Finance Minister Nirmala Sitharaman on Tuesday revised the income tax slab rates in the new tax regime in the first full budget of the Narendra Modi-led government after the 2024 Lok Sabha elections. With the new changes, the calculation for your income tax for FY 2024-25 will now change.

The government has announced an increase in the standard deduction to Rs 75,000 from Rs 50,000 in the latest Union Budget in a move, expected to benefit salaried individuals, providing them with higher tax savings and greater disposable income.

As part of these changes, the basic exemption limit under the new income tax regime continues to be Rs 3 lakh. Income from Rs 3 lakh to Rs 7 lakh will be taxed at 5% whereas income from Rs 7 lakh to Rs 10 lakh will be taxed at 10%. Income from Rs 10 lakh to Rs 12 lakh will be taxed at 15%. No changes were made in the higher income brackets of Rs 12 lakh to Rs 15 lakh which continue to be taxed at 20% and income earned above Rs 15 lakh will continue to be taxed at 30%.

Read on to know about the revised income tax slabs for 2024-25 under the new income tax regime.

Revised Income Tax Slabs For FY 2024-25 Under New Tax Regime

To understand the changes in income tax slabs better, take a look at the income tax slabs under the new tax regime before Budget 2024-25.

Old Income Tax Slabs Under New Tax Regime

For comparison you can take a look at the income tax slabs under the new tax regime before Budget 2023-24 as mentioned below.

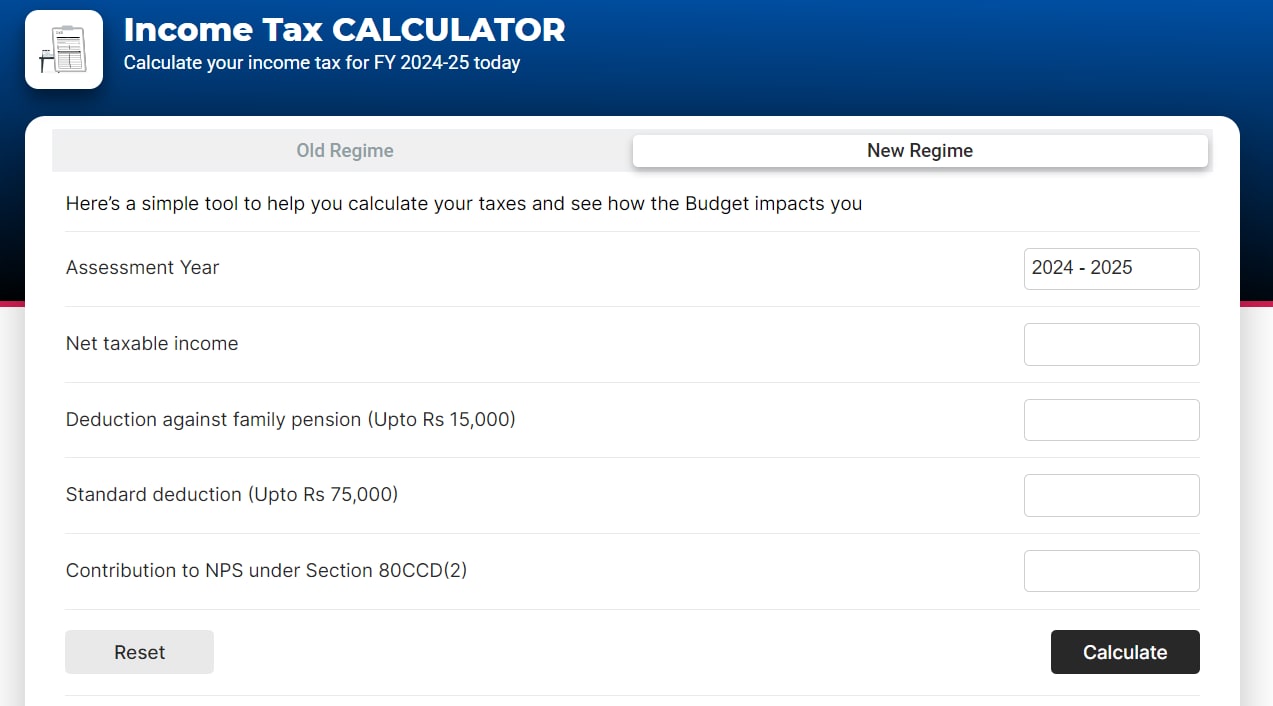

Use our New tax regime Income tax calculator to check your taxes for FY 2024-25.

income tax calculator under new tax regime

In Union Budget 2024, Finance Minister Nirmala Sitharaman has revamped the new income tax regime and the total number of income tax slabs under the new income tax regime remains the same but the tax slabs have been revised.

In Budget 2023, the new tax regime was made the default tax regime for FY 2023-24. This meant that when you don't opt for one of the two, the new tax regime will be considered as the 'default regime'. And to opt for the old tax regime, one has to categorically opt out of the new tax regime.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.