(Bloomberg Opinion) -- The regulatory approval of an exchange-traded fund isn't supposed to be a mass-media event worthy of Wrestlemania. Yet here we are. The hype around US spot Bitcoin ETFs has reached meme levels akin to pandemic-era laser eyes: Crypto prices are soaring, hackers are mobilizing and Redditors are pumping. But the promise of game-changing, gold-like adoption looks like a meme too far.

The speculative build-up to US Securities and Exchange Commission approval of the product has been music to the ears of Wall Streeters scrambling to flog ETFs at low, low prices — with fees set at around 0.2% to 0.4% and the prospect of as much as $4 billion being gathered on the first day alone for some 11 funds in the pipeline, according to Bloomberg Intelligence. Crypto bros should feel free to gloat as ETF leader BlackRock Inc.'s Larry Fink flips from calling Bitcoin an “index of money laundering” to saying it's “digitalizing gold.”

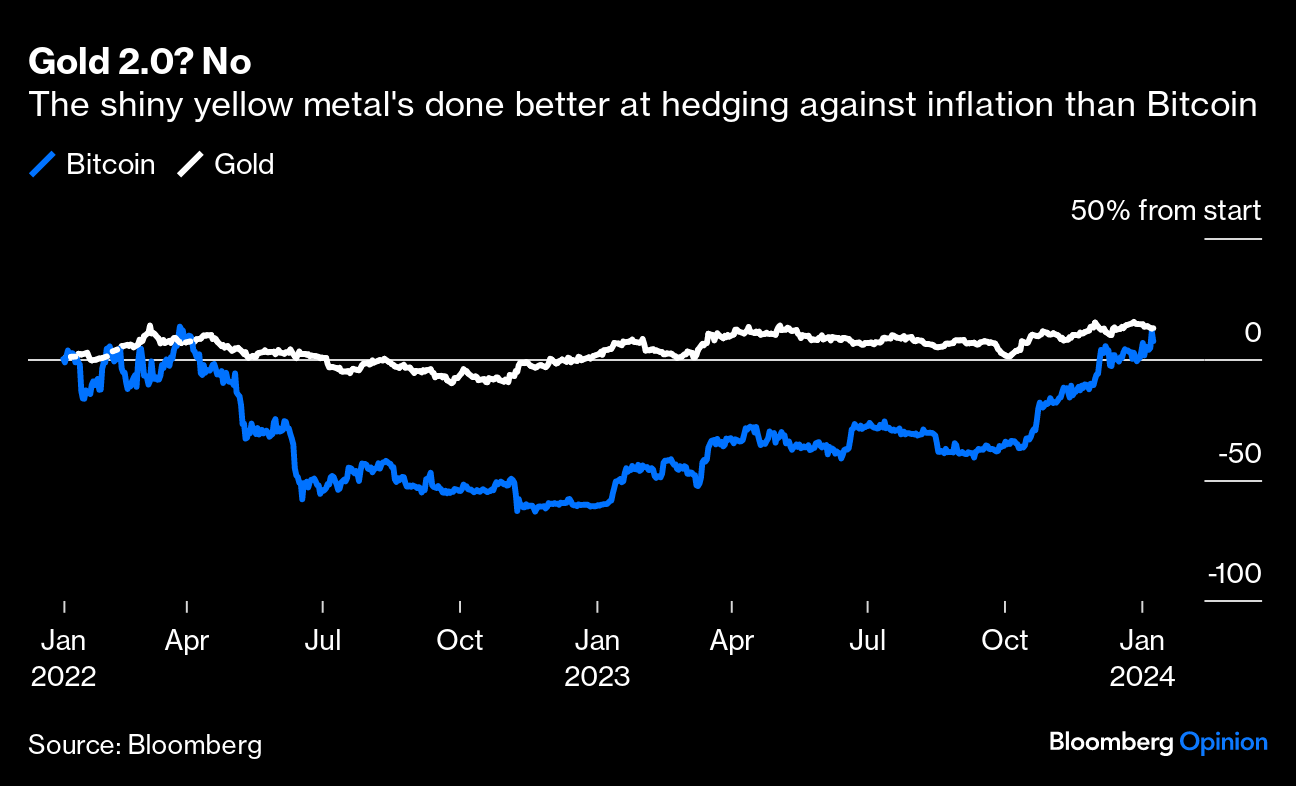

Yet cooler heads might wonder what happens next. The optimistic thesis from those who have been pushing for this kind of ETF for years, such as the Winklevoss twins, is that this is indeed Gold 2.0. If Bitcoin is increasingly held as a digital store of value, more a shiny object to hoard than a fintech killer app, analysts reckon there's much more upside to the current price. The twins' crypto exchange, Gemini, reckons an ETF is key to making Bitcoin look like a legitimate home for a chunk of $36.7 trillion of savings and retirement cash — similar to the adoption of gold after its first ETF 20 years ago.

But the road to Gold 2.0 for Bitcoin looks neither straight nor shiny. The approval of a spot ETF in 2024 comes fairly late: Bitcoin isn't an unknown quantity and there are already many ways to get exposure, from stocks to ETF-like products. The fact these products have tended to start off with a bang before fizzling out, underperforming or even shutting down — similar to the crypto market's hype cycles — means financial advisers may find it easier to preach to the converted than drum up support from nervous neophytes.

So, yes, new spot ETFs may do well, but that may have a lot to do with money that's already inside the crypto system looking for a cheaper or more efficient home than what's currently available, says Jonathan Bier, chief investment officer at Farside Investors.

Meanwhile, pitching Bitcoin as a commodity-like store of value akin to gold — ETF or no — has another problem: Its track record. The history of gold proves that it can work as a hedge against inflation, according to analysis by S&P Global Inc. published in May, which found gold and inflation expectations had tracked each other “quite well” since 2003 to a level consistent with causality. And during any major stock-market correction, gold has also been an effective hedge, according to a Morningstar report from August. Bitcoin has displayed none of these attributes.

The digital currency is certainly good at capturing some of gold's speculative qualities. You can buy it, hold it, gaze at it (in your digital wallet), then sell it (and later regret it). There's no passive income to be derived from it. The only thing to do is talk about it, often at length, online, at family gatherings, in chatrooms, until your family and friends no longer want to see or speak to you (until the price goes up again).

But that doesn't make it a safe, retirement-friendly asset. The SEC's foot-dragging over approving a spot Bitcoin ETF speaks to the regulatory gray zones that still exist — not to mention this week's market-moving hoax tweet from the SEC's official account claiming ETFs had been approved, which the regulator said was due to “unauthorized” access by an “unknown” party.

As Coinbase Global Inc., in battling the SEC over its definition of whether tokens on its platform constituted securities, said last year: “A token sale on Coinbase is no different from a trade of a baseball card or Pokemon card or a Beanie Baby or a painting or bitcoin or ether.” Is this really the future of finance?

The main lesson here seems to be that crypto's current attraction is about piggy-backing on the legitimacy of institutions, from the SEC to ETFs, much like the stamp of the sovereign gives value to a gold coin. It says nothing about where the chips will eventually fall in a world still searching for a crypto use case where central banks issue digital currencies, investment banks issue stablecoins, and BlackRock and its peers offer Bitcoin funds. The memes are glittering, but this isn't gold.

More From Bloomberg Opinion:

-

Stablecoins Could Have a Real-World Purpose: Andy Mukherjee

-

Matt Levine's Money Stuff: Put the Bitcoins in the Box

-

Bitcoin Hype Will Clash With the Rolex Recession: Lionel Laurent

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Lionel Laurent is a Bloomberg Opinion columnist writing about the future of money and the future of Europe. Previously, he was a reporter for Reuters and Forbes.

More stories like this are available on bloomberg.com/opinion

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.