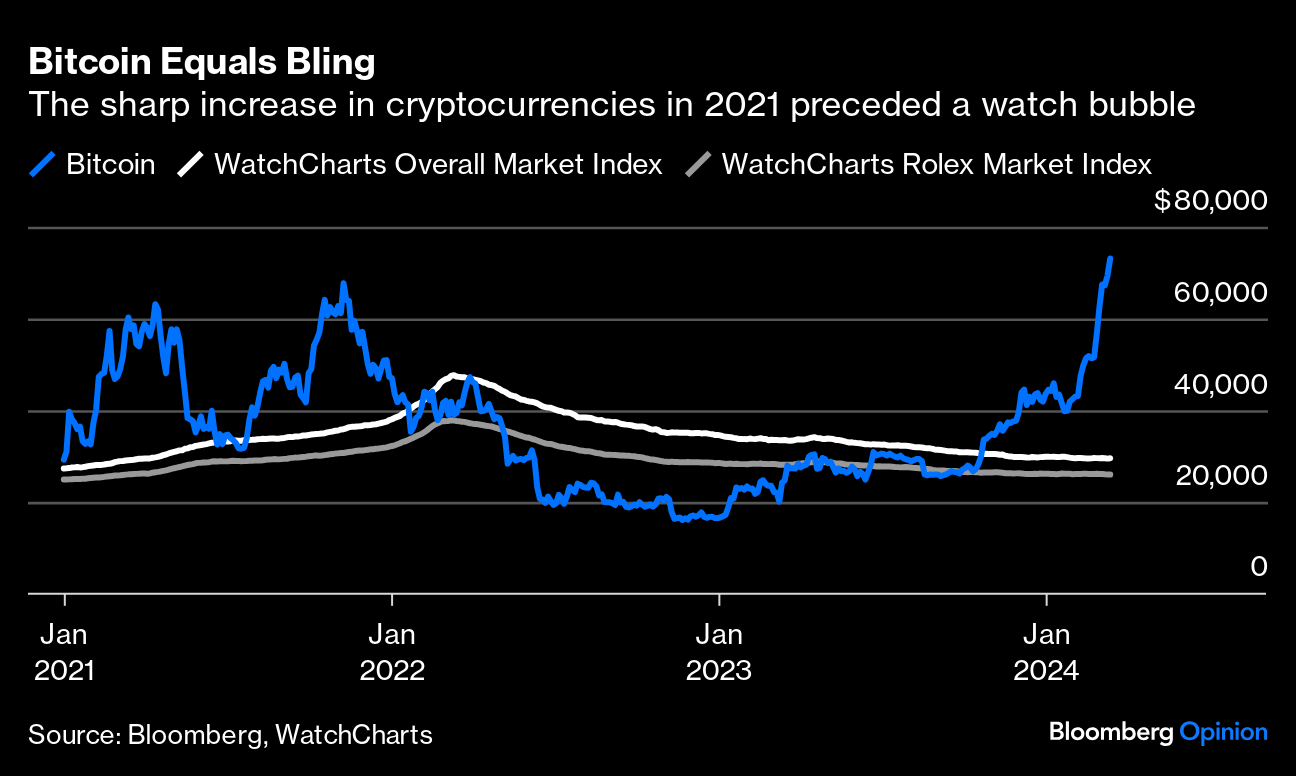

(Bloomberg Opinion) -- If that Rolex you've got your eye on is getting more expensive, Bitcoin may be to blame. The last time the cryptocurrency rallied, in 2021, it presaged a bubble in second-hand watch prices. There's a fair chance that the recent resurgence that's seen Bitcoin climb to a record will boost the values of timepieces, but for now, a repeat of the unprecedented escalation we saw back then looks some way off.

The prices at which watches change hands in the secondary market have moved broadly in line with both Bitcoin and the S&P 500 index over the past five years or so. The correlation between crypto and timepieces wasn't exact last time the currency took off; Bitcoin lost almost half of its value between early November 2021 and late January 2022, yet watch prices didn't peak until March 2022.

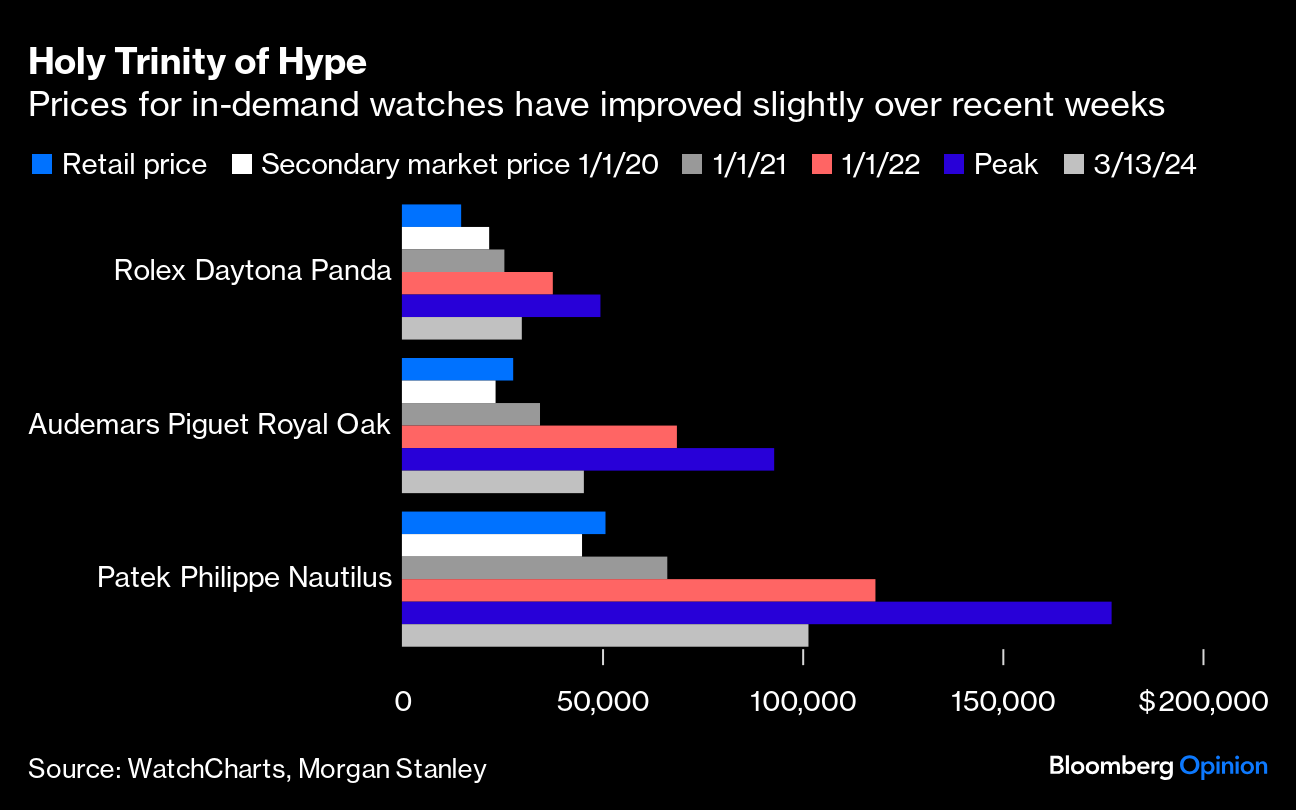

Crypto gains undoubtedly bolstered wealth and ignited a broader interest in investing in alternative assets, whether non-fungible tokens or timepieces. Novices and seasoned buyers alike all chased the same models, the holy trinity of hype — the Rolex , the Patek Philippe and the Audemars Piguet — propelling prices for used models to many multiples of what they cost in the shops.

With Bitcoin gaining about 80% since late January, as well as the S&P 500 melting up with small, consistent ever-higher highs, it's little wonder that watch prices on the secondary market have stabilized. The Bloomberg Subdial Watch Index returned to growth in February, up 0.2% for its biggest monthly gain since March 2023. It's a similar picture elsewhere, with WatchCharts' Rolex index down just 0.6% over the past month, and Patek Philippe and Audemars Piguet prices flat.

At least some of those making money from Bitcoin will treat themselves, and for many men, the first choice is likely to be a watch. But it's not immediately clear whether this will put values on the same upward trajectory we saw three years ago.

Those circumstances were probably unique. Stuck at home, consumers funneled money that would have been spent on dining out and vacations into luxury goods. With so much time on their hands, enthusiasts became enthralled with watches, with Reddit chats and TikTok videos dedicated to models such as a Rolex with a palm leaf dial, dubbed Interest in horology, previously the preserve of a cadre of collectors, moved to the mainstream. Add in stimulus payments and low interest rates, and speculation exploded.

Moreover, it's difficult to determine how much additional supply — another key determinant of prices — is yet to come to market. For some people who dabbled last time round, perhaps using leverage to amass collections, stability could be an opportunity to sell into the market, rather than buy.

Inventory levels remain elevated compared with two years ago, with little sign of a reduction in Rolex, Patek and Audemars Piguet stocks over the past few months, according to WatchCharts. Consequently, factors other than supply and demand may be contributing to the recent calm, such as speculation about a Rolex with a red and blue bezel, known as the , being discontinued, and the forthcoming Watches and Wonders event, where brands will show off their new releases.

Finally, although both the S&P 500 and Bitcoin have been on an upward streak since the end of October, the sharpest increases in crypto values have taken place over the last couple of months; for gains to find their way into the watch market, the rally must be sustained.

If it is, it may not just be watches on the secondary market that benefit. Sales in stores, which for some brands had begun to weaken, may also benefit. Broader demand for luxury goods may get a lift, too.

Crypto gains probably accounted for as much as a quarter of the growth in US luxury sales in 2021, analysts at Jefferies said at the time. The slump in 2022 and 2023 probably contributed to the contraction in spending among simply comfortable rather than super-wealthy consumers.

Any recovery in confidence among so-called aspirational luxury consumers would be good news, particularly for brands exposed to this demographic, such as Kering SA's Gucci and Balenciaga, parts of LVMH's Louis Vuitton, Moncler SpA and Britain's Burberry Group Plc. And any recovery in the US for top-end goods is much needed, given the surge in luxury valuations since late January.

The heftier price tag on your Rolex may be the first sign that Bitcoin equals bling once more.

More From Bloomberg Opinion:

-

Don't Bet Your Bonus on a Bargain Rolex: Andrea Felsted

-

I've Had Trouble Hearing. Then I Tried New Glasses: Dave Lee

-

The Skin Care Industry's Secret Weapon? Kids: Amanda Little

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Andrea Felsted is a Bloomberg Opinion columnist covering consumer goods and the retail industry. Previously, she was a reporter for the Financial Times.

More stories like this are available on bloomberg.com/opinion

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.