Banks are expected to gain a good share of foreign institutional capital coming into India after the monetary policy easing in the US, according to Mahesh Patil, the chief investment officer at Aditya Birla Sun Life AMC.

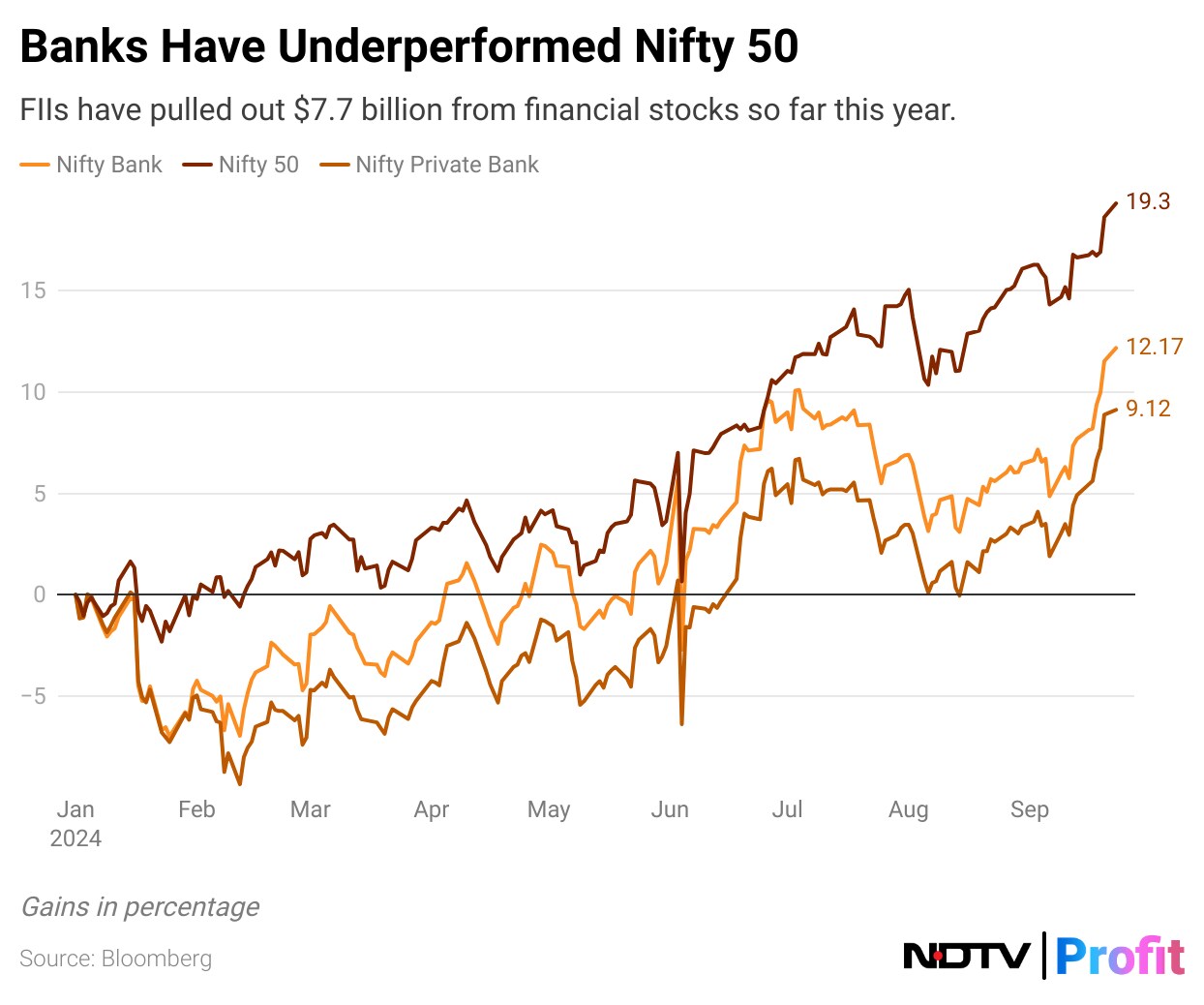

"There has been a huge sell down by FIIs in the bank because that's where the larger ownership was," Patil told NDTV Profit. Domestic financial services companies have seen net outflows of $7.7 billion as of last month. Outflows in the sector have outweighed the gains of $6.3 billion made in the overall equity market this year.

"Clearly the positioning of the banks for foreigners seems to be much lighter. So whenever money flow starts to move, I think that's a sector which could probably attract some of that flow," he said.

Patil said private banks have underperformed in the last one year and the valuations there are more reasonable compared to other sectors.

"There, the risk-reward looks more favourable, and you could see more money chasing them. It could possibly be a rotation back into the banks and a relative outperformance going forward," said the fund manager, who oversees Rs 3 lakh crore of assets.

He noted concerns around deposit growth for banks, that have led to downgrades in projections, but said liquidity is set to improve from the side of the Reserve Bank of India.

Patil said private banks have underperformed in the last one year and the valuations there are more reasonable compared to other sectors.

Further, Patil said consumer discretionary is more likely to be influenced by interest rate cuts domestically.

"We see more non-discretionary buying happening based on leverage, loans and any interest rate cuts in India, probably six months down the line, could mean more disposable income at the hands of the consumer. This is a sector which had underperformed last year and is now starting to pick up."

Watch The Full Conversation Here:

Now Friday's trade seems to suggest that most concerns: will we have a soft landing in the U.S.? Are we looking at any kind of recession? It seems to be behind us. From an India perspective, foreign flows look poised to re-enter. So what really should be the outlook? Are we now set for 26,000 quite firmly on the Nifty and what next? Joining me to talk on this is Mahesh Patil, CIO of Aditya Birla Sun Life. AMC.

Mr. Patil, a great time to have this conversation on what seems to be like a good day. Let me just come to you and I know you would probably say that it's just a number, but the distance to 26,000 seems like an exciting one, doesn't it?

Mahesh Patil: I think for markets this year again, it looks to be a good year. I think clocking here till date and it's been rising again, to some extent, driven by domestically. I think the growth momentum continues to be fairly decent and strong. The GDP numbers have been strong. We've seen that the much-awaited rate cut in the U.S. is also now kind of starting. More importantly, I think the liquidity is right; the money flow into the market continues to be robust from domestic investors, so that is keeping the markets really up. But also now, I think, post the rate cut, and I think with the dollar likely to weaken from here, we could also see emerging market flow of outflows into India, which have been kind of tepid for the last year or so, could also tend to reverse a bit. So I think the direction of the market looks to be fairly in the uptrend; though, I would say that the market, while it would continue to probably go up, we would probably see some more volatility coming in down the line because we have elections in the U.S. Again, the outcomes therefore lead to some volatility on the global front. So that is something that I think one needs to keep in mind. But I think one interesting thing that we're seeing is that while the Nifty and the other headline indices are making new highs, the breadth of the market is now slowly starting to weaken. So what I mean by that is that if you look at the number of stocks, which are down, say, around 20%-30% from their peaks, in this year, I think the percentage of stocks is now kind of increasing. So I think that's a slight change from what the market was doing, say, until the beginning of this calendar year. But otherwise, I think the earnings momentum is definitely slowing down. So I think that should slow down the pace of acceleration in the market, is what I would think.

Just to come to some of the factors that you mentioned, Mahesh and I think U.S. elections, rightly so, are the next big thing globally to look at at least the latest polls, and these things change. But at least the latest polls seem to point towards the Harris administration next. What does that mean for U.S. markets and from an Indian perspective? I'm not talking about the politics of it at all, but from an Indian perspective, does that make a big difference to us and to the U.S. markets?

Mahesh Patil: Yes. I think so, in a way. From the U.S. market standpoint, I think it would be probably a continuation of the existing rule of the Democrats. So, the policy of the earlier regime would continue. So I don't think that should lead to any large volatility over there. Obviously the stimulus would lead to, in terms of, how do you prime the U.S. economy and ensure that there is a soft landing? I think some of the measures that the Democrats and Kamala Harris have talked about in terms of generating employment should be positive. I would say that in that context, I think the volatility in the U.S. market could be much lower, if that is the outcome of what we are looking at. Even from an Indian perspective, I think I would say that it should be fairly normal. I don't see any reason because Trump would mean there would be more tariff barriers; at least the rhetoric there could have been slightly negative for India.

Okay, in terms of India right now, do you think, Mahesh, that we will see those global flows coming in? I mean, the numbers for Friday were astonishing. Some say because of the FTSE rejig, and a lot of them are passive flows. I don't know what your take is on that, but do you see that sort of floodgate opening now?

Mahesh Patil: Not like I mean, we are not going to see the floodgates opening and big money coming in, but if you look at two data points, it suggests that probably you should see the reversal of the outlook, which we have seen in the better part of this calendar year. One is the rate cuts, which means that you will see U.S. dollars starting to weaken and that's been quite apparent. That would mean more money into emerging markets and India should get its share over there. Also point to note is that India's weightage in the now Emerging Market Index or the global index, is at all times high; it is now overtaken China also, which is to be around close to 22% and relatively, if you look at the global funds, I mean, all the emerging market fund's fund managers globally are now slightly underweight India. Historically, they have been overweight in India and have been around three to four percent. That has now gone to be marginally underweight. So I don't think there is room for FIIs to really go underweight in India beyond this point because India is a relatively better performing market. So in that scenario now, I think I would say that you should see the flows starting to improve. Obviously India is relatively expensive vis-à-vis the region, and that's what has kept foreigners away. But I think there won't be much choice because India remains a good long-term growth market, and foreigners would want to participate in that. So I would say that you should see at least the FII flows starting to turn positive, though I would not like to say that you will see a large number coming in, because unless there is a correction and some moderation valuations, you could then see more money coming in in big quantum from the foreigners.

Will that be coming into banks? I'm wondering how, right now, Mahesh, you're feeling about banks, private banks. I know you will not tell me about HDFC specifically, fair enough. But you know, I'm wondering if you're feeling some of that concern, which we're seeing at the end of the last quarter numbers on deposit growth, etc. ebbing?

Mahesh Patil: On banks, one is on the technical side; if you look at it, there has been a huge selldown by FIIs in the bank. So when they were selling, the bulk of it was taken by the banking sector, because that's where the larger ownership was, especially somewhere in larger banks, where FIIs had the larger chunk and that's where now I think the after the last selling, I think clearly the positioning of the banks from the foreigners seems to be much lighter, and banks continue to be a large liquid name. So whenever money flow starts to move, I think that's a sector that could probably attract some of that flow. If you look at the private banks in general, they have underperformed in the last year or so, and the valuations there are more reasonable if you compare that with the long-term averages. So clearly there the risk reward looks more favourable, and you could see more money chasing them, and that could possibly be a rotation back into the banks, and you could see a relative outperformance over there going forward. So I think that could be a reason why. I think you could see banks potentially doing well. However, the headwinds from the banks in terms of the deposit growth. I think that still remains. That is still a challenge, and that's the reason why there have been downgrades to the credit growth for the banking sector in this fiscal year to around 12-13% compared to around 14-15% earlier. But I think the overall system liquidity, if you look at the RBI, liquidity is now starting to improve, so that should give some relief in terms of primary deposits. But clearly that remains the biggest challenge at this point in time for the banking system.

Just the last point from you. Mahesh, you know, we spoke a bit about banks, but in terms of the sector rotation that we've been seeing in the markets right now, what is looking most exciting to you? What are you most constructive on and will rate-sensitive companies like Autos and Realty make that list?

Mahesh Patil: I think, in a way, I would say that there are a couple of things on which we are positive. One is the consumer discretionary side, because that is more likely to be influenced by any rate cuts. We see more nondiscretionary buying happening based on leverage and loans, and any increase in cutting interest rates in India, probably six months down the line, could mean that you would see more disposable income at the hands of the consumer and this is a sector that had underperformed last year. It's only starting to pick up now in the last two to six months. So structurally, we think that's a sector that can do well from here. Also, the rural economy is, there are some green shoots there about picking up. Rural wages are slowly improving, the real wages are starting to improve, and the monsoons have been fairly okay. So you should see that picking up. So the second half. I think rural demand could pick up, and that could also drive demand for the rural players. So these are some of the themes that one can look at from a medium-term perspective.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.