(Bloomberg Opinion) -- The 2024 oil market is still in its infancy, but attention is already shifting to 2025. If the global economy is starting to abandon its oil addiction, as optimists contend, the first signs of the energy transition should emerge by next year. Spoiler alert: early indications are that the beginning of the end of the fossil-fuel industry remains elusive.

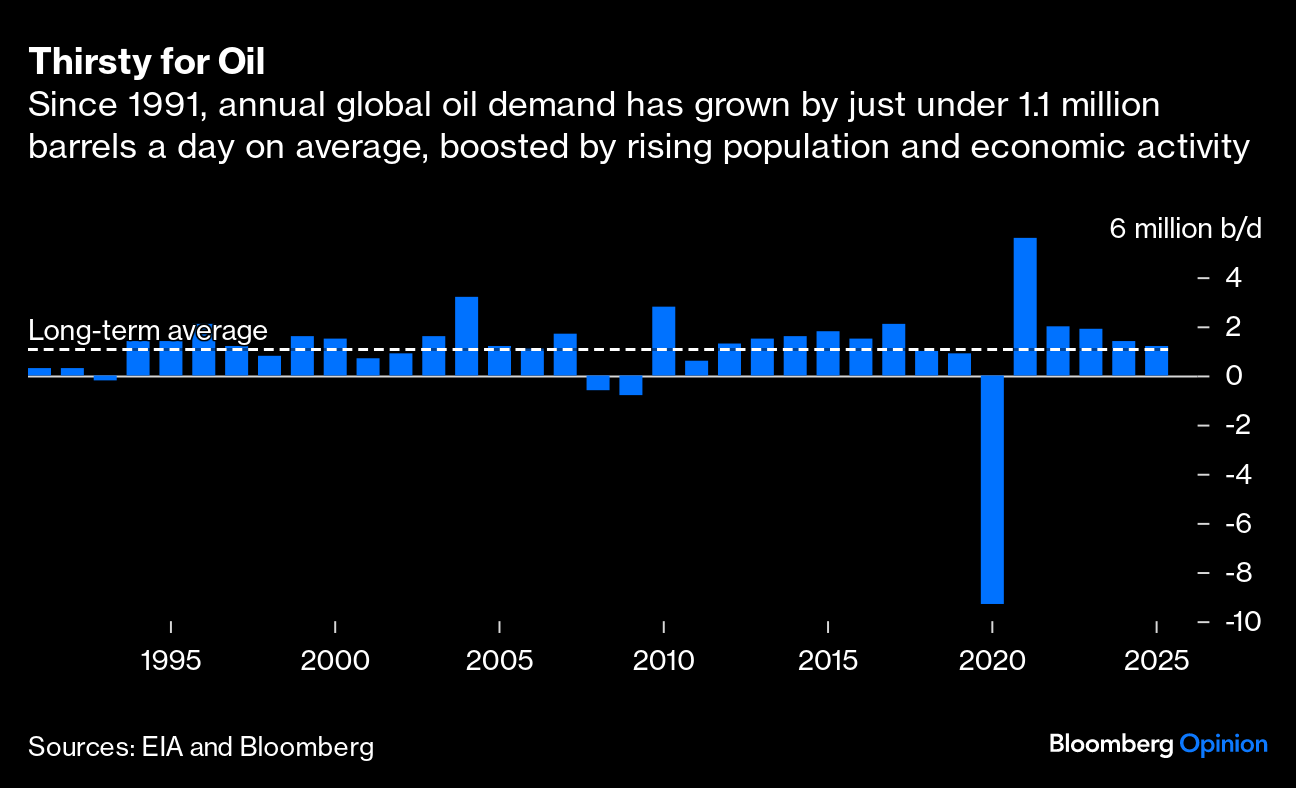

Every January the Energy Information Administration, the statistics arm of the US Department of Energy, is the first public forecaster to release its oil market predictions for the following year. On Tuesday, the EIA said it anticipates global oil demand will grow by 1.2 million barrels a day in 2025, compared with the 1.4 million barrels a day expected in 2024.

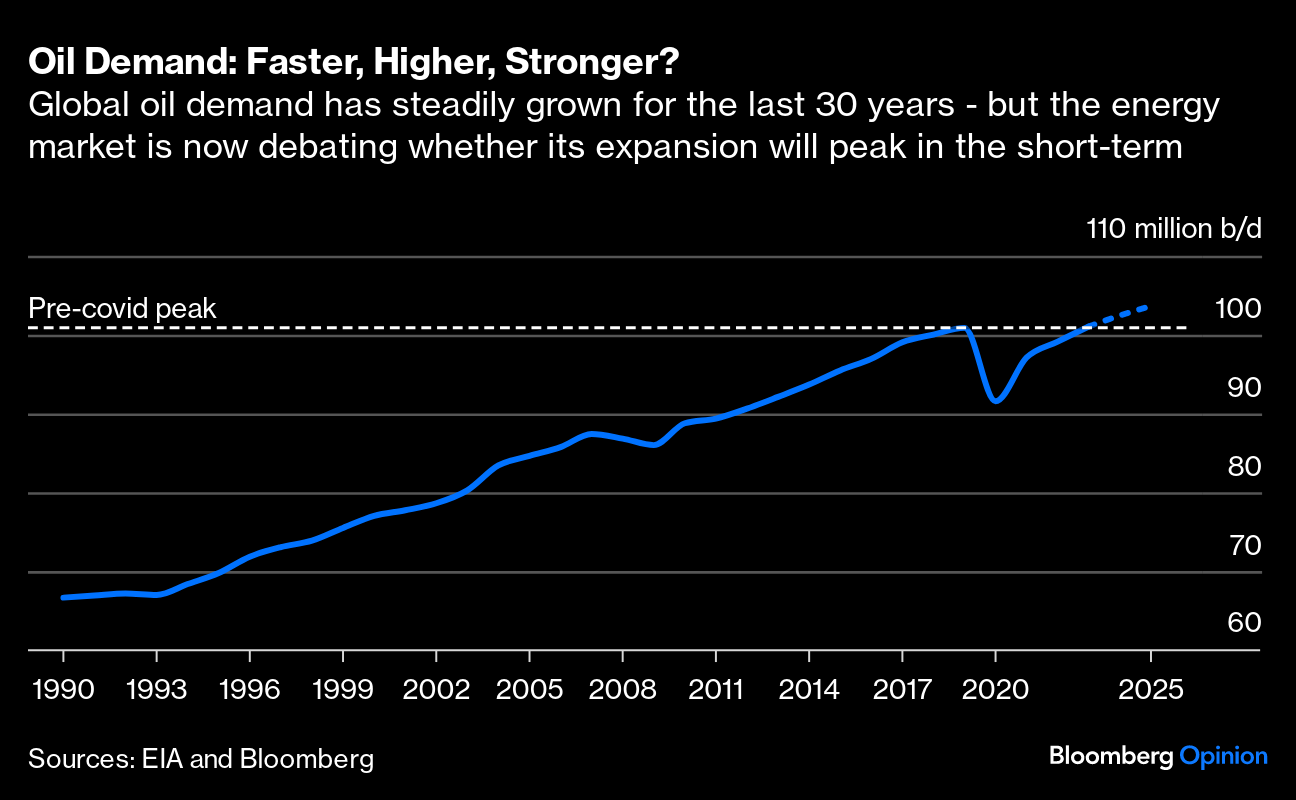

Despite the world agreeing at the COP28 climate talks in Dubai last year to move toward “transitioning away from fossil fuels,” the reality is that the process will take decades. What should be closer, however, is a sharp deceleration in the growth of global oil demand and a peak in consumption. If the zenith in demand is to arrive before the end of this decade, as the International Energy Agency has said, consumption growth needs to start slowing down as soon as next year, before halting completely in subsequent years. That's why 2025 is so important as a bellwether.

Reading the market since early 2020 has been extraordinary difficult due to the economic impact of the Covid-19 lockdowns. Now, the pandemic recovery has largely run its course, and the energy industry has returned to its status quo. From 1991 to 2023, global demand for crude has grown, on average, by 1.05 million barrels a day. Excluding the Covid-19 impact — and the recovery from it — oil demand growth has averaged 1.18 million barrels a day over the last 30 years — in line with the EIA's forecast of 1.2 million for 2025 which, technically, signals an above-average number.

As the EIA itself puts its, the demand increase it sees for 2024 and 2025 “is

While the forecast is tentative, it still provides important directional clues. The EIA will fine tune its estimate, and others will publish too their 2025 outlooks. The IEA will release its own predictions in April — earlier than in previous years — and OPEC will follow later. In the private sector, barrel counters have diverse views about next year, with growth forecasts ranging from 0.9 to 1.5 million barrels a day.

If the EIA is correct, global crude demand will reach an annual average of 103.7 million barrels per day in 2025, extending a long-term trend, with China and India accounting for much of the gain. Oil consumption in developed countries is retrenching, however. In products, the petrochemical sector will represent a large chunk of the additional oil consumption — again as in previous years, with plastics offsetting electric vehicles. The airline industry would be the second source of incremental demand.

The fact that 2025 could prove an average year for global oil demand growth doesn't mean that the energy transition is doomed. Consumption growth may slow from 2028 to 2029, with a peak perhaps being reached in the mid-2030s.

The outlook does show, however, that the transition is likely to take longer than the most optimistic have anticipated, in large part because of a factor that's often overlooked when analyzing the oil market: The world's population is still growing. As Martijn Rats of Morgan Stanley puts it, “global consumption-per-capita has been remarkably stable at about 4.5 barrels-per-person-per-year since the late 1970s.” The relationship has survived high and low energy prices; economic booms and busts and technical advances. With the world set to add another billion people between now and 2037, reaching 9 billion, the slew of new consumers would damp the impact of innovations such as electric vehicles.

So while it's early days, looking ahead to 2025 I see more of the same when it comes to oil demand — business as usual, rather than evidence of a transition away from fossil fuels.

More From Bloomberg Opinion:

Peak Gasoline Demand Turns Out to Be a Mirage: Javier Blas

The Year's Worst Climate News You Haven't Heard: David Fickling

COP28 Deal Shows Annual Gala Is Serious Business: Lara Williams

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Javier Blas is a Bloomberg Opinion columnist covering energy and commodities. He is coauthor of “The World for Sale: Money, Power and the Traders Who Barter the Earth's Resources.”

More stories like this are available on bloomberg.com/opinion

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.