A Slovenian company is bringing to India a technology that will allow low-cost feature phones to make mobile payments without internet.

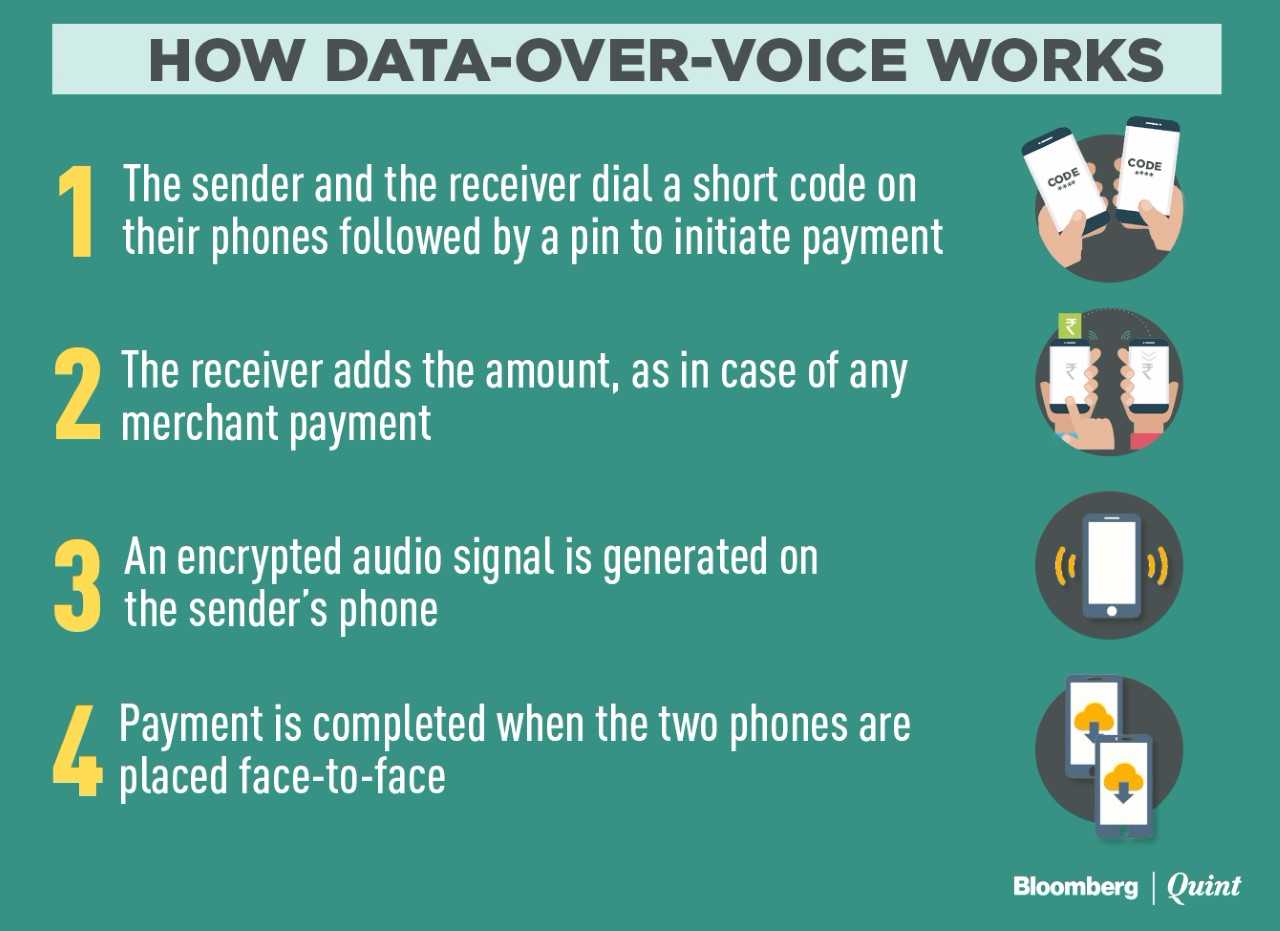

Margento's patented Data Over Voice solution sends encrypted audio signals between two face-to-face phones to complete a payment. It already provides it in 15 countries, including India's southern neighbour Sri Lanka.

The company has tied up with Chandigarh-based Masterline Telebiz, which makes recharge cards and other telecom devices and solutions for mobile transactions. With Margento's technology, any mobile can become a universal payments instrument, Naresh Nanda, founder of Masterline, told BloombergQuint in an interview.

Two-thirds of mobile devices sold in India are feature phones and Margento wants to grab a slice of the market. The opportunity is huge given that the overall internet penetration in India is around 31 percent, according to a report from the Internet and Mobile Association of India and market researcher IMRB International. Such solutions will complement the government's initiative to push digital payments.

A team of Margento is coming to India in the second week of August to tie up with some of the leading banks. The firm is also in talks with e-commerce companies to add to their cash-on-delivery payments, Nanda said.

How It Works

To be sure, Unstructured Supplementary Service Data or USSD already allows payments through feature phones. Users can check account balance, generate mini-statements and transfer funds via mobile IDs allotted by banks or IFSC code or Aadhaar number. It has a daily transaction limit of Rs 5,000. Similarly, banks allow credit and debit card payments through interactive voice response that requires a merchant or the receiver to make a call.

Both these technologies need multiple steps compared to Margento's solution that requires the user to dial a code once. Apart from phone-to-phone transactions, the company is also looking to provide point-of-sale solutions for making payments to merchants.

Once a bank adopts the technology, its users can purchase products and services, recharge prepaid accounts, receive and use loyalty bonuses, purchase, send and redeem mobile gifts, coupons and tickets, transfer money, or pay utility and other bills.

Masterline will be the reseller of the Margento's DOV technology products in India. “Post tie-ups with banks, we expect to handle 12-15 million transactions in a week, given a gestation of three months,” Nanda said.

It's not the first time a company is offering payments through voice in India. There have been several experiments, said Deepak Sharma, chief digital officer at Kotak Mahindra Bank. “After demonetisation, we also ran pilots but there are multiple challenges like background noise and the time taken.

Sharma said though Kotak Bank has not found a solution, it's exploring technologies that can be taken to scale. “As long the technology is relevant, banks are more than happy to adopt it.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.