(Bloomberg Opinion) --This election can hardly be faulted for lack of energy or commitment: The candidates have made it a contest of competing catastrophisms, with the survival of democracy itself at stake. Fighting over these existential issues, they've managed to agree on only one thing — that humdrum norms of competent governance are for now beside the point.

One of those norms is fiscal responsibility. Sooner or later, governments that set this concern aside come to grief regardless of their other commitments. When that happens, they take their economies down with them. The prospect is no longer unthinkable for the US. Yet it's hard to recall an election that ignored the issue so totally or in which pandering on taxes and public spending was so unrestrained.

Keeping up with the candidates' new unaffordable promises has been close to impossible. Every speech has offered a tax-cut sweetener for one constituency or another, plus pledges of more public spending on defense, say, or border security, affordable housing, paid family leave, Medicare expansions, and on and on, according to taste.

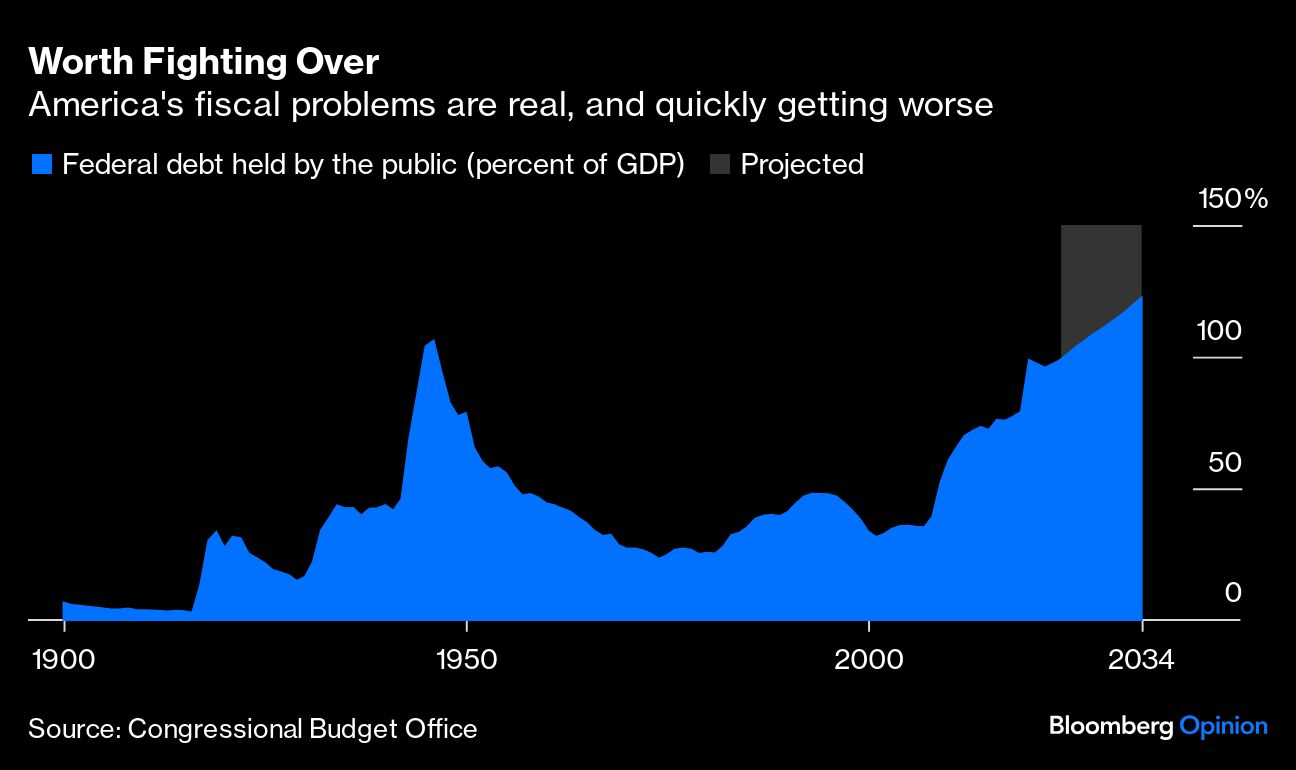

This added largess, if it materializes, will worsen an already-dire fiscal outlook. This year the government will collect taxes worth about 17% of gross domestic product, roughly the average for the preceding half-century. But it will spend about 24% of GDP, compared to a 50-year average of 21%. The resulting deficit of 7% of GDP is nearly twice the historic norm, even though the economy is at full employment and growing steadily. The ratio of public debt to GDP stands at 99%, double the long-run average, and on current policies is projected to exceed 122% by 2034.

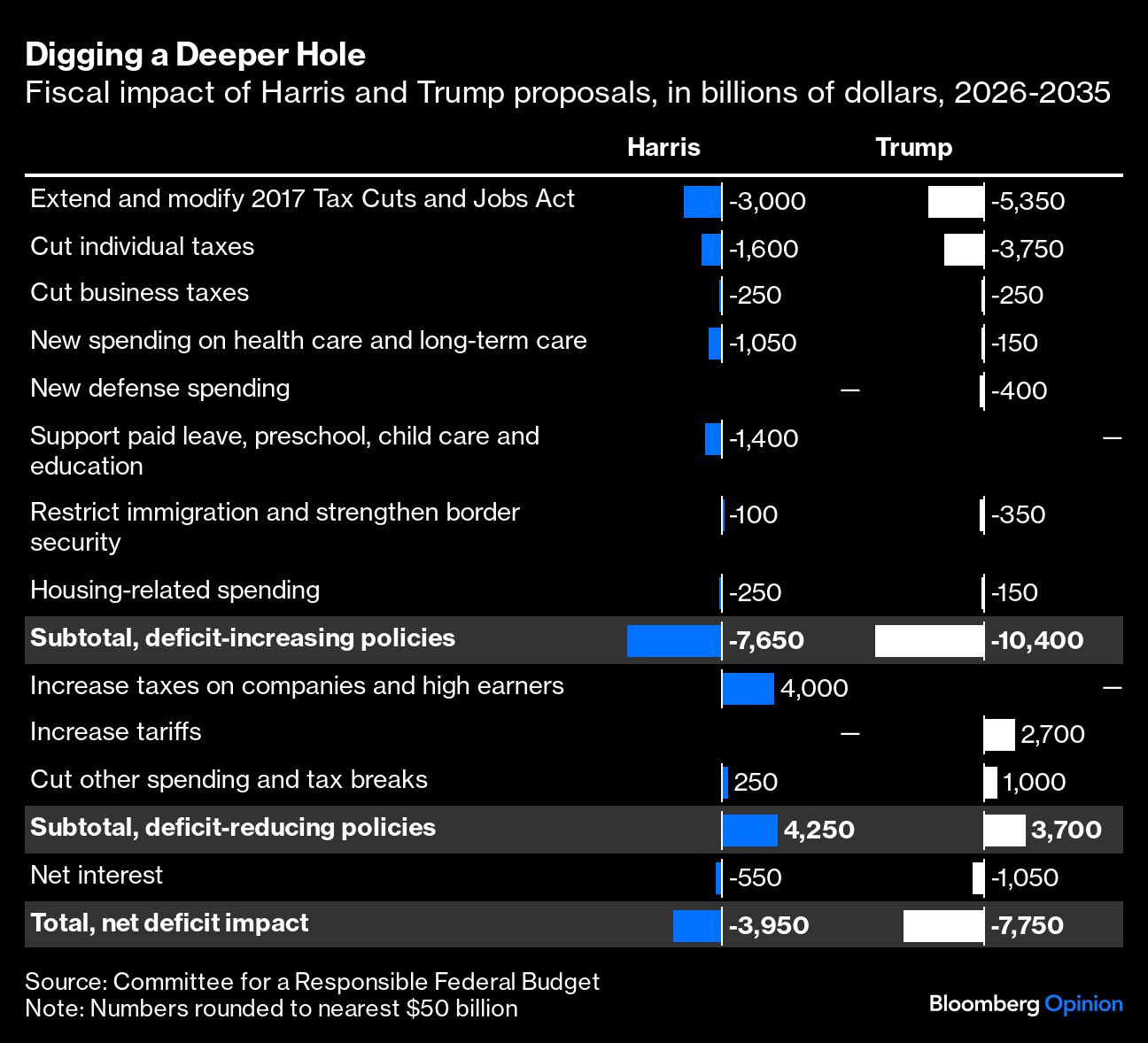

Enter former President Donald Trump and Vice President Kamala Harris. Both have announced blizzards of new deficit-raising tax cuts and spending hikes. Neither has spelled out the details, which makes it impossible to calculate the consequences precisely — but the Committee for a Responsible Federal Budget, a nonpartisan watchdog, has done its best to keep a detailed tally.

The Harris plan would add another $4 trillion of debt over the 10 years to 2035, according to the group's central case. She promises more than $7 trillion of tax cuts and new spending, only partly offset by higher revenue. The giveaways include retaining most of the 2017 Tax Cuts and Jobs Act (which would otherwise expire next year), exempting tips from income tax, expanding the child tax credit, spending more on pre-K and child care, and much else. Her revenue increases would come from a higher corporate tax rate and new taxes on investment income. The higher borrowing adds about $500 billion to interest costs. Projected debt rises to 134% of GDP by 2035, then keeps on climbing.

This record-breaking recklessness is a model of probity compared to Trump's proposals. His plan, again in the group's central case, would add almost $8 trillion of debt by 2035. His blandishments come to more than $10 trillion — roughly half of that from extending and expanding the 2017 cuts, plus exempting Social Security benefits, overtime pay and tips from income tax. His main new source of revenue would be tariffs, raising about $2.5 trillion (ignoring the fiscal consequences of an escalating trade war). Add an extra trillion for debt-service costs, and you get a debt-to-GDP ratio of 143% by 2035.

To repeat, the current-policy scenario is already unsustainable. The question is not whether such rapid accumulation of debt will stop but when, and with how much collateral damage. Far from grappling with this looming crisis, both candidates have promised to ignore it altogether.

Granted, presidential campaigns are rarely the moment for sober reflection on national problems. And what comes after this election gives the country a lot to worry about. But it's increasingly clear that a fiscal breakdown can't be left off that list.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.