This is first of a series of articles that focus on better banking for India.

In any economy, the real sector is the engine of growth, development, and job creation. However, to perform its role in an optimal manner, it needs an adequate supply of financial instruments that allows people and enterprises to save and borrow money, and buy insurance. When people save, they transfer money from today to tomorrow; as they borrow, they transfer money from tomorrow to today; and when buying insurance, transfer money from the good to the bad states of the world. Without these instruments, the economy becomes a primitive barter system in which people are reduced to subsistence living because they need to produce all of their requirements from the physical capital and labour that they own with no hope of specialisation or of accelerated growth.

An Ideal System, And The Reality

Financial systems, comprising capital, banking, and insurance markets perform the essential function of creating these financial instruments.

An idealised and perfectly competitive market for capital can assist in the delivery of an ‘efficient' allocation of resources in the economy without the need for any intervention. The belief is that in such a market, millions of investors continuously work hard to assess the growth prospects and risks of firms and accordingly give each one the benefit of an appropriately fine-tuned price and volume of financial resources that they are able to access via capital markets. This ensures that only those firms that can make a return commensurate with the risks that they take on, can survive and grow. Such an idealised market-process then plays a key role in ensuring that there is an optimal allocation of all the labour and capital resources in the economy, thus maximising its growth relative to its potential.

This idealised route places an enormous burden on firms to disclose timely information and to be ready for the vicissitudes of the market. It also requires a large group of informed investors who are prepared to participate in it. In developing countries, these requirements are satisfied by only a small portion of firms and a small pool of investors. In such a scenario, most such economies, including India, attempt to work with two classes of investors, those who seek low risk in exchange for low returns and supply large amounts of capital, and a smaller number that seek much higher returns and are willing to take on much higher levels of risk. In a bank, the first are known as depositors and the second are those that supply risk-capital. Well-managed banks then combine these two forms of capital and build a well-functioning ‘internal market' for risk and money which ensures that the aggregate level of risk that the bank takes on matches the expectations of its combined investor group.

If a bank functioning in this way is to come close to replicating the allocative efficiency of capital markets, the manner in which the internal market within each bank operates is absolutely key. In such a market, small levels of routine losses, and larger losses in exceptional circumstances, are a part of the ‘market discovery' process. However, the large losses on a relatively frequent basis that the Indian banking system has seen, suggests that the functioning of the internal market is broken.

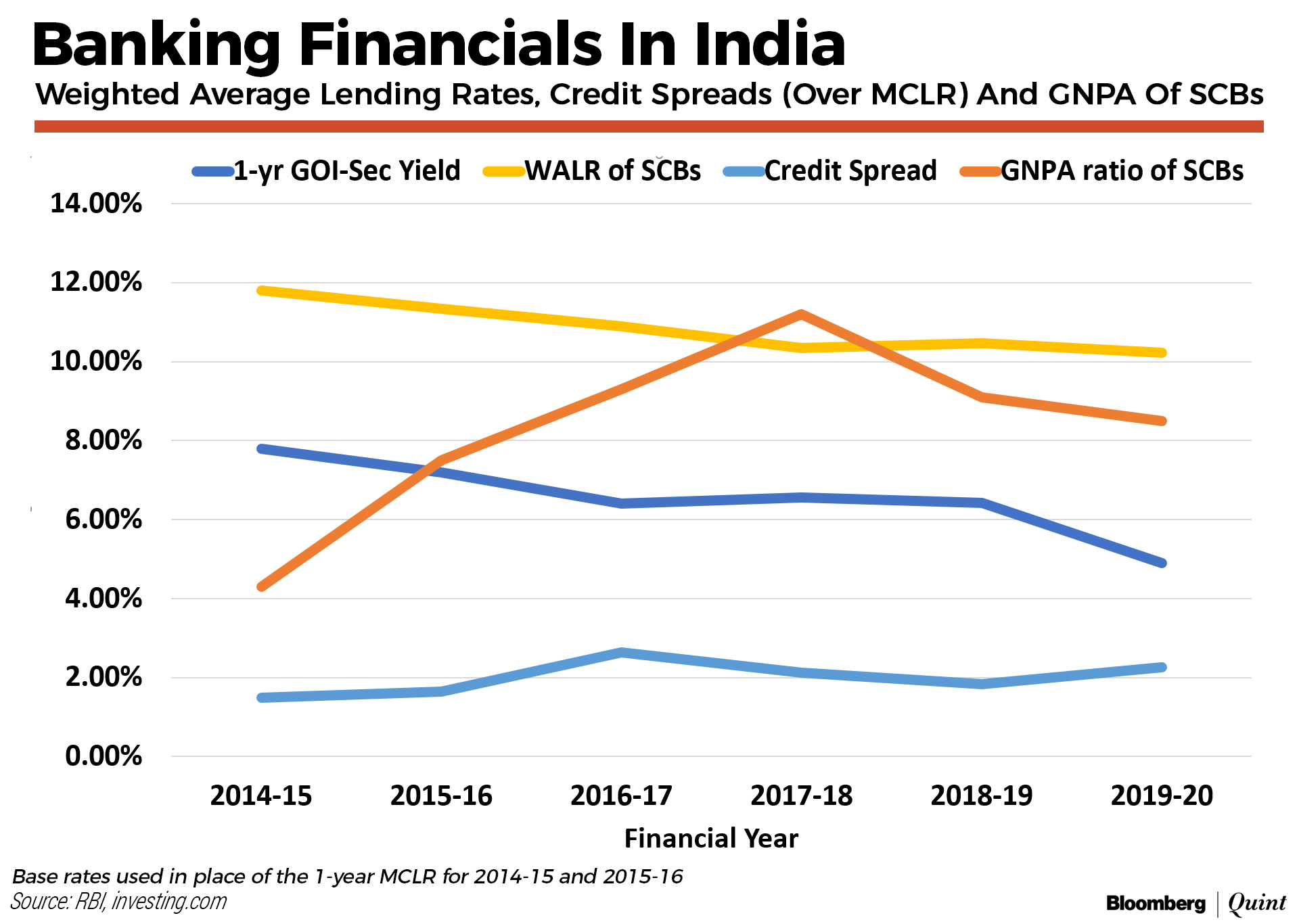

A 2017 working group of the RBI, set up to review the lending rates charged by banks, concluded that “banks deviated in an ad hoc manner from the specified methodologies for calculating the base rate” and that “variations in the spreads across banks appear too large to be explained based on bank-level business strategy and borrower-level credit risk”. Both these findings are symptomatic of the poor functioning of the “internal market”. This is also borne out by the aggregate banking system-level data which suggests that there are very poor links between the lending rates charged by the banks and either market interest rates or underlying risks borne by them.

Additionally, an assessment of the current situation in India suggests that driven by the poor performance of this ‘internal market', banks have done a poor job of ensuring risk-ordinality of credit-risk pricing among borrowers. That is when borrowers with comparable risk-profiles are priced in a similar manner no matter which segment they represent. For example, young urban borrowers can get a home loan at interest rates close to 10% per annum, but a middle-aged female rural borrower with an impeccable 15-year track record of repayment, pays more than 20% per annum for a much lower quantum of credit. This is another marker of the poor functioning of the ‘internal market' within banks, and of the manner in which financial access is being delivered.

Getting It Right

All of this suggests that getting the internal market within each bank to function well is an urgent priority if the banking system is to play its intended and critical role within the real economy. Additionally, while multiple approaches are possible, given the added concerns in the banking system of systemic stability, a preferred approach is one in which there are tiers of financial institutions that take on risks. At the centre of this model are very large, low-risk banks that act as aggregate suppliers of very low-risk debt to lower tiers of financial institutions and to bond markets. These banks at the core are conservatively managed and approach their risk management process principally by seeking constantly to lower their risk level. As one approaches the periphery, the size of financial institutions reduces, and the aggregate level of risk that they assume increases. This allows the institutions at the periphery to lend to riskier sectors that need credit, without increasing systemic risk.

Banks are an essential feature of the Indian landscape and their functioning is critical to the manner in which the entire economy performs. But if they are to perform this role in a high-quality manner, they will need to work hard to build a well-functioning internal market, which at the moment is quite broken.

Additionally, the overall system will need to develop a structure in which risk-taking is balanced with the need to be innovative and to build outreach by creating a core that is highly safe and a periphery that can take on more risks.

Nachiket Mor is a former banker and has served on the Board of Directors of the Reserve Bank of India and its Board for Financial Supervision for many years. Madhu Srinivas is Senior Research Associate at Dvara Research.

The views expressed here are those of the authors, and do not necessarily represent the views of BloombergQuint or its editorial team.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.