Punjab National Bank reported a lower-than-expected net loss in the first quarter.

India's second-largest state-owned lender reported a net loss of Rs 940 crore for the three months ended June 2018, compared with a Rs 343 crore profit a year ago, it said in its exchange filing. That's lower than the Rs 2,335 crore loss estimated by analysts tracked by Bloomberg. The bank had reported its highest ever quarterly loss of Rs 13,417 crore in the quarter ended March 2018.

Net interest income, or the core income of the lender, rose 22 percent year-on-year to Rs 4,691.8 crore, higher than the Rs 3,555 crore estimate. Net interest margin rose to 2.9 percent from 2.56 percent a year ago.

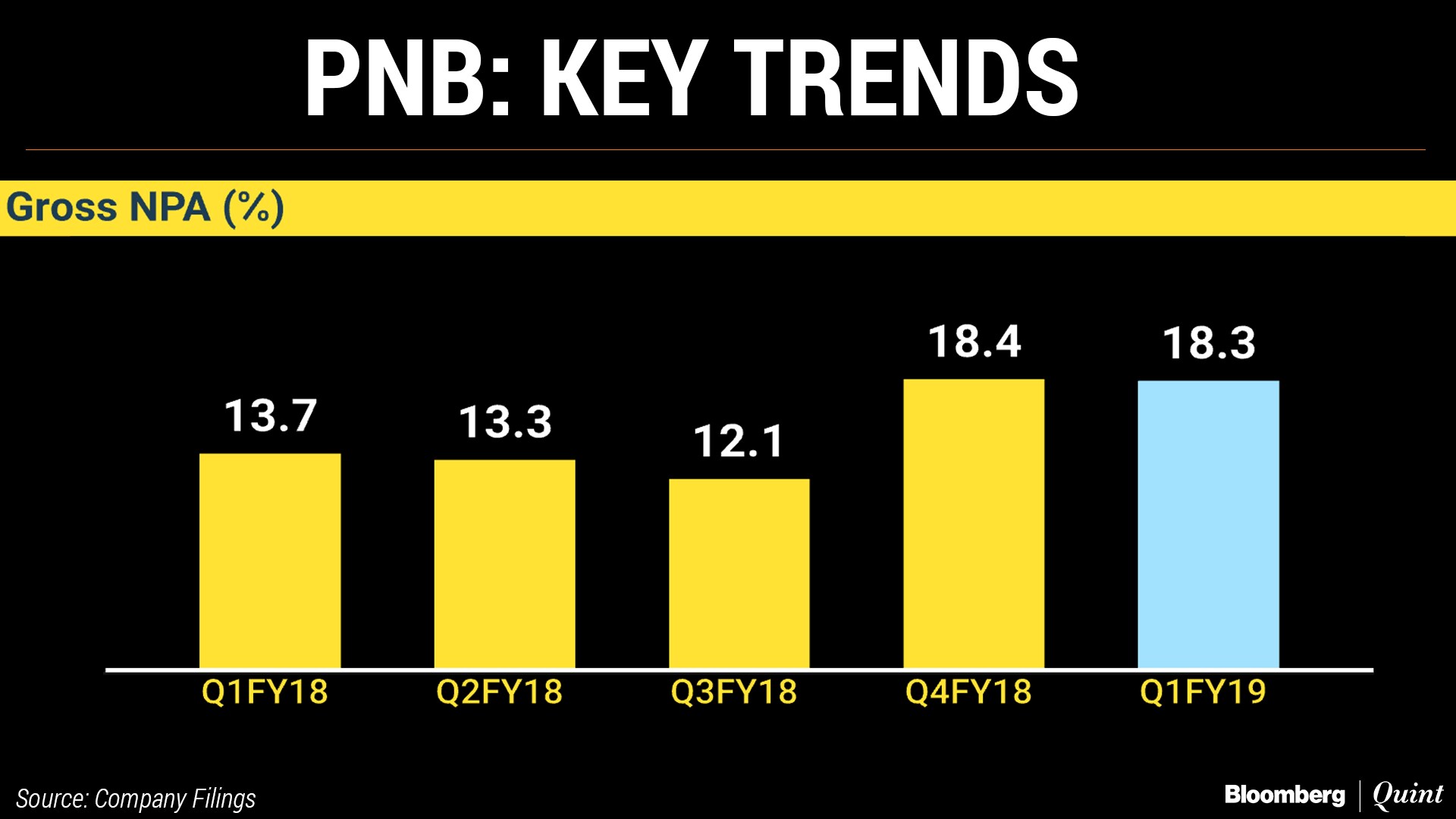

Asset quality of the lender hit by India's largest banking fraud improved marginally with the gross non-performing asset ratio slipping to 18.26 percent from 18.38 percent in March and the net NPA ratio narrowing to 10.58 percent from 11.24 percent.

The Continued Fallout Of The Nirav Modi Fraud

PNB had informed exchanges in February that firms related to jewellers Nirav Modi and Mehul Choski had allegedly obtained fraudulent guarantees in connivance with some employees at the Brady House branch to borrow money overseas.

The bank has so far provided for about 63 percent of the total fraud amount of Rs 14,400 crore. PNB, which had set aside 50 percent of the provision requirement of Rs 7,178 crore in the March quarter, provided another Rs 1,863 crore in the June quarter.

The remaining provision will be spread over the September and December quarters. This means the bank will have to take about 37 percent hit on account of the fraud over the next two quarters.

While it hasn't recovered anything against the dues to those companies yet, the bank's management remains hopeful. “We have lodged our claim with the Enforcement Directorate; once the case is settled, we are hopeful of getting some amount”, said LV Prabhakar, executive director at PNB, to BloombergQuint.

Outlook On Asset Quality

The bank saw substantial recoveries during the first quarter.

Total recoveries during the quarter stood at Rs 8,845 crore, Managing Director and Chief Executive Officer Sunil Mehta said in the press conference. The bank aims at recovering Rs 20,000 crore overall by the end of September.

Prabhakar told BloombergQuint that while a large chunk of the recoveries had come from one steel account which was resolved under the IBC, recoveries had picked up across small and medium accounts too. The bank's stressed asset vertical is focussed on ensuring that recoveries hold strong during the rest of the year.

Fresh slippages, or new loans turning bad, fell on a sequential basis to Rs 5,250 crore in the three months ending June 2018. The management said it doesn't expect any surprises in the September ending quarter due to the impact of the Reserve Bank of India's February 12 circular. As per the new rules, banks have to start monitoring accounts which are even overdue by one day. Large accounts must be resolved within 180 days or referred for insolvency.

According to the bank's management, about Rs 8,000-9,000 crore worth of loans are currently under the special mention account categories. These loans are 30-day and 60-day overdue and could potentially go unpaid for 90 days, when the bank will have to recognise them as non-performing assets.

The bank has an exposure of Rs 24,000 crore to the power sector. Prabhakar, however, said the bank doesn't expect “much heat in those (power) accounts because we are hopeful of resolution.”

Meanwhile, the bank is strengthening its balancesheet.

The bank's overall provisions fell sequentially to Rs 4,982 crore from Rs 16,203 crore. However, the provision coverage ratio rose to above 61 percent.

Shift In Lending Strategy

Given the need to conserve capital, PNB is being selective in lending and is concentrating on low-risk rated assets. The bank is increasing exposure to government guaranteed-, AAA, AA or A-rated accounts, said Prabhakar.

While a move towards lower risk assets can have an adverse impact on lending margins, the bank said it will be able to maintain net interest margin in the 2.8-3.0 percent range. It's domestic NIM in the June ended quarter stood at 2.90 percent.

The bank hopes that recoveries along with capital conservation via low risk lending will allow it to improve its capital position and reduce the need for future government funding. The capital adequacy ratio rose from 9.2 percent to 9.62 percent in the quarter ended June.

PNB's shares fluctuated between gains and losses after the earnings were announced. The stock has fallen 47.1 percent so far this year compared to 11.18 percent decline in the NSE Nifty PSU Bank Index.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.