Global funds are beginning to go big on India, as the fastest-growing economy targets to anchor the emerging markets by climbing key gauges in MSCI Inc., to usher consistent flows.

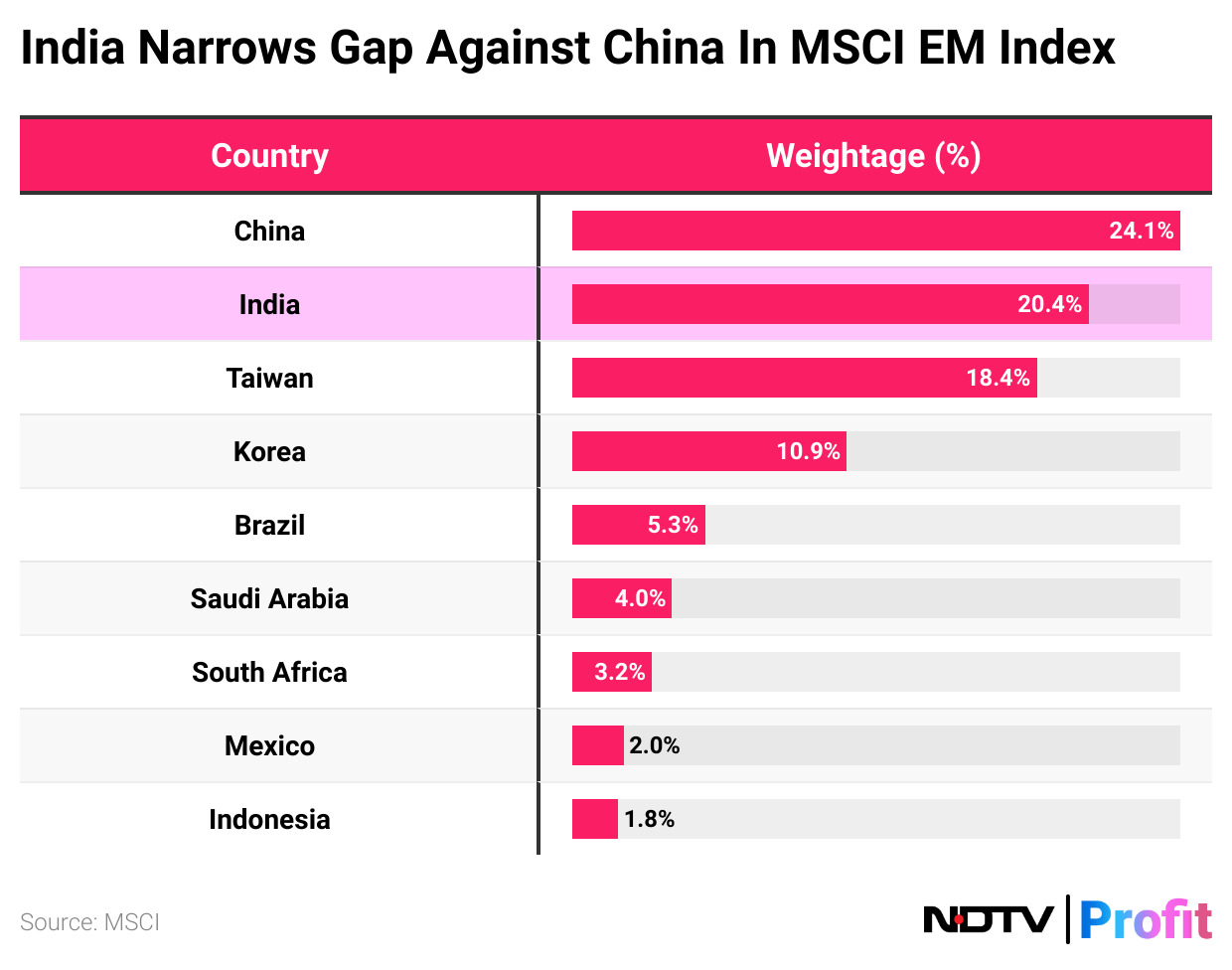

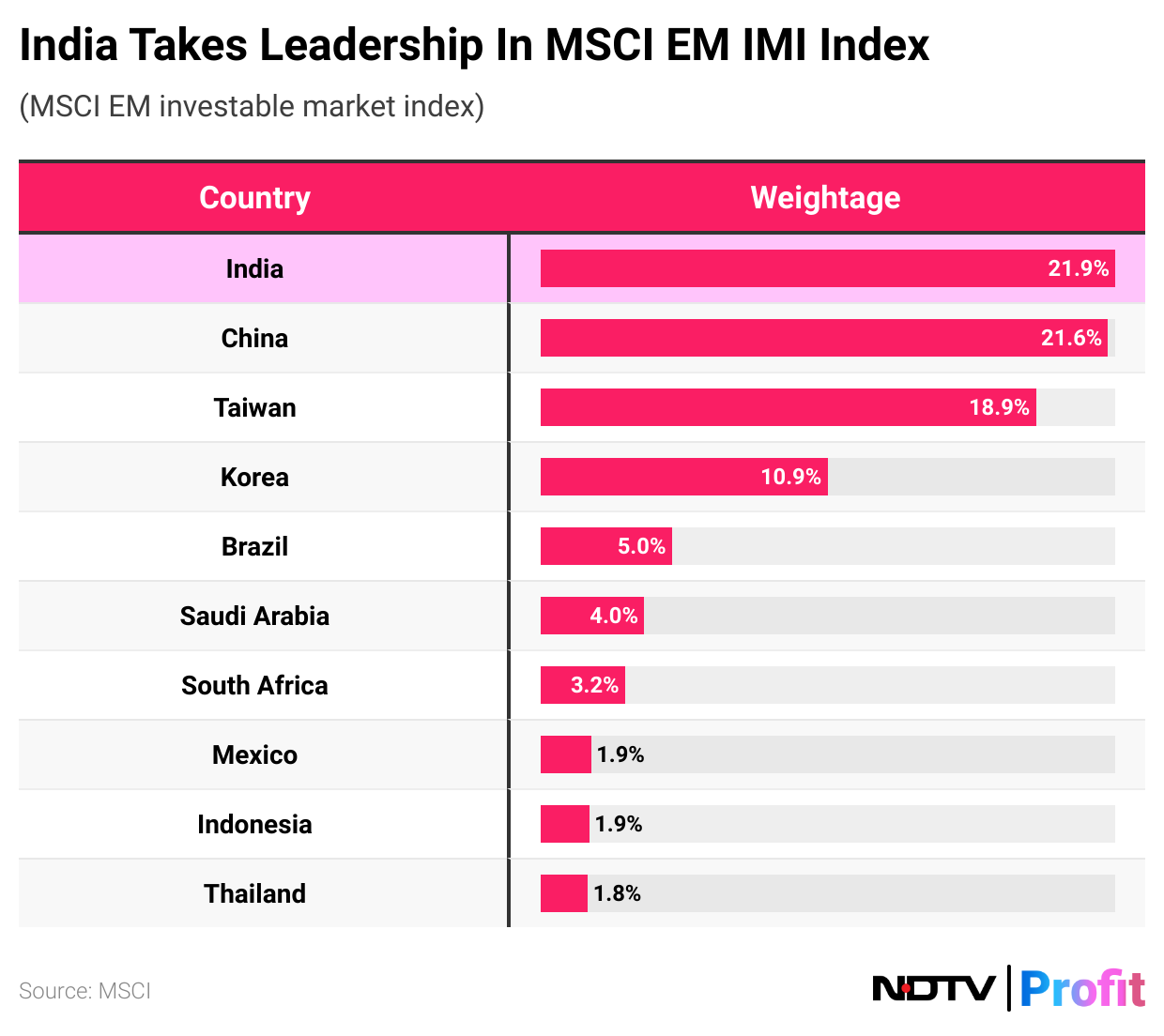

India is narrowing its gap to take leadership in the key emerging markets gauge of the international index aggregator. However, the South Asian country piped China to top the MSCI's EM Investable Market Index earlier this month.

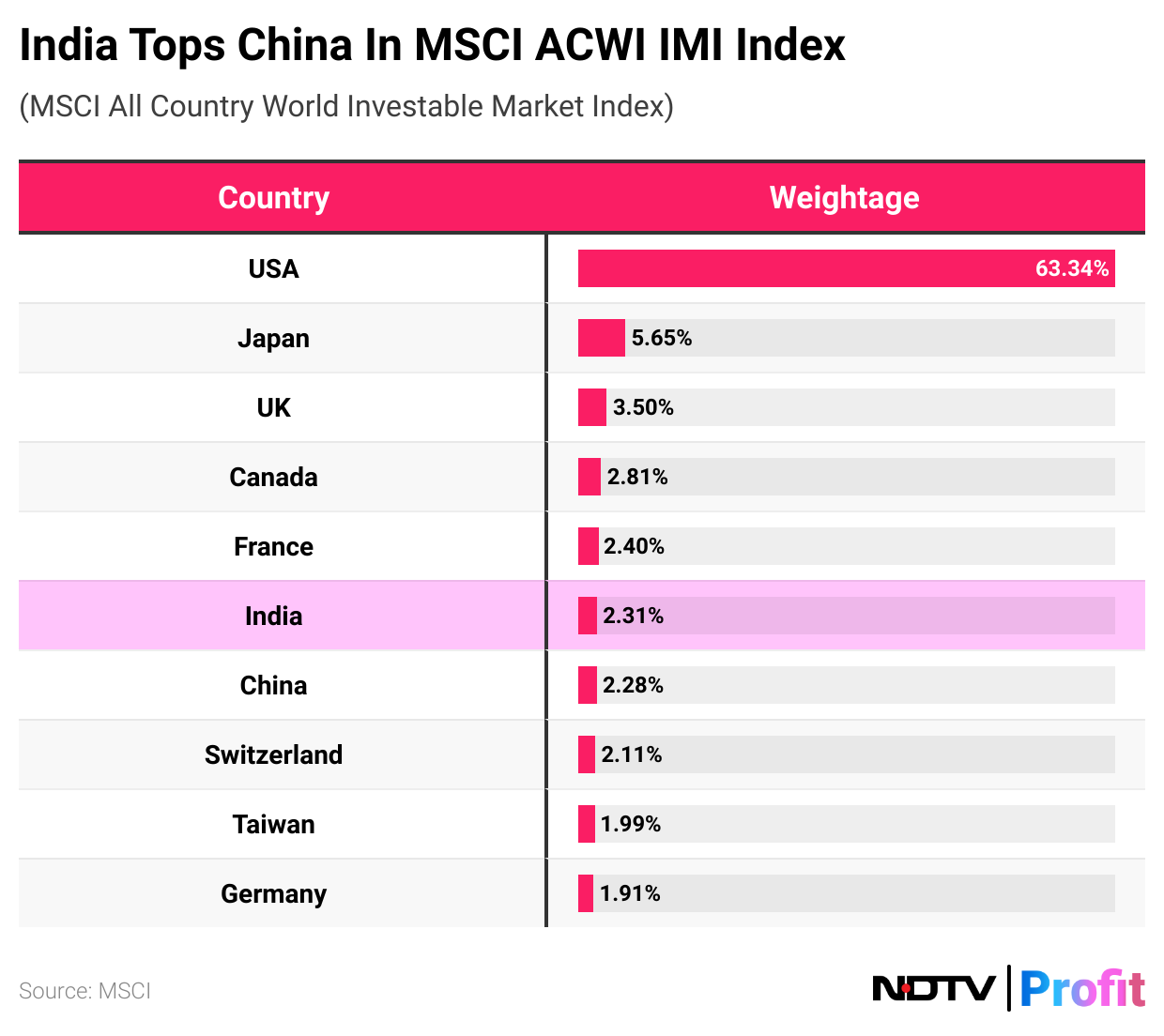

The country also recently topped China in the MSCI AC World IMI index to make it the sixth biggest in the world, only behind France, according to a Morgan Stanley note.

India's weightage in the EM gauge jumped to a record of 19.8% from 18.8% in May, while that of table topper China slipped to 24.2% from 24.7%, as per the index aggregator's quarterly review for August.

The Morgan Stanley Capital International Index is a benchmark for international investors, reflecting the performance of Indian companies. Foreign institutional investors are significantly influenced by this gauge when making decisions to allocate capital to domestic stocks.

The rising index weight can be a "telltale sign of exuberance", Morgan Stanley said, but noted that fundamental factors such as improving free float of Indian companies and rising relative earnings could be the reason. "India's newfound position in EM is not a worry."

On top of this, the onset of the rate cut cycle by the US Federal Reserve will add to the inflows as India set to give the best yield among its emerging peers.

As the global interest rates go down, emerging equity markets get fund inflows and India is one of the better-performing equity markets, said Sharad Chandra, director, Mehta Equities Ltd.

The weight of India in the global indices is now almost equal to that of China, he said. "The passive money has to, in any case, flow to the Indian market to replicate the index."

FIIs Go Big In Cash And Derivative Space

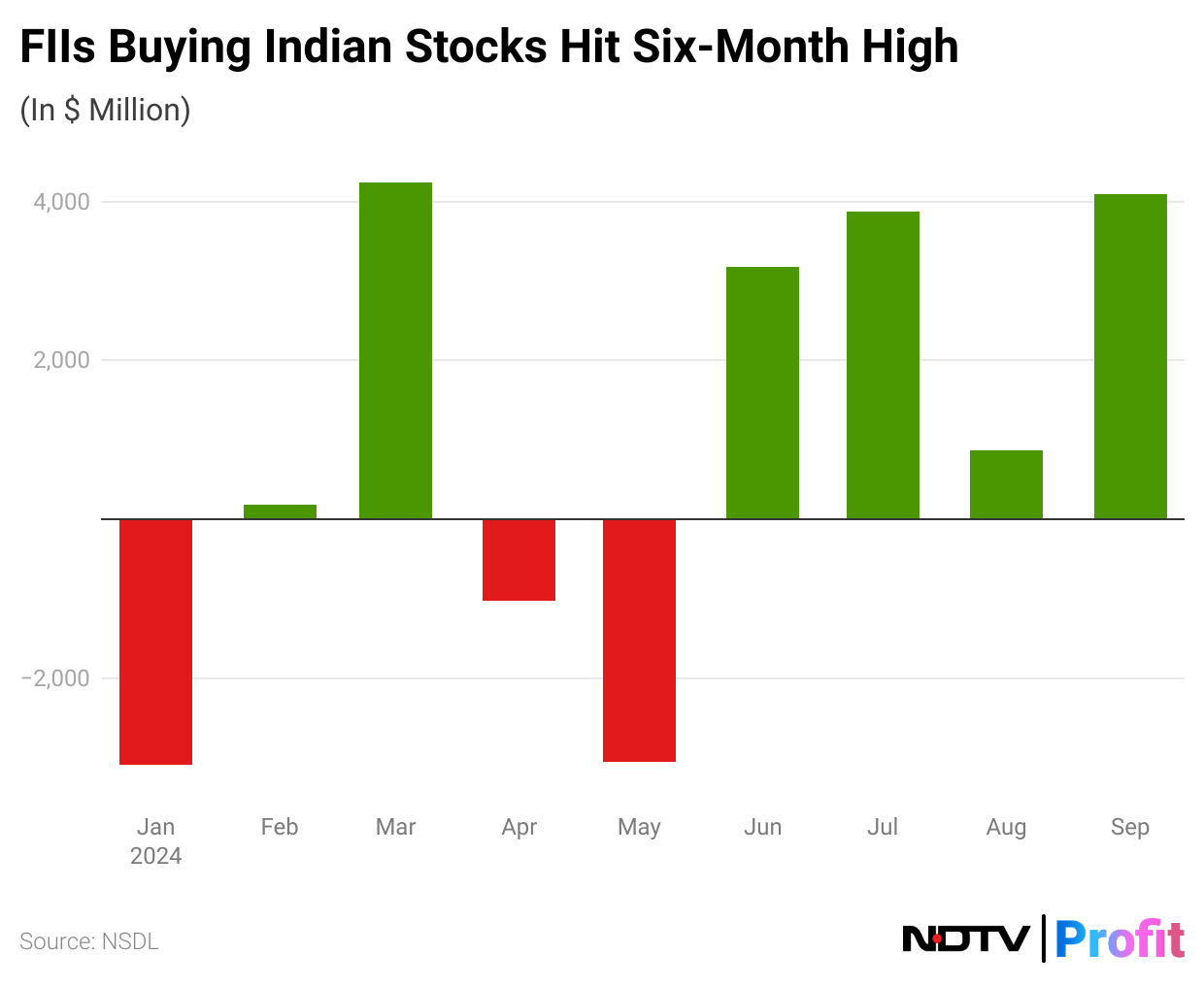

Foreign institutions' enthusiasm hit a peak last week as last Friday saw the biggest buying so far this year. Global funds mopped up Rs 14,000 crore in the cash market while pocketing Rs 58,500 crore in the derivative market on Friday.

After a brief pause, September is on course to become the best month on inflows in the last six.

Foreign institutions have been net buyers of Indian equities worth Rs 20,973 crore so far in 2024, according to data from the National Securities Depository Ltd., updated till the previous trading day. During the same period, they have racked up government bonds worth Rs 98,124 crore.

Further inflows depends on the global flows to risky assets and the attractiveness of India vis–a–vis the global markets, Chandra said. Foreign flows will continue to come if the government continues on the path of reforms, Chandra said.

Inflows Push Rupee Away From Narrow Trade

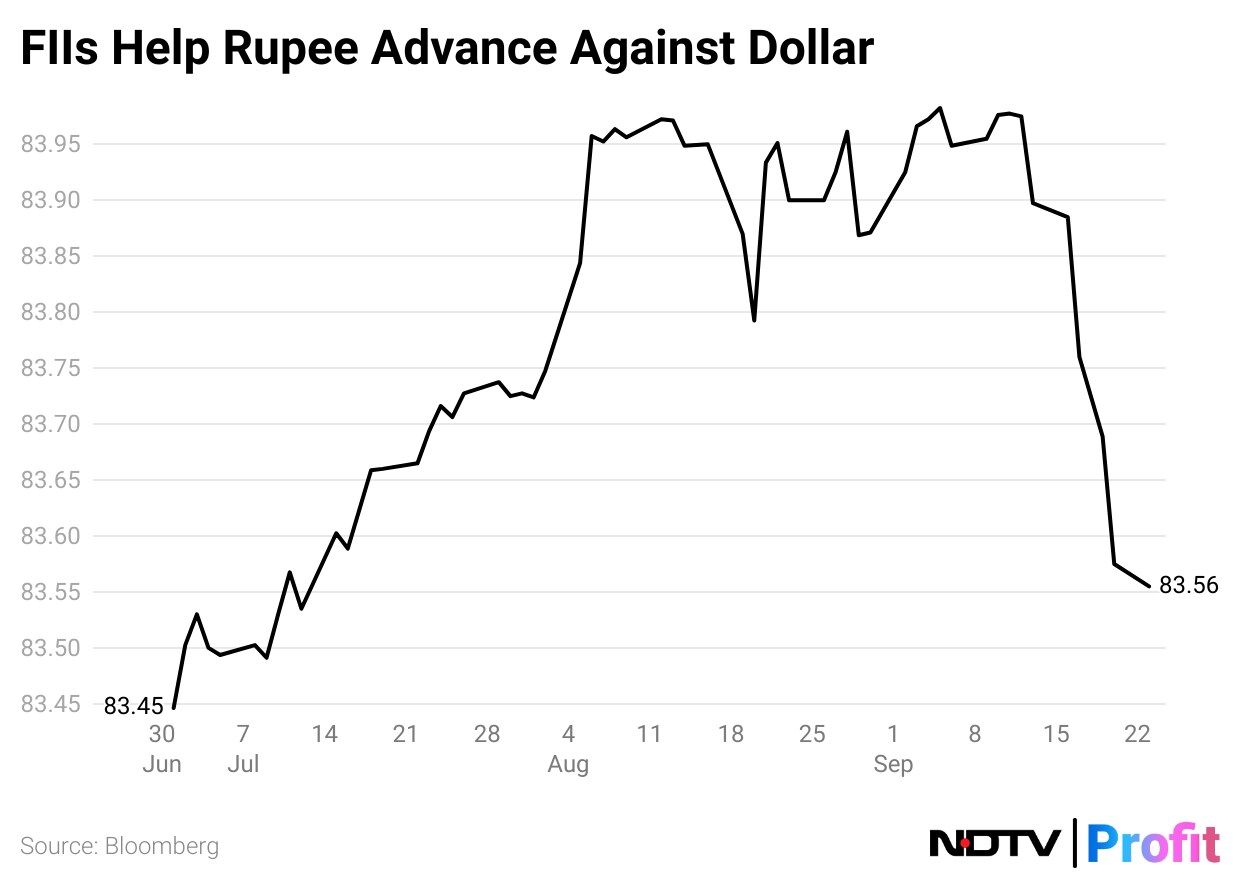

Foreign Inflows have aided the Reserve Bank of India's efforts to bring down the currency, after it neared the key 84 mark against the dollar. The domestic currency saw the best week so far this year as foreign investors rushed to buy local stocks.

The currency appreciated by 35 paise against the greenback last week, according to Bloomberg data. The Rupee on Monday closed at the highest level against the dollar since July 12.

The depreciation earlier, that took the currency near record lows, was the trade deficit print which came in at 10-month high, according to Kunal Sodhani, vice president, Shinhan Bank. Inflows into both equity, as well as debt has been very good post that, he said.

Widening of interest rate differential between US and India may attract more flows to India in the coming months, Sodhani said. "Expected broader range play for USDINR is 83.20-83.90."

There will be two RBI policies which will be important to watch, along with their stance and the middle east crisis should not be ignored.

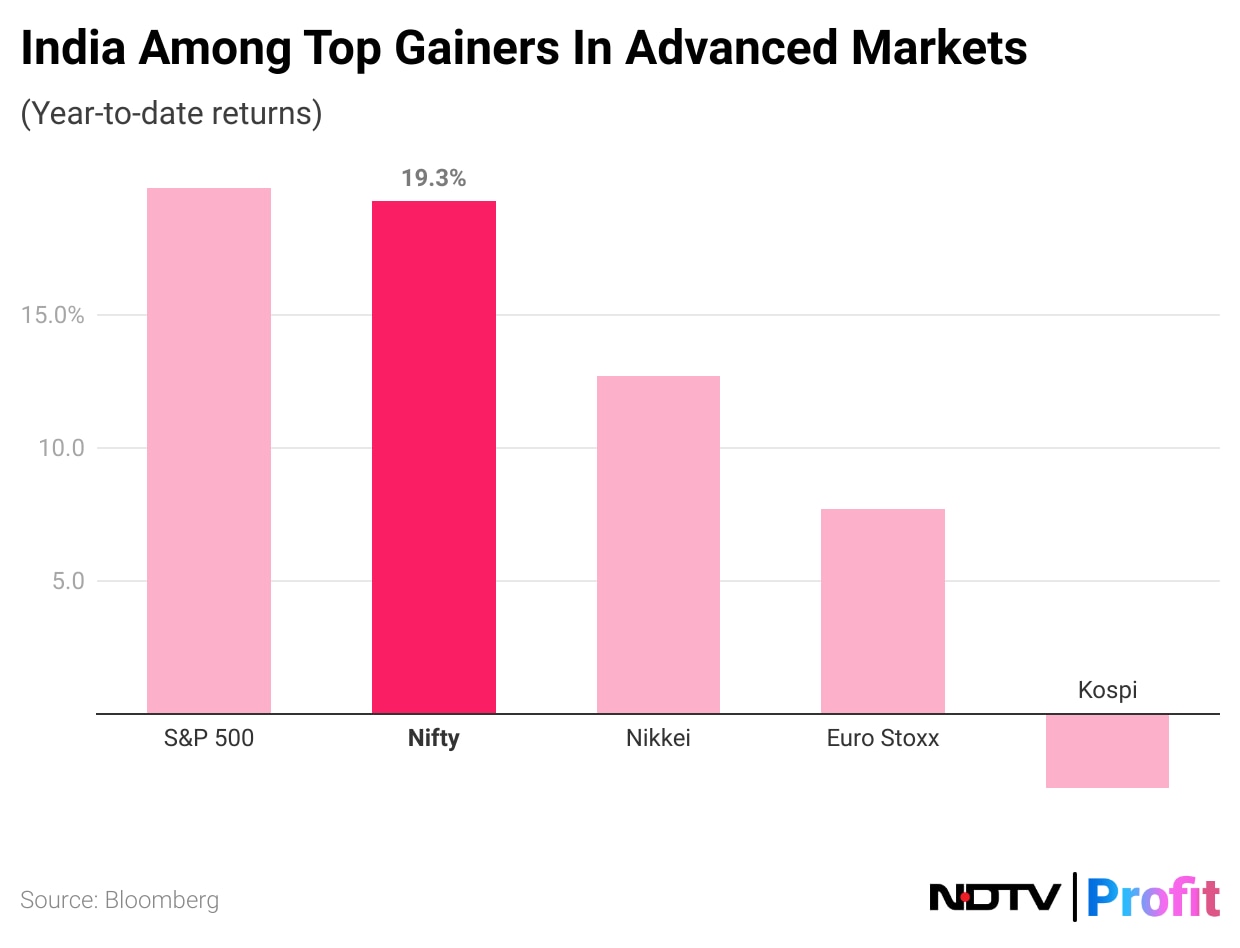

Stocks To Close Best Among Advanced Peers?

India's benchmarks have been on a record-hitting spree as foreign inflows have pumped up the gauges to cross landmark levels. The NSE Nifty 50 is about 100 points away from crossing the 26,000 mark, while the BSE Sensex topped the 84,500 mark.

India stocks have been the second best performing among advanced peers only after the stocks on Wall Street. The NSE Nifty 50 and the 30-stock BSE Sensex—have risen 19.3% and 17.5% respectively, so far this year, making them the third and sixth best-performing Asian indices.

However, not all is well for Asia's fifth-largest stock market, as there is caution looming on the valuation front. India remains the most expensive emerging market with current price-to-earnings pegged at 25.5.

However, high valuations is pricing in high corporate sector growth, Chandra said. "Any disappointment on that front may lead to a price correction or time correction."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.