Challenging macro conditions have caused the executable order book of Coforge Ltd. to slowdown, resulting in 17% year-on-year growth in FY24 as opposed to 20% increase in FY23. This suggests a decrease in revenue growth, according to analysts.

"The acquisition of Cigniti (Cigniti Technologies Ltd.) will enable the company to add 20% to the company's topline and lead to 11.5% of dilution. However, this acquisition will enable the company to achieve $2 billion target by FY27E and 150-250 basis points margin expansion," IDBI Capital said in a note.

Coforge will continue to outperform peers, organically, according to Nuvama. "While Cigniti does fill the white spaces management talked about and is also EPS accretive, we would have preferred a company with capabilities in new-age tech domain," the research firm said in a May 5 note.

Coforge Q4 FY24 Results Highlights (Consolidated, QoQ)

Revenue up 1.51% at Rs 2,358.5 crore.

Ebit down 4.1% at Rs 301.1 crore.

Ebit margin down 74 basis points at 12.76%.

Net profit down 5.6% at Rs 229.2 crore.

Here is what brokerages have to say.

Citi Research

Citi Research maintained a 'sell' on the stock, with a target price of Rs 4,550 apiece.

Management suspended FY25 revenue growth guidance due to uncertain environment, indicated to deliver robust growth in FY25.

FY25 gross margins and adjusted Ebitda margins to improve by 50 basis points, while reported Ebitda margins likely to be flat.

FY25 growth to be monitored given that executable orderbook growth at 17.3%. In addition, QIP overhang will likely remain in the near team. Acquisition integration to be monitored in a tough demand environment.

Nuvama Institutional Research

The research firm has 'buy' rating on the stock, with a target price of Rs 5,850 per share.

Nuvama cut FY25E/26E earnings per share estimates by 8.0%/7.0%, on lower growth and cut target multiple to 27 times from 30 times on acquisition led derating.

Management expects strong growth in FY25, based on strong 12 months executable order book at $1,019 million, without giving explicit quantitative growth guidance.

Ebitda margin expanded 70 basis points quarter-on-quarter to 18% in Q4, driven by improvement in utilisation and ramp up in offshore revenue. It expects adjusted Ebitda margins to increase 50 basis points each in FY25, while reported Ebitda margins to be flattish.

Acquisition of Cigniti Technologies at 2.1 times EV/sales adds 20% to revenue.

Coforge has announced its intent to acquire 54% stake in Cigniti at valuation of Rs 39 billion. Coforge shall use proceed from the QIP to fund the acquisition.

Management highlighted that the acquisition would help expand its presence in new vertical and increase presence in the US geography.

IDBI Capital

Considering weak revenue profile of acquired company IDBI maintains 'hold' rating on the stock, with a revised target price of Rs 5,495 per share.

The acquisition of Cigniti will enable the company to add 20% to the company's topline and lead to 11.5% of dilution.

The merged firm's retail vertical will be operating at close to $100 million per annum in size, while the hi-tech and healthcare verticals will be operating at around 50 million per annum size immediately post merger.

Further, it will help Coforge expand in North America. The company will also enable cross selling of its services.

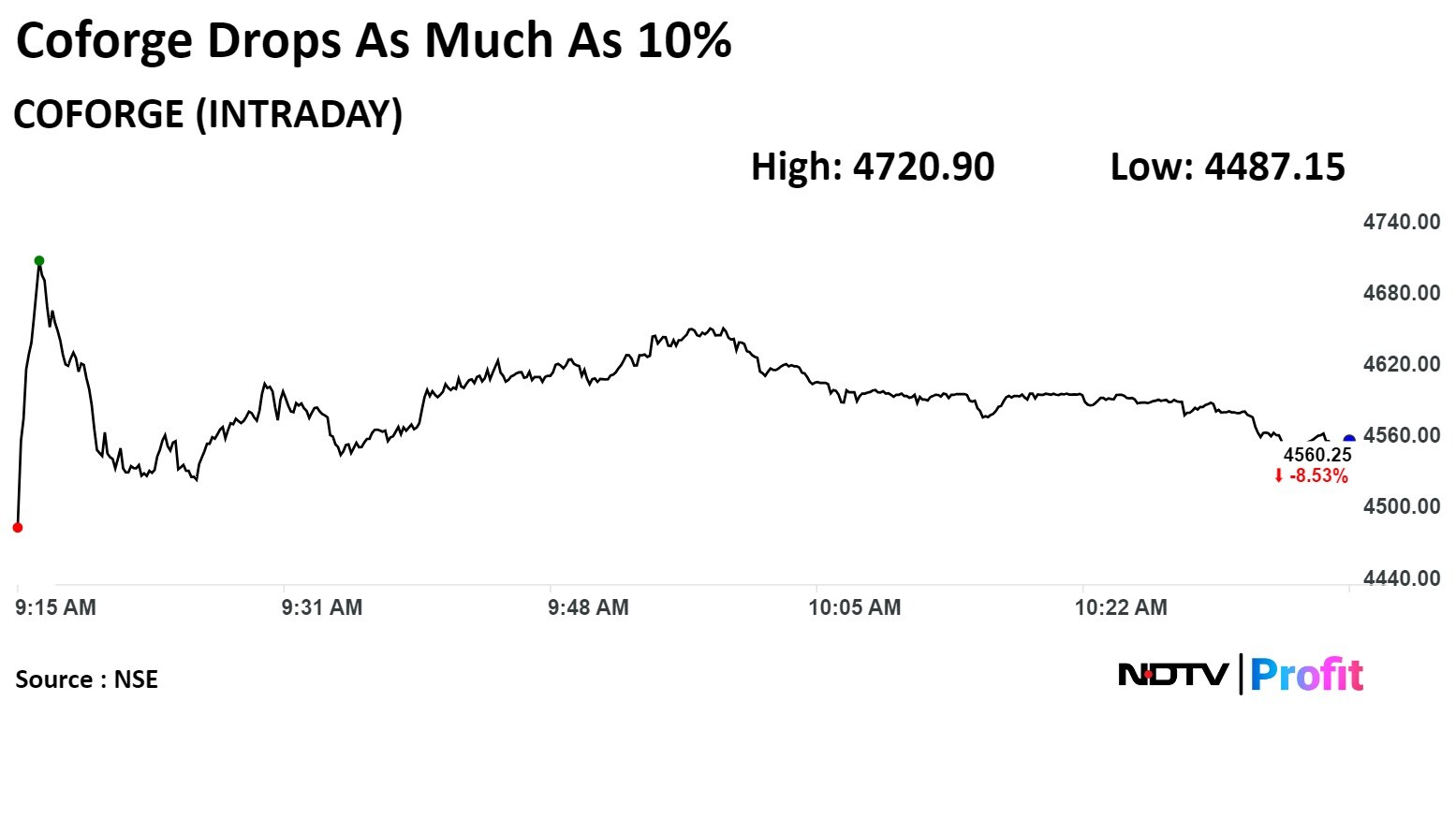

Shares of Coforge fell as much as 10% before paring loss to trade 7.75% lower at 10:10 a.m., compared to a 0.2% advance in the benchmark Nifty 50.

The stock has risen 12.1% in the last 12 months and 23.7% year-to-date. Total traded volume so far in the day stood at 23 times its 30-day average. The relative strength index was at 19.

Of the 35 analysts tracking the company, 22 have a 'buy' rating, five recommend a 'hold' and eight suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 26%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.