India's IT services firms are staring at their slowest third-quarter growth in the past decade, as seasonal weakness and cross-currency headwinds build a perfect storm for a $250-billion industry that's in the throes of a slowdown.

What's more, the cloudy outlook is likely to persist through 2024, with nary a silver lining.

“During Q3 FY24, we expect aggregate revenue growth for our coverage universe to remain muted at 0.8% QoQ in constant currency terms, given the seasonal impact of furloughs that are deeper this year,” Jefferies analysts Akshat Agarwal and Ankur Pant said in a Dec. 29, 2023, research report. “While sequential growth has improved by 40 bps vs Q2, this is the slowest aggregate growth in the third quarter of any year in the past decade.”

One basis point is one-hundredth of a percentage point.

Indian IT firms don't have much succour from their industry bellwether, Accenture Plc, either. While the world's largest IT company by market capitalisation maintained its revenue growth guidance at 2-5% for its fiscal ending Aug. 31, 2024, it has pointed to near-term pain in the December-February quarter.

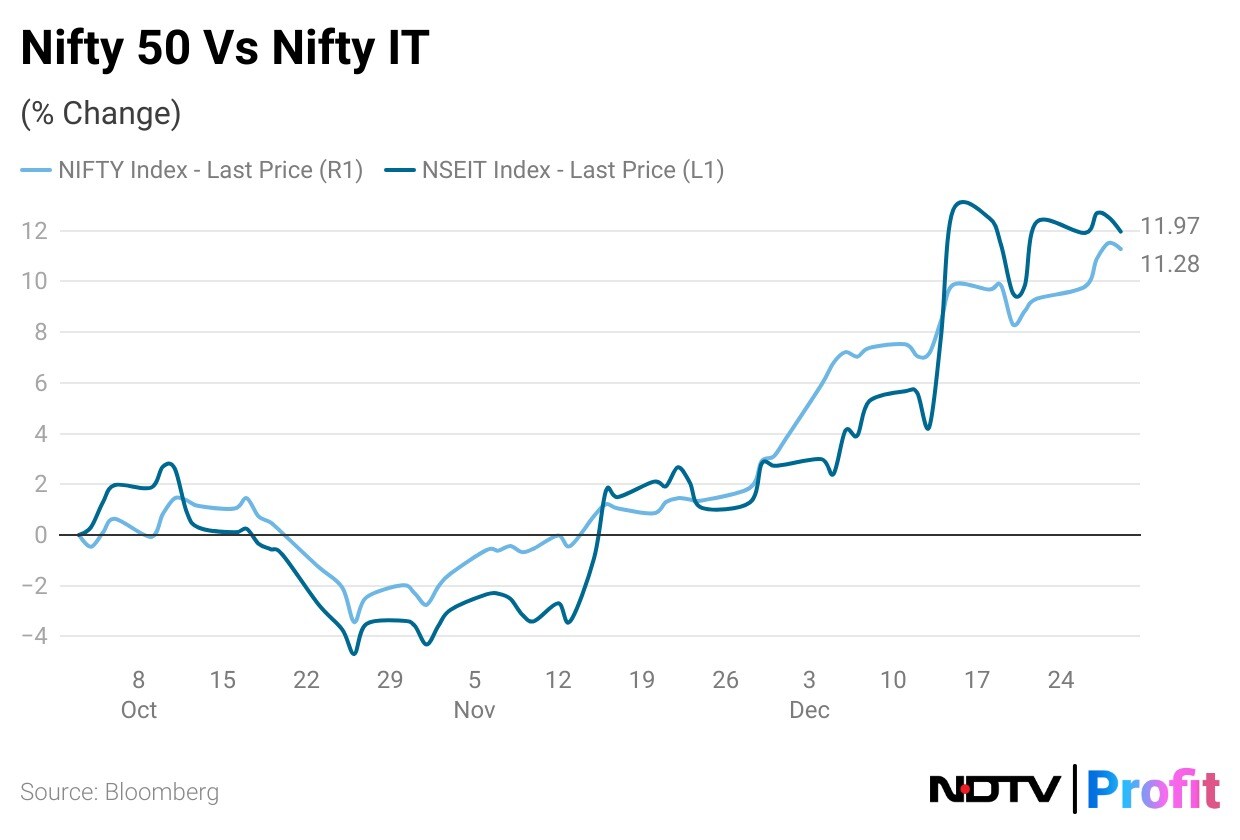

Still, a gauge of India's top IT stocks has outperformed the benchmark by 210 basis points in the three months through Dec. 31—the market expects the worst is over and that growth will accelerate through the fiscal ending March 31, 2025.

“The Q3 FY24 results, while modest in absolute terms, shall be along expectations,” Vibhor Singhal, Nikhil Choudhary and Yukti Khemani—analysts at Nuvama Institutional Equities—said in a Jan. 2 report.

“The strong deal momentum reinforces our positive stance on the sector. The recent Fed [U.S. Federal Reserve] commentary further enhances tech spending visibility in the medium- to long-term. We expect growth to rebound in FY25 driven by a sustainable strong demand environment.”

Kumar Rakesh of BNP Paribas said the sector is traversing an inflection point, as there are some signs of bottoming out.

“Resilience in the U.S. economy and the Fed's indication of three rate cuts in 2024 should spur enterprise confidence,” he said in a Jan. 3 note. “We think the industry is close to the trough of this cycle. Signs of improvement in the global economy and strong deal wins in recent quarters give us confidence about revenue growth acceleration that we forecast for FY25.”

Girish Pai of Nirmal Bang, however, begs to differ.

“Elevated price-to-earnings multiples (of Indian IT firms) indicate that the market is taking a view that the worst is over in this cycle and that earnings will accelerate through FY25,” he wrote in a Dec. 28 note. “We have a non-consensus view that FY25 growth will not be as strong and therefore have cut our FY25 estimates.”

Profitability, At All Costs

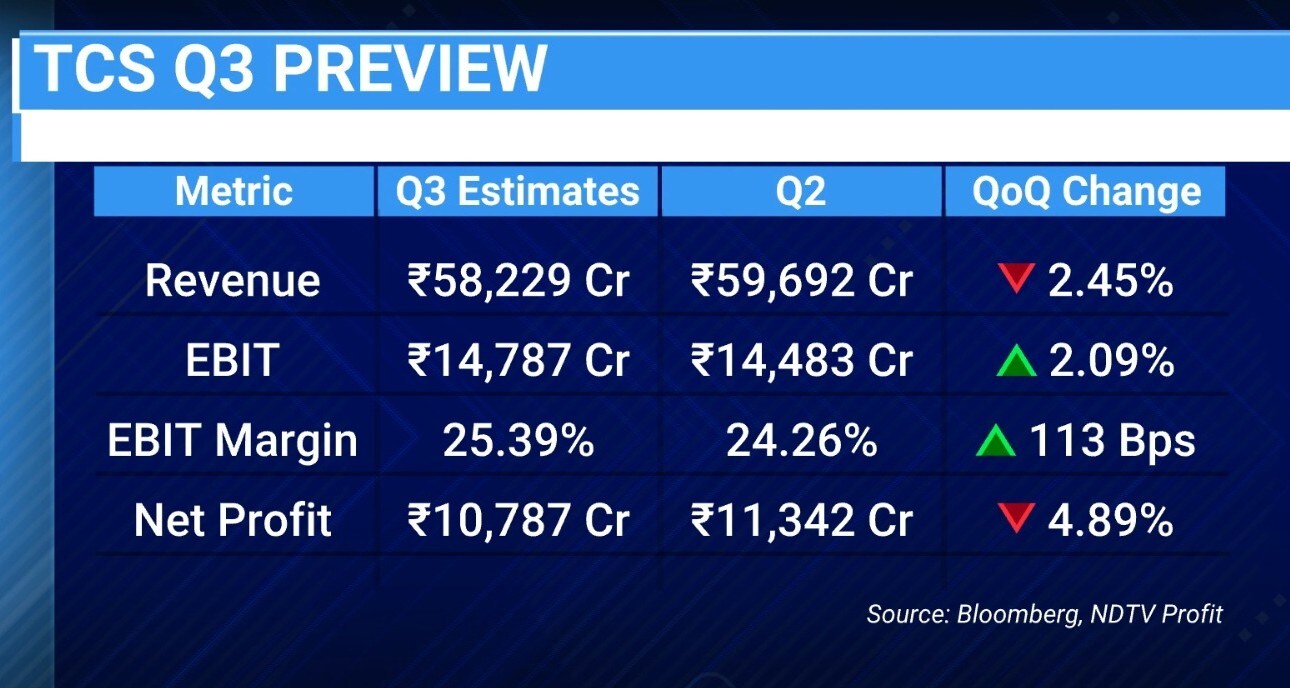

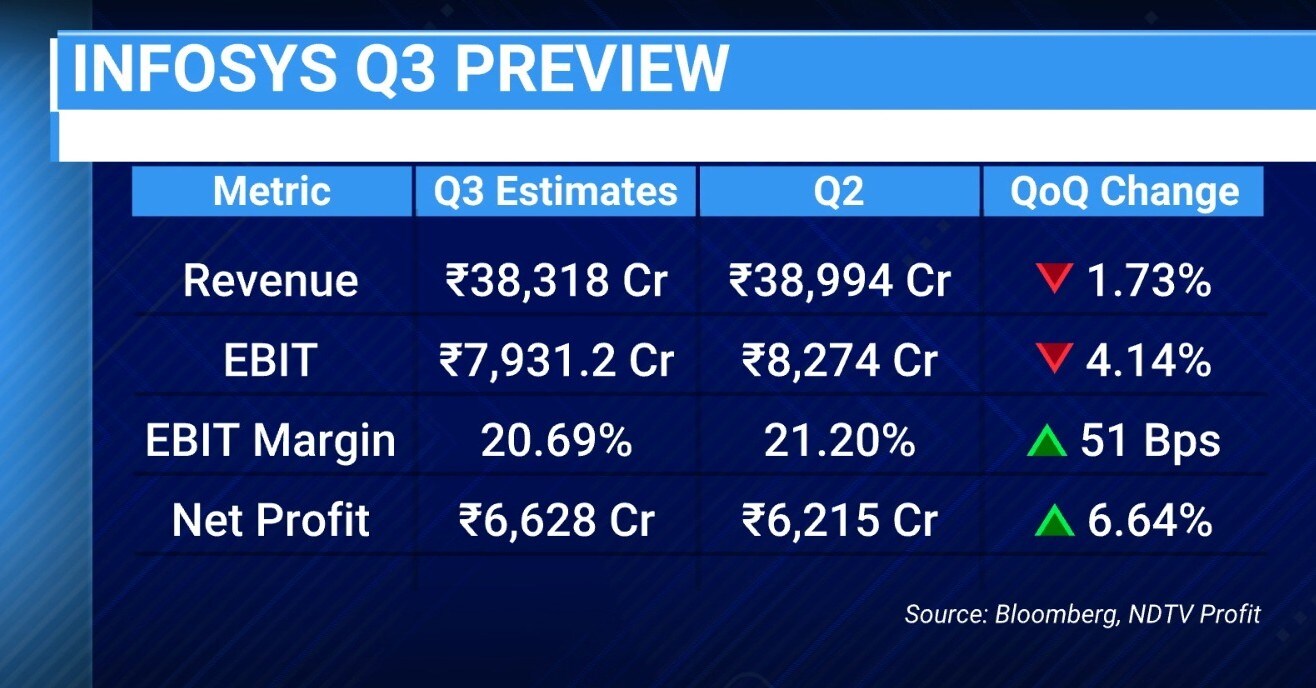

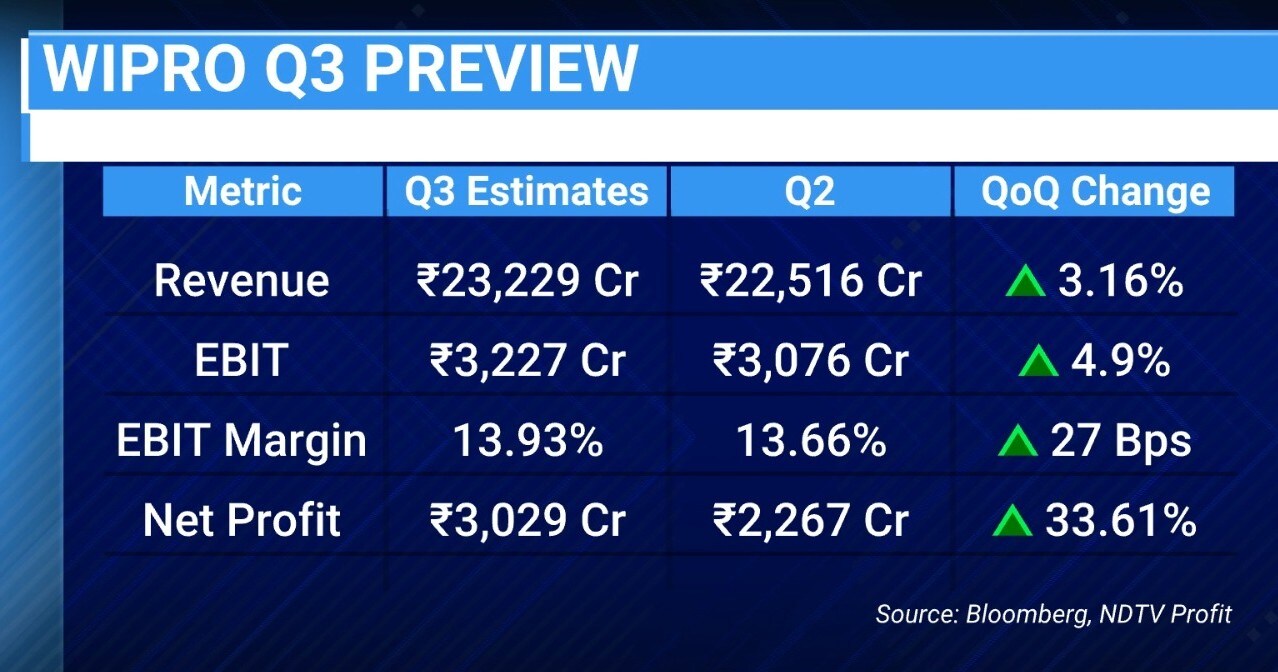

Amid record-breaking dealmaking that refuses to convert meaningfully into revenue, Indian IT firms have over the past year or so chosen to preserve margin. But, that too seems to be under pressure now, as most margin levers now stand exhausted. Additionally, furloughs in the October-December quarter have eaten into operational efficiencies.

“We expect some companies to see higher-than-expected furloughs, impacting revenue, but we see it partially being offset by mega deal ramp-ups,” BNP Paribas said. “We expect EBIT margin to fall quarter-on-quarter due to wage hikes, furloughs and one-time impacts."

But Nuvama said that operational profitability in the third quarter largely remained stable as supply-side dynamics have reversed and attrition bottomed out.

The decline in margin is also likely to be company-specific—some have doled out their much-delayed wage hikes (Infosys Ltd. and Wipro Ltd.), spent on acquisitions (MPhasis Ltd.) or seen their top-line erode (Zensar Technologies Ltd).

Jefferies expects margins to stay intact, and even show some expansion.

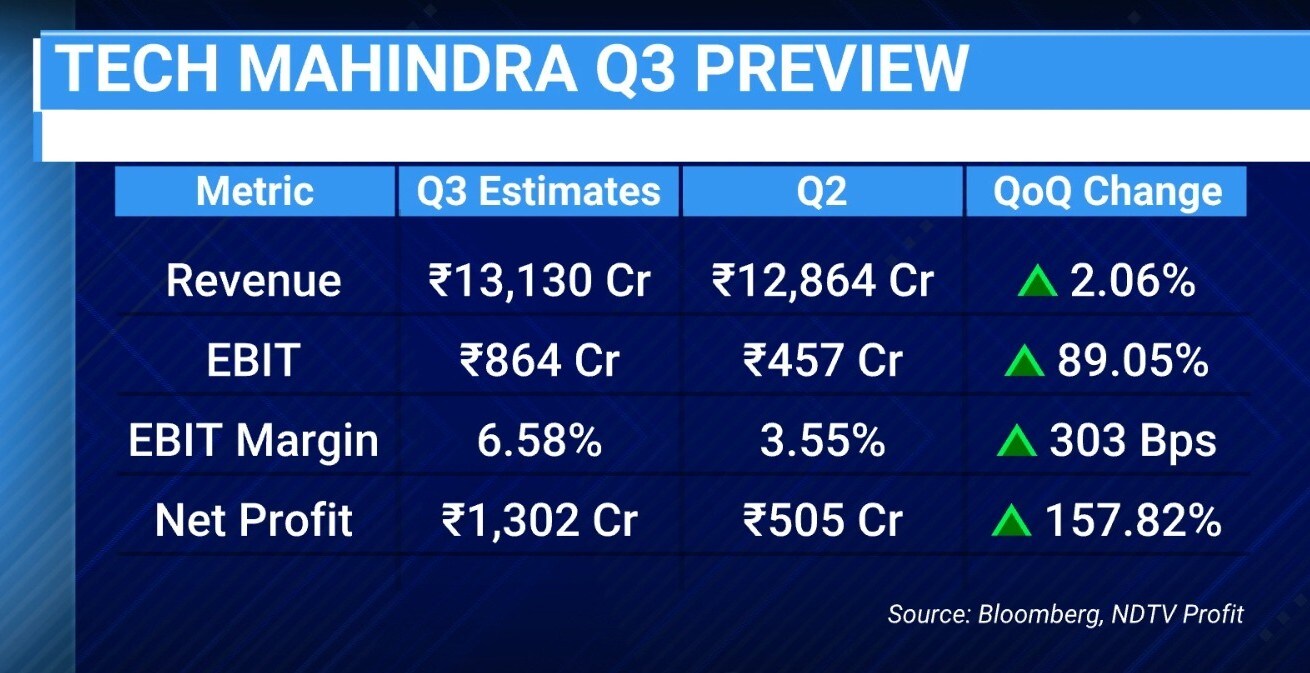

“Despite muted revenue growth, we expect aggregate revenue to expand by 30 bps QoQ as IT firms focus on preserving margins,” the brokerage said. “Coforge Ltd. and Tech Mahindra Ltd. are likely to see strong margin expansion of 280-300 bps, driven by recovery from one-offs in Q2 FY24 and operational efficiencies. We expect margins for Infosys/Wipro to contract by 120/180 bps on wage hikes and revenue decline.”

Deal Dynamics

The pace of dealmaking isn't a concern. Their conversion into revenue is.

Most analysts expect deal flows into IT companies to hold firm despite a volatile demand environment. The book-to-bill ratio of most companies are close to the peak due to strong deal wins and lower revenue conversion, Nuvama said.

Jefferies said deal wins likely remained soft in the fiscal third quarter as furloughs weighed on mega deal announcements. Infosys cancelled a $1.5-billion AI deal just weeks ago—a spillover effect, if any, will be keenly watched.

The post-quarter commentary on demand conditions in the fiscal fourth quarter and the rest of the calendar year will also be in focus. The several mega deals signed during the fiscal second quarter are also nearing ramp-ups.

BNP Paribas, meanwhile, is anticipating a revival in discretionary demand in the second half of FY25.

Commentary And Outlook

In 2023, India's $250-billion IT services industry came off post-pandemic highs of rampant digital transformation. Discretionary deals largely dried up but large contracts made for record dealmaking. Macroeconomic headwinds in the United States—stemming from a prolonged war in Europe and strife in the Middle East—had clients cautious on spending. Any meaningful conversion into revenue didn't happen.

Against that backdrop, the muted growth guidance for FY24 will be largely maintained, but the post-quarter commentary will be keenly watched for cues on demand conditions in 2024.

“The focus shall now shift from FY24 to FY25/FY26, with keen interest in how client budgets are shaping up for 2024, especially after recent Fed commentary,” Nuvama said. “We stay positive on the sector, with medium- to long-term growth potential outweighing near-term headwinds.”

Nirmal Bang, however, isn't as optimistic, nor is Jefferies.

“We think most companies will indicate that a clearer picture will emerge only after Q4 FY24. The likely modest traction in Q4 FY24 will not be considered part of a broader structural pick-up,” Pai of Nirmal Bang said. “We remain ‘underweight' on the Indian IT space as we believe that a shallow recession (in the U.S.) is likely in 2024, leading to consensus estimates being downgraded for revenue and margins, leading to PE multiples compression.”

Jefferies, on its part, alluded to Accenture's first-quarter earnings—that it isn't an indicator of recovery on the ground for Indian IT firms. Additionally, the Nifty IT's outperformance relative to the Nifty 50 is all smoke and mirrors.

“We believe that Nifty IT's 31% premium to Nifty 50 looks rich, given that over the past 15 years, entering Nifty IT at these levels has resulted in underperformance,” Jefferies said. “Given Nifty IT's 9.5% return in December, absence of positive commentary could adversely impact stock performance in the near-term."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.