The Monetary Policy Committee will likely raise interest rates by 25 basis points, when it concludes its August meeting on Wednesday. This would take the benchmark repo rate to 6.5 percent.

Thirty-three out of 46 economists polled by Bloomberg expect the MPC to hike rates for a second time, as it tries to keep a lid on inflation pressures in the economy.

While the view remains divided, more economists today expect a rate hike than they did ahead of the June meeting. Then many felt that the MPC will choose to wait for data to become clearer before it kicks off the rate hiking cycle. Since then, it has become clearer that the MPC is leaning towards pre-emptive action to bring inflation closer to the mid-point of its inflation target of 4 (+/- 2) percent.

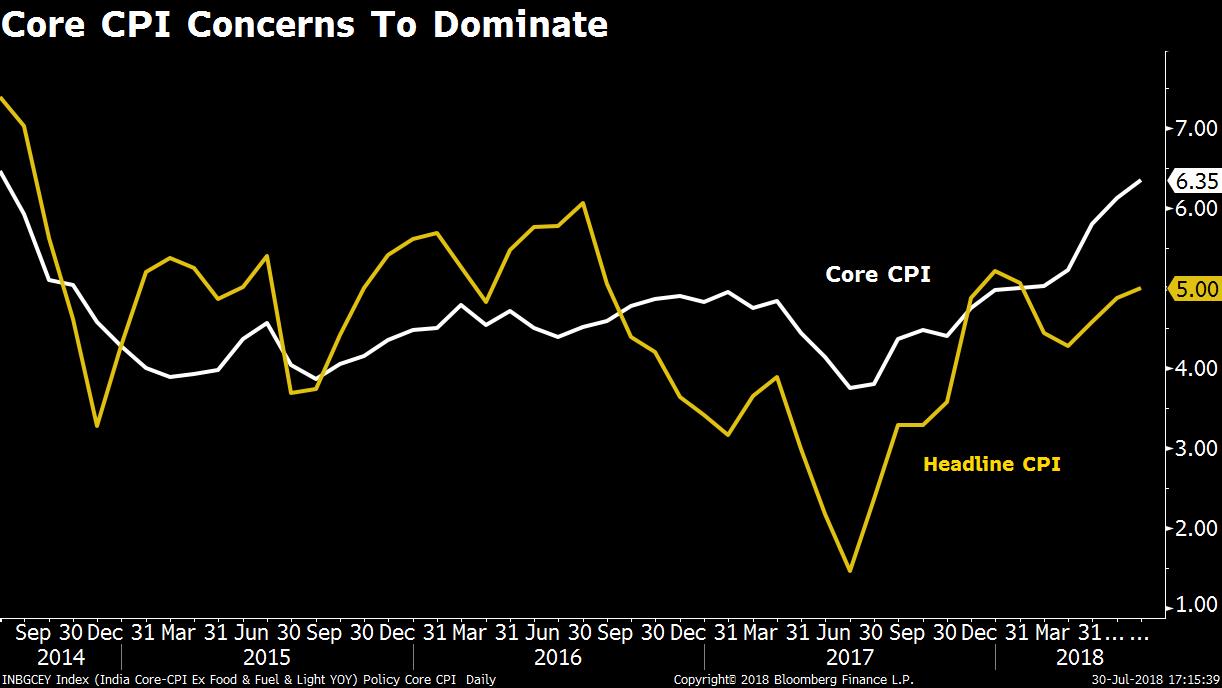

Core Inflation: Now And Later

With oil prices and the currency remaining range bound between the June and August meetings, the MPC will likely focus its attention on inflation and core inflation data.

Core inflation inched up to 6.3 percent in May vs 6.1 percent in April. Headline inflation rose to 5 percent. Those arguing for a rate hike say that higher core inflation is reflecting both cost pressures from higher input prices and demand pressures due to a strengthening economy. As such, one more rate hike would help quell any spike in price pressures later in the year.

“Emerging market history is replete with the same lesson: the earlier central banks act, the less they eventually need to do,” wrote Sajjid Chinoy, chief India economist at JPMorgan in an article on BloombergQuint.

Others view it differently.

Inflation pressures may peak in June and decline thereafter, argues Soumya Kanti Ghosh, chief economist at State Bank of India. He also believes that the perceived impact of higher minimum support prices may be less than feared.

“In our view, inflation risks are still evenly balanced. While the MSP hike could statistically push up CPI by 73 basis points, such inflation is unlikely to materialise as it is purely subject to procurement by the Central Government/State Government,” Ghosh wrote in a report last week.

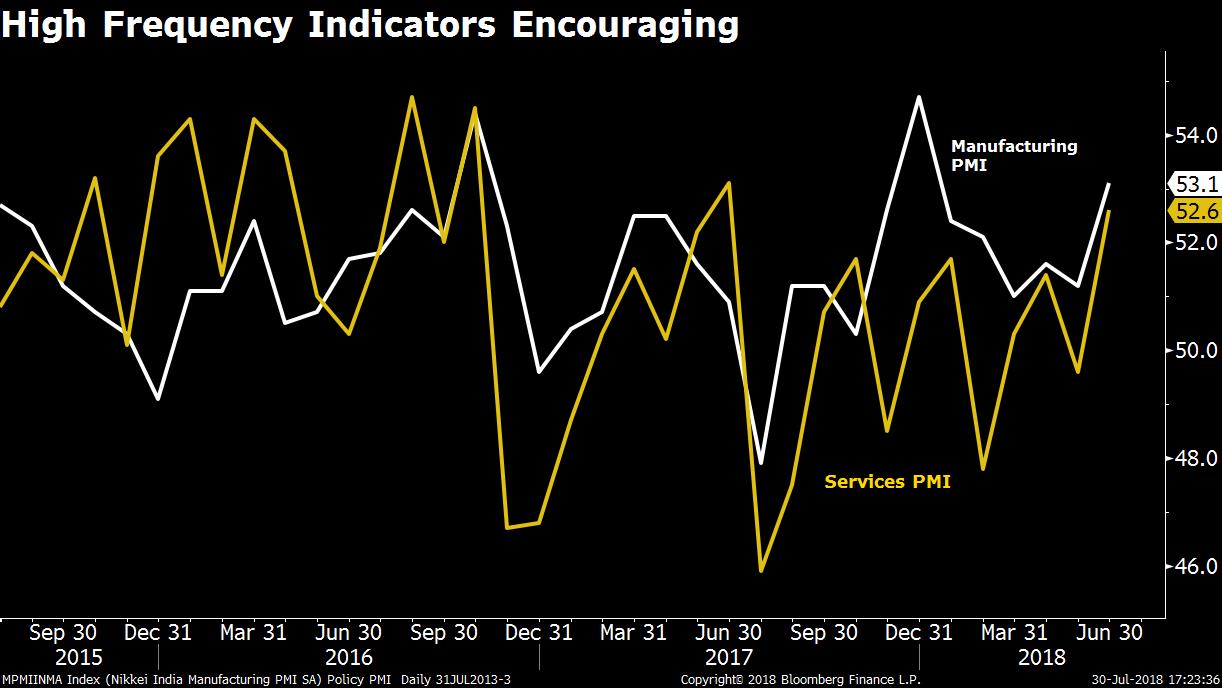

Comfort On Growth

The MPC will have the luxury of focusing on the inflation data as growth indicators have held steady.

High frequency data have shown a pick-up in manufacturing and services activity. Bank credit growth of close to 12 percent, also suggests some underlying momentum in growth.

High frequency data shows solid momentum, said Sonal Varma, chief India economist at Nomura Global Markets Research in a note this week. Varma, however, pointed out growth may slip marginally in the second half of the year due to tighter financial conditions and slowing global growth.

For now though, the committee's resolution is likely to reflect greater confidence on growth. The output gap is also seen closing and will likely be reflected in higher capacity utilisation. Data for capacity utilisation as of March 2018 will be released on Wednesday.

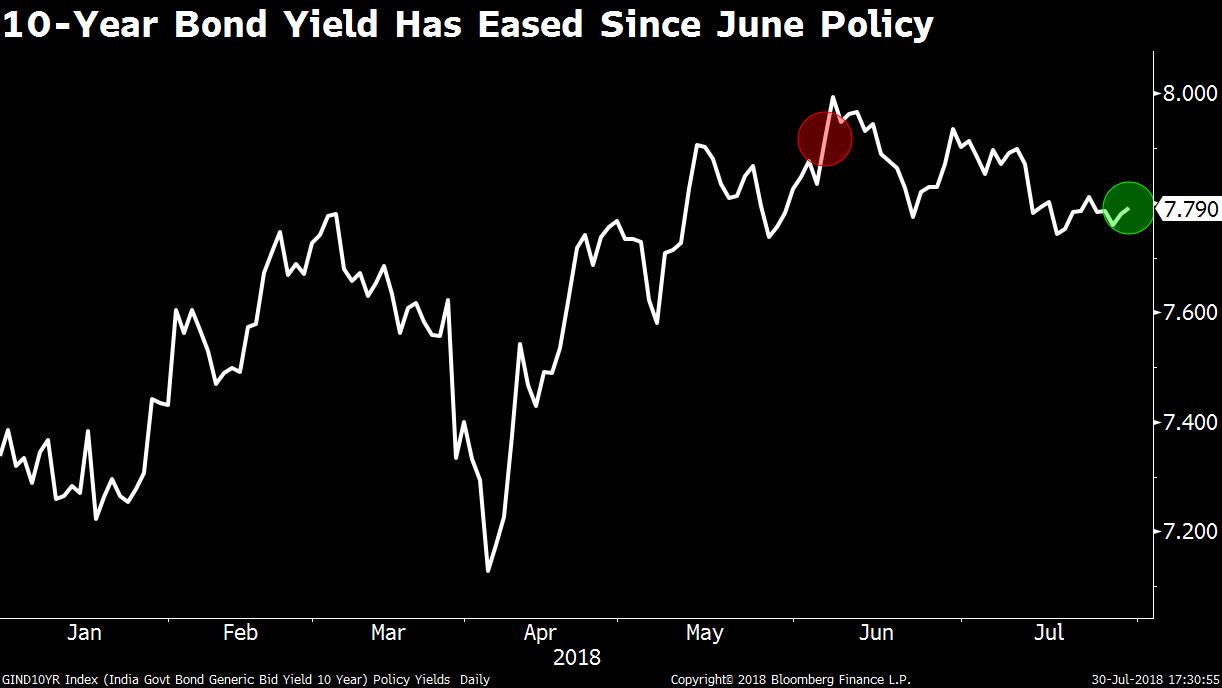

Bond Markets: Breathing Easier

One of the concerns ahead of the June policy review was the prevailing condition in the bond markets. Public sector banks were absent from the markets and foreign investors were selling.

Since then, conditions have improved. Data suggests that public sector banks are once again buying bonds and foreign investor selling has abated. That, together with liquidity infusions from the Reserve Bank of India has calmed the markets. Bond yields have actually dropped between the June policy and now, despite the 25 basis point hike in the repo rate.

Still, the 10-year benchmark yield remains 155 basis points above the policy repo rate - a spread which is considered wider than normal.

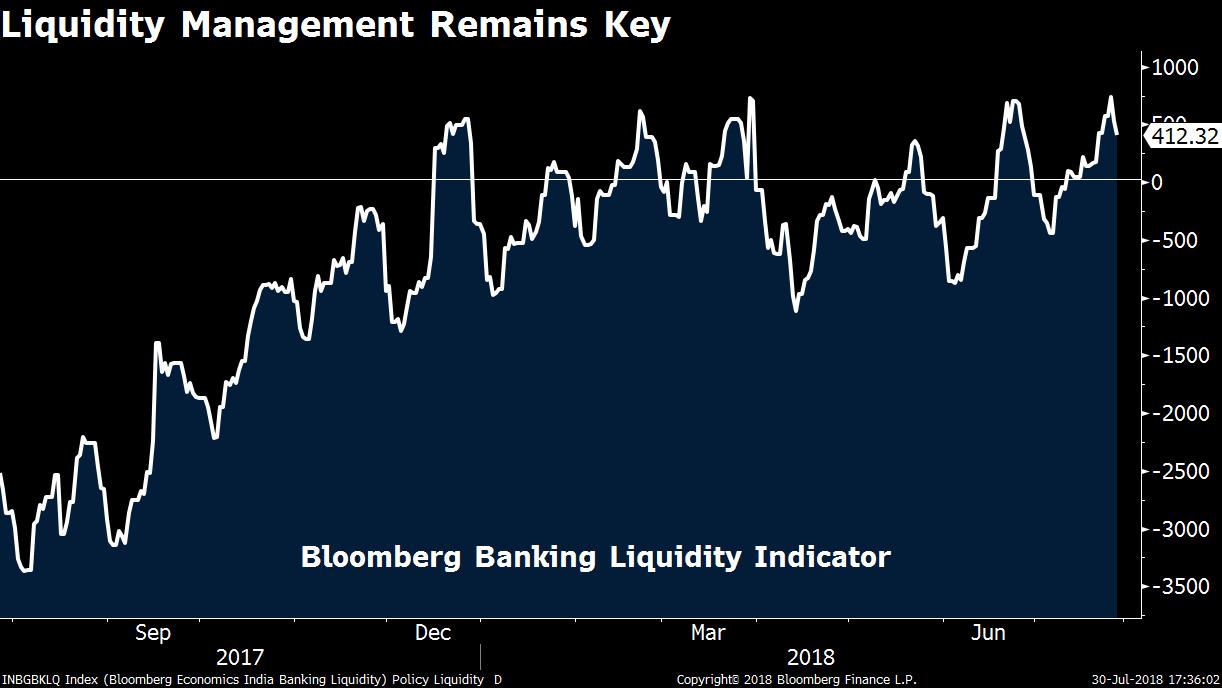

Liquidity Support

The RBI is likely to continue assuring the markets of adequate liquidity support, based on the needs of the economy.

RBI deputy governor Viral Acharya has made it clear that liquidity infusions will be driven by an assessment of durable liquidity needs rather than a need to bring down bond yields. The RBI has purchased Rs 20,000 crore in government bonds through open market operations (OMO) so far this fiscal year.

Some in the market believe that the RBI will step up the amount of liquidity it is pumping into the system.

RBI has purchased Rs 20,000 crore through OMO till date, even as it's incremental lending to the government, including OMOs, stands at Rs 1.86 lakh crore. This is nearly 7.5 times the amount it lent during the same period last year. In our view, RBI is likely to get more aggressive on this front and might also announce a slew of liquidity measures.Dhananjay Sinha, Head of Research & Economist, Emkay Global Financial Services

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.