SRF's share price fell on Thursday after weak earnings for the quarter ended September led some brokerages to reduce the stock's target price and their earnings estimates as the company is uncertain on outlook for specialty chemicals, given weak macro scenario.

SRF reported a 33% decline in its net profit to Rs 201 crore in the quarter ended Sept. 30, 2024 compared to Rs 285-crore consensus estimate of analysts tracked by Bloomberg.

Nuvama in a report explained that SRF posted weak results as the global agrochem industry continues to suffer from higher inventory and pricing pressure. While the brokerage retained a 'buy' rating for the stock, it cut estimates for FY25/26/27 EPS by 23%/11%/11% with a slower-than-expected recovery in its chemical business and weak H1FY25 results. The brokerage has also reduces the stock's target price to Rs 2,628 from Rs 2,719 earlier.

In contrast to other brokerage firms whose target price implies a downside, Nuvama's new target implies an upside of 16.9%.

Jefferies' report said that company has withdrew revenue and margin guidance for specialty chemicals for current fiscal in a deviation from normal practice indicating clouded visibility of a recovery in second half that it is still hopeful of. The brokerage has cut its current and next financial year's profit estimates by 20% and 15% respectively, while maintaining its 'underperform' rating and a lower target price of Rs 1,970.

The new target price implies 12.4% downside as it noted risk reward is unfavorable.

The brokerage also noted delay in customer registrations has delayed its foray into Als while elevated ref gas inventories in the US continue to weigh on pricing.

Citi Research has also reduced the stock's target price to imply a 20% downside at Rs 1,800 from Rs 1,950 earlier while reiterating its 'sell' call for the stock. The brokerage has cut FY25-27 Ebitda by 13-18% factoring in a more gradual improvement in the chemicals segment.

For the company's specialty chemicals business, Citi said volumes of some key products saw lower offtake due to inventory issues at customer's end. "While the segment continues to see competitive pressures from China, management continues to expect improvement in 2H," it said.

In fluorochemicals, while ref gas sales volumes grew in the domestic market, reduced export realisations put pressure on margins as US continues to experience decline due to regulatory requirements, according to the brokerage.

Motilal Oswal has an unchanged 'neutral' rating for the stock as well as target of Rs 2,080, implying only a 7% downside, citing management it expects some recovery in 3Q which is likely to further accelerate in 4QFY25, led by a healthy order book in specialty chemicals and ramp-up of export/domestic volumes in the fluorochemicals business.

At the same time, it has cut its FY25/FY26 Ebitda estimates by 13%/7% factoring in the weak macro scenario and uncertain near-term outlook in the chemicals business.

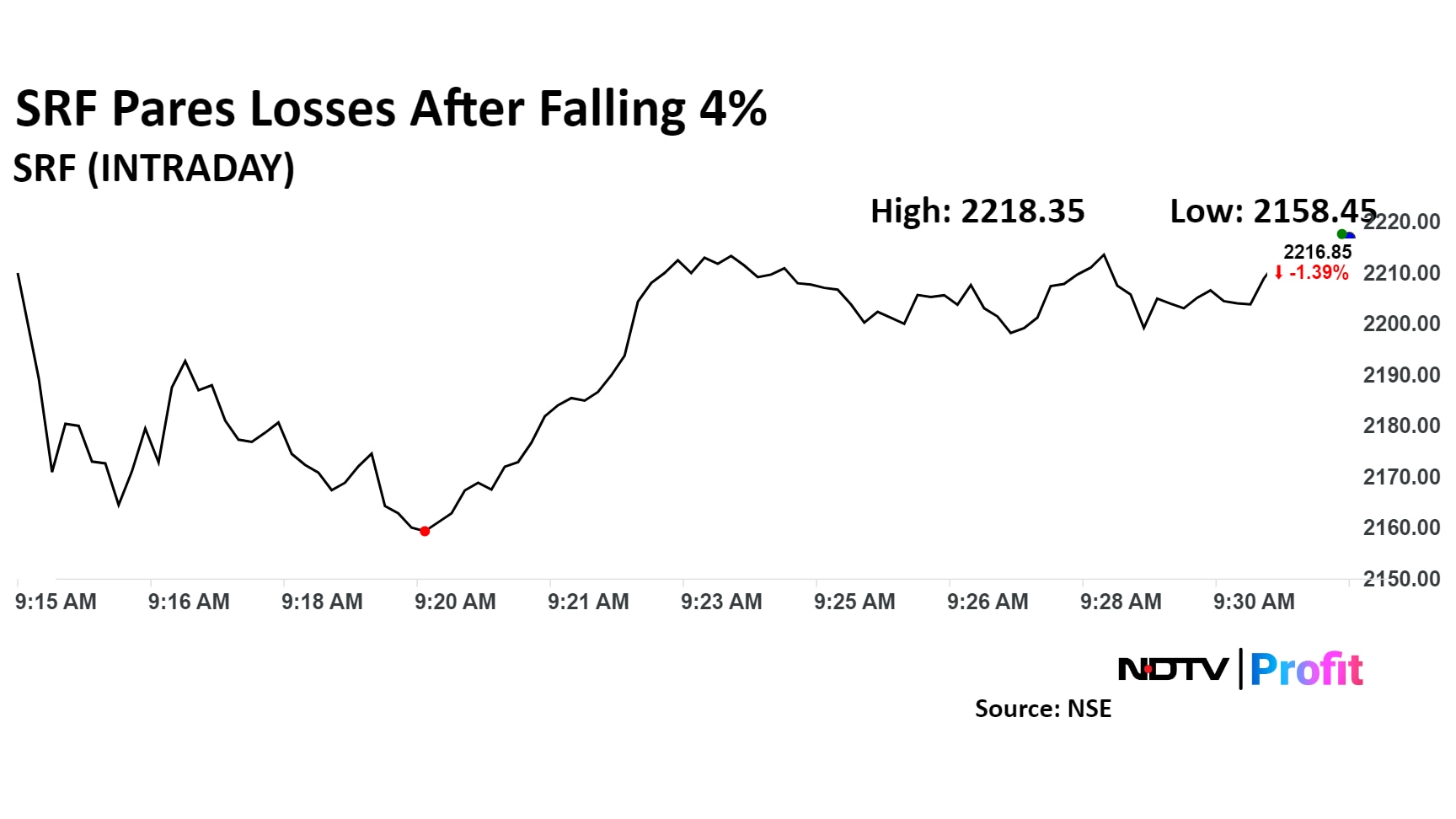

The scrip fell as much as 4% to Rs 2,158.45 apiece. It pared losses to trade 1% lower at Rs 2,224.8 apiece, as of 9:33 a.m. This compares to a 0.2% decline in the NSE Nifty 50 index.

It has fallen 10.3% on a year-to-date basis but risen 1.3% in the last 12 months. Total traded volume so far in the day stood at 0.40 times its 30-day average. The relative strength index was at 36.

Out of the 33 analysts tracking the company, 14 maintain a 'buy' rating, nine recommend a 'hold,' and ten suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 3.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.