(Bloomberg Opinion) -- The Federal Reserve is widely expected to lower its benchmark federal funds rate by a quarter of a percentage point on Thursday to a range of 4.5% to 4.75%. The big question is how much lower the Fed might go from there during this rate-cutting cycle. The bond market suggests it won't be as low as some expect or as low as policymakers signaled less than two months back.

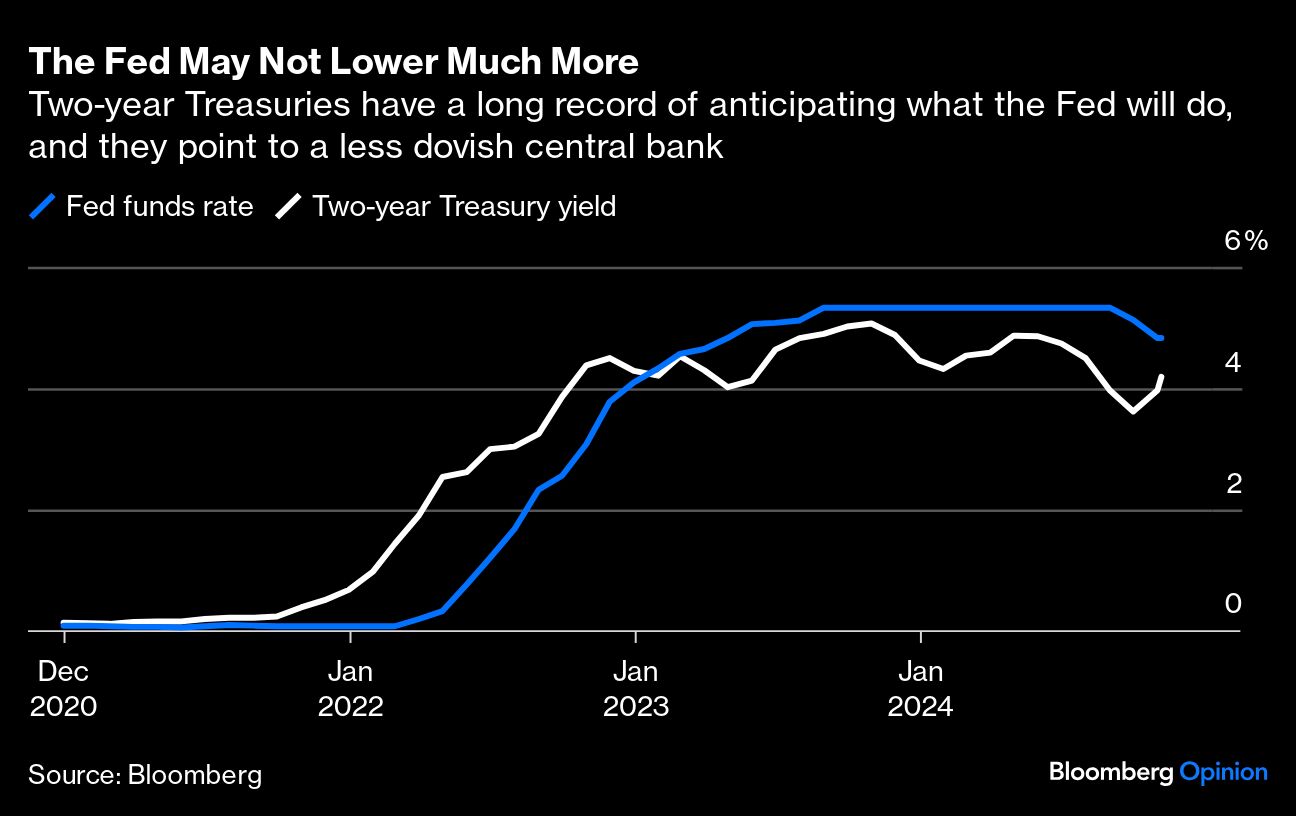

So says the yield on two-year Treasuries, which tracks the fed funds rate closely, but often in anticipation of what the Fed will do. It's been a good predictor historically. Most recently, it signaled in 2021 that the Fed would raise rates to fight inflation months before policymakers moved. It also turned lower several months before the central bank began easing policy in September.

But the two-year has had a change of heart recently — not about lower rates but about the magnitude of reductions to come.

Just over a month ago, the two-year yield was around 3.5%, bolstering the consensus that the Fed was on its way to the so-called terminal rate — generally understood as 0.5 to 1 percentage point above its inflation target of 2%. The Fed cemented this impression in the Summary of Economic Projections in September, where the median member of its rate-setting committee saw the benchmark falling to 3.4% by the end of next year.

In the past few weeks, however, the two-year yield has climbed 70 basis points to 4.2%. That's a big move, signaling that the bond market expects just two more quarter-percentage-point cuts after Thursday's reduction. It implies that the fed funds rate will settle in a range of 4% to 4.25% — well above the terminal rate.

Why the change? It's hard to read the mind of markets, but some recent developments around the Fed's dual mandate of maximum employment and stable prices are noteworthy. As to the first, the economy no longer seems to be tipping into recession and dragging the labor market down with it. Widespread recession fears in 2022 seemed to be vindicated when the unemployment rate began to climb a year later, peaking at 4.3% in July from a low of 3.4% in April 2023. That prompted the Fed to pay at least as much attention to the labor market as to inflation, ultimately leading it to begin lowering rates.

A recession is nowhere in sight, though. The economy grew at an annual rate of about 3% after inflation during the second and third quarters, and the Atlanta Fed's tracker of gross domestic product estimates growth of 2.4% this quarter. The unemployment rate has also ticked down to 4.1% since July, despite some noisy monthly jobs numbers along the way. That probably explains why the 10-year Treasury yield has moved modestly north of the two-year yield, right sizing an inverted yield curve that many had taken to signal the risk of recession. As it turns out, the labor market may not need as much help as previously anticipated.

Now consider the other side of the Fed's mandate. The inflation rate is careening toward the Fed's 2% target, but getting there may be harder after the presidential election. Donald Trump's spending plans could add up to $15 trillion in deficits over the next 10 years, according to the nonpartisan Committee for a Responsible Federal Budget.

That's a huge amount of fiscal stimulus on top of the $11 trillion in total deficits since 2020 that contributed to the recent bout of consumer price increases. Never mind Trump's promise to expand tariffs or deport undocumented workers, or the too-little-mentioned size of the Fed's balance sheet, which has swelled to $7 trillion, a heap of monetary stimulus that would have been unthinkable before the Covid pandemic. All of that is potential food for inflation.

Other parts of the bond market certainly seem to think so. The five-year breakeven rate — the difference in yield between nominal and inflation-adjusted five-year Treasuries, which is a good gauge of inflation expectations — is up to 2.5% from closer to 1.8% in September. The 10-year breakeven hit the Fed's sweet spot of 2% in September but has climbed to 2.4% since then. Those numbers are not wildly higher than the Fed's target, granted, but they're directionally significant.

A surefooted economy aided by a mountain of fiscal and monetary stimulus is less a recipe for a weak labor market and more the makings of an inflation rate that is stubbornly higher than the Fed's target. That may explain why the two-year doesn't see the Fed lowering rates much further.

Keep an eye on that two-year yield. It's likely to tell investors more about where the Fed is headed than anything the central bank or its Chair Jerome Powell say on Thursday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.