Pay Attention

‘Brexit' evokes a range of responses, from the bemused, “what the heck is going on?” to the apathetic “who cares?” The Indian reaction resonates between the phlegmatic (“this topic doesn't perturb me”) and amused (“ha, the British are partitioning themselves”). Not surprisingly, the Government of India has published no grand White Paper policy on, nor developed any technical legal responses to, Brexit. Busy with their businesses, most private sector firms haven't thought through strategy or tactics about the impact of Brexit on their existing import, export, and foreign direct investment patterns.

This public-private complacency does not serve India's international economic interests.

Regardless of how Brexit turns out on March 29, 2019, or whether it even occurs, the Government of India and the private sector should take advantage of the present uncertainty about the future relationship between the United Kingdom and European Union to rethink Indian trade relations with the former colonial master and the entire Continent.

Brexit is an opportunity for India to reset the legal terms of its trade with the UK and EU, at the multilateral level, and through free trade agreements.

The bottom line question for the Indian government and businesses is this: how should India respond to Brexit so as to maximize opportunities for its goods and services exporters? The bottom line answer is this: India should re-negotiate with the UK and EU the World Trade Organization Schedules of Concessions, for both goods and services, should resume its FTA discussions with the EU, and should prepare to launch FTA talks with the UK.

Confessedly, this answer presumes the Indian government enhances its capacity to attend to all these matters competently and contemporaneously. Given the budgets and staff sizes at India's Ministries of Commerce and External Affairs, that's dubious.

But, let's proceed on the optimistic assumption the Indian government sees Brexit as a fillip to do the needful, namely, fix the problem of its resource-starved trade diplomacy in relation to the global challenges the Modi administration faces, and global aspirations it professes.

Explaining “England as Our Gateway to Europe”

India's PM @narendramodi has told the @WSJ he wants Britain to remain in the EU and declared "the UK is the gateway to Europe". #StrongerIn

Indian businesses traditionally rely on the UK as their port of entry into the EU. Seven decades after the last British soldier left India through the Gateway of India, on February 28, 1948, Indian businesses marched after the First Battalion of the Somerset Light Infantry to England, and onward to the Continent. Three reasons explain why.

First, Indian businesses shared with England a common colonial history.

Officials from the Raj and leading industrialist families knew each other and spoke a shared language.For all the hell it was, the 1947 partition was no rerun of the 1917 Bolshevik or 1949 Chinese Communist Revolution.

Second, not only were Indian capitalists not purged by India's post-partition leaders, but also Indian legislators adopted much of English common and statutory law, thus providing businesses similar rule frameworks for contracts and property rights, and similar court systems in which to adjudicate disputes. Indian businesses could trade with or invest in England, and the legal foundations of their operations were as recognizable in Manchester as they were in Mumbai.

Third, international trade law assured Indian businesses that entry into the UK was an entry into the EU. The EU was founded in 1993 by the Maastricht Treaty, building on the 1957 Treaty of Rome that created the single market, the European Economic Community, a customs union, and 1951 Treaty of Paris, which established the European Coal and Steel Community.

From six original members (Belgium, France, Italy, Luxembourg, the Netherlands, and West Germany), the EU expanded over time to its present 28 members. The UK joined in 1973, and in 1975 Britishers showed in a popular referendum their wild enthusiasm for EEC membership, 67.2-32.8 percent. Monetary union came in 2002, encompassing 19 members (the UK stayed out of the Eurozone).

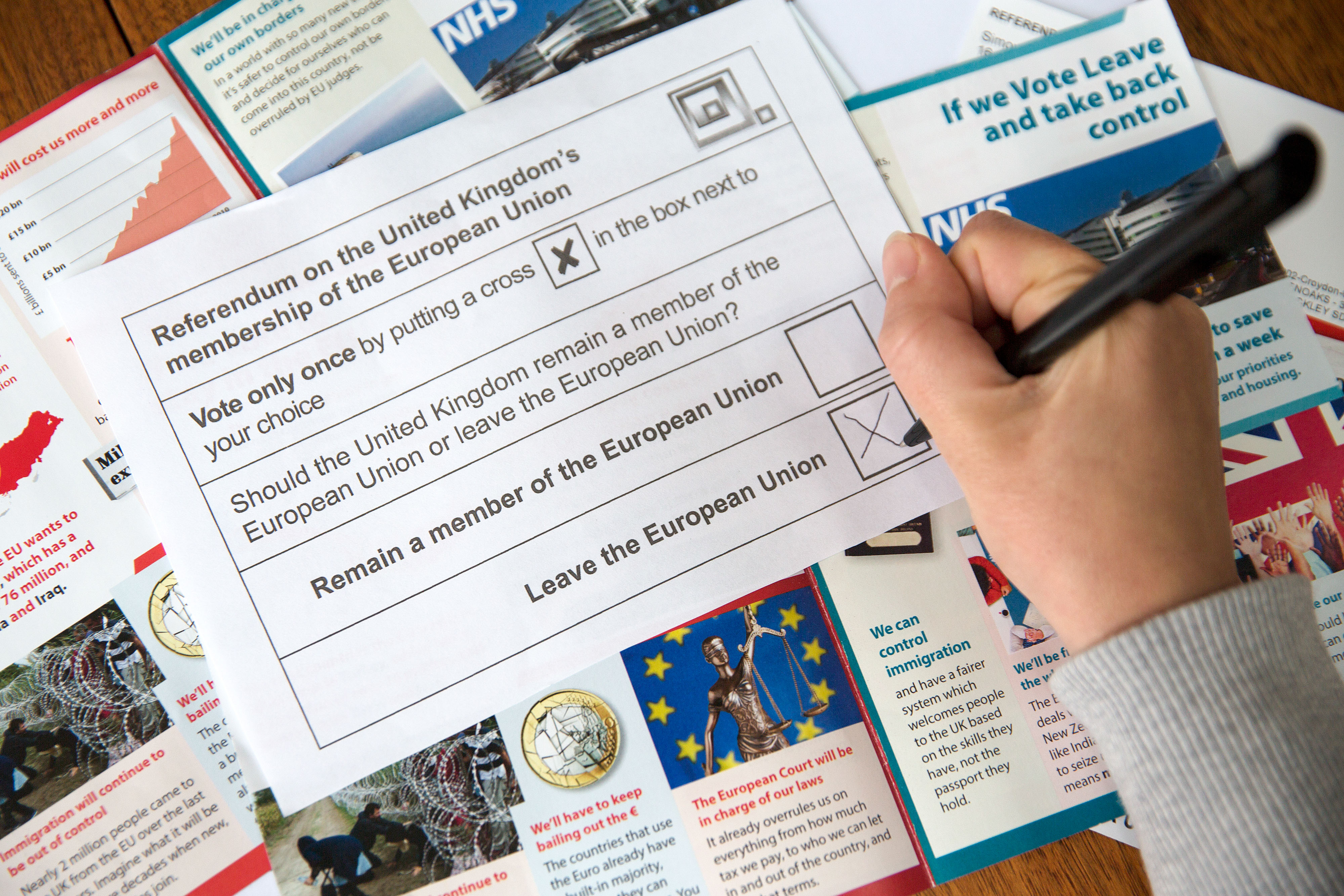

The 2009 Treaty of Lisbon incorporated the EEC and other entities under the umbrella of the EU, and set up the constitutional structure that so many Britishers now despise. Well, ‘so many' as in 51.89 percent ‘Leave' versus 48.11 percent ‘Remain' (with a 72.21 percent turnout), judging from the June 23, 2016 Brexit referendum.

M&A Deals Aren't Enough

Today, roughly 800 Indian companies operate in the UK, employing 104,932 people. Eighty-seven of these firms grew at an average rate of 44 percent (measured by turnover), spanning goods such as automotive (four firms) and pharmaceuticals and chemicals (16), and services such as technology (20), engineering (16), and financial (four).

India invests more in the UK than in the rest of the EU combined.The UK is taking itself out of that combination. As Indian companies search for new markets beyond the UK, they will be unable to rely on the “four freedoms” guarantee of the EU customs union: free movement of goods, services, capital, and labor. British ports won't give them easy entry across the Continent, so they'll need new ports on the Continent to ship goods and services, shift capital, and supply labor around the EU-27.

They can build their own ports through mergers and acquisitions. A few of them have done that before. In 2007, Mumbai-based Tata Steel bought the Anglo-Dutch company, Corus, thus simultaneously accessing the UK and Continental markets. That's not a feat Tata could achieve post-Brexit.

To be sure, there's no need for Indian companies to leave the UK. But, they won't want to sit there, either. With Brexit, score one for the UK as being the first EU member to leave, though the Bank of England says it's an own-goal. Quitting the world's most economically successful customs union (measured by both GDP and Human Development Index) will shave 3.9-9.3 percent from Britain's Gross Domestic Product in the first 15 years after Brexit. In 2017, four of the top 10 Indian deals in Europe were acquisitions of UK companies (driven partly by the depreciation of the pound against the rupee after the Brexit vote).

So, if Indian firms aspire to grow, and certainly if they seek to be pan-European, then they'll need to focus their M&A deals on the Continent, while holding onto their (shrinking) British market.But blockbuster M&A deals won't be enough, i.e., the major private players cannot by themselves put the entire Indian economy in a competitive post-Brexit position, nor open the UK and Continental markets for subcontinental SMEs looking to head west. Here's where active Government of India trade diplomacy will matter, if India is to sail past its “England as Our Gateway to Europe” lethargy.

Sailing Past Brexit

To sail on, it's essential to appreciate how a customs union like the EU operates under international trade law. Article XXIV of the General Agreement on Tariffs and Trade (one of the WTO treaties), defines a “customs union” as having no internal barriers to the movement of goods, and as having a common external tariff. So, once an Indian company ships merchandise to England and pays the applicable common external tariff, it or its distributors may move that merchandise anywhere in the EU, with no further duties. As part of the EU, the UK shares the same Schedule of Concessions for goods as does for all other EU members.

Similarly, Article V of the General Agreement on Trade in Services (another WTO treaty) assures Indian service suppliers that entry into the UK facilitates further entry to other EU members. Again, the UK and EU share a common Schedule of Concessions for services (though depending on the services sector or sub-sector, certain country-specific limits to market access or national treatment might apply).

That's all pre-Brexit. Post-Brexit…

First: New WTO Schedules

The Indian government needs to bargain for new WTO trade terms with the UK and EU. Britain proposed retaining the same goods and services Schedules post-Brexit as it had pre-Brexit, and along with the EU, asked that tariff rate quotas on agricultural products be split between it and the EU following Brexit. The US said “no way,” and so should India.

The value of concessions America, India, or any other WTO member gave to the EU with the UK in the customs union is not the same as that value once the UK exits.Nor is that value correctly divided with a simple split of tariff-rate quotas. Much depends on a product-by-product, and likewise service-by-service, analysis of the post-Brexit British and Continental markets.

Thus, India needs to think critically, applying GATT Article XXVIII (concerning Modification of Tariff Schedules) to determine, given the ‘special circumstances' of Brexit, what new ‘concessions,' ‘compensatory adjustments,' and/or ‘adequate compensation' India needs from the UK to ensure the market access enjoyed by Indian exporters of agricultural and industrial products is not worse post-Brexit than pre-Brexit. The Indian government must engage in the same exercise for its merchandise exports with respect to the EU.

Ditto for services. India must renegotiate market access and national treatment terms with the UK and EU for Indian services exports, under GATS Article XXI (Modification of Schedules).

That's not all.

The Indian government needs to know what it will do if these Schedules modifications negotiations fail.On goods, it needs to draw up a list of ‘substantially equivalent concessions' it ‘initially negotiated' with the UK and/or EU that it will ‘modify or withdraw'. On services, it needs to evaluate the prospect of WTO arbitration over ‘compensatory adjustments' the UK and/or EU offers that India finds unacceptable, and thereafter modify or withdraw ‘substantially equivalent benefits'.

In all such negotiations, India must be mindful of the impact of a key motivation for the ‘Leave' vote: the Britishers' sense of a giant, unaccountable, Brussels-based Eurocracy telling England what qualifies as ‘ice cream'. The UK and EU disagree on setting standards—what they are, and who should set them—for goods and services.

Post-Brexit, does kulfi qualify as ice cream in the UK and EU, one of them, or neither of them?The Indian government will have to figure out what's the best outcome for Indian producer-exporters, and push for it.

Second: From Mode IV to Modes I, II, and III

The UK does not want Eastern European workers to move freely from the Continent onto its soil – a key motivation for the ‘Leave' vote. Yet, since the 1986-94 Uruguay Round GATS negotiations, Indian trade policy remains anchored in demands for what GATS defines as ‘Mode IV' delivery of services, or in common parlance, temporary migration of business professionals.

If Britishers don't want more Poles or Rumanians, then why would they—for whom the Raj is an ever-receding memory—want even-more-foreign Indians, even if those Indians are skilled professionals, such as doctors and engineers?However, Mode I (so-called cross-border supply) is less threatening to Britishers: that's where Indian professionals deliver services from their offices in Mumbai to patients and clients in Manchester via the internet. Mode II (consumption abroad) also is non-threatening to them: Britishers travel to India for top-quality medical treatment, and first-class engineering consultancy advice. Mode III (foreign direct investment) is a positive for the Britishers: Indian companies set up bricks-and-mortar operations in the UK, employing Britishers.

Simply put, amidst the stormy cultural seas of Brexit, India needs to pull up its anchor to Mode IV services delivery, and sail on to Modes I, II, and III as it negotiates new services Schedules with the UK and EU.

Third: FTAs

The Indian government needs to pull up another anchor – the one it drags into every FTA negotiation, a lack of ambition. India needs to engage the EU and UK in commercially broad, deep FTA talks. It should do so in that order, because depending on its Brexit terms, the UK may not be able to negotiate, or at least implement, its own FTAs for years.

Launched in June 2007, EU-India FTA talks broke down after 12 negotiating rounds in summer 2013.

">The EU found India was not interested in expanding market access for goods, services, recognizing geographical indications, or opening government procurement, in terms of broad coverage and deep cuts in barriers. India wouldn't budge enough on its high tariffs on autos and wine, barriers to banking, legal, and retail services, sloppy protection of GIs, and closed public procurement market.

To its credit, India pushed the EU on agricultural market access. To its discredit, India refused to pull up that Mode IV anchor, demanding greater flexibility of movement for its professionals – more of them on longer residences in the EU. India needs to look to Modes I, II, and III, in FTA talks, as in GATS negotiations.

Brexit Matters

Complacent with “England as Our Gateway to Europe,” India is muddling along. But, England's partition from the EU is India's opportunity for integration with the Continent. Brexit should mean a lot for India.

Raj Bhala is the inaugural Brenneisen Distinguished Professor, The University of Kansas, School of Law, and Senior Advisor to Dentons U.S. LLP. The views expressed here are his and do not necessarily represent the views of the State of Kansas or University, or Dentons or any of its clients, and do not constitute legal advice.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.