(Bloomberg Opinion) -- If India wants to build a robust computer and electronics manufacturing industry, it needs to shift focus, fast. Instead of concentrating on the domestic market, it should become regionally competitive and export-driven. That means recognizing that Vietnam, not China, is its biggest rival.

The latest reminder of this urgency came last week with a US appeal for New Delhi to make the business environment easier and more transparent to navigate, or keep losing out on foreign direct investment. Cutting import duties ought to be high on the list, US Ambassador to India Eric Garcetti told the Indo-American Chamber of Commerce on Jan 30.

If you tax inputs, you are taxing your outputs, Garcetti noted. “You are not taxing us, you are not protecting the market. What you are doing is limiting a market.”

A day later, the Indian government reduced tariffs on a range of imported components including battery covers, lenses, antennae and mechanical parts to 10% from 15%. The timing might look like New Delhi was following orders, but it's more likely a coincidence and even possible that Washington knew it was coming.

The US constantly pushes foreign leaders to open up their markets and to make life easier for international companies. It's not alone. In July, Japanese Foreign Minister Yoshimasa Hayashi “requested cooperation to improve the investment environment” during a visit to India that included a meeting with Prime Minister Narendra Modi.

Many countries including the US, Japan, and Australia — all fellow members of the Quad security grouping — want the world's most-populous nation to succeed for reasons that boil down to one simple hope: To build a viable alternative to China. Through this lens, all sides view a rising Indian industrial base as a win-win. New Delhi should take the advice to properly open its markets as being genuine rather than mere self-interest.

Though India is getting a lot of overseas investment, Foxconn Technology Group's announcement last month that it will spend $100 million on a new plant in Vietnam is a reminder that it doesn't hold a monopoly over business migration away from China. Mexico, Thailand, Indonesia and Czech Republic are also in the running to secure additional funding to build out the supply chains of the global computer and electronics makers.

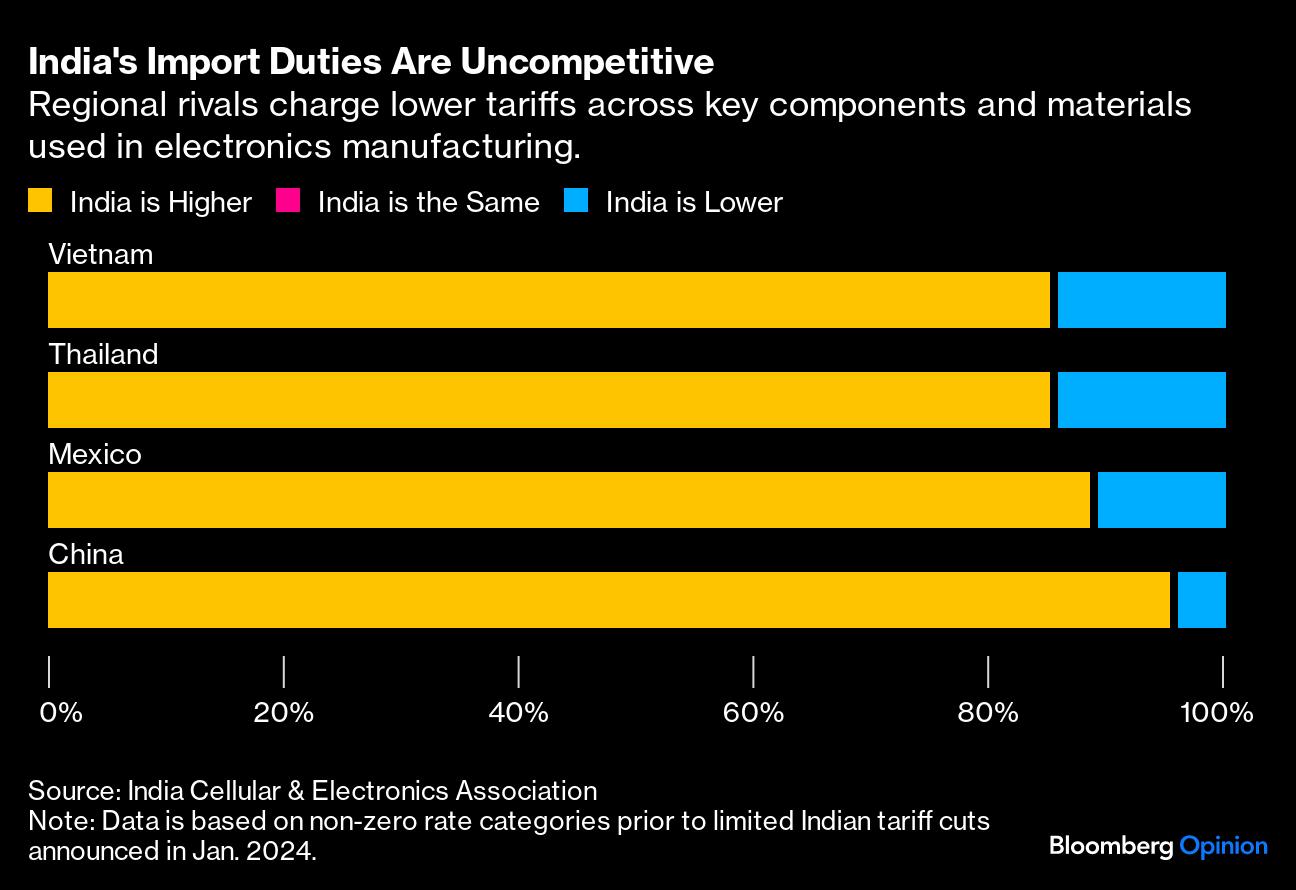

Most nations offer a similar mix of incentives to lure investors. These include tax breaks, dedicated free-trade or industrial zones, discounted utilities like water and electricity, free land and commitments to supply workers. But India stands out among peers in implementing higher import taxes, which motivate companies to set up in the country to supply local consumers but makes them less competitive in the export market.

The Modi government's “Make In India” policy launched a decade ago looks at first to have achieved its desired result. The government raised tariffs on manufactured products, which in turn spurred spurred companies like Foxconn and Pegatron Corp. to expand operations there to skirt those duties.

That early success is a false signal. Making in India solely India is simply not viable. One need only compare with China, boasting more than 1 billion smartphone users, to see that a domestic market alone isn't enough to sustain large and complicated electronics supply chains. Much of what's manufactured in China is exported.

For India to succeed, it needs to start thinking outward, which means understanding that the investment and business environment there isn't competitive. Research shows that for more than 85% of the tariff categories within electronics, India's duties are higher than each of China, Mexico, Thailand and Vietnam.

Vietnam isn't perfect either. Though its tariff regime is lower, the nation has numerous barriers including a complicated process for obtaining work permits, consumption taxes that can negate the benefits of free-trade agreements, restrictions on land use by foreign entities and weak intellectual-property enforcement. In most countries, domestic politics makes eliminating hurdles like these slow and complicated.

Yet the sooner New Delhi understands that it's competing for investment dollars to drive export manufacturing, and that its own business environment doesn't compare well with regional rivals like Vietnam, the quicker it can get to work paving the way for the nation's success. The clearest signal the government can give to show foreign investors that India is ready for business is to eliminate tariffs.

More From Bloomberg Opinion:

- India's Trade Policy Works in Vietnam's Favor: Andy Mukherjee

- Tata, Vedanta Offer India Lessons in Industry Policy: Tim Culpan

- Modi's Thriftiness May End Up Shortchanging India: Mihir Sharma

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tim Culpan is a Bloomberg Opinion columnist covering technology in Asia. Previously, he was a technology reporter for Bloomberg News.

More stories like this are available on bloomberg.com/opinion

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.