There are procedures to follow when a parent passes and leaves a will behind. In cases where there is the absence of a will, the procedure to follow is completely different.

If the parent has not left a will behind, then one may feel completely lost on where to start. Here is a guide to help identify the steps to take when there is no will.

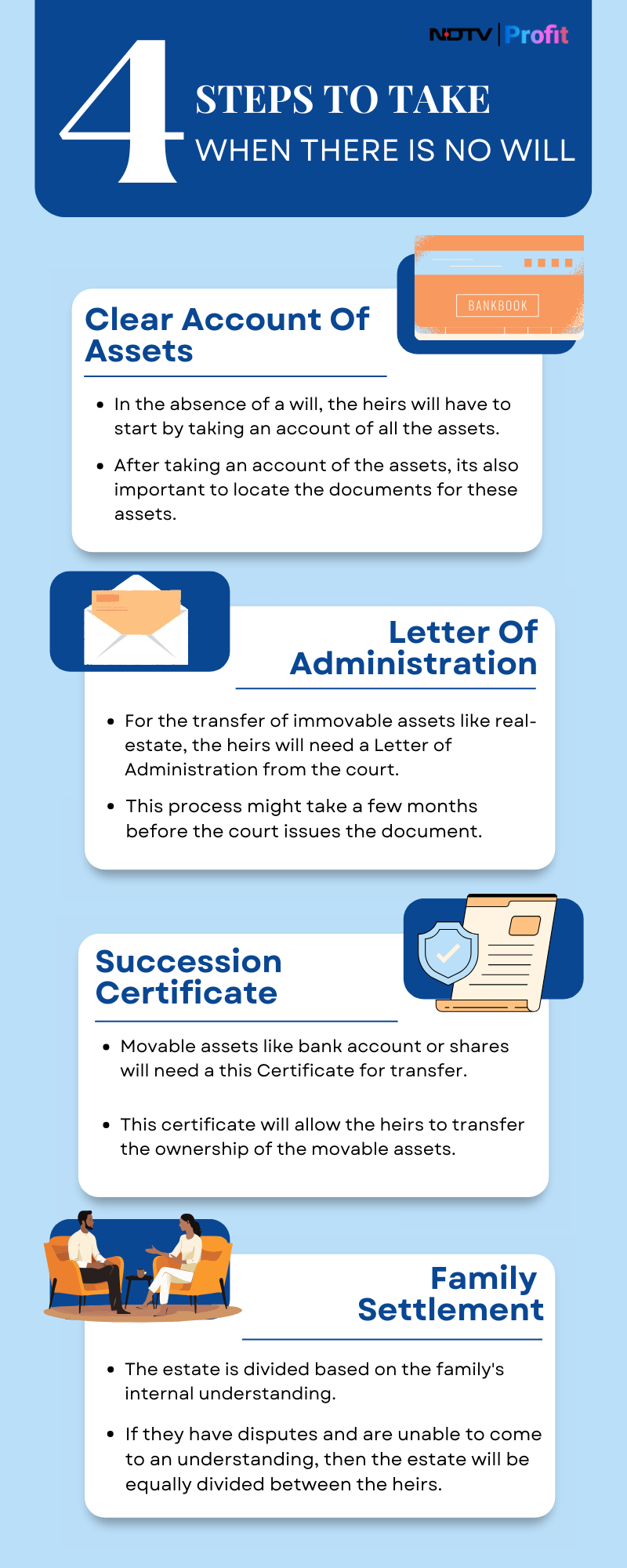

Clear Account Of Assets

A good place to start will be to list out the assets that were held by the deceased. When there is a will, both the estate and the division would be clearly mentioned. In the absence of a will, the heirs will have to start by taking an account of all the assets.

"Understand what assets the deceased left behind," Shaishavi Kadakia, partner at Cyril Amarchand Mangaldas, said. "Since there is no will, heirs may not have access to asset details, which are typically identified in the will. So, unless the deceased left behind a systematic asset register, a lot of the initial work could be just discovery."

After taking an account of the assets, it is also important to locate the documents for these assets. This process might also take up some time depending on the accessibility of these documents as well.

(Source: NDTV Profit)

The next step depends on the type assets possessed by the deceased. There are two separate legal documents that are required depending on the nature of the assets.

Here are the two types of documents that one might require from the court to transfer the ownership of assets.

Letter of Administration

For the transfer of immovable assets like real estate, the heirs will need a letter of administration from the court. One or more legal heirs can approach the court and request for appointment as an administrator.

When there is no will, a letter of administration from the court allows you to become an administrator of the assets. This grant applies to the entire estate.Shaishavi Kadakia, partner at Cyril Amarchand Mangaldas

This process might take a few months as there are procedures that the court needs to complete before the letter is issued. "The court will examine and seek objections. If there is no objection, the applicant can then be made administrator," she said.

Depending on what the assets are, the heirs can approach the relevant regulator with the letter of administrator to have those assets moved to their name.

Succession Certificate

For movable assets like bank account or mutual fund shares, the heirs will need a succession certificate from the court.

An alternative to a letter of administration could be a succession certificate, for which one needs to approach the court. But the ambit of this SC is more limited as it only to securities, such as shares and debts.Shaishavi Kadakia, partner at Cyril Amarchand Mangaldas

This certificate will then allow the heirs to transfer the ownership of the movable assets. It is also important to note that in some cases of certain immovable property, local authorities may ask for a legal heirship certificate.

"This is issued by the local magistrate or tahsildar to show the list of legal heirs. This is obtained quicker than a letter of administration that will take months, but not all authorities will accept it as the basis for permitting transmission of assets," Kadakia said.

Family Settlement

There is also a family settlement that can be done in the absence of a will. Essentially, the estate is divided based on the family's internal understanding.

A family settlement can be entered into among the heirs for reallocation of the deceased's assets among them, according to Kadakia. "If interest in an immovable property is involved, then there will need to be a separate document per property and the document will have to be registered with the sub-registrar of assurances."

Dispute And Division

Now, this is if the family or all the heirs can come to a mutually feasible division. If they have disputes and are unable to come to an understanding, then the estate will be equally divided between the heirs.

"Everyone will get an equal share if there are internal disputes," Manmeet Kaur, partner at Karanjawala & Co., said. "The daughters get an equal share after the 2005 amendment. One may be entitled to an equal share when the estate is divided with all the heirs."

These documents like family settlement agreements, letters of administration and succession certificates are issued versus the state. This means that in the future, if someone comes in with a better title, then they can claim it back from the state, according to Kaur.

Nomination

Now, those were the steps to take if the parent passed without a will or a nomination. When there is a nomination, it is relatively easy for the nominee to transfer certain assets.

"There are some assets like bank accounts, insurance and PPF, where the nominee can collect the assets without any other documents, although in most cases, the nominee acts as akin to a trustee and must hold the assets for the legal heirs" Kadakia said.

For immovable land like a flat in a housing society, the nominee can also approach the society to transfer the ownership directly. "If there is land, then heirs must approach the land revenue officer/municipal authority with the death certificate and would have to submit the documentation sought," she said.

All these steps can only apply when a will is left behind. There may be various cases where a parent may have passed, leaving debts. The procedure to follow in this case is entirely different.

In the final part of this series, which comes out on Sept. 26, we bring you the steps to follow when there is debt and liability to be addressed.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.