TCS CEO On North America Outlook

TCS CEO said the company did not find new investments towards cost optimization in North America and discretionary spend is not happening.

"It is a scenario of more wait and watch. That's the reason we are hesitant to say we have bottomed out," he said, in response to whether the decline in North America has bottomed out and if sequential growth can pick up.

TCS On Annual Guidance Consideration

On request from an analyst for TCS to start giving guidance on a full year basis, a senior company official said it will be taken under consideration.

"We will definitely consider. It's been a considered stand for a long time because we believe that there is a certain amount of prudence in not giving agents because it helps us in driving growth and maximizing growth based on what we see in the market space. But we will consider your request and we'll have an internal discussion."

TCS CEO Says GenAI Impact On IT Spending

"We have not seen a headwind so far. Clients do want us to look at Generative AI as one of the lever to better deliver in terms of cycle time or in terms of cost, in terms of quality. That discussion always happens, but we have not seen as a headwind so far," says CEO in a post-earnings analyst concall.

TCS CEO On Customer Demands

"Cybersecurity services continued to grow this quarter. The focused areas of our customers are being network security, identity and access management, modernization, risk and compliance, and cloud security," says CEO in a post-earnings analyst concall.

TCS CEO On AI Deal Outlook

"Artificial intelligence deal pipeline has inched higher from $900 million last quarter to $1.5 billion. Most AI deals remain short term, but we have started seeing some long term opportunities. Expecting demand recovery in the UK and US after elections."

TCS CEO On Exam Technology Market

Amid cloud over integrity and conduct of exams in the wake of the NEET controversy, TCS CEO said the company is the biggest player in the exam technology segment with TCS iON and expects to maintain its technological edge.

"The assessment platform (TCS iON) is one of the best in terms of technology. The market share in computer-based exams is very high and continue to strengthen the technology further and we expect to play in this market significantly."

TCS iON is an end-to-end learning, assessment, and mark management solutions platform.

TCS CEO Says Non-BSNL Growth Strong

"On a sequential basis, there is strong growth outside of BSNL relative to previous quarters. Non-BSNL (revenue) growth was substantial sequentially. All markets and verticals grew sequentially," said CEO K Krithivasan.

TCS CFO On Profitability

"We stay committed to 26-28% aspirational margin level. Margins will inch up quarter by quarter," said CFO Samir Seksaria.

TCS CEO On Geographical Spread Of Income

"Diversification of revenue has been an important strategy. We look at these markets (middle east, Asia-Pacific, Latam) as new growth levers. We do hope other geographies grow faster," CEO K Krithivasan said.

CONTEXT | TCS Year-on-year growth in key markets:

North America: 1.1% decline

Latin America: 6.3% advance

UK: 6% advance

Continental Europe: 0.9% advance

Asia Pacific: 7.6% advance

India: 61.8% advance

MEA: 8.5% advance

TCS CEO On Project Pipeline

"Some deals did not close in Q1, was pushed further. It need not be due to decision-making. Our project pipeline is quite healthy like the previous quarter. Mega deals are lumpy, but large deals are healthy. AI Cloud and Cybersecurity will continue to lead growth in future," CEO K Krithivasan said.

TCS FY25 Hiring Trend

Chief HR Officer Milind Lakkad said fresher hiring will be close to 40,000, depending on market conditions.

TCS Q1 Results: CEO Responds On BFSI, North America Outlook

"For BFSI and North America growth to reflect on annual print will require more positive quarters. Revenues will take a few more quarters to turn positive on an annual basis," CEO K Krithivasan said. BFSI segment in North America grew better than in Europe and UK, he added.

TCS Q1 Results: CFO On Increments

The impact of increments this quarter is 170 basis points in line with previous trends, said CFO Samir Seksaria.

TCS Q1 Results: CEO Says Market Condition Unchanged

"It is too early to call whether the growth momentum is sustainable because the market condition remains same as last quarter. There is nothing new to add to market sentiments," says MD and CEO K Krithivasan.

In terms of order book which has slumped this quarter, he said the overall pipeline of deals continue to be at all-time high. "At the current revenue range, we are looking at $7-9 billion TCV (total contract value) is a comfort range."

TCS Q1 Results: Press Briefing Starts

TCS has started the press conference in its Mumbai headquarters to discuss the first quarter earnings result.

Present in the event is MD and CEO K Krithivasan, CFO Samir Seksaria and Milind Lakkad, Chief HR Officer.

TCS Q1 Results Press Conference: What To Expect

The top management of TCS will hold a press conference shortly to discuss the first quarter earnings result.

Here's what to expect:

Commentary on topline growth for the rest of the fiscal year and improving profitability.

Reasons for performance decline in key sectors like BFSI and the roadmap to address it.

Outlook for deal wins given decline in order book both sequentially and annually. Focus on deal wins in artificial intelligence and other frontier tech.

Hirings trends, especially of freshers, to shore up talent pool this fiscal.

Outlook for top markets like North America and plans to diversify geographical client-base.

TCS Order Book Declines

TCS deal wins decline 37% sequentially to $8.3 billion in the first quarter compared to $13.2 billion in March quarter.

The order book was $10.2 billion in the same period last year.

TCS Q1 Results: Press Conference | WATCH

The top management of TCS is addressing the media in Mumbai to brief about the first quarter earnings result.

The live press conference can be watched here:

TCS Q1 Results: Early Reactions

"The TCS commentary will hold key not just for TCS but the entire sector because a lot of revenue contributions come from the BFSI space. Retail, manufacturing and other segments and subsegments are top segments where growth patterns and discretionary demand from clients are expected to come back. This will critically determine the second half. First half is largely a mix in terms of hit on Ebit margin both in terms of a slow recovery which was already expected," Mayuresh Joshi, HOR, Marketsmith India told NDTV Profit.

TCS Q1 Results: Segment Growth (Y-o-Y)

Banking, Financial Services and Insurance: 0.9% decline

Manufacturing: 9.4% advance

Consumer Business: 0.3% decline

Technology & Services: 3.9% decline

Communication and Media: 7.4% decline

Life Sciences and Healthcare: 4% advance

Energy, Resources and Utilities: 5.7% advance

Regional Markets & Others: 37.7% advance

TCS Research And Innovation Picture

As on June 30, the company has applied for 8,194 patents, including 154 applied during the quarter, and has been granted 4,146 patents including 227 granted during the quarter.

TCS Attrition Picture

TCS' workforce stood at 606,998 as on June 30. The employee base has 35.5% women and with 151 nationalities. IT services' attrition was at 12.1% for the last twelve months.

Our continued focus on employee engagement and development led to industry-leading retention and strong business performance, with the net headcount addition being a matter of immense satisfaction, Milind Lakkad, Chief HR Officer said. "I am delighted to announce the successful completion of our annual increment process."

TCS Q1 Results

TCS CFO Says Committed To Invest In Top Talent

In spite of the usual impact of the annual wage increments in this quarter, TCS have delivered strong operating margin performance, validating our efforts towards operational excellence, according to Samir Seksaria, Chief Financial Officer, TCS.

"We remain focused on making the right investments in R&I and talent, strengthening our superior return ratios and creating long term value for our stakeholders.”

TCS Q1 Results: First Reactions

"Deal wins have not been the concern in the previous fiscal as well, deal ramp up was a bigger worry because of the indecisiveness in the mind of the spender. This has to change. Deal wins may continue to drive up the book-to-bill ratio," said Rahul Jain, vice president-Research, Dolat Capital.

TCS CEO And MD Says

“I am pleased to report a strong start to the new fiscal year with all-round growth across industries and markets. We are continuing to expand our client relationships, create new capabilities in emerging technologies and invest in innovation, including a new AI-focused TCS PacePort in France, IoT lab in the US and expanding our delivery centers in Latin America, Canada and Europe," says K Krithivasan.

TCS On Key Clients

TCS will consolidate Xerox's technology services to improve business outcomes, migrate complex legacy data centers to the Azure public cloud, deploy a cloud-based Digital ERP platform.

Collaborated with IIT-Bombay to develop India's first Quantum Diamond Microchip Imager.

Selected by Burgan Bank, a leading commercial bank in Kuwait.

Selected as strategic partner by a leading American home improvement retailer, to establish Next-Gen technology and data architecture landscape to transform to an AI ready enterprise.

TCS Q1 Results: Growth By Markets

Year-on-year growth in key markets.

North America: 1.1% decline

Latin America: 6.3% advance

UK: 6% advance

Continental Europe: 0.9% advance

Asia Pacific: 7.6% advance

India: 61.8% advance

MEA: 8.5% advance

TCS On AI Focus

The company's release to the exchanges says that in the reported quarter over 270 AI/GenAI engagements have been deployed or are in various stages of progress.

TCS On Increments

Milind Lakkad, Chief HR Officer says that the IT bellwether has an industry-leading retention and strong business performance, with the net headcount addition being a matter of immense satisfaction.

TCS Q1 Results: Segment Revenue

Banking, Financial Services and Insurance: Rs 23,074 crore

Manufacturing: Rs 6,271 crore

Consumer Business: Rs 9,991 crore

Communication, Media and Technology: Rs 10,794 crore

Life Sciences and Healthcare: Rs 6,909 crore

Others: Rs 5,574 crore

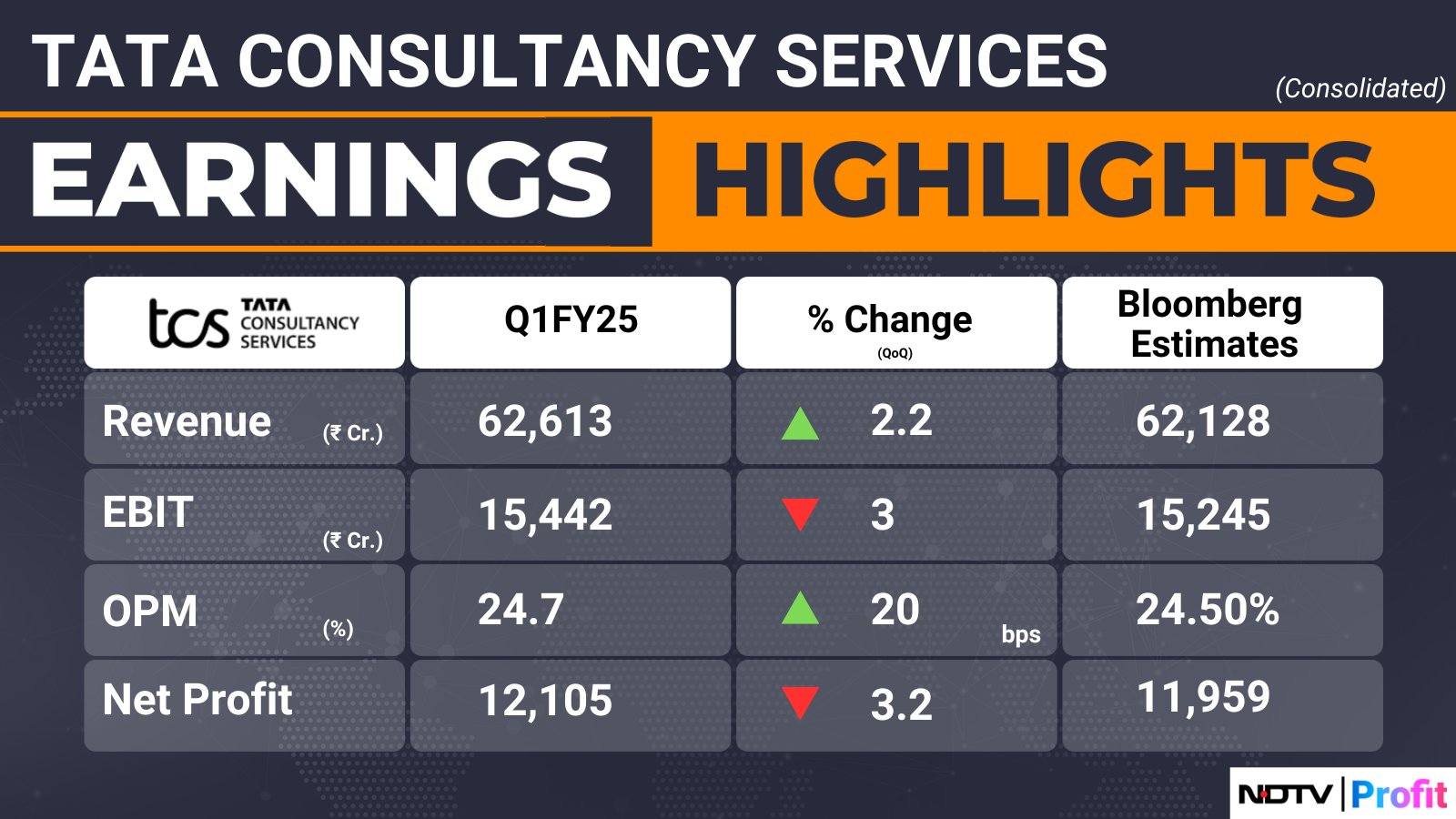

TCS Q1 Results: Ebit Down 3%

TCS reports an Ebit of Rs 15,442 crore vs Bloomberg estimate of Rs 15,918 crore. It is a decline of 3%.

TCS Q1 Results: Ebit Margin At 24.7%

TCS reports an Ebit margin of 24.7% vs Bloomberg estimate of 26%.

TCS Interim Dividend

TCS has announced an interim dividend of Rs 10 per share. The board has fixed Aug. 5 as the record date for dividend payments. The company has set July 20 as the record date for the interim dividend.

In comparison, the company issued a final dividend of Rs 28 each on May 16, 2024. In January 2024, the company announced an interim dividend of Rs 9 and a special dividend of Rs 18.

TCS Q1 Results: Revenue Up 2.2%

TCS reports a 2.2% rise in consolidated revenue at Rs 62,613 crore vs Bloomberg estimate of Rs 61,237 crore.

TCS Q1 Results: Net Profit Meets Estimates

TCS reported consolidated net profit at Rs 12,105 crore vs Bloomberg estimate of 11,959 crore.

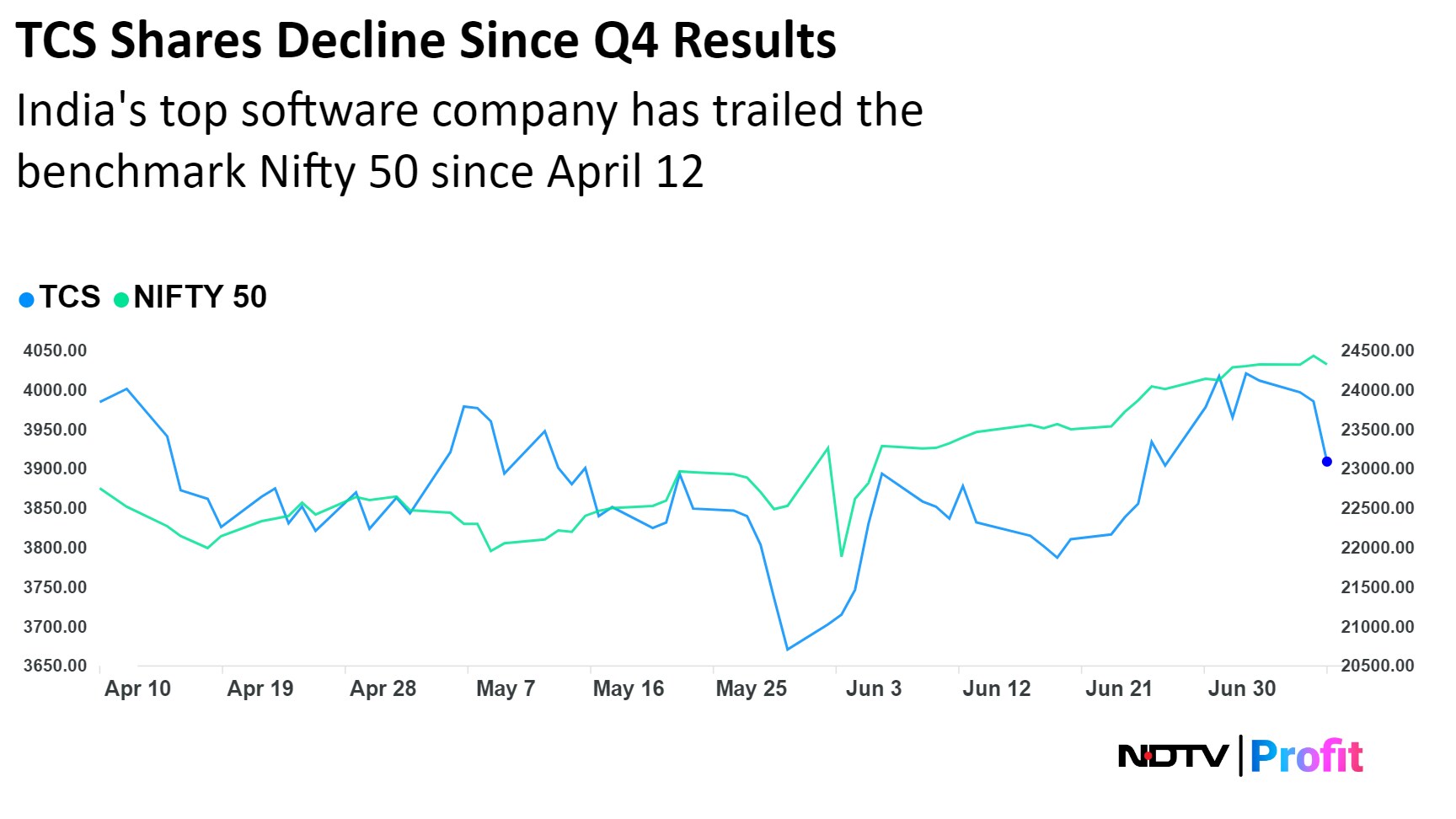

TCS Results: Share Price Movement

Shares of TCS closed 0.18% at Rs 3,902 apiece on Thursday, ahead of the release of its first quarter earnings. Since it announced the results of the March quarter on April 12, the stock has declined 2%, compared to nearly 7% gain in the benchmark Nifty 50.

TCS Results: Performance In Previous Quarter

Revenue of India's largest IT services firm rose 1.1% over the previous three months to Rs 61,237 crore in the quarter ended March 31, 2024. Net profit rose 12.7% Rs 12,502 crore. Ebit increased 5% to Rs 15,918 crore while margin expanded 97 basis points to 25.99%.

For the entire year, revenue rose 6.8% over the previous fiscal to Rs 2,40,893 crore. While maintaining operational profitability at 24.6%, net profit grew 10.5% to Rs 46,585 crore. At Rs 44,282 crore, the free cash flow was nearly 100% of the bottom line.

TCS's North American business, which makes up more than half of its top line, shrank 2.3% year-on-year in Q4 FY24. In comparison, the regional markets of the Asia Pacific and the Middle East grew by 5.2% and 10.7%, respectively. For the full year, North American business shrank by 0.2%, but regional geographies grew by 4.5% and 14.4%, respectively.

Similarly, the financial services domain—which brings in more than a third of the revenue—shrank 3.2% year-on-year in January–March 2024. For the full financial year, its contribution declined by 1%. That negative impact was offset by growth in manufacturing and utilities.

TCS Q1 Results: What To Look Out For

Progress in ramp-up of deal with state-run telecom service provider Bharat Sanchar Nigam.

Trends in banking and financial services and retail verticals.

IT Q1 Results Preview

Information technology companies are set to report their earnings for the three months to June. The discretionary demand from clients of such firms is under the focus.

Yet, there may be a breather as Accenture Plc did not cut its guidance in its third quarter results. The Dublin-headquartered tech firm—whose earnings often serve as a weather vane for Indian IT—reported its highest bookings in the 'Managed Services' segment, indicating stable demand if not an uptick.

Factors to watch out for the Indian IT firms include clients' budget outlook, trends in discretionary demand and traction in deal wins' conversion to revenue. Here's what brokerages expect in the first-quarter earnings of India's software services firms.

Although IT companies have guided for weak discretionary demand, Accenture's earnings offer a ray of hope. CLSA said discretionary demand is expected to stabilise while clients would await a trigger to increase such spends.

Most brokerages expect Infosys Ltd. and HCL Technologies Ltd. to maintain their FY25 revenue and margin guidance. JPMorgan, however, sees an uptick in HCLTech's FY25 revenue growth. Wipro Ltd. is expected to guide anywhere between (-)1.5 to 2% for Q2 FY25 revenue growth over a quarter ago in constant currency terms.

TCS Q1 Results: Here's What Analysts Are Expecting

Tata Consultancy Services Ltd. is all set to kick-off the first quarter earnings season of fiscal 2025.

TCS may report a 3.8% sequential decline in net profit to Rs 11,957 crore, according to consensus estimates compiled by Bloomberg. The topline may rise 1.4% to Rs 62,121 crore.

TCS Q1 FY25 Estimates (Consolidated, QoQ)

Revenue may rise 1.4% to Rs 62,121 crore.

Ebit may fall 4.2% to Rs 15,246 crore.

Ebit margin expected at 24.5% versus 25.9%

Net profit may fall 3.8% to Rs 11,957 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.