The Unified Pension Scheme (UPS) aims to offer the benefits of both the new and old pension schemes by providing a balanced blend of both. The Union cabinet has approved the scheme for Central government employees and it will be effective from April 1, 2025. The scheme aims to provide a defined benefit or a fixed pension along with inflation adjustment.

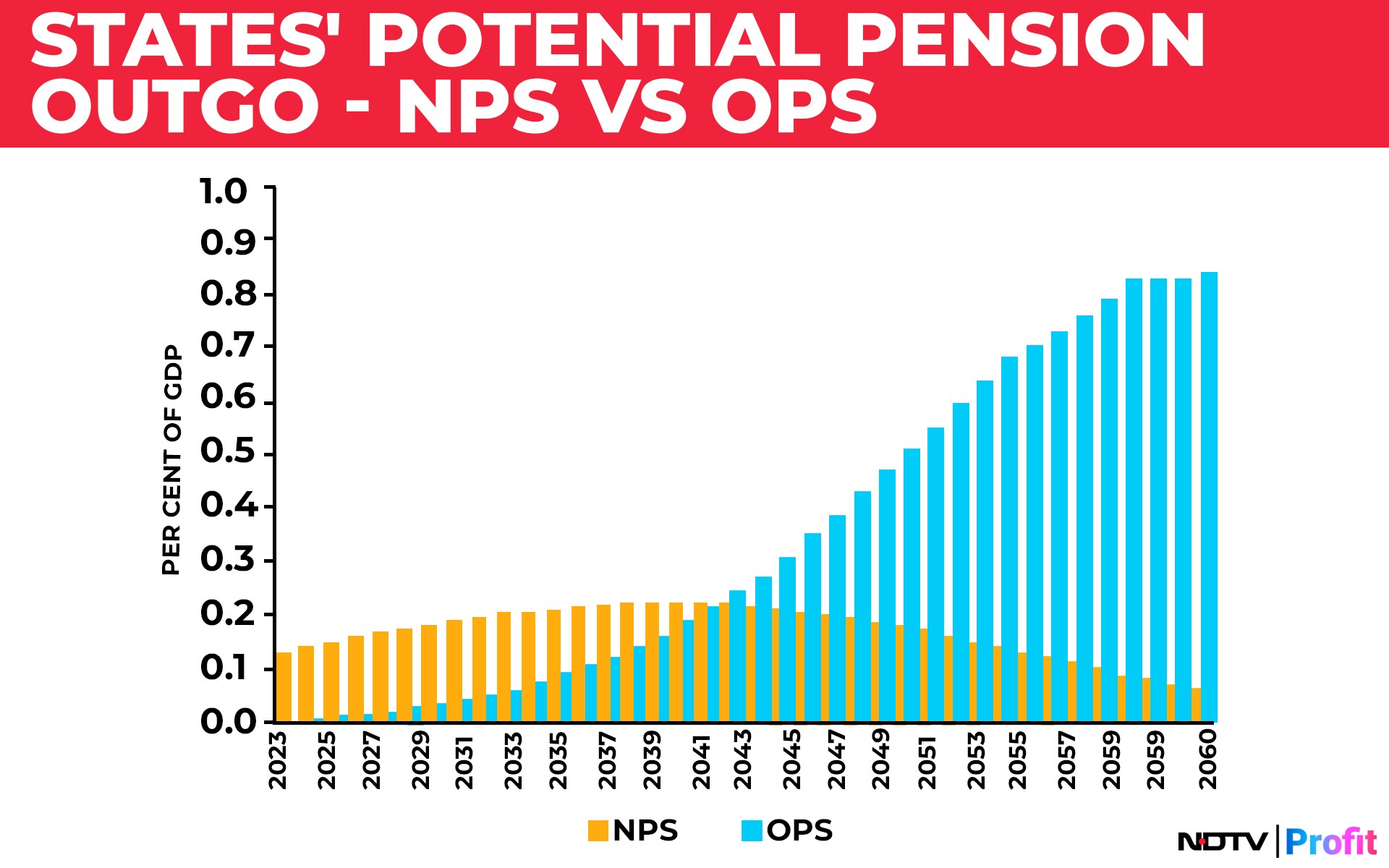

"In the near term, the fiscal impact is likely to be minimal (0.02% of GDP for the Centre in FY25). As more states adopt the UPS, they will have to bear an additional fiscal burden," according to a report by Nomura.

The primary aim of the UPS is to address the disenchantment of employees with the National Pension System (NPS) vis-à-vis the Old Pension Scheme (OPS), the report stated.

Funding Breakdown Of OPS And NPS

In the Old Pension Scheme or OPS, the payout was from the budget itself and not a corpus that included contributions from the employee. The outflow from the Centre was not viable under this system.

In 2004, the new pension system or NPS, was introduced. Under this, an employee contributed 10% of salary, while the government contributed 14% of the employee's salary towards the pension fund.

One major issue with the NPS was that there was no guarantee of a fixed amount, according to the report.

The scheme also failed to include inflation indexation. There were other issues, like the lack of provision for family pension on the death of the pensioner.

UPS offers a fixed pension amounting to 50% of the average basic pay in the last year of service. The scheme is also set to include inflation indexation.

Fiscal Burden

UPS, like the NPS, will continue to have the employee contributing 10% of the basic pay and dearness allowance to the pension fund.

The government's contribution has been increased from 14% to 18.5% under the UPS.

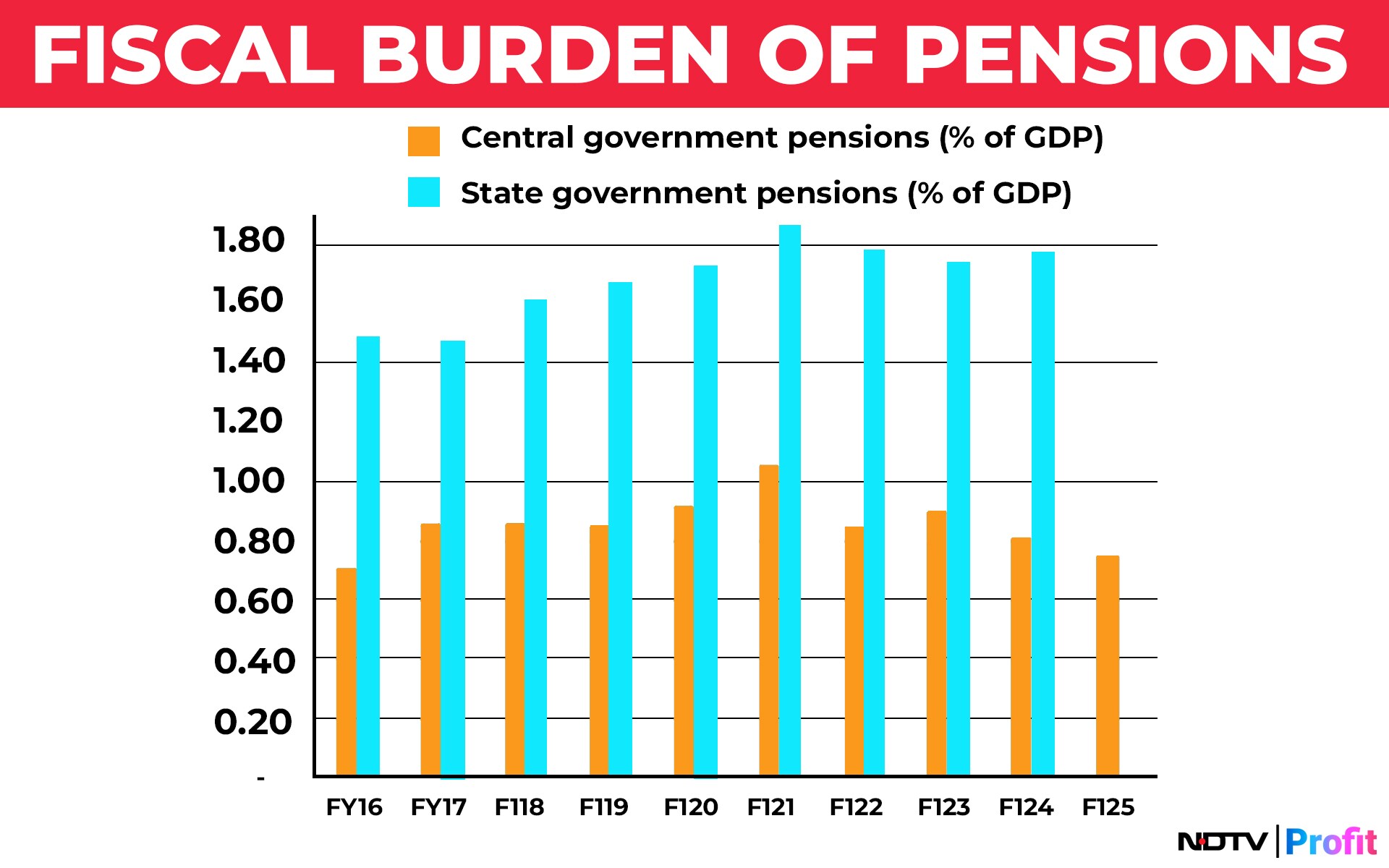

"State governments witnessed a sharp rise in the pension burden to almost 1.9% of GDP in FY21, and in the past few years, it has remained sticky at 1.7-1.8% of GDP," stated the report.

Currently, the central government spends 0.75% of GDP on pensions. The fixed amount of pension, inflation indexation and a higher government contribution are bound to increase the fiscal burden of the government.

Political Gambit

The unpopularity of the NPS among government workers had been snowballing into a political issue, with states like Chhattisgarh, Rajasthan, Punjab and Karnataka switching back to OPS despite the higher fiscal costs.

"Due to the reliance on coalition partners, policy-making is turning cautious and calculated. With polls in the last quarter, adoption of the UPS has become a political necessity," said the report.

Close on the heels of the Centre's announcement, Maharashtra became the first state to approve UPS for its employees, underscoring the political importance of the issue.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.