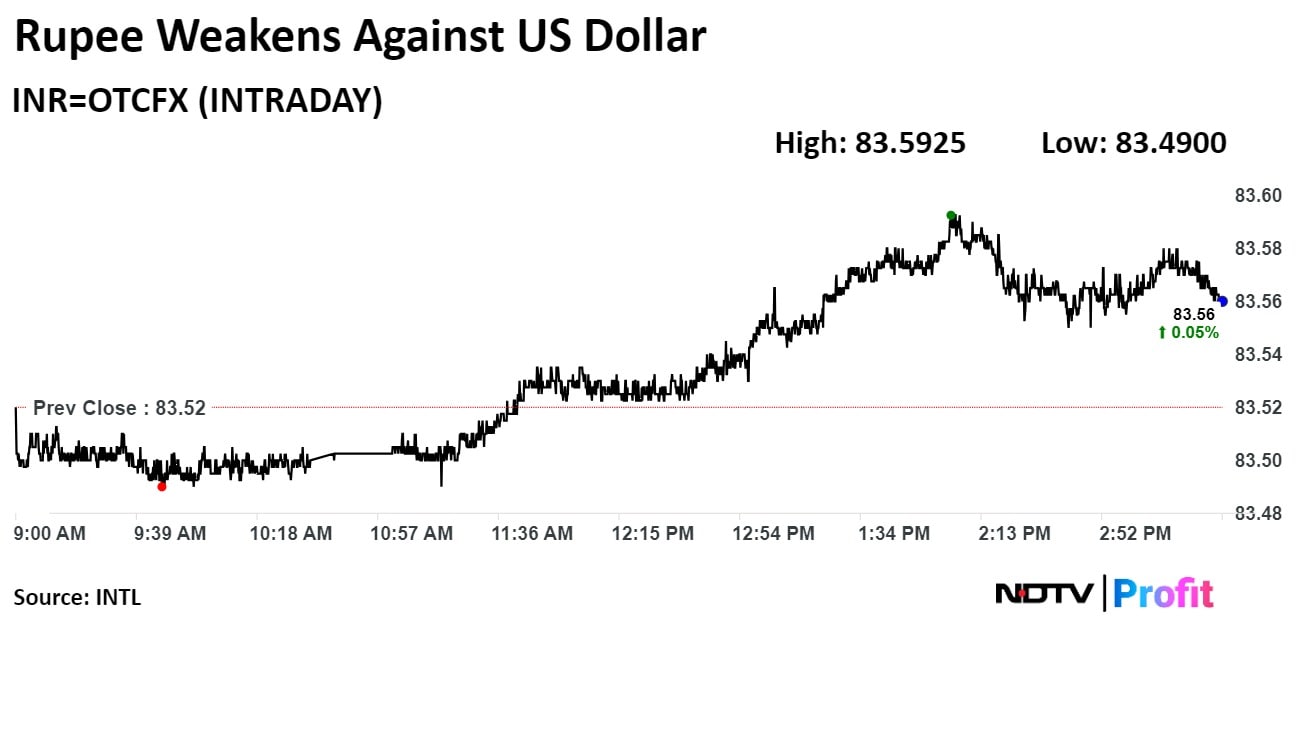

The Indian rupee pared all its opening gains to close weaker on Thursday as rising crude oil prices increased the demand for dollars from oil importers.

The local currency depreciated 3 paise to close at 83.56 against the greenback after it opened at Rs 83.51, according to Bloomberg. It had closed at Rs 83.53 on Wednesday.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.