Elections come and go. But markets, they don't go anywhere. Or, factually, they go up over a five-year period. Here's the exercise: Pick any five-year term in the modern era, and chances are that markets would have done better point-to-point. This simple statistic should tell you that, as a long-term investor, volatility in markets during election phases, where emotions for market participants run high, should not worry you. In fact, you should take advantage of this opportunity.

Picture this: The Nifty rose nearly 88% in the period between last Friday and the election results in 2019. If you had missed out on investing due to the volatility between April and May 2019, you would have missed out on this wealth-creating opportunity. In fact, if you had used the volatility and bought it around the 11,100 levels that the index touched in May 2019, then your returns would have been nearly 99%. And these returns would have occurred despite the loss in business during Covid-19. Similarly, while there was volatility in the earlier periods, the indices returned 55% and 56% in the subsequent five-year periods.

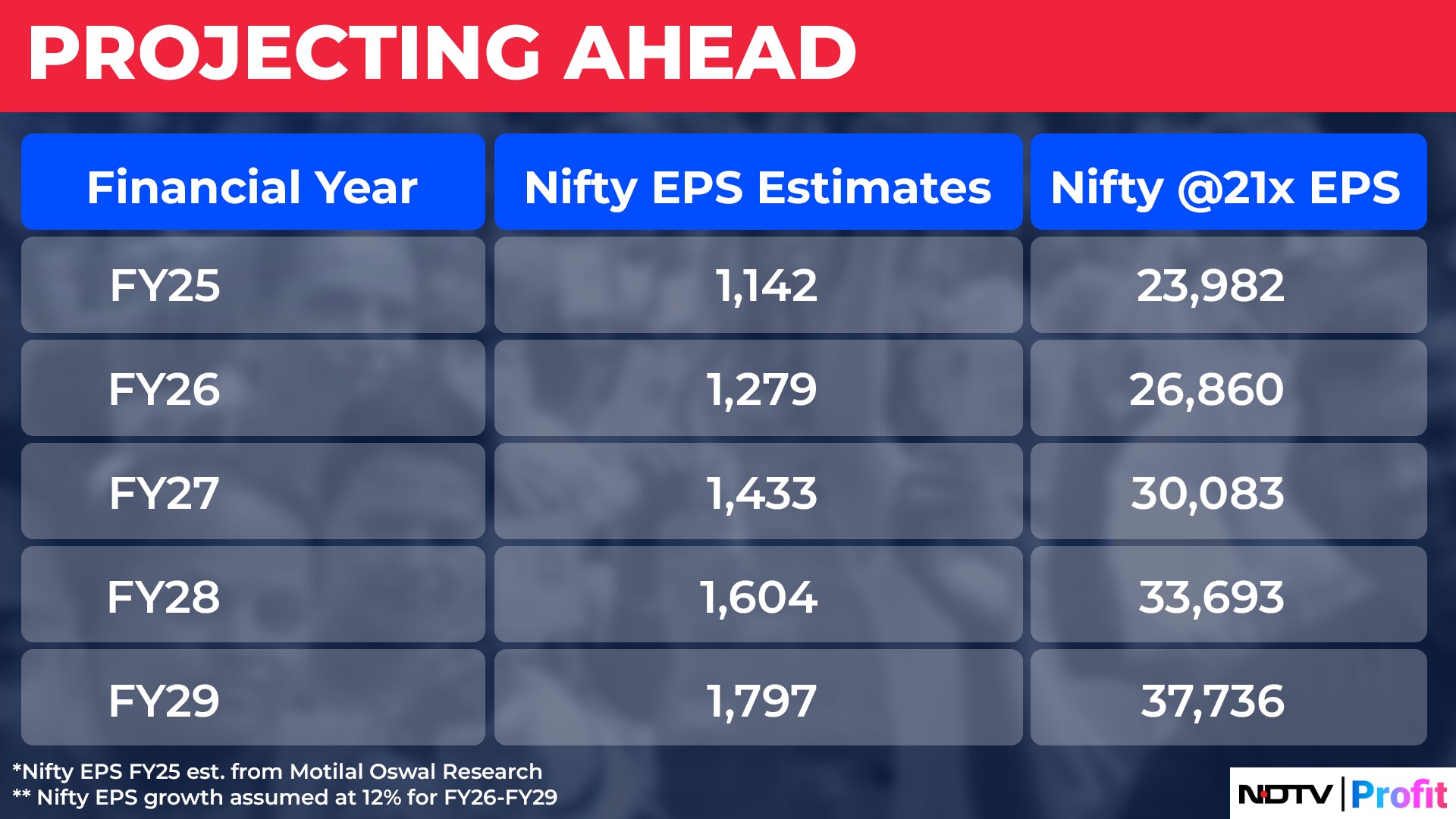

This clearly shows that if you are a long-term investor, then this volatility should not bother you. And there is also a mathematical way to lay this down. Various brokerages assume that the Nifty will clock in earnings per share of between Rs 1,125 and Rs 1,150 in FY25. If we assume Rs 1,142, the estimate of Motilal Oswal Financial Services Ltd., and then attach a mere 12% EPS growth for the index for the subsequent three years, the Nifty would rest at an EPS of Rs 1,604 by FY28. Theoretically, assuming Nifty trades at 20–21 times over extended periods, it could rest at a level of 33,700 in FY28, or potentially earlier, given that markets act as future discounting machines.

This implies that the individual selling their current market positions (assuming for simplicity that their investments are in the Nifty Index fund) is relinquishing nearly 71% of their returns prior to the next elections. That compares to a 46% pre-tax return on the best fixed-income instrument. Granted, it will save the investor from volatility. But as we said before, if you make volatility your friend, you could make returns more magnificent. Embrace the election volatility. It is here for investors to enhance their returns.

With inputs from Chinmay Vasdev.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.