(Bloomberg) -- India's two biggest outsourcers reported muted sales numbers, signaling companies across the world are yet to revive IT spending in a meaningful way.

Infosys Ltd. narrowed its sales growth forecast for the fiscal year through March 2024 to between 1.5% and 2%, expecting clients to remain cautious about purchasing software services. Bigger Tata Consultancy Services Ltd. said its revenue growth during the quarter grew 1.7% in constant currency terms, down just over 1 percentage point over the three months through September and 12 percentage points lower from a year ago.

TCS and Infosys lead India's $245 billion-plus IT services sector, where growth has slowed as enterprise customers in the US and Europe limit investments to cope with high interest rates and inflation. Russia's persistent war on Ukraine has also led to economic uncertainty for businesses.

Addressing a post-earnings briefing, Infosys CEO Salil Parekh said his company did not see any changes in client behavior from the previous quarter. TCS too echoed the sentiment.

“Overall, the situation has not deteriorated from the last quarter. Given all the things that we are all hearing from everybody the fact that there is no deterioration is itself a positive sign,” TCS Chief Operating Officer N. Ganapathy Subramaniam told a news conference in Mumbai. “There is a demand out there, and that's something that we have to go and capture as it matures,”

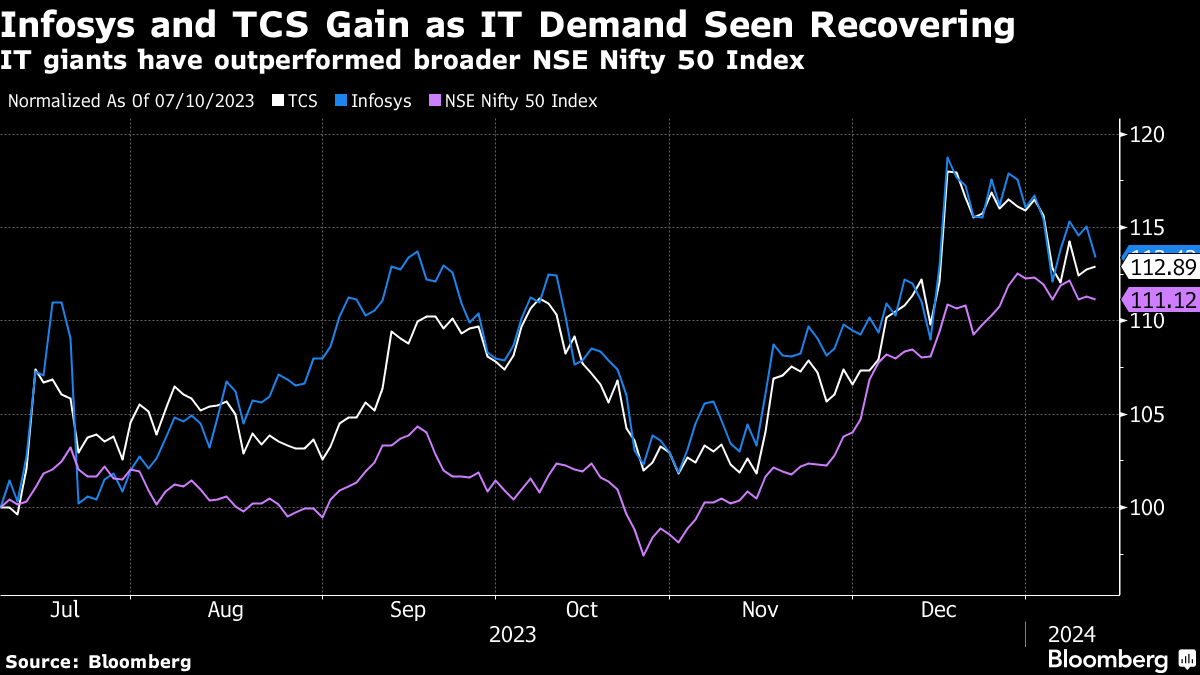

TCS and Infosys shares have risen more than 10% over the past two months on expectations the slump has run its course. Brokerage firms including Citigroup Inc. and Jefferies Financial Group Inc. have sounded caution on the sector's outperformance, citing rich valuations and tepid growth prospects.

Read more: Citi, Jefferies Sound Caution on India Tech Rally on Valuation

To cope with the slowdown, the companies have curbed expenditure and reduced hiring of engineering graduates, who typically bank on a job offer from IT giants. They've also expanded to new technologies such as artificial intelligence, seeking to spur demand.

For the fiscal third quarter through December, Bengaluru-based Infosys' net income fell 7.3% to 61.1 billion rupees ($736 million), meeting analysts expectations. Sales rose 1.3% to 388.2 billion rupees. Mumbai-based TCS reported a net income of 110.6 billion rupees, missing analysts' estimates.

Shares in Infosys closed 1.7% lower, while TCS edged 0.6% higher in Mumbai.

Beyond the current trough, TCS, Infosys and their rivals remain optimistic about the long-term growth prospects of India's showpiece IT services industry, which accounts for 7.5% of the South Asian country's more than $3 trillion economy. They expect long-term demand to be fueled by the rising business need for AI and cloud services.

TCS, Asia's biggest outsourcer, is betting on its partnership with Microsoft Corp. to develop AI-based software services for clients, seeking to win higher margins and spur growth, Chief Executive Officer K Krithivasan told Bloomberg News previously.

(Updates with executives' comments in 4th and 5th paragraphs.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.