Trent Ltd.'s net profit increased by 47% in the second quarter of fiscal 2025 but missed analysts' estimates. The net profit of the Tata-group company rose to Rs 335 crore in the July–September quarter, compared to Rs 228 crore in the same period last year.

Analysts polled by Bloomberg had a consensus estimate of Rs 431 crore for the fashion retail major's bottom-line.

Trent's Q2FY25 earnings have missed analyst estimates on all fronts except margins.

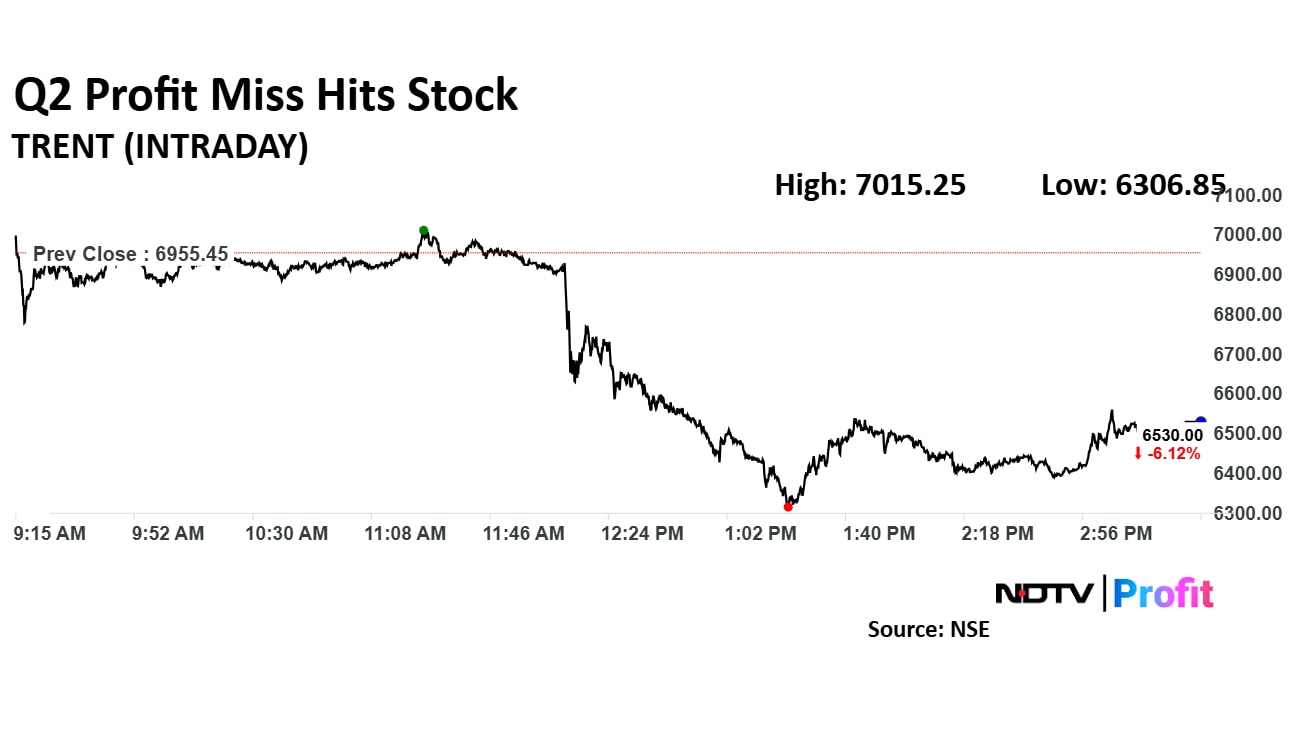

Shares of the Westside operator fell as more than 9% after the earnings were announced.

Trent Q2 Results: Key Highlights

Revenue up 39% to Rs 4,157 crore versus Rs 2,982 crore (Bloomberg estimate: Rs 4,388 crore).

Ebitda up 41% to Rs 643 crore versus Rs 456 crore (Bloomberg estimate: Rs 670 crore).

Margins at 15.5% versus 15.3% (Bloomberg estimate: 15.3%).

Net profit up 47% at Rs 335 crore versus Rs 235 crore (Bloomberg estimate: Rs 431 crore).

Why Trent Missed Estimates?

The Trent quarterly numbers missed estimates on all fronts. One of the prime reasons for this is that the revenue growth in the past four quarters has been over 50% but this quarter it fell to 39%. Moreover, like-for-like growth in the past four months was above 20% but it fell to 14% in the reported quarter.

Moreover the chairman of Trent, Noel Tata's comments have highlighted weak consumer demand and how seasonality led to headwinds for retail businesses overall. Moreover, the chairman of Trent highlighted that the company will look to explore additional avenues of growth.

Muted Consumer Market

Trent Ltd. reported a steady second-quarter performance even as it navigated a muted consumer market. The company opened seven new Westside stores and 34 Zudio outlets, including its first Zudio in Dubai, across 27 cities. Despite the challenging demand environment, both Westside and Zudio maintained consistent gross margins, reflecting Trent's operational efficiency.

Emerging categories now account for over 20% of Trent's total revenues, while Westside's online reach contributed over 5% to its revenue, indicating strong digital traction. The company also posted a like-for-like (LFL) growth of over 14%, driven by loyal customer engagement and effective product strategies.

Noel Tata On Trent

Commenting on the performance, Noel Tata, Chairman of Trent, acknowledged that consumer sentiment remained relatively subdued and that seasonality added further headwinds for the retail segment. However, Tata highlighted the success of Trent's Star business, which saw a 27% revenue increase over the same quarter last year, driven by strong customer response and the company's strategic playbook.

Tata also noted the positive impact of Trent's own-branded products on Star's performance and emphasised Trent's focus on exploring additional avenues for growth, underscoring the brand's commitment to resilience and adaptability in the evolving retail landscape.

Trent shares fell as much as 9.33% during trade today, before paring some losses to close 6.12% at Rs 6,530 apiece. Meanwhile, the benchmark Nifty 50 ended 1.19% lower.

The stock has risen 169% in the past 12 months, and 114% in the year to date. The total traded volume for the day stood at 4 times the 30-day average. The relative strength index for the counter stood at 28.9, indicating that the stock may be oversold.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.