ICICI Bank Ltd. is projected by brokerages as a sector leader poised for sustained growth given its resilience in the current economic environment, coupled with strong fundamentals, effective cost controls, and a solid return on assets. They remain highly optimistic about the private lender's outlook.

Jefferies highlighted that ICICI Bank is operating on a "league of its own" citing its operational efficiency and improving cost-to-income ratio. The brokerage has a 'buy' rating on the stock and increased its target price to Rs 1,550 apiece, citing the lender's diversified loan portfolio and cautious stance on unsecured lending. It also noted that the bank's stable loan-to-deposit ratio and deposit growth support sustainable expansion.

Nuvama Institutional Equities remains positive on ICICI Bank, selecting it as a top sector pick with a 'buy' rating and a target price of Rs 1,420. The brokerage pointed to ICICI's strong asset quality, reflected in reduced slippage ratios quarter-over-quarter, as a key factor for its bullish stance.

The report highlights ICICI's ability to maintain a stable credit cost trajectory even amid economic challenges, positioning it to deliver a strong performance in a weak sector.

Sustained focus on granularity and quality assets have made ICICI Bank's balance sheet strong enough to deliver strong and consistent results every quarter since fiscal 2021.Nuvama on ICICI

Emkay has a 'buy' rating on the stock and also raised its target price for the private lender to Rs 1,400 apiece, based on the bank's healthy net interest margins and disciplined provisioning. The brokerage believes that the bank is defying industry and peer trends, and growth was driven by pick-ups in corporate, business banking, and non-PL retail books.

ICICI Bank remains a preferred pick in the banking space because of its superior returns profile, top-management credibility, and strong capital allocation strategy.

Highlights of Q2 Earnings

Net profit rose 14.5% year-on-year to Rs 11,746 crore, above Bloomberg's estimate of Rs 10,952 crore.

Net interest income increased 9.5% year-on-year to Rs 20,048 crore.

Asset quality improved, with the gross NPA ratio declining to 1.97% as of Sept. 30 from 2.15% in the previous quarter and 2.48% a year ago.

Net NPA fell to 0.42% from 0.43% in the previous quarter and the same quarter last year.

Gross NPA additions were Rs 5,073 crore in the second quarter, down from Rs 5,916 crore in first quarter, with Rs 4,300 crore coming from retail and rural NPAs.

Domestic gross advances grew 15% year-on-year, reaching Rs 12.77 lakh crore.

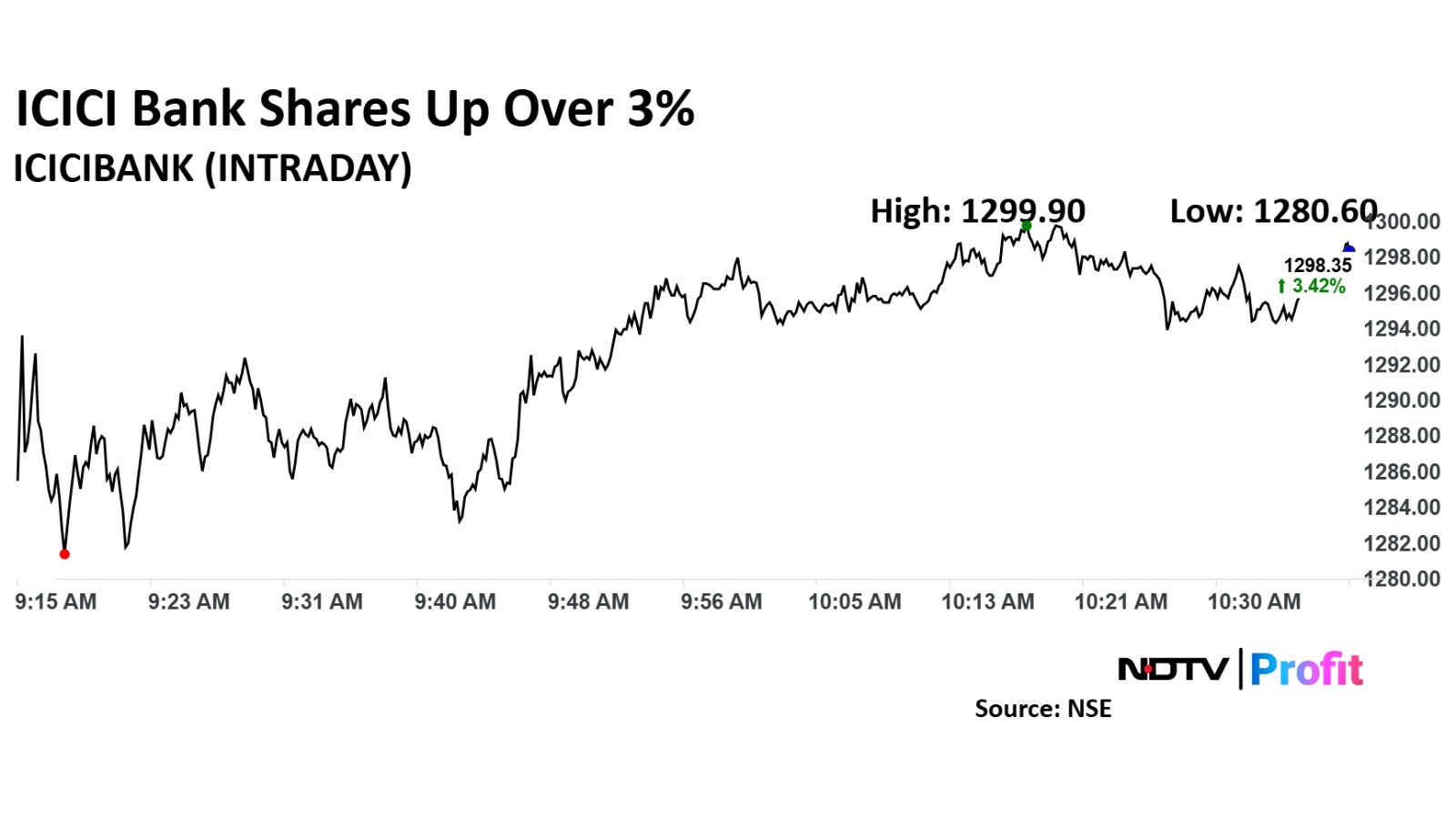

ICICI Bank Share Price Today

ICICI Bank's stock rose as much as 3.54% during the day before paring some gains to trade 3.45% higher at Rs 1,298.80 apiece, compared to a 0.96% advance in the benchmark Nifty 50 as of 10:39 a.m.

The stock has risen 40.50% in the last 12 months and 30.34% on a year-to-date basis. Total traded volume so far in the day stood at 3 times its 30-day average. The relative strength index was at 61.70.

Forty five of the 50 analysts tracking ICICI Bank have a 'buy' rating on the stock and five recommend a 'hold', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 12.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.