In this series of columns, members of a drafting team on the Working Group report on Social Stock Exchange detail important recommendations. This the first in the series.

The Social Stock Exchange report, prepared by a SEBI-appointed Working Group, envisions a paradigm shift for the social sector ecosystem and especially for non-profit organisations. The key objective of such an exchange will be to unlock large pools of capital and their channeling through scalable instruments and structures to NPOs.

The primary obstacle that NPOs have traditionally faced in fundraising has been a lack of appreciation among funders and donors for the work that they do. Therefore, an important step to overcoming this obstacle is for NPOs to communicate their work in a standardised format to funders and donors. Accordingly, the Working Group recommends that a common minimum reporting standard anchor all of the fundraising activity through the SSE. We leave to another article a description of the funding instruments and structures the SSE will enable access to. In this article, we describe the reporting standard, as that is the real game changer for NPOs.

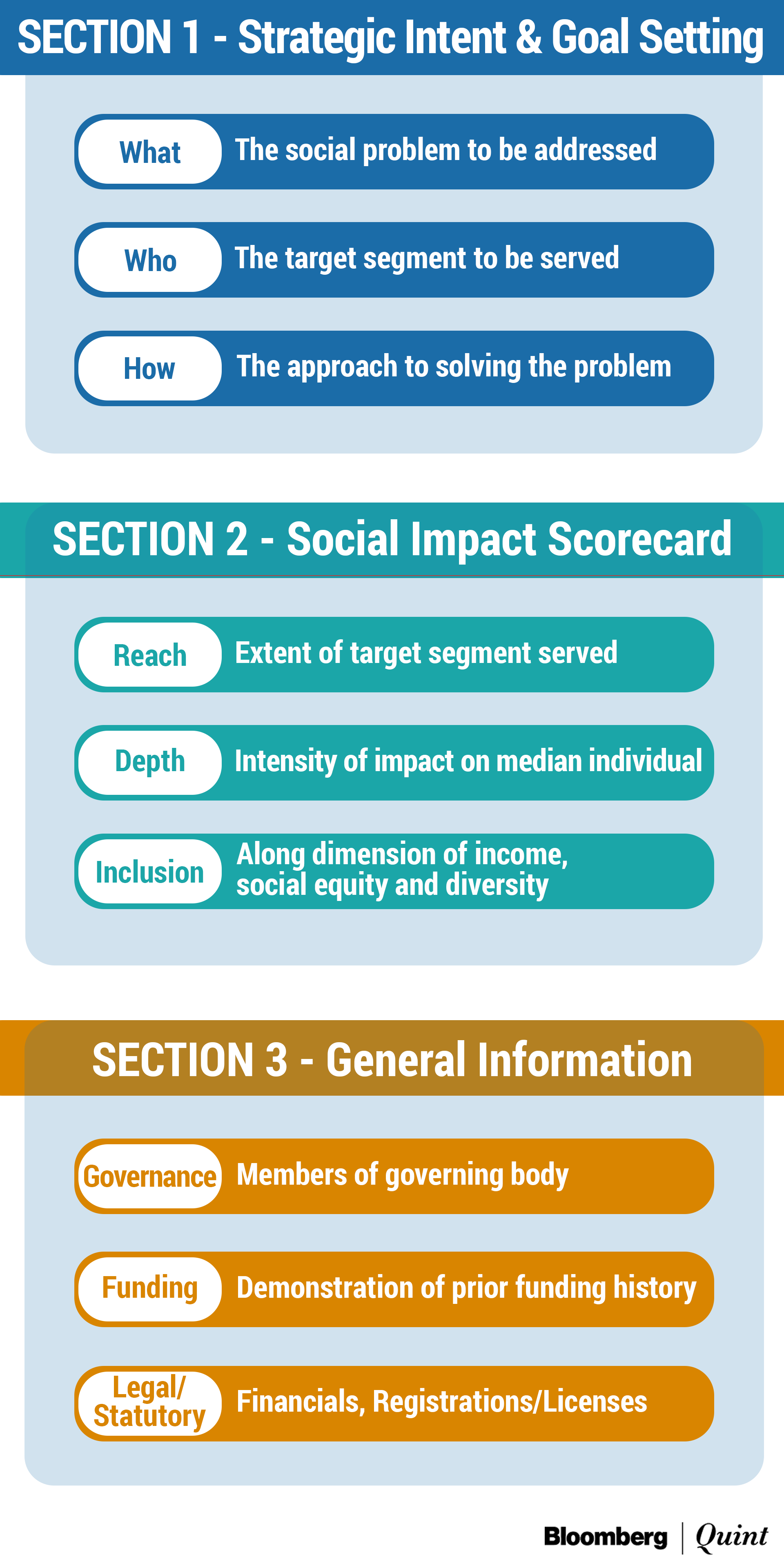

The reporting standard is divided into three sections.

In the first section, the NPO will declare its intent to create social impact by describing the social problem it will focus on (the What of its work), the target segment it will serve (the Who), and the approach it will adopt to solve the problem (the How). The idea here is to simply and transparently communicate to funders why the NPO exists, and what kind of change it wishes to effect.

In the second section of the report, the NPO will report on the social impact that it is actually creating. In turn, social impact is considered to have three aspects – a reach aspect (the extent of the target segment served), a depth aspect (the impact on the median individual), and an inclusion aspect (the extent to which the NPO's work is redressing instances of social or economic disadvantage, and is therefore inclusive).

In the third section of the report, the NPO will describe its governance structure, prior funding history, and some financials.

Taken together, the three sections of the report are intended to communicate a holistic picture of the reporting NPO's operations and activities to funders and donors. This is why the report will be a precondition for participating in the SSE, and in effect, any NPO that commits to reporting in accordance with this standard will win the trust and confidence of funders and donors.

It is important to note that the reporting standard does not disproportionately favor only quantitative impact assessments. Qualitative accounts and audio/visual assessments will also be welcome.

In making this accommodation, the WG has acknowledged that NPO work is often difficult to describe and its impact hard to measure. Further, many NPOs could be engaged in activities that yield outcomes only over a very long horizon. The reporting standard is sufficiently flexible that even these NPOs could use it to adequately describe the nature and complexity of their work – since reporting on inputs and outputs is not being ruled out.

As such, the WG has recommended a reporting standard that will be simple to understand, yet not so rigid or fixed that it will not be able to accommodate a variety of reporting formats, spanning the entire range from qualitative, diffuse, low-resolution, to quantitative, sharp, high-resolution. The WG has also made a provision for the SSE to assist NPOs with reporting, and we will describe this and other enabling measures in the third of our articles.

The model will be one of assisted self-reporting. The emphasis will be on thoughtful rather than onerous measurement. Self-reporting does not mean that NPOs will not be accountable. For one, they will be assisted in their reporting by entities like GiveIndia and GuideStar, which the SSE will help organise for this work, and which already have a credible presence in the social sector. For another, the very existence of a market for social capital (which is what the SSE is enabling) implies that accountability to this market will always function as a constraint on any kind of gaming or abuse of the reporting standard.

The minimum reporting standard is a substantial step forward for NPOs, and for the sector. For the first time, India's NPOs will be able to use a common framework to communicate to funders and donors, and this will be key to unlocking capital for the sector. With time, it is envisioned that the standard will evolve in rigor and sophistication, and the NPOs will evolve as well in their ability to assess and measure their impact. For the immediate term, however, a crucial barrier will have been lifted, and the NPO sector will have been set on a new course of development.

Deepti George and Indradeep Ghosh work at Dvara Research and were members of the drafting team of the Working Group report on Social Stock Exchange. The publication of this article was coordinated by Omidyar Network India whose members assisted in the drafting and participated in the Working Group.

The views expressed here are those of the author and do not necessarily represent the views of BloombergQuint or its editorial team.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.