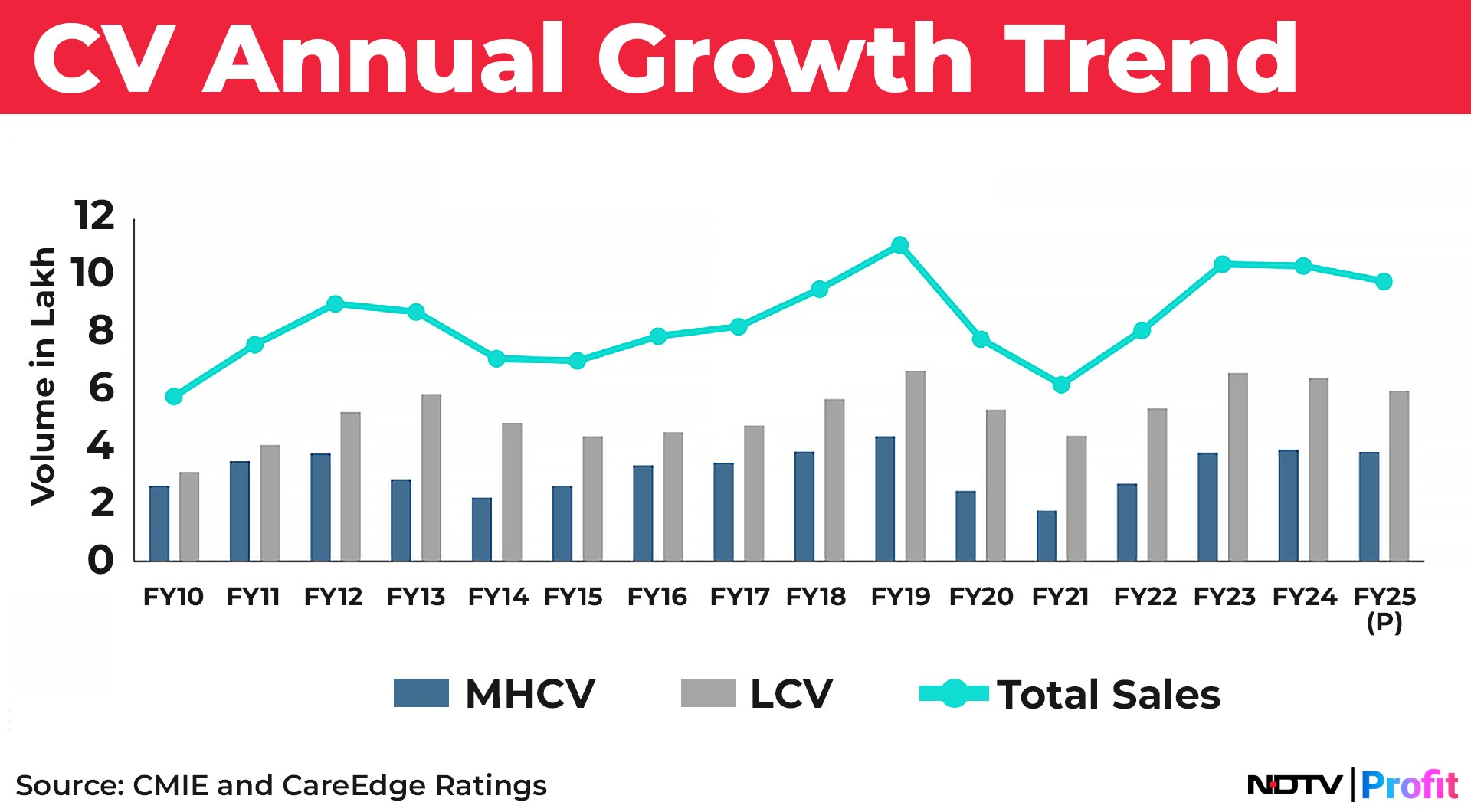

Following muted growth in fiscal 2024, commercial vehicle sales are expected to decline by 3-6% in fiscal 2025, due to reduced demand and high dealer inventory, according to the latest CareEdge report.

However, demand may improve post second quarter, with the end of general elections and increased infrastructure projects post-monsoon. Replacement demand and mandatory scrapping of older government vehicles are expected to support volumes, the report said.

The commercial vehicle category experienced a downturn, with sales decreasing by 4.74% year-on-year and 12.42% month-on-month in June 2024, as per Federation of Automobile Dealers Associations data.

June presented various challenges, including delayed monsoons, poor market sentiment and postponed purchases due to low demand and funding delays, FADA said in its latest report. "The industry continues to face degrowth, impacted by high temperatures affecting the agricultural sector and infrastructural project slowdowns," it said.

Fiscal 2024 saw muted growth in India's commercial vehicle industry due to a high base in fiscal 2023, BS VI transition costs, and an election-related slowdown, which led to higher dealer inventory, according to CareEdge. Contrasting trends are expected for medium, heavy and light commercial vehicles in fiscal 2025. MHCVs are anticipated to improve in the second half of the year due to post-monsoon infrastructure development, it said.

However, LCVs may face challenges from rising vehicle prices, high interest rates, and inflation, causing small local transport operators to defer fleet expansion plans due to limited financial capacity, as per the CareEdge report.

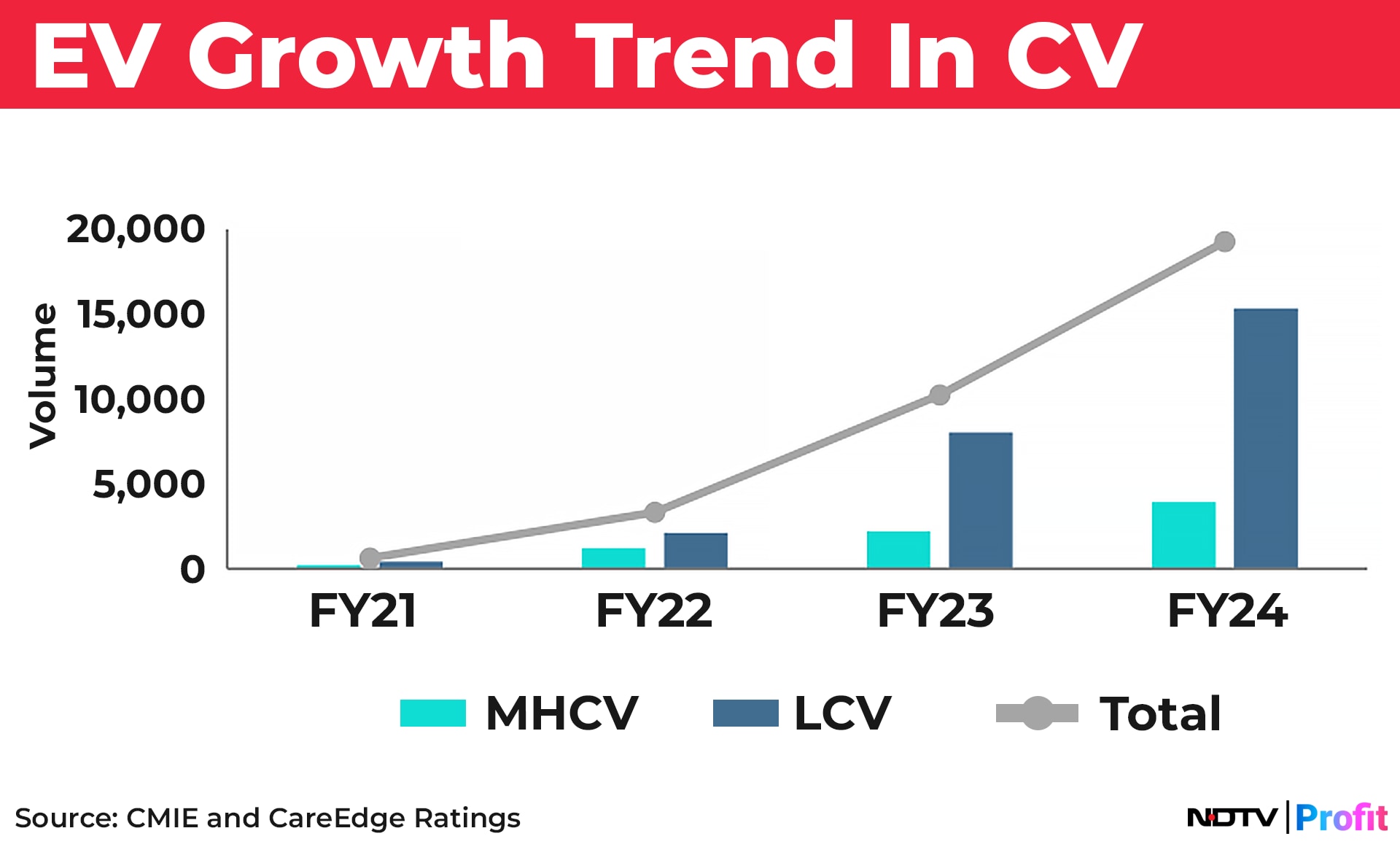

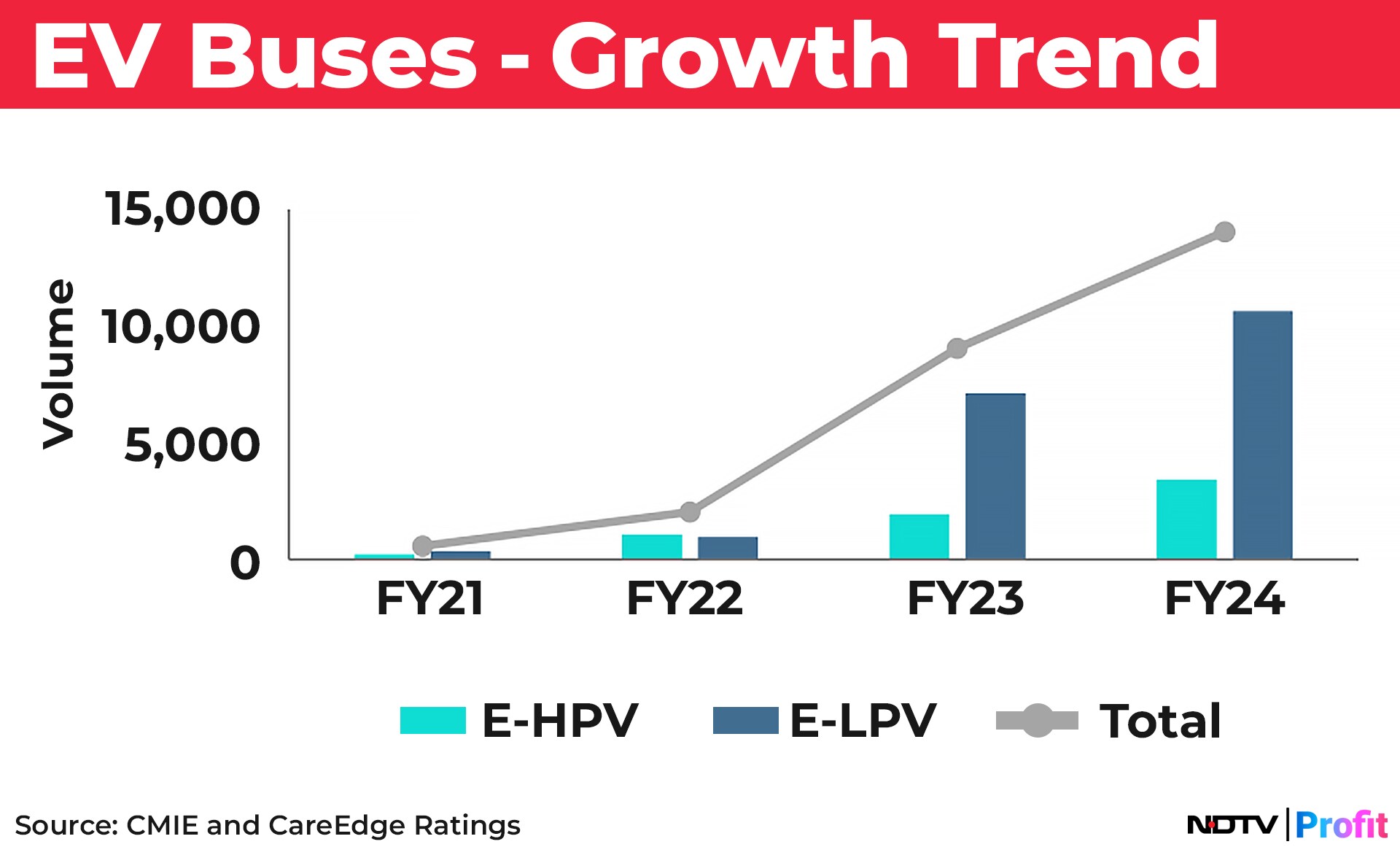

Between fiscal 2021 and fiscal 2024, the electric vehicle segment saw significant growth in commercial vehicles, especially e-buses and light commercial vehicles. Increased adoption rates, expanding EV infrastructure, and lower operational costs attracted fleet operators, it said.

E-buses and electrified LCVs, crucial for last-mile logistics, benefited from government initiatives and the push for cleaner transportation alternatives. The surge in demand for electric buses in major Indian cities is set to drive commercial vehicle growth. Factors such as rapid urbanisation, environmental concerns, high diesel costs, and advancements in battery infrastructure contributed to this trend, the report said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.