The turbulence in the equity markets across the globe has drawn attention back to value-oriented equity strategies. Investors have the option of looking at mutual funds that follow these principles while managing their portfolio. But it's not just tough times that call for a value-oriented approach. The main question that is often asked is whether it is worth having some exposure to value-oriented funds in your portfolio on a continuing basis. Here is a look at what the data shows:

The Value Strategy

A value strategy in portfolio management looks at buying companies that are trading below their intrinsic value. Implementing this strategy is not an easy task because arriving at the intrinsic value of a company is the key part of the process.

There could be short time periods when such a situation might arise, when a company's stock trades below its intrinsic value before the opportunity disappears. This makes it important for the investor or the fund manager to ensure that they are able to invest when such opportunities arise.

The other aspect is the time period when the result of this investment strategy becomes visible. It can take a long time before results are seen, and sometimes it can be very frustrating for investors to find that such companies are not getting their true value. During this period, the investment will continue to underperform, so it requires an element of patience.

How Have Value Oriented Funds Fared?

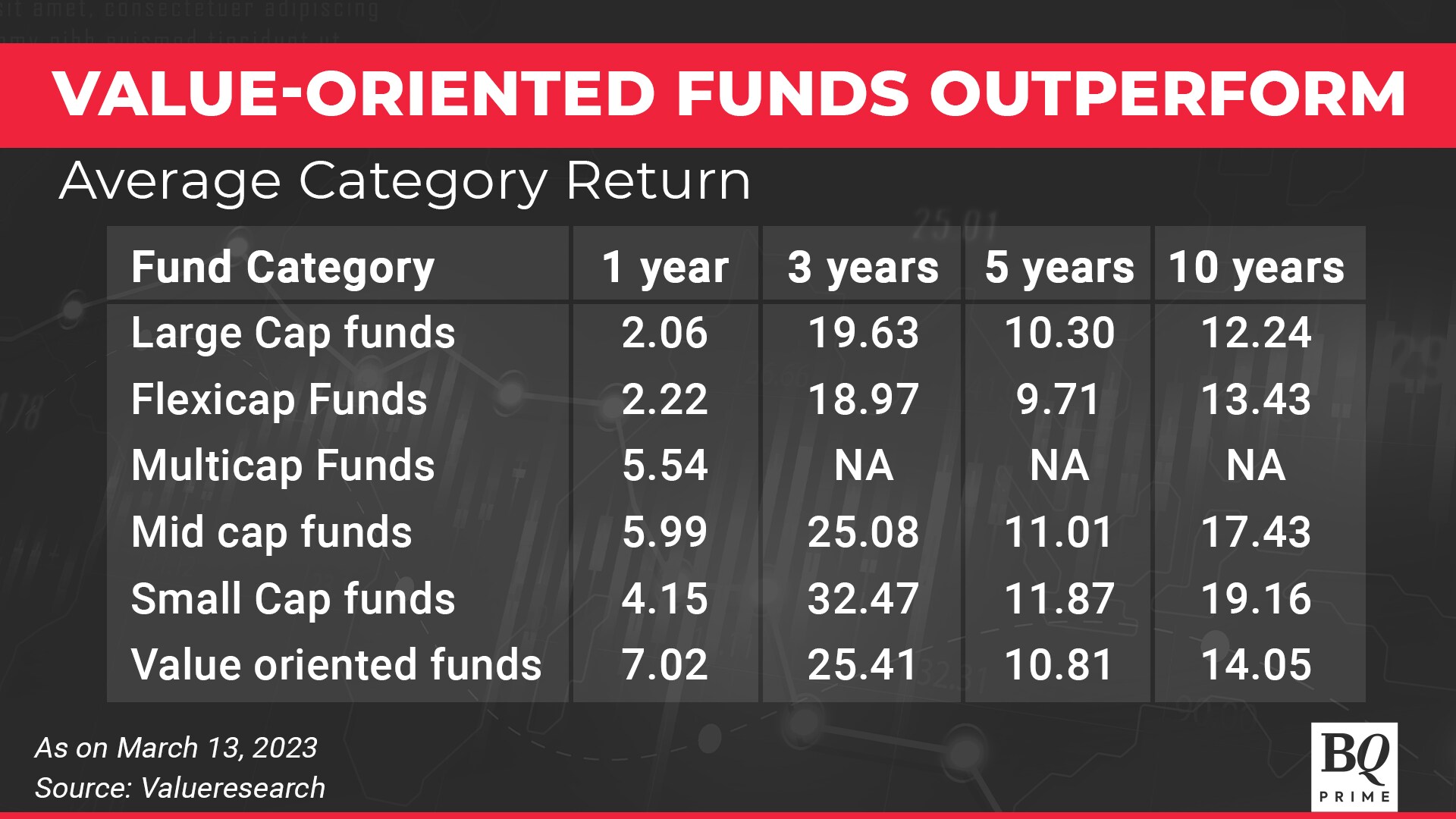

There are different periods of time when growth and value strategies deliver returns for investors. In order to look at whether there is sense in having a value-oriented exposure in the portfolio for a longer time frame, the average return that has been generated by this category of funds should be calculated and compared with other diversified equity fund categories like large cap, mid cap, small cap, and flexi-cap funds.

The multi-cap category came into existence just under three years ago, so there is no long-term data available for this category. There are more than 20 schemes in the active space that qualify for the value-oriented category.

Over the past year, we've witnessed an upheaval in the equity markets, and there have been waves of selling over many months. Slowly, various companies in different market cap categories have come under pressure, and data from Value Research shows that while large and flexi-cap categories have an average return of around 2%, it is the value-oriented funds that have stolen the show with a 7% return. This is more than the average return of even the mid- and small-cap categories. The multi-cap category, which has exposure across market caps, has an average return of around 6%.

The three-year situation, which covers the entire Covid period, right from the initial fall and recovery leading to new highs and then the slump in the last year, has seen the large cap and flexi-cap categories earn around 19% per annum. Over this period too, the value-oriented funds have managed an average category return of 25% per annum, matching that of mid-caps but lower than the small caps that have rallied with gains of around 32% per annum.

The surprising thing is that value investing has managed to hold its ground over the longer term too, because when we consider the five-year and 10-year periods, this includes a very long equity cycle with lots of rallies and slumps. Here too, value-oriented funds have given higher returns than the large- and flexi-cap fund categories' average.

What Should The Investor Do?

The data clearly shows that looking at value-oriented funds or even funds that adopt a value investing approach makes for a good addition to the portfolio. The important thing is that this should not be considered only when there is a problem in the equity markets and the worth of these funds becomes evident.

These funds can be added to the portfolio at any point in time in conjunction with other categories of funds because they have shown the ability to perform across market cycles, and that too, over a longer time frame. For many time periods, they have also returned similar figures as even mid-cap funds, which is significant.

A value-oriented strategy will have exposure across different market caps, so this should be known by investors. The risk of these funds not performing for a long period of time always remains, but a smart allocation to such funds in the portfolio seems to have paid off over the past decade.

The writer is Founder - Moneyeduschool

The views expressed here are those of the author, and do not necessarily represent the views of BQ Prime or its editorial team.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.