(Bloomberg) -- The new cocoa harvest in West Africa's most important growers looks set to disappoint, just when the world desperately needs more beans.

Farmers in Ivory Coast are about to start reaping the so-called mid-crop, the second and smaller harvest of the season in the top producer and neighboring countries. But the incoming haul will do little to soothe a rattled market that's crying out for more supply and making chocolate more expensive.

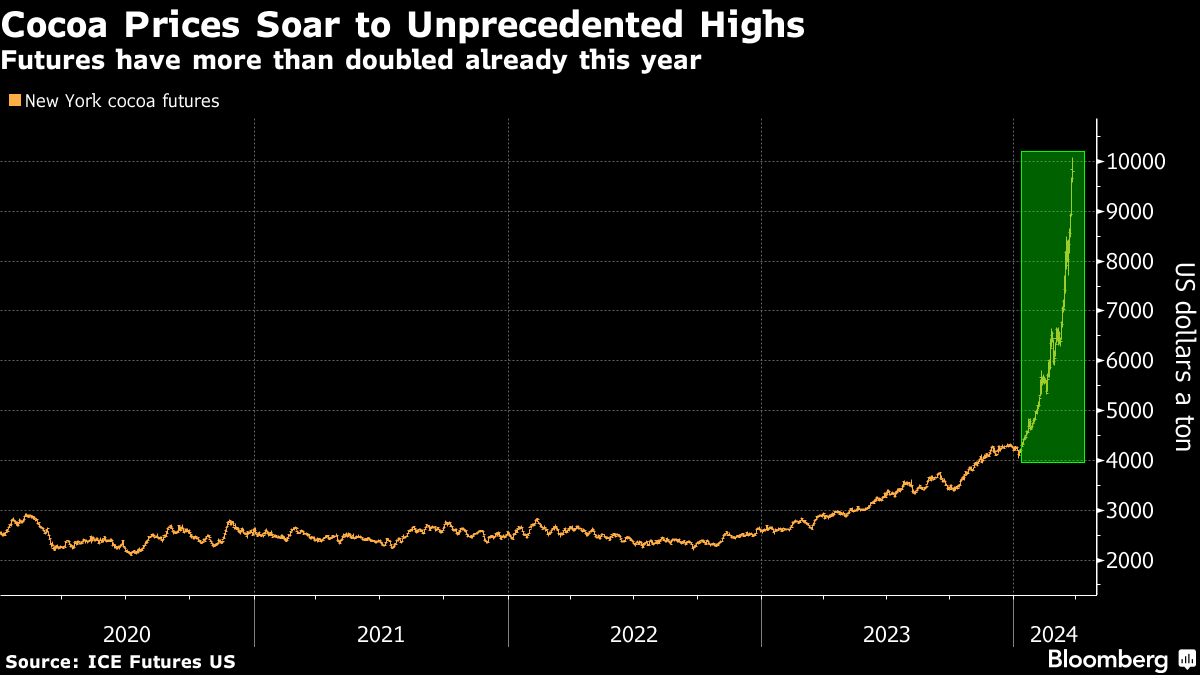

Prices have spiked to a record as bad weather and disease hurt African output, fueling a scramble to secure supplies. For now, the market needs fresh crops to ease a global shortage. But the mid-crop is also a reminder of a longer-term issue for farmers in Ivory Coast and Ghana — where the government tightly controls prices. Without better pay to invest in outdated plantations, they have little incentive to produce more in the years ahead, extending deficits.

“We need at least double the current producer pay to keep farmers on their farm,” said Michael Acheampong, who oversees more than 1,500 growers from Kwarbeng, north of Accra in Ghana. Some are even selling land for gold mining as a low government price “doesn't make cocoa growing a viable business.”

Here's a summary of the situation in the region's largest producers:

Ivory Coast

The regulator expects the mid-crop — often reserved for local processors — to shrink at least 17% to between 400,000 and 500,000 tons, Bloomberg reported in early March, citing people familiar with the forecast. Bean arrivals to export ports are almost a third behind last year's pace after a poor main crop.

The nation last year set prices for the main crop at 1,000 CFA franc ($1.65) per kilogram, roughly a sixth of what New York futures are now trading at. Farmers — who don't benefit from changes in market prices because they're set each season by the industry regulator — are asking for more pay for the new mid-crop.

But the regulator has proposed keeping prices the same as the main crop, according to people familiar with the matter who asked not to be identified.

“This year, due to the shortage of beans, there was a bidding war which did not really benefit the farmers,” said Jacques Kouakou, who heads a cocoa cooperative. “We hope for a good price for the mid-crop season.”

Regulator Le Conseil du Cafe-Cacao didn't immediately respond to a request for comment.

Ghana

The No. 2 grower's mid-crop starts in about July, but is already looking bad. Farmers may collect just 25,000 tons, compared with an earlier forecast for 150,000 tons, people familiar with the matter said. Smuggling to neighboring nations where prices are higher has also tightened supplies.

The country's regulator is also facing funding challenges that could make it harder to finance farmer pay and help growers buy seeds and fertilizers. Still, President Nana Akufo-Addo last month pledged to raise farmers' pay for the season that starts in October.

Cameroon and Nigeria

Growers here benefit almost immediately from market rallies, rather than being tied to government-set rates — with prices in those nations at least tripling in the past year.

Recent rain has revived hopes for Cameroon's mid-crop that runs through July, though more showers are needed in the coming months and it's probably too early to say if the harvest will beat last year. For the full season, the National Cocoa and Coffee Board said output should rise slightly to almost 300,000 tons.

Nigeria's mid-crop will end later than usual due to delayed rain, and could reach 76,500 tons, its cocoa association said. While slightly more than last year, it's below an earlier estimate of 90,000 tons and the outlook for the full-season has been cut.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.