The Indian two-wheeler industry is expected to sustain a steady volume growth rate of around 7–9% in FY25, which would be slightly lower than the 9.8% growth that it had achieved in FY24, according to a CareEdge report that was released on Monday.

The growth in FY25 is expected to be driven by higher electric vehicle sales supported by the Electric Mobility Promotion Scheme 2024 (though only until July 2024 and likely extension), the expectation of interest rate cuts in the second half of FY25, strong demand for new model launches, a recovery in exports from its low base in FY24, and a favourable monsoon that is likely to improve rural consumer sentiment and income levels.

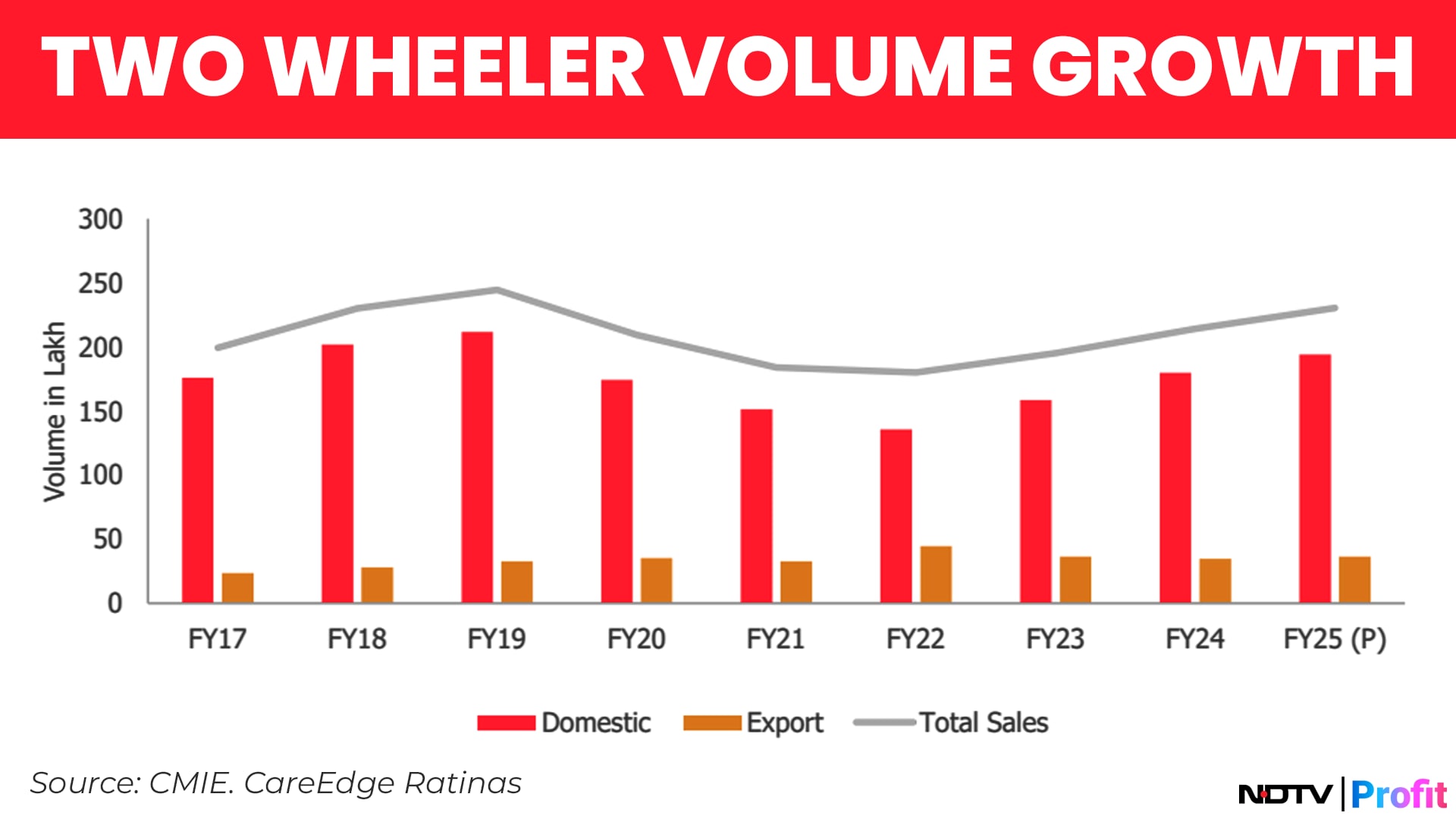

The Indian two-wheeler industry recorded sales of 19.51 million units in FY23, which is an 8% growth from the previous fiscal's 18.01 million units. The industry maintained its upward trajectory in FY24, achieving 9.8% growth with total sales reaching 21.43 million units. However, this figure remains below the peak sales volume of 24.46 million units recorded in FY19.

In FY24, the domestic two-wheeler industry sold 17.97 million units, reflecting a 13% growth rate, while export volumes declined by 5%, though they showed recovery from the FY23 levels.

Despite challenges, signs of revival emerged over the past five months (January–May 2024), with robust double-digit growth in two-wheeler exports. Feb. 2024 saw a 19-month high in export volumes at 0.33 million units.

The improvement in exports is due to marginal recovery and stabilisation in key markets, and this positive trend is expected to continue into FY25. Despite the promising outlook, the industry faces challenges in regaining the pre-pandemic sales levels of FY19.

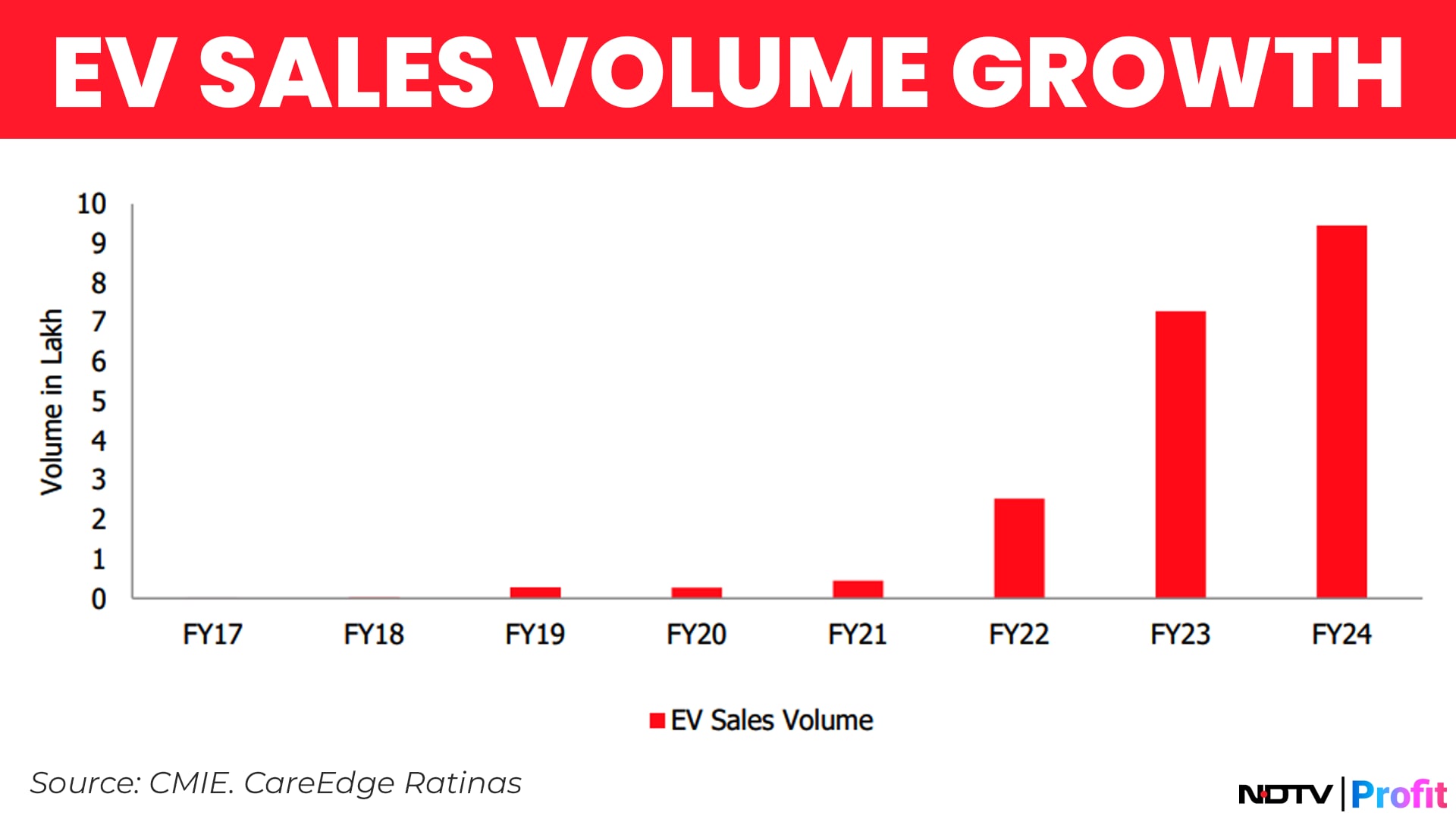

Electric vehicles have driven significant growth in the two-wheeler market. In FY23, EV sales rose to 0.73 million units, 4.54% of total sales, a leap from 1.87% the previous year and an 188% year-on-year increase. FY24 saw further growth, with EV sales surpassing 0.94 million units, up 30%. Demand is fueled by lower fuel costs, reduced maintenance, and government incentives like FAME II, which enhance affordability.

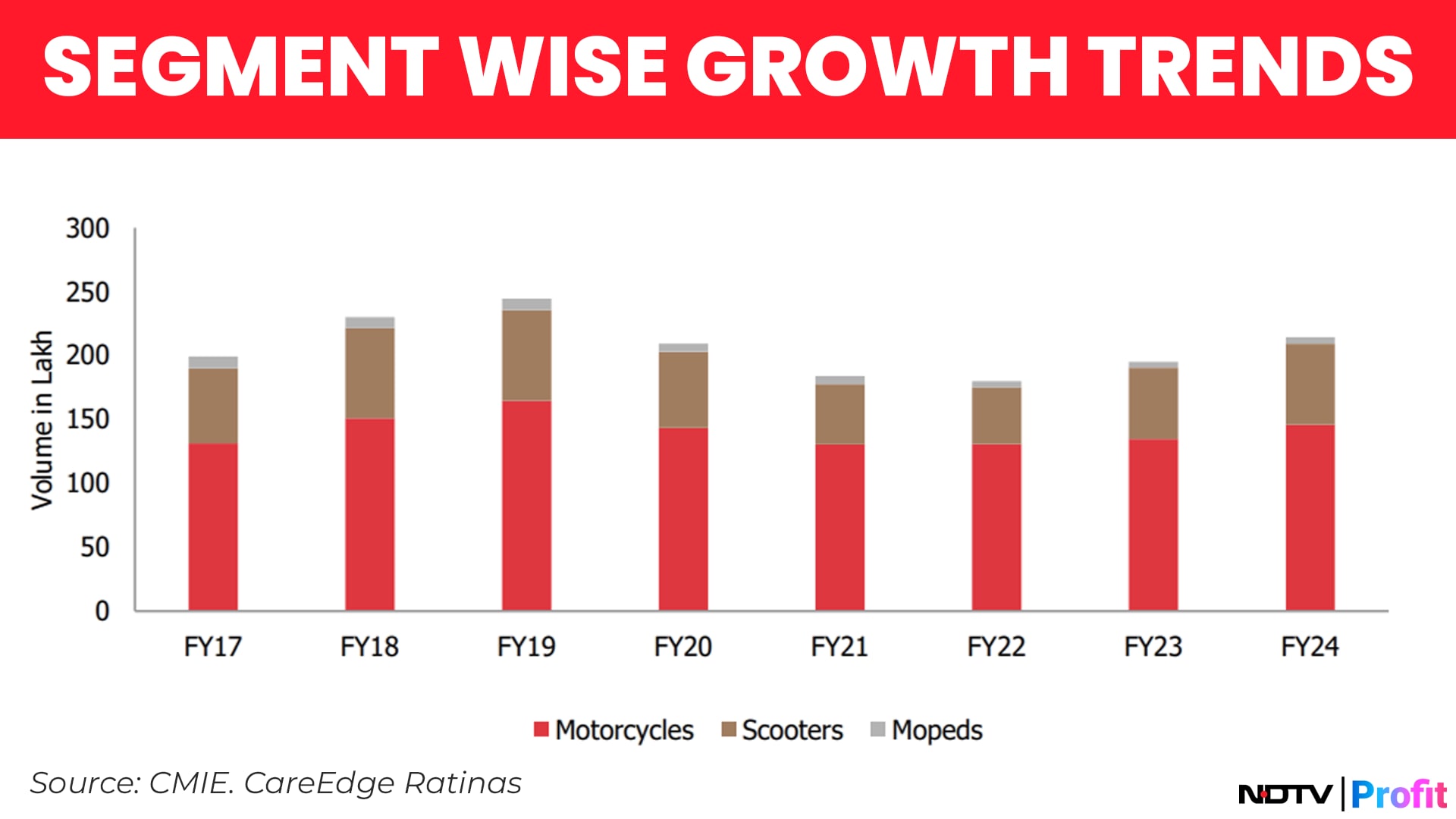

Segment-wise, motorcycles have consistently dominated the market, accounting for the majority of two-wheeler sales. In FY24, motorcycle sales volumes grew by 8%, while scooter sales rose by 13%. This segment-wise growth trend is expected to continue into FY25.

Motorcycles continue to be favored for their fuel efficiency, affordability, and versatility, while scooters are increasingly popular among urban commuters. The rise of electric two-wheelers further bolsters market expansion.

In the motorcycle segment, FY24 witnessed a 6% YoY growth in entry-level motorcycles, with executive and premium motorcycles growing by 14% and 16%, respectively.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.