Locked-down Indians rekindled their love for home buying during the pandemic. Ever since, they've been rushing to upgrade their lives and living spaces until the third quarter of 2024. While there is no slowdown in real estate demand, the pace of decision-making seems to simmer down.

“What is happening is that it's stabilising, not going down. The home buyers who were earlier taking a month to make a decision are now taking three months. They are rationalising,” said Jayesh Rathod, director and co-founder of The Guardians Real Estate Advisory, on the changed mood of buyers.

Realty Adjusts To New Price Reality

The real estate boom, which came after seven years of lackluster sales in 2021, entered its third year of the upcycle. In the third quarter of 2024, real estate sales in the top 7 cities fell for the first time in two years—on a both quarterly as well as yearly basis.

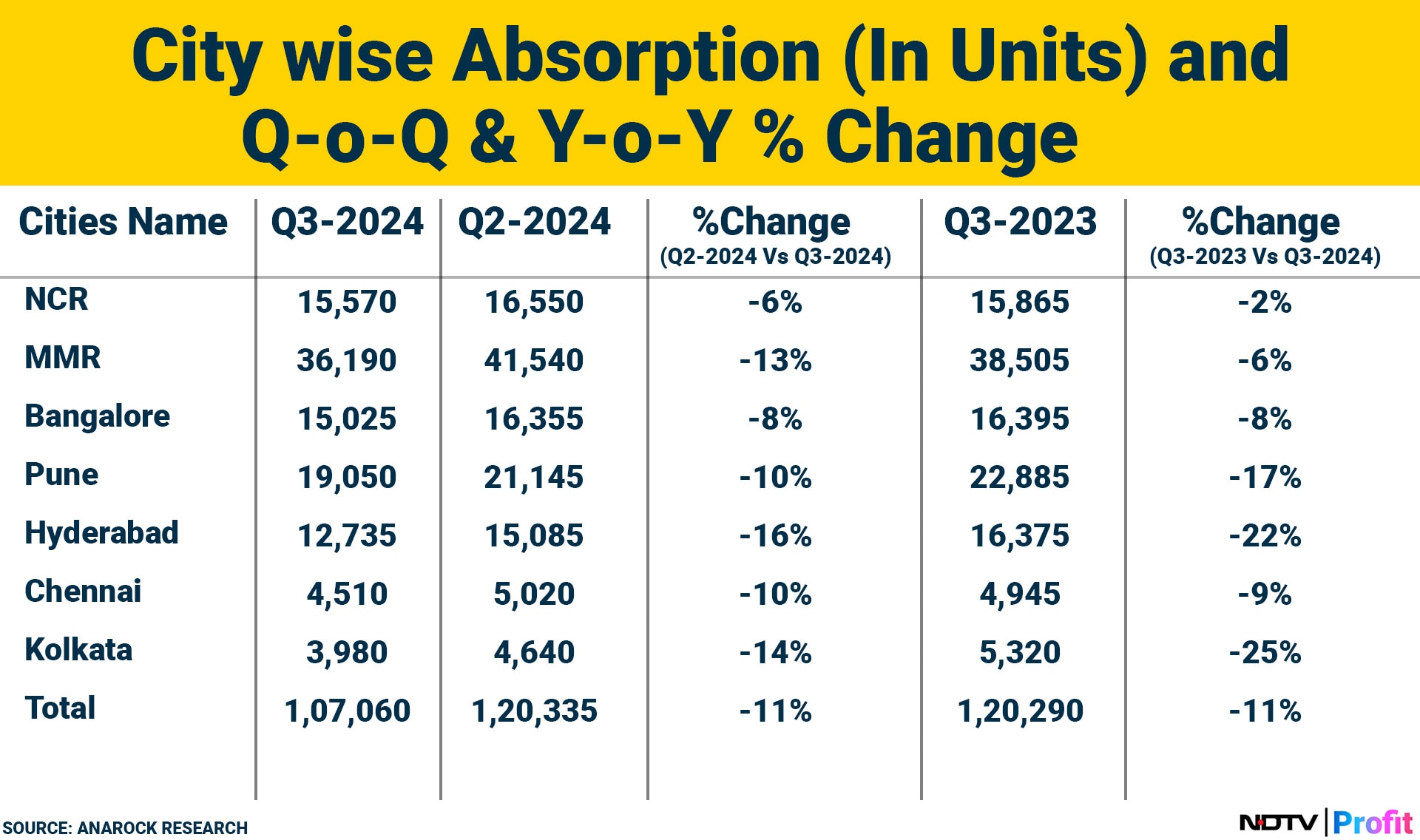

The June to September quarter of 2024 saw an 11% fall in sales across the top seven markets—notably in Hyderabad, Pune, and Kolkata—on a year-on-year basis, according to data by real estate agency Anarock.

“In Q2 2024 too, we saw residential sales dip on a quarterly basis (by 8%), but on a yearly basis, we saw a 5% jump. Hence, there has been a dip in sales on a quarterly basis in the last two quarters. However, one thing to know is that the base period considered—Q1 2024—was an exceptional quarter when sales were the highest ever,” said Anuj Puri, chairman of Anarock Group.

Apart from the impact of the inauspicious Shraddh period and general elections in the third quarter, the market is also reacting to the sharp rise in property prices.

“Over the last few quarters, prices have increased by 3% to as much as 50% in some prime localities of key markets, affecting immediate buying decisions. However, we expect buyers to gradually adjust to the new price realities,” says Vikas Wadhawan, chief financial officer at REA India and business head of PropTiger.com.

Steady After Ready

Experts insist that demand has not left the market and has only shifted one type of property to another. In the last two years, home buyers who were going mostly for ready-to-move-in properties are also now long-ranging their decisions.

“We are now in the middle of the upcycle, and a lot of ready-to-move-in inventory as well as those that would be delivered in one to one-and-a-half years has almost been sold. That's why ready-to-move in homes are going for higher prices,” explains Sharad Mittal, founder and chief executive officer of Arnya Real Estate Fund Advisors.

Millennials in particular have been driving growth in ready homes to save on rising rental costs in top cities. But now, a few of them have shifted gears to other types of properties too.

“Particularly for the markets witnessing higher price escalation, home buyers are investing more in under-construction property to leverage the price differential with a ready-to-move property,” says Angad Bedi, chairman and managing director of BCD Group, a Bangalore-based real estate company.

Regulatory action in the real estate space has also encouraged more investors to go for under-construction properties. Maharashtra RERA has recently implemented new rules that bring more transparency into real estate investments. With more certainty over project completion and possession, under-construction properties are now more attractive.

Supply Slips And Prices Hold Steady

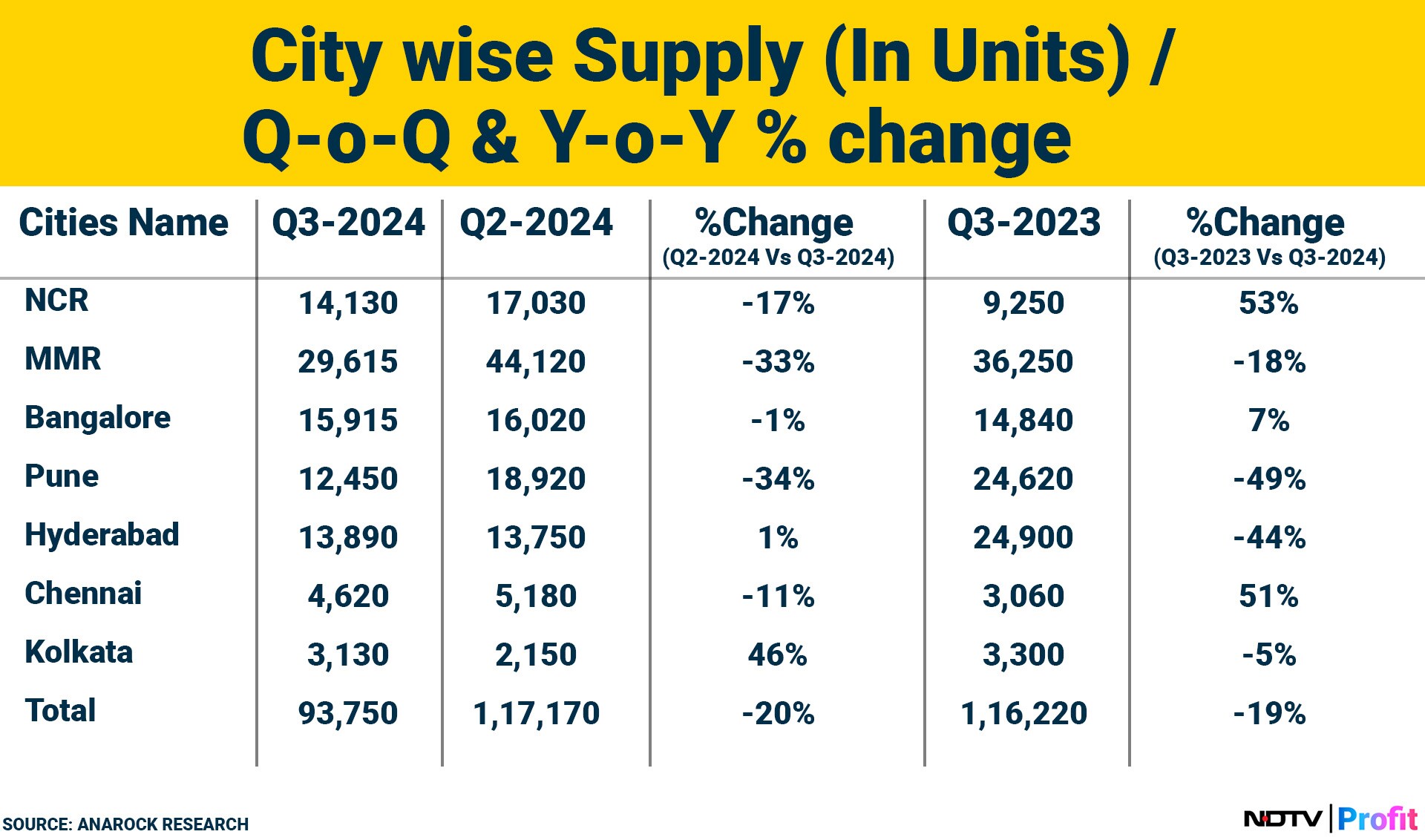

As buyers wait and watch, real estate players are also bringing in fewer supply into the market. In the third quarter, new supply addition has come down by 19% on a year on year basis and 20% on a quarter on quarter basis. Pune, Hyderabad and MMR saw new supply fall, while NCR and Chennai kept up with their additions.

“The industry's inventory is at a healthy level which is expected to be maintained for sometime before the season witnesses robust launches. This also helps in maintaining demand-supply balance in the industry, helping avoid price fluctuations,” says Darshan Govindaraju, director at Bangalore's Vaishnavi Group.

Unlike other upcycles when there was a mad rush by developers to acquire land and projects, they too are taking a rational approach now. “Now developers are looking at immediate sales instead of buying excessive land parcels. They're not going for those parcels where they do not see cash flows in the near future,” opines Mittal.

Property prices too are nearing the much-needed consolidation phase. The rate of property growth in the fourth quarter was at 4% sequentially as compared to 7% in second quarter. This time around, experts insist that a lot of price growth is a reflection of real demand.

“There are few markets especially in Gurugram and even Hyderabad where speculation could be there, but many other markets are seeing genuine steady rise in the prices,” says Puri.

Going ahead, experts foresee a steady growth of prices as well as demand in MMR with its fast paced infrastructure addition. Bangalore and Pune will continue their upward march due to the rise of GCCs and inward migration. Kolkata on the other hand is expected to see affordable segment sales, while Hyderabad with its oversupply might see a temporary blip before a comeback.

Even if festive effect improves fourth quarter's sales, 2024 might not break another record in real estate sales. But it might hold steady on top of the staggering heights it has reached.

Katya Naidu is a senior business journalist who writes about equity markets, startups, energy, infrastructure, real estate and healthcare.

Disclaimer: The views expressed here are those of the author and do not necessarily represent the views of NDTV Profit or its editorial team.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

.jpg?im=FeatureCrop,algorithm=dnn,width=350)