What is UAN?

UAN stands for Universal Account Number and is a unique 12-digit identification number assigned to every individual who contributes to the Employee Provident Fund (EPF). It functions like a social security number for EPF accounts, remaining constant throughout one's career irrespective of job changes. This ensures seamless consolidation of PF across various employers under one umbrella.

The main objective behind this function is to capture KYC details of members in order to eliminate dependency on the employer and improve the quality of service. KYC details will be tagged to the allotted UAN rather the member ID thereby eliminating redundancy.

What does a UAN Card look like?

The following image shows the front and back sides of a UAN card. The front portion of the card displays UAN, name, father's/husband's name, member ID (as available in the EPFO member database), photo and KYC.

The backside of the UAN card displays the latest five-member IDs linked with this UAN along with helpdesk number and email ID.

If the KYC of this member is uploaded by the employer, it will reflect on the front side of the UAN card by displaying ‘Yes' in front of the KYC. In case of non-availability of KYC, it will always reflect ‘No' in front of KYC on the UAN Card.

Front and back of UAN card

How to know my UAN number

Here's how you can find your UAN online (in short steps):

Visit the EPFO official website at epfindia.gov.in

Under the "Services" section, select "For Employees" and then choose "Member UAN/Online Service (OCS/OTCP)." This will redirect you to the member portal.

On the member portal homepage, look for the "Important Links" section and click on "Know Your UAN."

Enter your registered mobile number linked to your UAN and Provide the captcha code displayed.

Click on "Request OTP" to receive a one-time password on your registered mobile number. Enter the received OTP and the new captcha code displayed on the screen and click on 'Validate OTP'.

Then you will be prompted to enter your Full Name, Date Of Birth and either Aadhaar, PAN or Member ID.

Enter these required details and fill in the captcha code displayed on the screen.

Click on "Show My UAN" to retrieve your UAN.

If you have linked your UAN then your UAN number will be displayed on the screen.

How to know my UAN number

Here's how you can find your UAN online (with visuals):

Step 1: Visit the EPFO official website at epfindia.gov.in

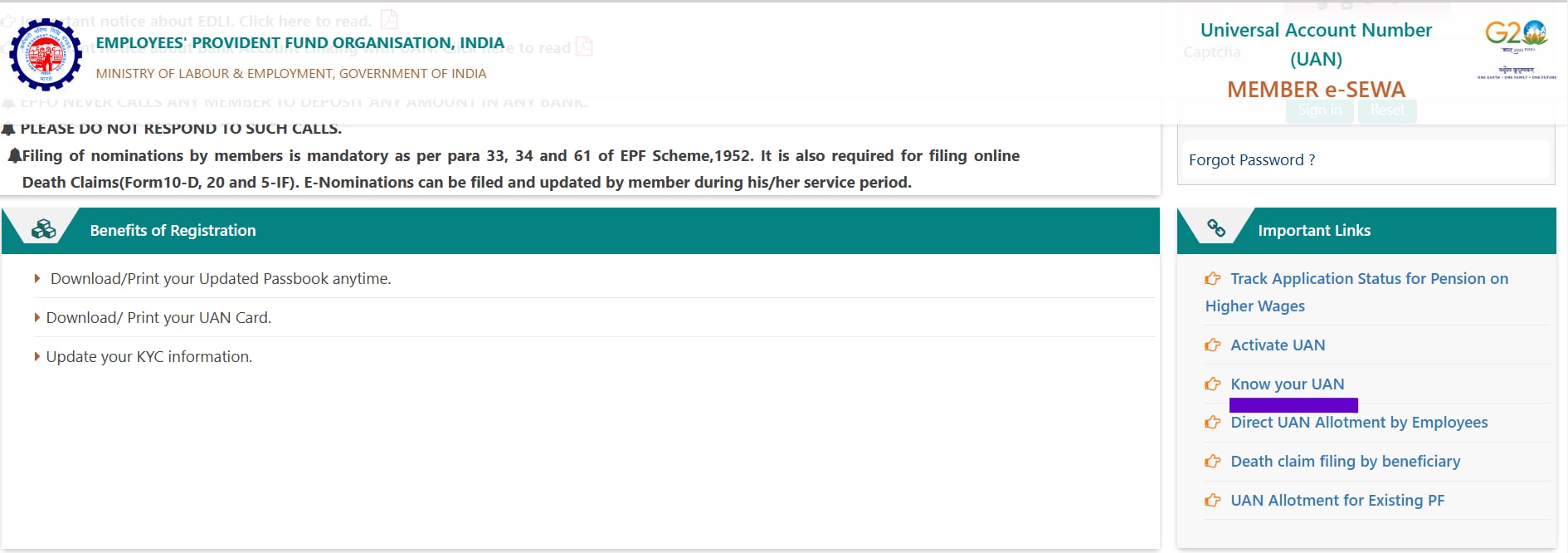

Step 2: Under the "Services" section, select "For Employees" and then choose "Member UAN/Online Service (OCS/OTCP)." This will redirect you to the member portal.

Step 3: On the member portal homepage, look for the "Important Links" section and click on "Know Your UAN."

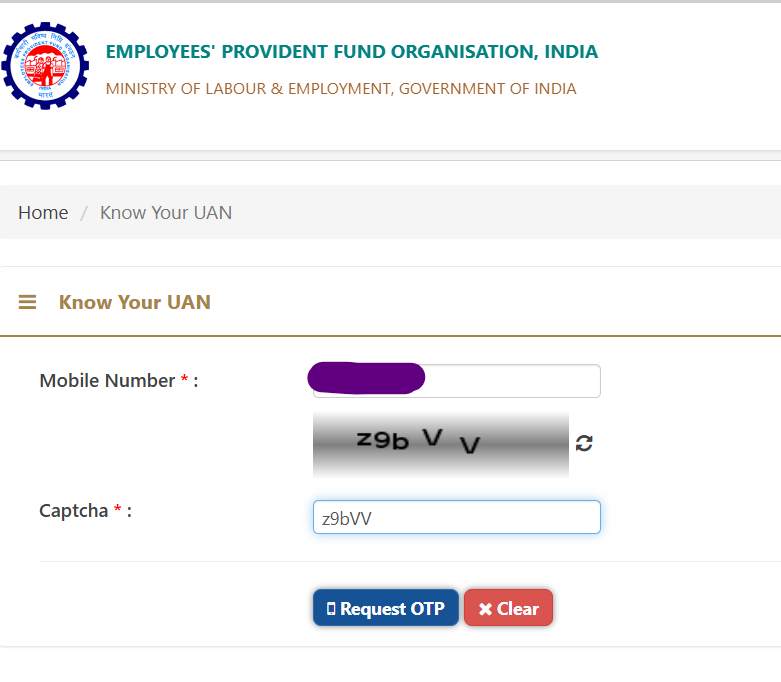

Step 4: Enter your registered mobile number linked to your UAN and provide the captcha code displayed.

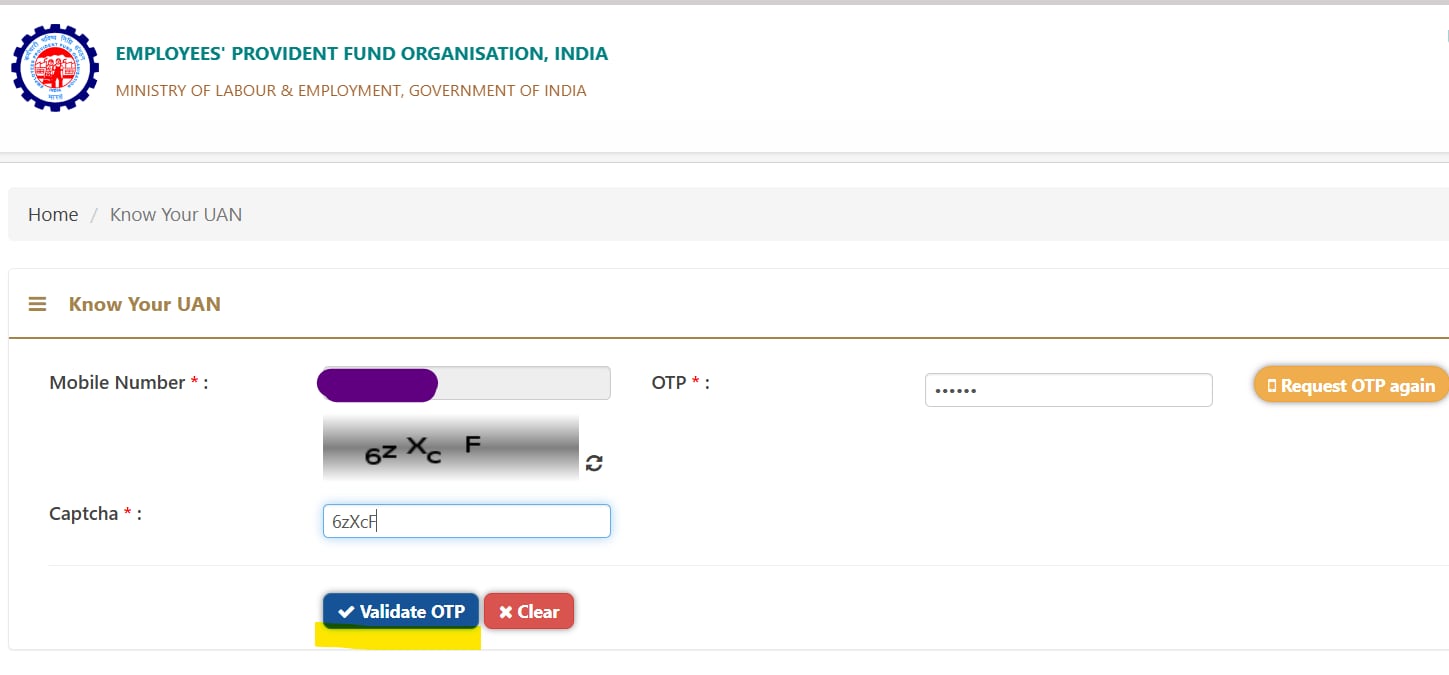

Step 5: Click on 'Request OTP' and enter the OTP (one time password) and captcha displayed and click on 'Validate OTP'.

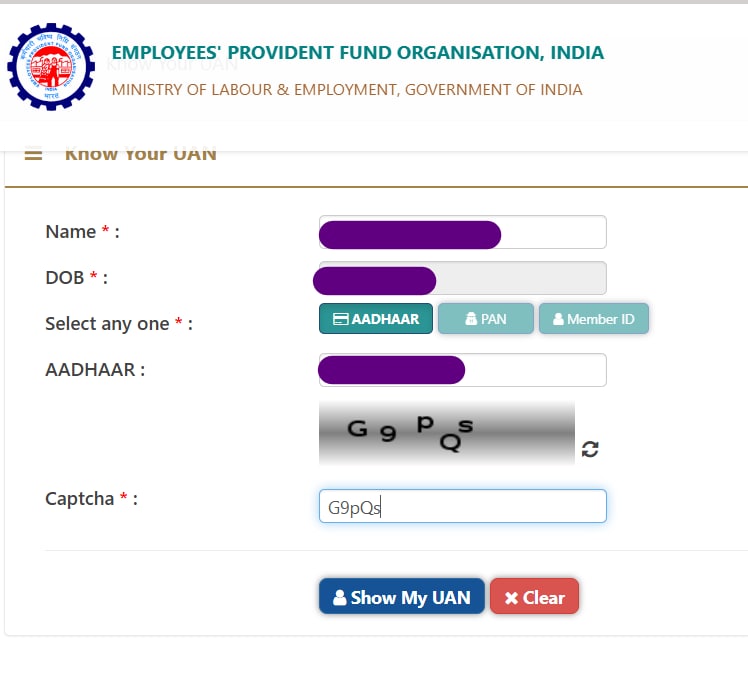

Step 6: You will be prompted to enter your Full Name, Date Of Birth and either Aadhaar, PAN or Member ID. Enter these required details and fill in the captcha code displayed on the screen.

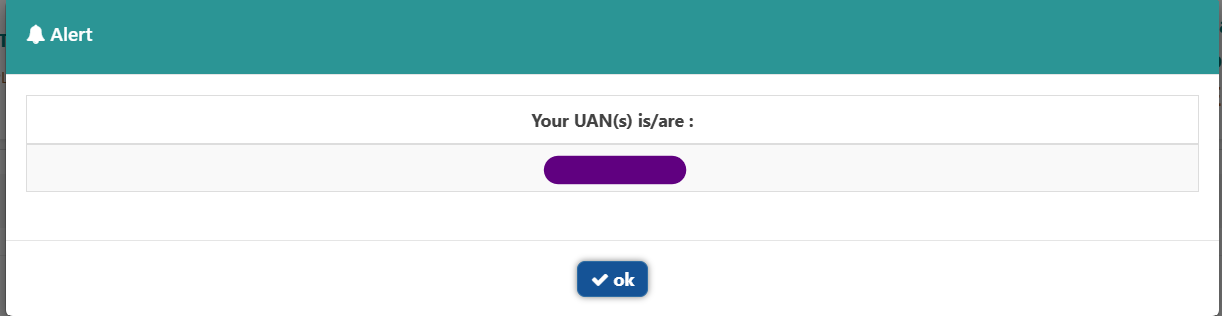

Step 7: Click on "Show My UAN" to retrieve your UAN. If you have linked your UAN then your UAN number will be displayed on the screen.

Pre-conditions for checking UAN

Employees must keep in mind the following:

Must exist in the ECR w.e.f. January 2014 onwards. (Member can check UAN allotment status in the official website:: http://uanmembers.epfoservices.in/check_uan_status.php )

Member must obtain UAN number and member ID from the employer.

Activation of the registration is mandatory.

Member has to create user name and password for accessing UAN driven member portal.

Member must have scanned copies of the KYC documents to be uploaded.

Benefits of having a UAN

Here are a few reasons why having a UAN number is beneficial:

When you switch jobs, your previous employer's PF contribution gets transferred to your new EPF account linked to your UAN. This eliminates the need to open new accounts or track multiple PF accounts.

UAN facilitates online access to your EPF account details, including contributions, balance, and KYC information. You can easily track your contributions and manage your account activity.

UAN minimises the need for manual claim filing for PF withdrawals or transfers. With online access, the claim process becomes faster and more convenient.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.