Lupin's second quarter earnings have analysts buzzing, with brokerages highlighting the pharmaceutical giant's standout financials despite market challenges.

Macquarie analysts described the results as an "all-round beat". Although revenue aligned closely with their forecast, Ebitda and profit after tax exceeded expectations by 3% and 10%, respectively, compared to Bloomberg's estimates. This strong performance was driven by a solid 23% Ebitda margin, outperforming consensus estimates.

Hence, Macquarie maintained an 'outperform' rating on Lupin, optimistic about the company's steady growth across regions. They set a target price of Rs 2,515 per share.

Nomura had a similar bullish sentiment, noting Lupin's sales, Ebitda, and profit after tax all surpassed its expectations by 3.2%, 8.3%, and 11.5%, respectively. Strong growth in India and steady US sales kept the company on track. Lupin's margin rose by 373 basis points year-on-year, benefiting from a favourable product mix and easing raw material costs.

Nomura remains optimistic with a 'buy' rating and a target price of Rs 2,427 per share.

Investec's view is more tempered, maintaining a 'hold' rating with a target price of Rs 2,100 apiece. While they acknowledged Lupin's strong India sales, which were up 19% year-on-year, they pointed to a dip in US sales due to heightened competition in generics and inventory issues.

Investec is cautious about Lupin's near-term growth potential, especially with ongoing competition in the US market.

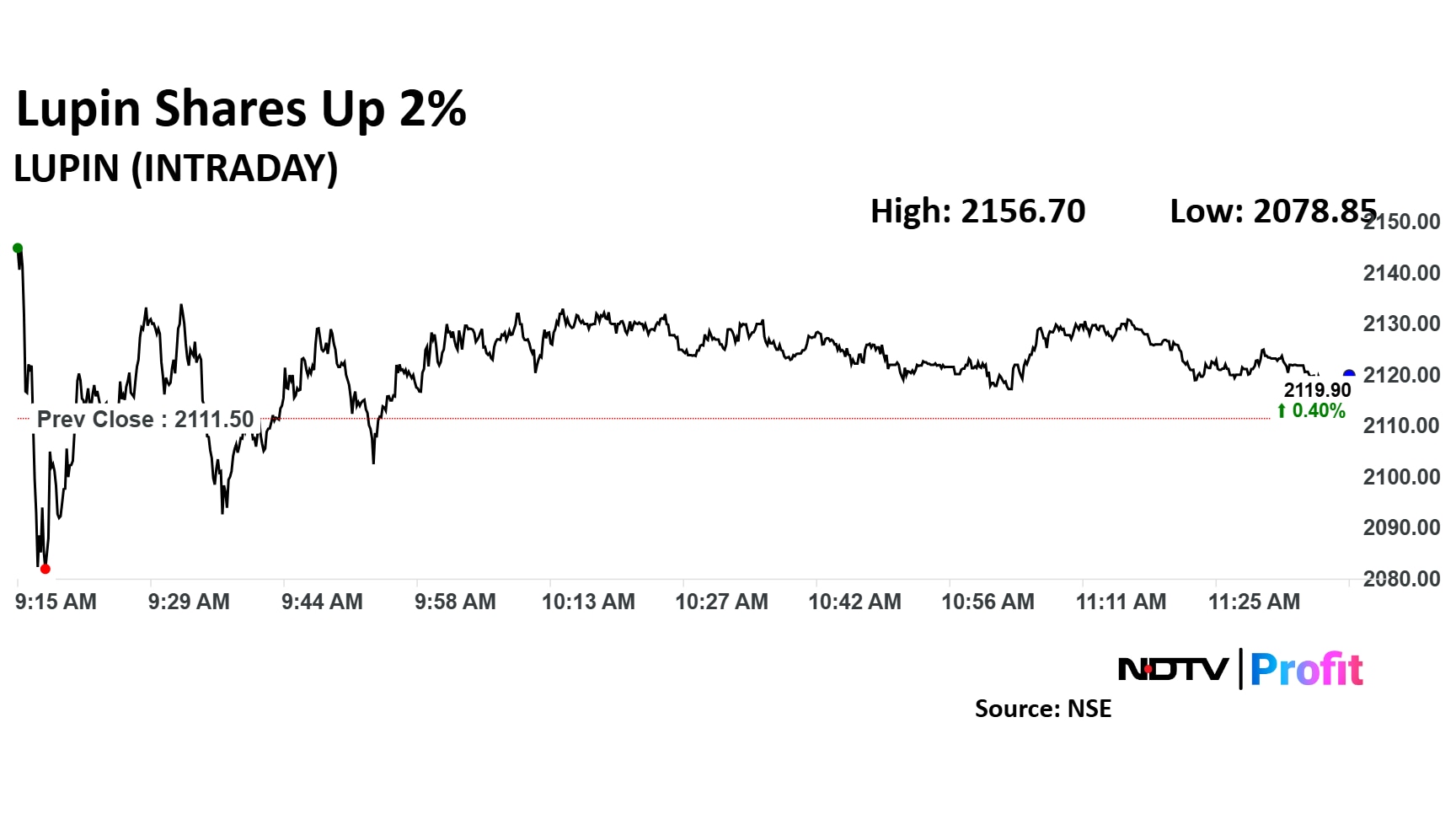

Shares of Lupin rose as much as 2.14% before paring gains to trade 0.36% higher at Rs 2,119 apiece at 11:37 a.m., compared to a 0.22% advance in the NSE Nifty 50.

The stock has risen 51.81% on a year-to-date basis, and has advanced 74.96% in the last 12 months. Total traded volume so far in the day stood at 5.9 times its 30-day average. The relative strength index was at 42.51.

Out of 26 analysts tracking the company, 17 maintain a 'buy' rating, 10 recommend a 'hold' and nine suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 3.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.