The legal framework for insolvency resolution in India underwent a structural change when the Insolvency and Bankruptcy Code, 2016 (IBC) was passed in May 2016. Once the provisions relating to corporate insolvency were notified (November 2016), the first cases of insolvency started being admitted in the National Company Law Tribunal (NCLT), the quasi-judicial tribunal vested with adjudication powers under the IBC. The final orders on these cases became the first public records of India's new insolvency framework. In a recent working paper titled Watching India's insolvency reforms: a new dataset of insolvency cases, we introduce a new dataset of all final orders passed by the NCLT and the appellate forum, the National Company Law Appellate Tribunal (NCLAT) under the IBC. In the paper, we also illustratively apply the data to answer questions about the economic impact of the IBC and the functioning of the judiciary under it. This article presents some summary statistics on the IBC and our preliminary findings relating to the working of the IBC.

We use information collected from the final orders published by the NCLT in the first six months of operationalisation of the IBC, that is, from December 1, 2016 until May 15, 2017 (hereafter, “sample period”). There are 23 fields of information for each case in the data set. This includes parameters such as, who are the initial users of the insolvency process under the IBC, what kind of evidence are they using to support their claims before the NCLT, the average time taken by the NCLT to dispose off cases, the outcome of the proceedings, reason for dismissal of a case and the variation in admission and dismissal across the nine benches of the NCLT.

Using Data To Understand The Economic Impact Of The IBC

We apply the data to answer three questions relating to the economic impact of the law:

Does the law improve the balance between rights of the creditors and the firm debtor during insolvency?

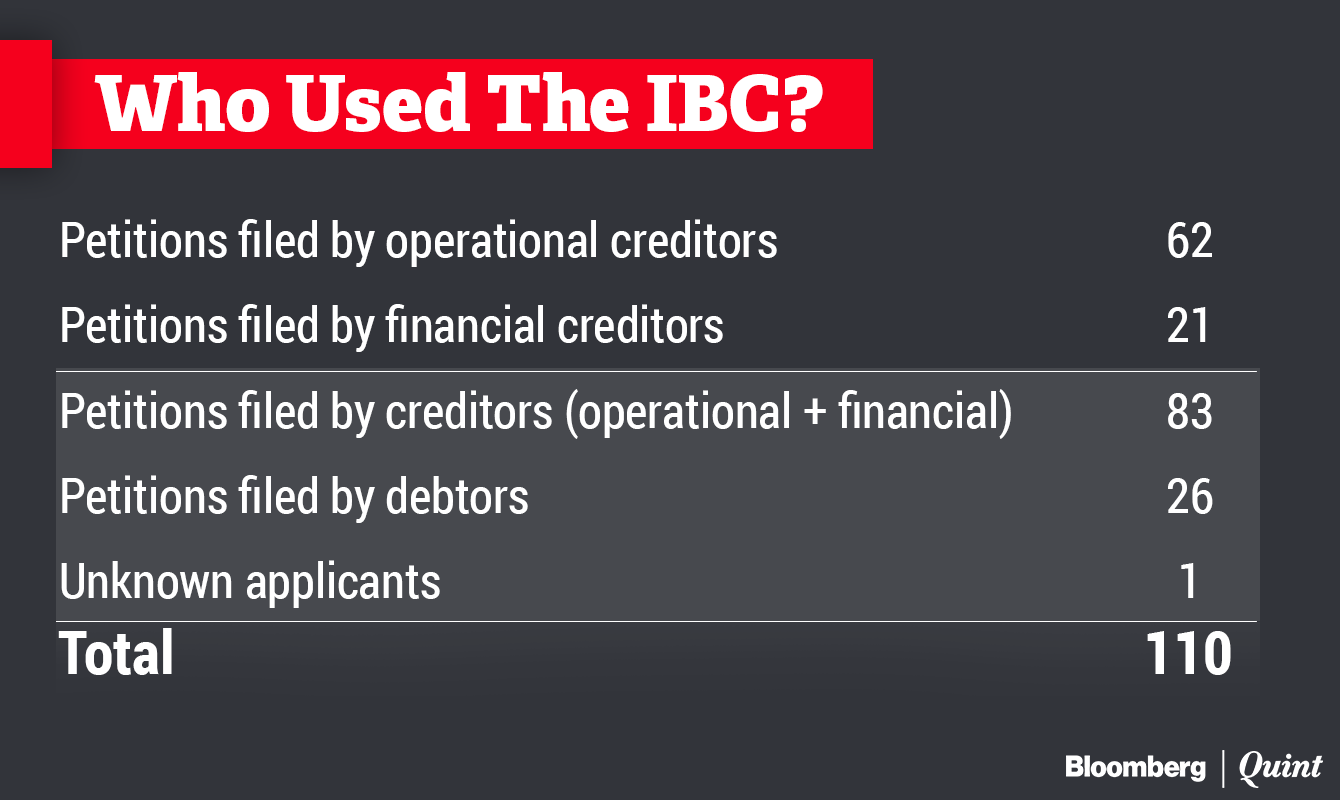

It created scope for the judiciary to intervene in the commercial matters of debt re-structuring. The law itself and the courts and tribunals enforcing it, also exhibited a rehabilitation and pro-debtor bias (Ravi 2015). While the sample period represents the earliest days of operationalisation of the IBC and the current data-set is small to conclusively answer this question, this early data indicates that there has been a shift in the enforcement of creditors' rights under the IBC. Table 1 shows who used the IBC during the first six months of its operationalisation.

Of the 110 cases that were disposed off during the sample period, 75 percent of the cases were triggered by creditors. Of these, 75 percent were filed by unsecured operational creditors. This indicates that operational creditors, who hitherto had weak enforcement rights, have taken recourse to the IBC to enforce their claims. There may be multiple reasons for the relatively low number of financial creditors taking recourse to the IBC during the first six months. Anecdotal evidence suggests that firm debtors default to financial creditors the last. Financial creditors may largely be secured creditors who may choose to enforce their claim by realising their security. There was lack of regulatory certainty on provisioning norms for banks and the apprehension of scrutiny by the anti-corruption investigative agencies among bank management. However, in the absence of data on default or the enforcement of security by financial creditors in India, the reason for the divergence in creditor behavior in triggering the IBC is unclear.

Another feature of interest is the behaviour of the debtor. There is a commonly voiced apprehension that the debtor will avoid resorting to insolvency because the IBC moves away from the debtor-in-possession model to a framework where the debtor's board is suspended and the affairs of the debtor are run by an independent insolvency professional. However, contrary to this apprehension, around 24 percent of the petitions in this early six month period have been filed by debtors.

Of the 110 cases that were filed, 50 percent of them have been admitted by the NCLT and are now undergoing a mutually negotiated debt restructuring process.

This shows that unlike the previous regime where the judicial bodies exhibited a pro-debtor bias, there is no explicit admission or dismissal bias for insolvency cases under the IBC.

Within the caveat that these are early days and we still have to observe how these cases get resolved, the observed data suggests that creditors are able to use the new insolvency and bankruptcy regime with increasing confidence compared to the previous regime.

Also Read: As Banks Deny Working Capital To Insolvency Cases, Resolution Professionals Turn To Funds

Does the law empower various types of creditors when the firm defaults?

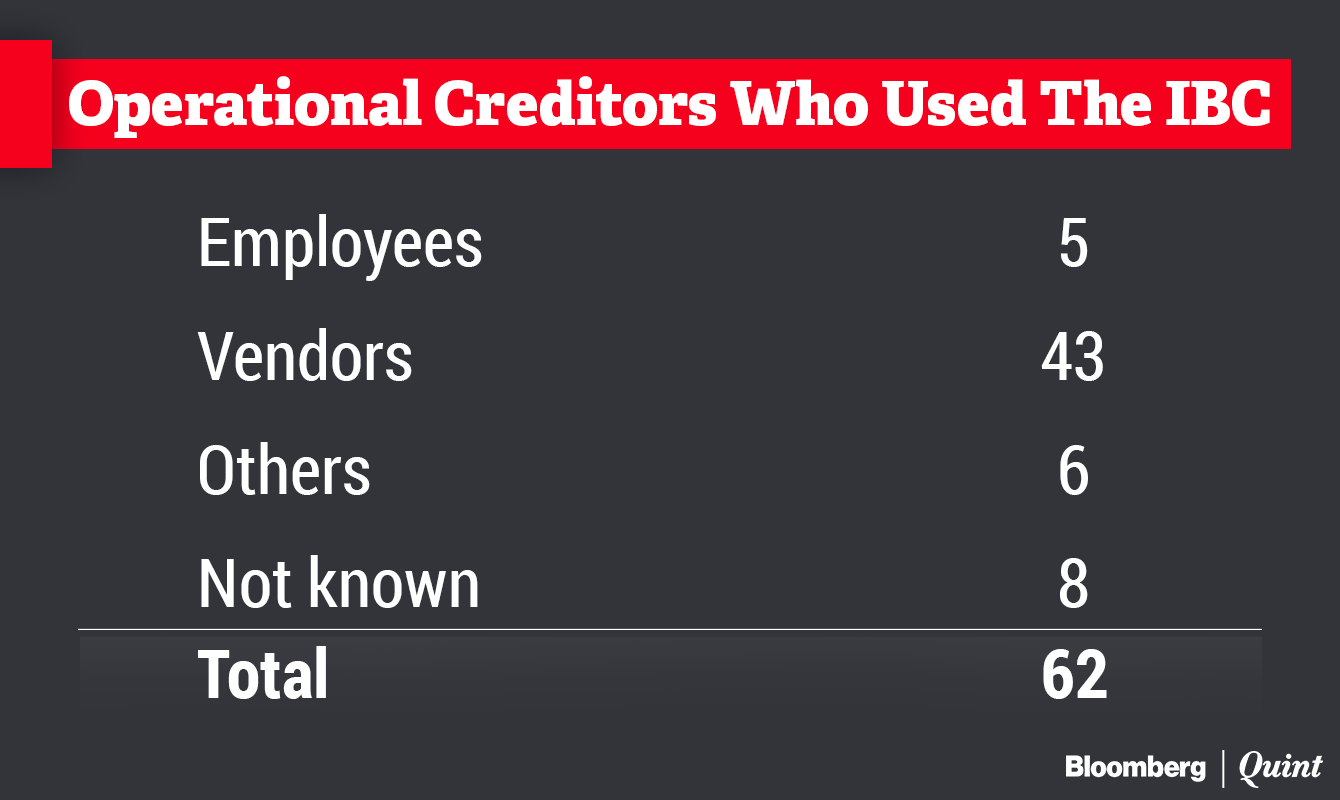

Table 2 shows the kind of operational creditors who took resort to the IBC during the sample period. While majority of the operational creditors are suppliers to the debtor, we find that even holders of decrees are taking recourse to the IBC.

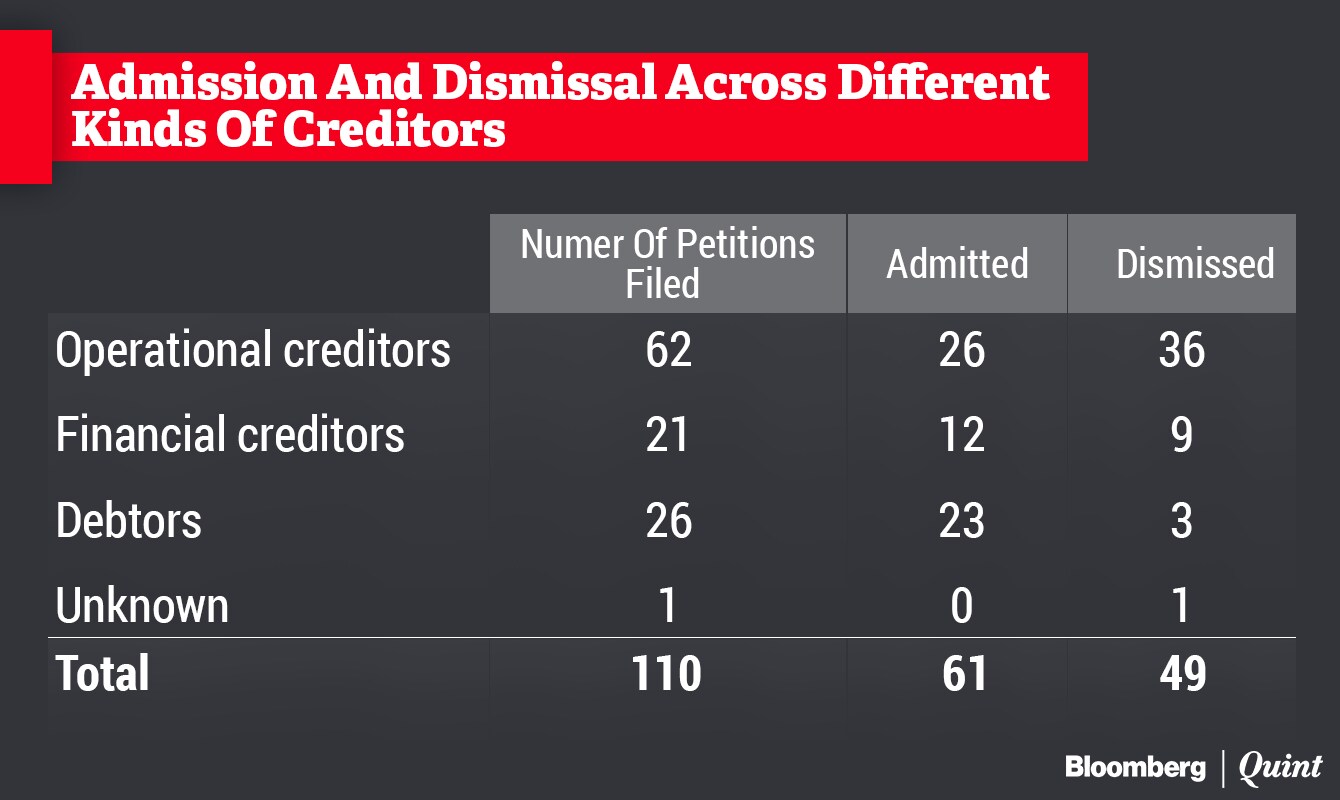

Table 3 shows the outcomes of the insolvency cases filed by different kinds of creditors during the sample period. While 43 percent of the cases filed by the financial creditors were dismissed, the percentage of dismissal for operational creditors is slightly higher at 58 percent.

A reading of Tables 2 and 3 would indicate that even during the earliest days of its operationalisation, a wide variety of creditors have shown the ability to trigger insolvency proceedings under the IBC. This is in contrast to the previous regime where only a certain subset of creditors were able to trigger insolvency proceedings against firm debtors, and other creditors had to file cases in civil courts.

Also Read: Has India's First Insolvency Resolution Approval Set A Dangerous Precedent?

Does the law empower only large-sized debt holders?

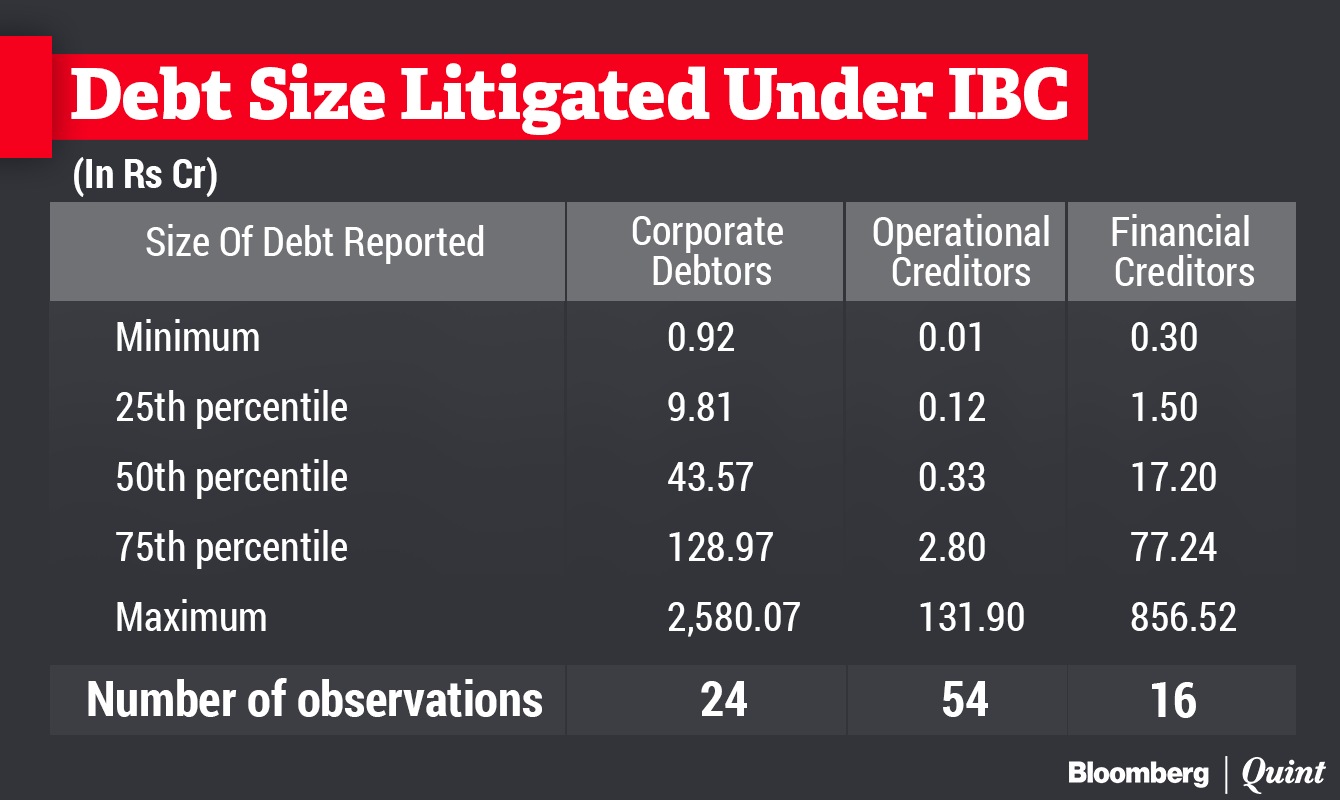

Table 4 shows the size of debt claims that have been used to trigger the IBC during the sample period. The table also presents the distribution across the different quartiles, by showing threshold values at three different cut-off points: for the 25th percentile point, the 50th percentile and the 75th percentile point. The 25th percentile point is the value below which 25 percent of the cases will fall, the 50th percentile point is the point below which 50 percent of the cases will fall and so on. Further, this has been done by the different types of stakeholders: financial creditors, operational creditors and the debtor.

The table shows that the smallest claim to trigger the IBC was filed by an operational creditor with a claim of debt default of Rs 1.09 lakh. In comparison, the smallest debt against which a financial creditor triggered the IBC was Rs 30.69 lakh which was 30 times larger. The maximum debt default claimed by an operational creditor was Rs 131.9 crore while the largest default to a financial creditor was Rs 856.5 crore which was only 8 times larger.

This shows that operational creditors, who had considerably weaker rights under the previous regime, had considerably large debt repayments due from firm debtors.

Thus, while the IBC is being triggered by creditors on a wide range of size of defaults, most of the cases observed so far (more than 75 percent of the cases) tend to be triggered using debt defaults that are approximately 10 to 100 times larger than the threshold of Rs.100,000 set in the law.

Using Data To Understand The Functioning Of The NCLT Under The IBC

We find that the published data is ambiguous about behavioural or structural changes in the judiciary to fit within the role defined for it, in the IBC. The information display systems of the NCLT do not give an overview of the entire cycle of a case, and bits and pieces of information are available in the final orders. For instance, while each order specifies the date on which it was passed, several orders do not capture other information critical for assessing the time taken for the disposal of insolvency petitions, such as: the date on which the insolvency petition was filed, the date on which it first came up for hearing. 16 of the 110 orders studied did not reflect the amount of debt or default that was the subject matter of the case. Admittedly, there are more laborous methods to discern the entire life cycle and facts of a given case, such as examining the case records maintained by the registry at the each bench of the NCLT. However, for reasons explained in our paper, we find that these methods will also not help in ascertaining the performance of the NCLT as a whole. This constrains the ability of both the court administration as well as independent researchers to readily assess the performance of the NCLT.

With the limited data that is available from the published orders, we have attempted to answer two important questions about the functioning of the NCLT under the IBC.

Does the NCLT function within the timelines set in the law?

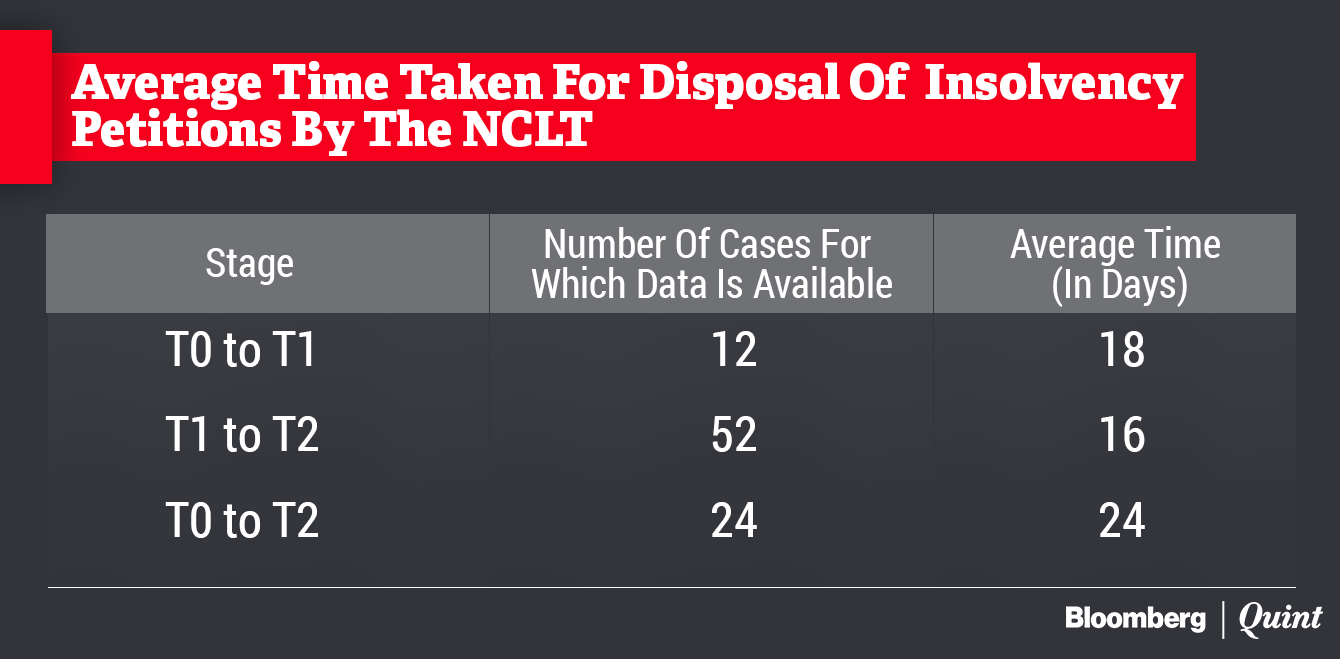

The IBC requires the NCLT to dispose off an insolvency petition within 14 calendar days from the date on which it is filed before it. Our dataset captures the following dates in the life-cycle of an insolvency petition: date on which the case is filed (T0), date on which it first comes up for hearing (T1) and the date on which it is disposed off (T2). The amount of time that elapses between T0 and T1 could be attributed to the internal processes of the NCLT in scheduling hearings for a case. Our assessment shows that the NCLT exceeds the timeline of 14 days prescribed by statute. Table 5 summarises our findings.

Table 5 shows that the average time taken from the date of filing the insolvency petition to the date on which it first comes up for hearing, is 18 days. The average time between the date on which it first came up for hearing and the date on which it is finally disposed off, is 16 days. Finally, the average time taken for disposal is 24 days (T0 to T2).

Currently, the data does not allow us to analyse the reasons for this delay.

Is the role played by the NCLT as visualised within the IBC?

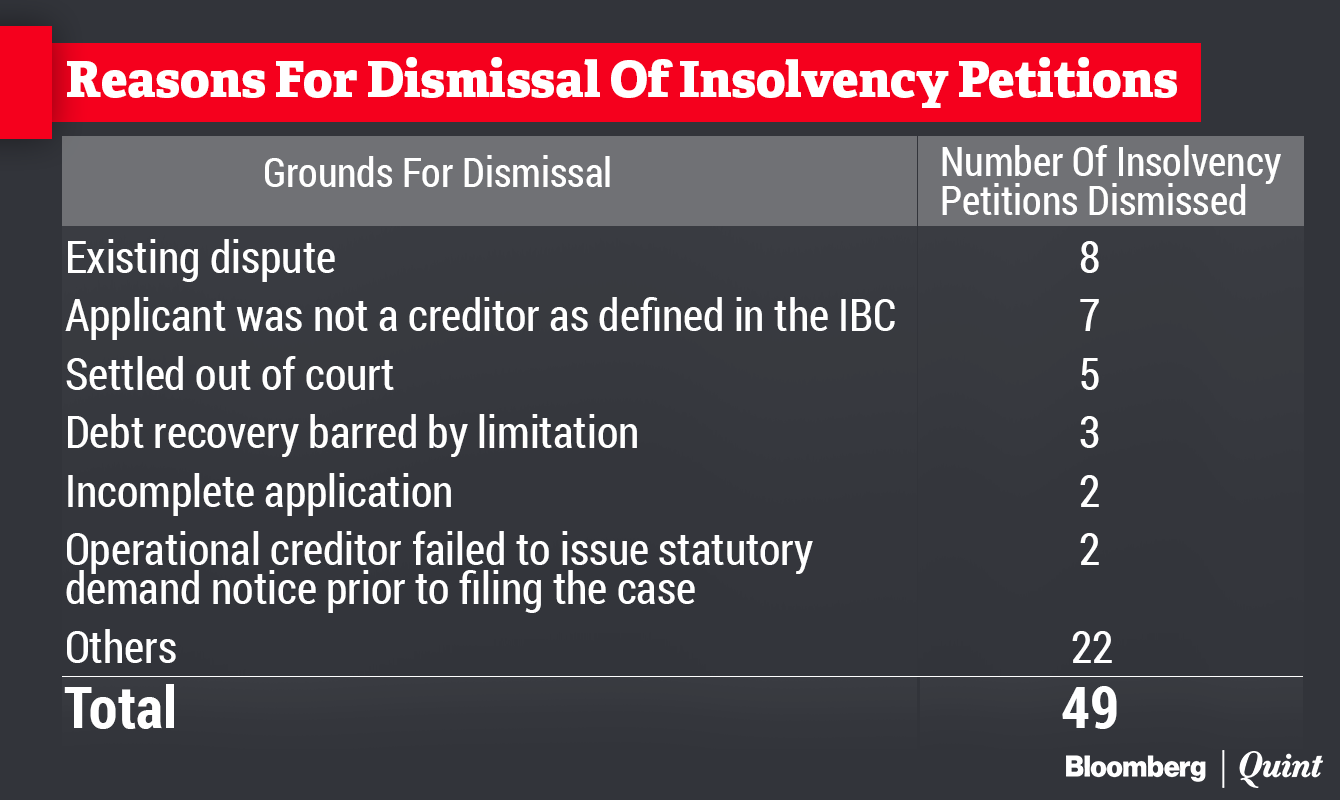

While the law enumerates specific grounds for dismissing an insolvency case and is largely biased towards allowing an insolvency to be triggered if the debtor has committed a default in repayment of an undisputed debt, the NCLT has dismissed petitions on extraneous considerations as well. Table 6 shows the various grounds on which insolvency petitions were dismissed during the sample period.

A review of a sample of dismissals classified as "Others" in Table 6 shows that the NCLT considers extraneous factors for dismissing the insolvency petition. For instance, in an insolvency petition filed before the Mumbai bench, the Tribunal recognized that all the ingredients required under the IBC were present to admit the petition. However, the NCLT extended the scope of its inquiry to the balance sheet of the debtor and held that since the debtor had sufficient assets on its balance sheet, it would be unfair and inconvenient for the debtor if the petition were admitted. The NCLT ignored the creditor's argument that the provisions of the IBC do not allow the Tribunal to embark upon a balance sheet analysis.

This indicates that the NCLT seems to be viewing the admission of an insolvency case as an excessively harsh outcome for a debtor.

If this trend continues, it may degenerate into a debtor-favouring bias going ahead. Thus, the data shows that the working of the NCLT is not always in line with the letter and spirit of the IBC.

Information Gaps In The NCLT Orders

We find that there is no standardised format of recording case information. Consequently, several final orders lack in basic information such as the kind of creditor who filed the petition, the claim amount and the date on which the insolvency case was instituted. Our finding on information gaps in the orders of the NCLT is in line with the findings of other research done with respect to the orders passed by the Debt Recovery Tribunals in India (Regy and Roy 2017).

There are three adverse consequences of such information gaps in the NCLT orders.

- First, the absence of basic information about the case hinders the ability of the NCLT to monitor the efficiency of its own benches. It also constrains researchers from assessing the quality of the procedural requirements and outcomes of the law.

- Second, this will hinder the ability to identify systemic lapses in the functioning of tribunals and in designing appropriate interventions. Third, inadequate or incomplete data has implications for the overall accountability and transparency of these tribunals to the public, and in the long run, will erode the credibility of the NCLT as an institution.

- Finally, the strength of the legal framework ultimately rests on the efficiency of the adjudicator of the law. This is especially so for a procedural law like the bankruptcy law. Structural lapses in the NCLT are likely to cripple the working of the legal framework, reduce the efficiency of resolution and leave the bankruptcy reforms process undone.

Fortunately, these are early days yet, and there is scope for course correction.

Also Read: Has Supreme Court Made ‘Settlements' Easier Or Tougher In The Insolvency Regime?

Conclusion And Way Forward

The empirical analysis in our paper, though preliminary, indicates that the IBC is likely to have a structural change in the behaviour of economic agents, as well as in the areas where the NCLT functions as the adjudicator under the IBC. Our exercise of building a dynamic dataset that is geared towards impact assessment, also brings out the gaps in data that courts publish. Our findings on the data gaps, elaborated in greater detail in the paper, will provide a framework for re-thinking the data management and publication systems of tribunals in India.

The ultimate goal of this dataset is to provide a foundation to answer questions on the impact of the IBC and the overall functioning of the Indian bankruptcy regime. The dataset is dynamic and will be updated on a regular basis. As the insolvency cases increase, the dataset will too increase in scope and size. As more data gets published, relevant fields, such as recovery rates and expenses associated with the recovery process, can potentially be integrated into the dataset. This will fuel deeper research on insolvency and credit markets in India. Such data-backed research will support policy interventions in this space in the years to come.

This article was originally published on Ajay Shah's blog.

Sreyan Chatterjee, Gausia Shaikh and Bhargavi Zaveri are researchers at the Indira Gandhi Institute of Development Research.

The views expressed here are those of the authors' and do not necessarily represent the views of BloombergQuint or its editorial team.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.