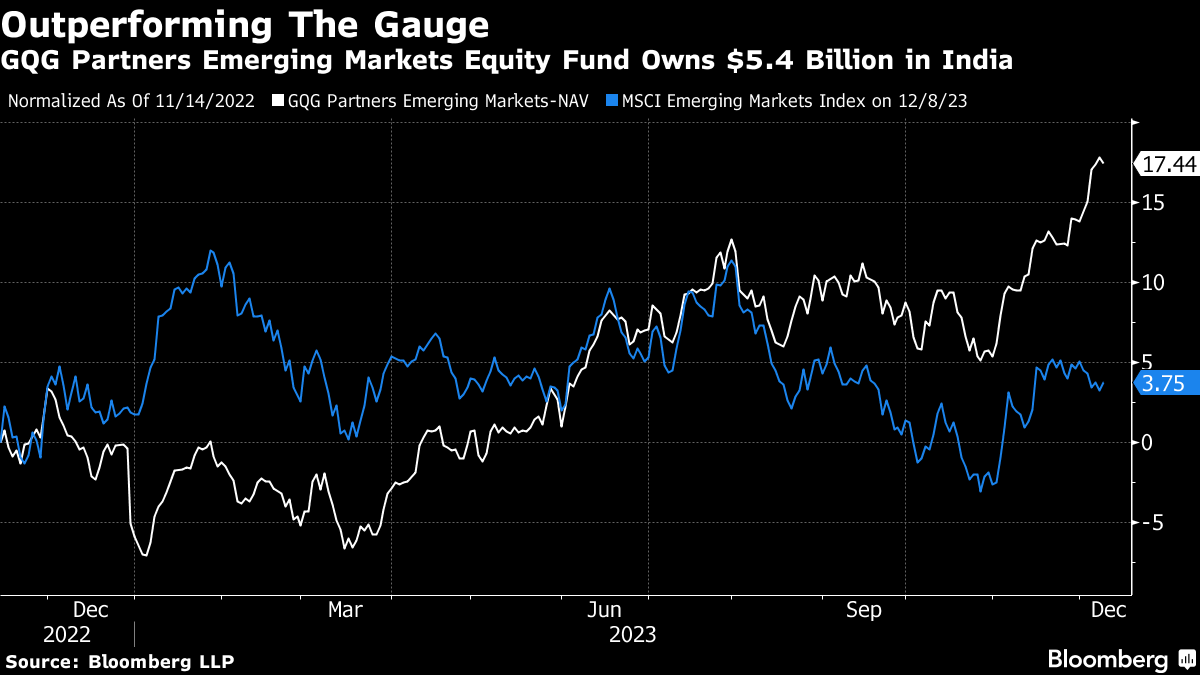

(Bloomberg) -- Rajiv Jain's GQG Partners LLC saw the value of its India portfolio more than double in little over a year, driven by winning stock picks that go beyond headline-grabbing investments in the Adani Group.

The value of India investments across six of GQG's funds jumped to $9.9 billion compared with $4.4 billion a year earlier, according to data compiled by Bloomberg from latest regulatory filings and information on the Florida-based investor's website.

GQG added stocks across infrastructure, consumer goods and energy sectors in the India equity market which topped the $4 trillion mark last week, cementing its status as one of the best performers in the emerging world. India is getting much love from global investors eager for alternatives to China at a time when Prime Minister Narendra Modi's nation-building drive has led to investment of billions of dollars for constructing roads, airports, bridges and power facilities.

Bloomberg's calculations rely on the last closing share prices and the latest shareholding in Indian stocks disclosed by GQG for four mutual funds and two others. This may not capture the US investment firm's entire India exposure since it has other funds whose portfolio details are not available.

The valuation of GQG's Adani investment has vaulted to $7 billion, validation for Jain who cut against the grain when he bought shares worth $1.9 billion in March in the shortseller-stung conglomerate and then topped up some. But he and his fund managers have also bought several less flashy stocks in India that have surged over 50% this year, beating the 15% rise in the benchmark S&P BSE Sensex.

What's In, What's Out

The largest fund, GQG Partners Emerging Markets Equity Fund, bought JSW Energy Ltd., Patanjali Foods Ltd., Macrotech Developers Ltd., Max Healthcare Institute Ltd. and IDFC First Bank Ltd. for the first time between April and September this year. It added ITC Ltd. — the fund's largest bet — and State Bank of India Ltd. among other stocks, filings show. The fund last week bought 92.6 million shares in GMR Airports Infrastructure Ltd., which climbed 6.1% on Monday pushing the full year jump to 84%.

It also exited its holdings in Reliance Industries Ltd., Infosys Ltd., Cipla Ltd. and Bajaj Finserv Ltd. All of these have underperformed against the Sensex in 2023.

A representative for GQG declined to comment on an emailed query seeking comments on their India investment strategy.

Jain, who was born in India but moved to the US in 1990 for his MBA, co-founded GQG Partners in 2016 and has built it into a $113 billion powerhouse since. Unlike many of his peers, Jain doesn't have a account on X, formerly known as Twitter, makes rare TV appearances and has little penchant for driverless-car companies or hypersonic-missile manufacturers.

Instead, he buys into industries with a decidedly 20th-century feel: energy, tobacco, banking. GQG's India stocks portfolio also mirrors this.

In a June interview with Bloomberg, Jain said his firm plans to buy more of India stocks and downplayed the corporate governance and political risks that were weighing down the Adani Group.

South Florida's Anti-Cathie Wood Quietly Builds a Stock Behemoth

A total of nine GQG funds, that includes mutual funds, collective investments and managed funds, had investments worth $14.5 billion in India as of October end, or about 20% of their total assets under management, according to a Bloomberg analysis of filings. However, portfolio details are available for only six funds that have seen India investments surge by 125% since last year.

Out-Sized Bets

Jain, known to like safe, defensive stocks and then make out-sized bets on them, grabbed investor attention globally when he bought into four Adani Group stocks in March — weeks after the Gautam Adani-led conglomerate was accused of corporate malfeasance by short-seller Hindenburg Research. The market rout wiped off more than $150 billion off Adani Group's market value at one point despite denying these allegations.

GQG didn't just buy into Adani's besieged stocks, it doubled down, with Jain calling them “one of the best infrastructure assets” in India. He said in an April interview with Bloomberg that Hindenburg's accusations might look messy “from a Western point of view” but they were perhaps less problematic in the Indian business context.

Adani Group's market value, driven largely by a spurt over the past two weeks, has increased by about $81 billion since GQG's March purchase.

That said, not all of GQG's picks have been outperformers. Some, such as HDFC Bank Ltd. and ICICI Bank Ltd. that its EM fund added this year, have lagged the Sensex.

The overall impact on the portfolio, though, has been limited, thanks to the outsized gains in some of its other holdings, including Adani. And it doesn't look like Jain is in it for the short term.

Modi's Nation-Building Push Spurs $125 Billion Industrials Rally

While GQG likes “private sector banks, IT and consumer staples,” Jain spotlighted infrastructure as the sector to watch in India in the June interview with Bloomberg. “We feel infrastructure is the new story and still under appreciated,” he said then.

--With assistance from Miles Weiss, Baiju Kalesh, Ashutosh Joshi and Chiranjivi Chakraborty.

(Updates with GQG's recent purchase of GMR Airports shares in the sixth paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.