.jpeg?downsize=773:435)

HDFC Bank Ltd. is seeing its business normalise after post-merger disruptions. Despite initial concerns about weak loan growth, key indicators and latest earnings for the private lender remained encouraging, said Pranav Gundlapalle, senior research analyst at Bernstein.

The bank reported its earnings for the quarter ended September on Saturday, with a 5.3% increase in net profit at Rs 16,821 crore. This exceeded the Bloomberg consensus estimate of Rs 16,284 crore. The rise in bottom-line was supported by higher net interest income.

"Borrowings did not decline... and there was no increase in product costs or a rise in slippages," Gundlapalle said in a televised interview with NDTV Profit.

Bernstein has a target price of Rs 2,100 for the HDFC Bank stock over the next 12 months, implying an upside of 20% from the current levels.

The analyst emphasised that a normalisation process is underway, particularly concerning the loan-to-deposit ratio, which management has prioritised. As credit growth slows and deposit growth increases, he believes effective asset quality curation could create a favourable environment for the stock to outperform.

Gundlapalle believes that continued normalisation in the bank's balance sheet should drive upside potential, although he cautioned that a sharp slowdown in deposit growth poses a significant risk not only for HDFC Bank but for the banking sector as a whole.

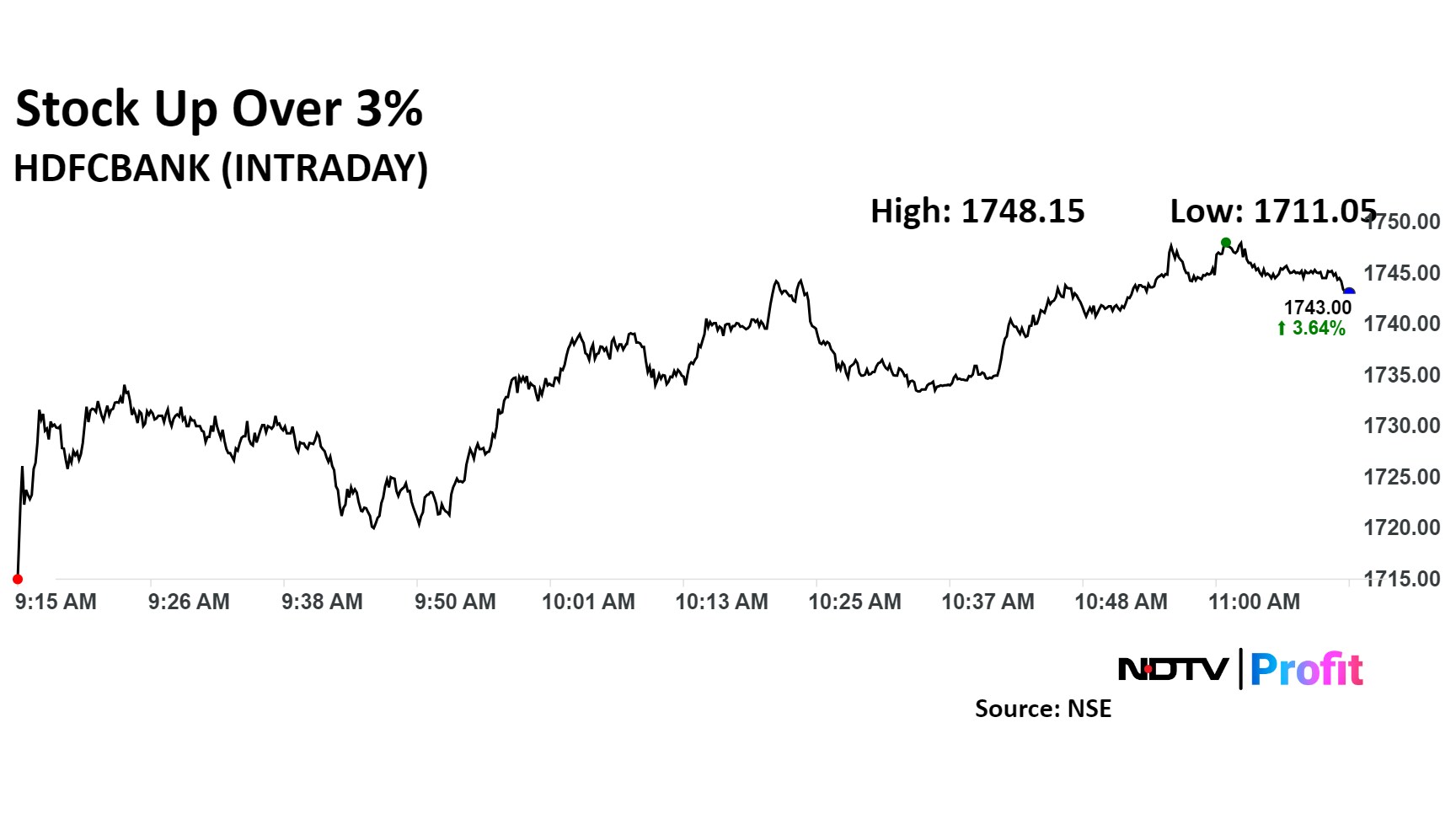

HDFC Bank Share Price

The scrip rose as much as 3.93% to Rs 1,748 apiece. It was trading at the same level as of 11:03 a.m. This compares to a 0.05% decline in the NSE Nifty 50.

It has risen 16.06% in the last 12 months. Total traded volume so far in the day stood at 2.0 times its 30-day average. The relative strength index was at 60.

Out of 47 analysts tracking the company, 38 maintain a 'buy' rating, and nine recommend a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 11.4%.

Kotak Mahindra Bank's Slippages Raise Concerns

Meanwhile, Gundlapalle expressed concerns regarding Kotak Mahindra Bank's recent earnings. While the Ashok Vaswani-led bank managed to achieve strong overall loan and deposit growth, it came at the expense of margins.

"The decline was largely driven by a forced shift to more secure businesses... and the bigger concern is about increasing slippages," the Bernstein analyst noted.

Gundlapalle indicated that Kotak's rising credit slippages could signal broader stress in the unsecured loan segment within the sector. However, he cautioned against extrapolating past underwriting outcomes to newer segments without accounting for the necessary seasoning of these areas.

Regarding Kotak's credit card challenges, Gundlapalle mentioned that the management has not provided a clear timeline for resolution. The bank is undergoing changes to address regulatory concerns, but this process may take time. He highlighted the bank's recent acquisition of Standard Chartered's portfolio, suggesting a continued appetite for higher-yielding products, though the timing remains uncertain.

For Kotak Mahindra Bank, Gundlapalle says the target price is Rs 1,750, only marginally up from the current levels. He noted that unless there is a significant improvement in deposit accumulation, the bank's previous growth premium may be at risk, leading to a cautious outlook until the Reserve Bank of India's embargo is lifted.

Kotak Mahindra Bank Share Price

Shares of Kotak Mahindra Bank fell as much as 7.27% before paring loss to trade 6.44% lower at Rs 1,750.55 apiece, as of 11:07 a.m. This compares to a 0.11% decline in the NSE Nifty 50.

The stock has risen 0.64% in the last 12 months. Total traded volume so far in the day stood at 3.9 times its 30-day average. The relative strength index was at 36.

Out of 43 analysts tracking the company, 24 maintain a 'buy' rating, 14 recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 15.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.