Will India's domestic economy slightly cool down post elections once election-related spending abates? In any case, export-oriented industries may pick up as the global economy revives.

Looking beyond the near-term geopolitical issues, the world economy is experiencing a cyclical upswing this year, led by higher levels of global liquidity and uptrend in manufacturing activity across major economies after a two-year lull.

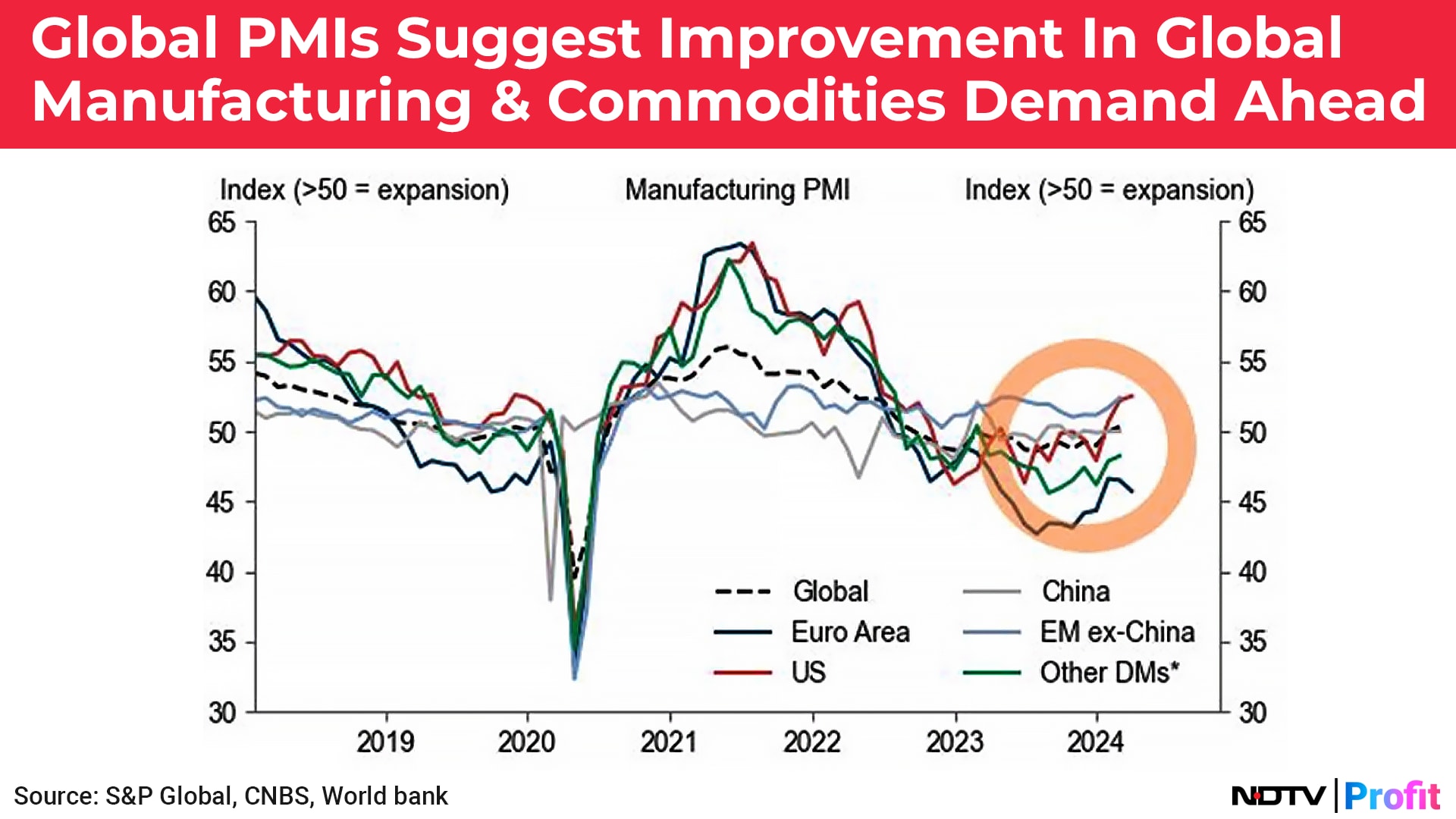

As such, manufacturing and economic activity is picking up across the world. China and developed economies, including the US, Europe and Australia, are seeing uptick in their manufacturing PMIs after a slowdown in the past year.

The Global Manufacturing PMI, aggregate index of the PMIs of major countries across the world, has once again entered the positive territory (above 50) with the latest release in April showing a reading of 50.4.

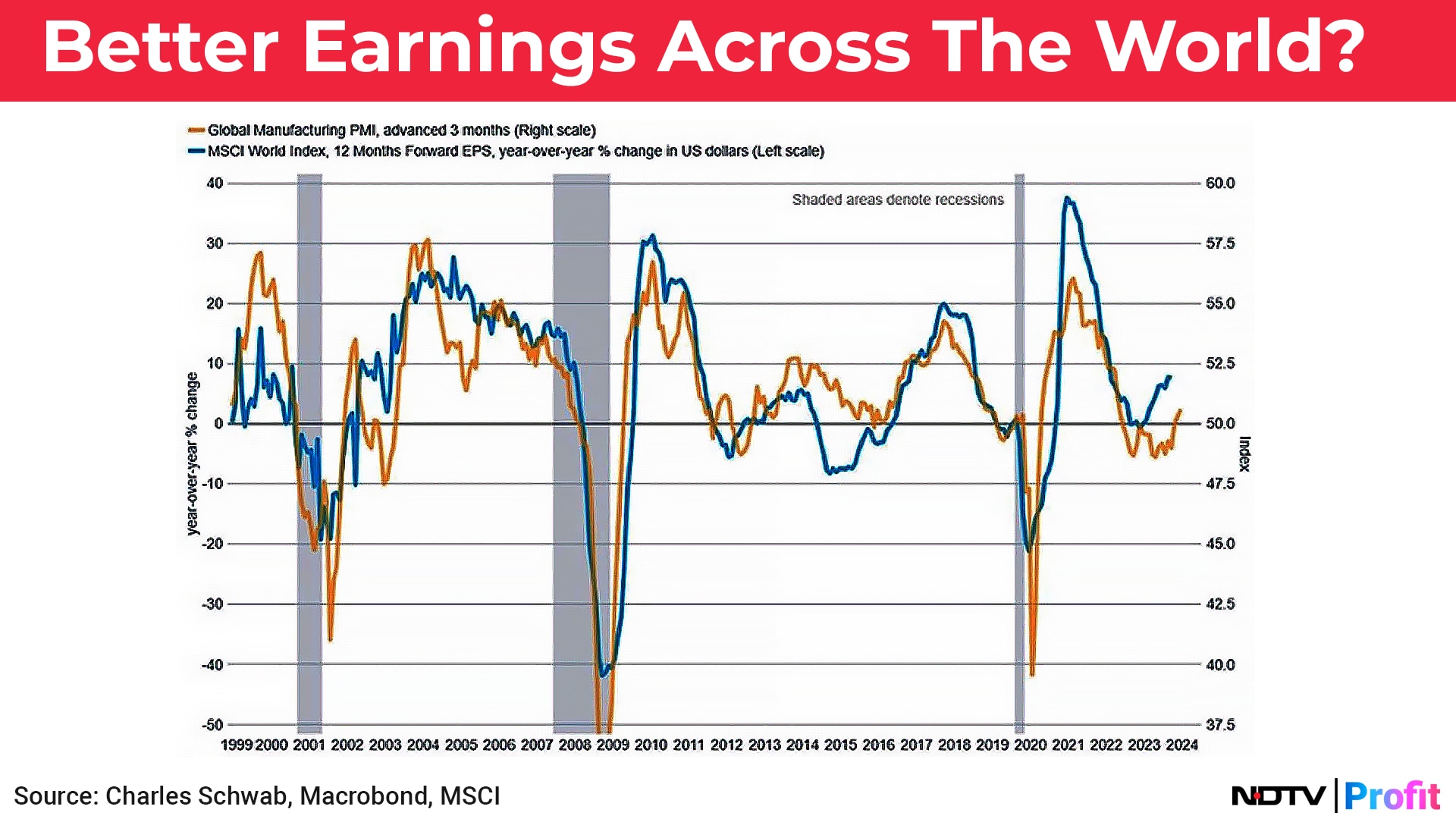

A chart of MSCI World Index EPS (12 months forward EPS) overlayed with the Manufacturing PMI shows a very strong positive correlation. Accordingly, an uptick in the Global manufacturing cycle should lead to better earnings across the world and should be bullish for equity markets.

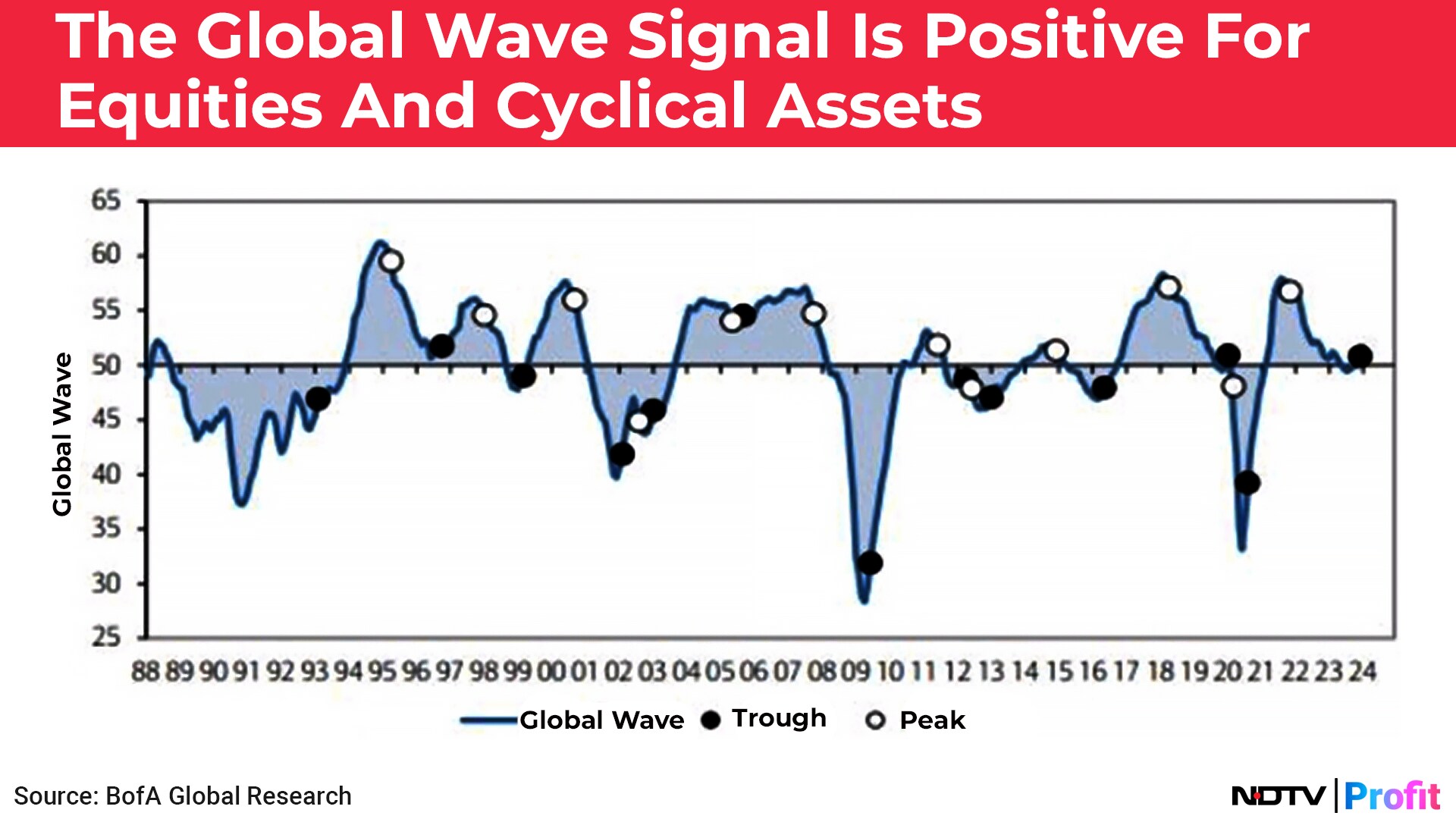

The Global Wave, a proprietary index developed by BoA Global Research, suggests that equities and cyclical assets should do well in the coming months. It last peaked in late 2021 and was fell for the next two years before bottoming in late 2023. As such, global equity markets should remain buoyant in the current year.

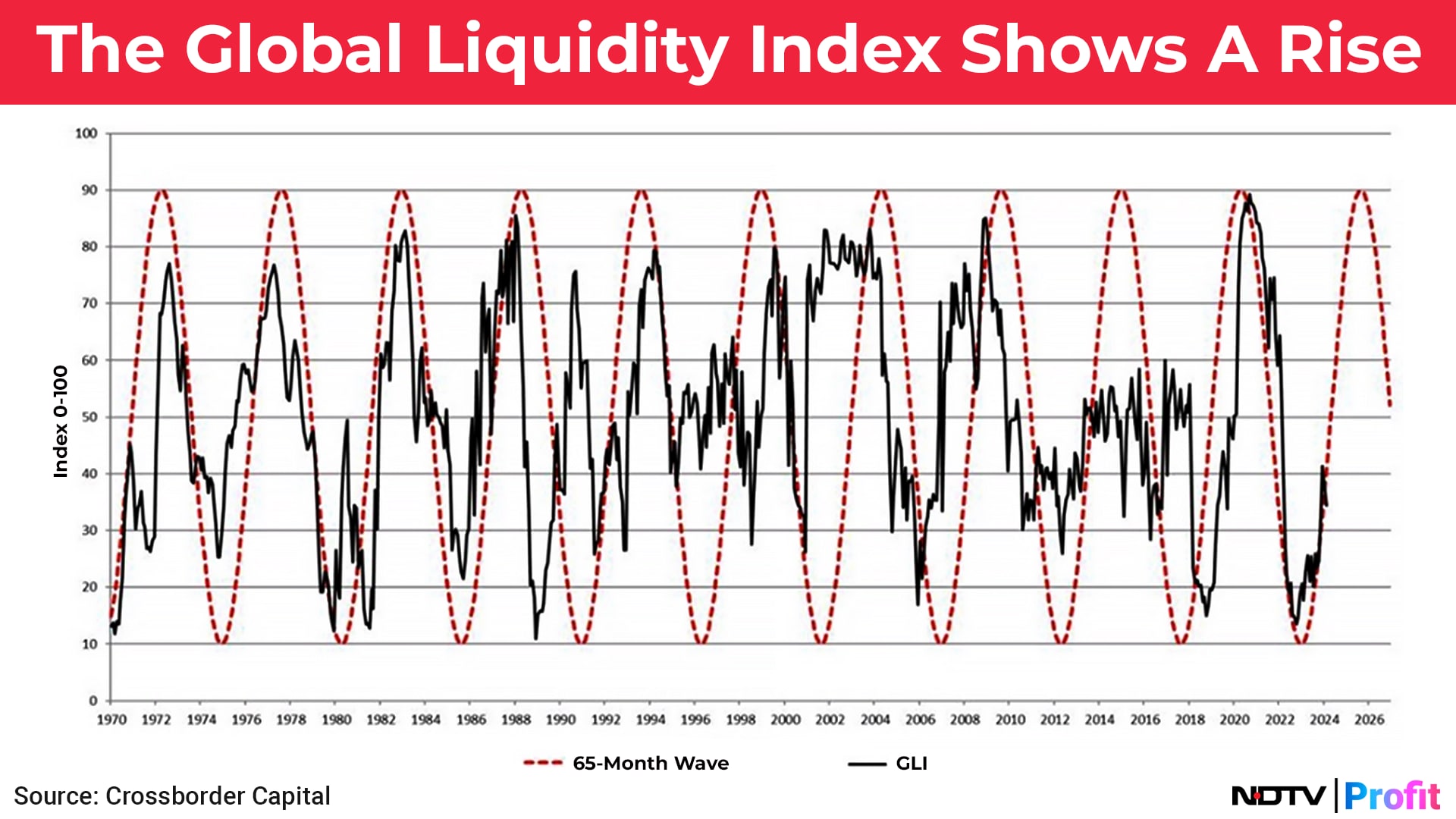

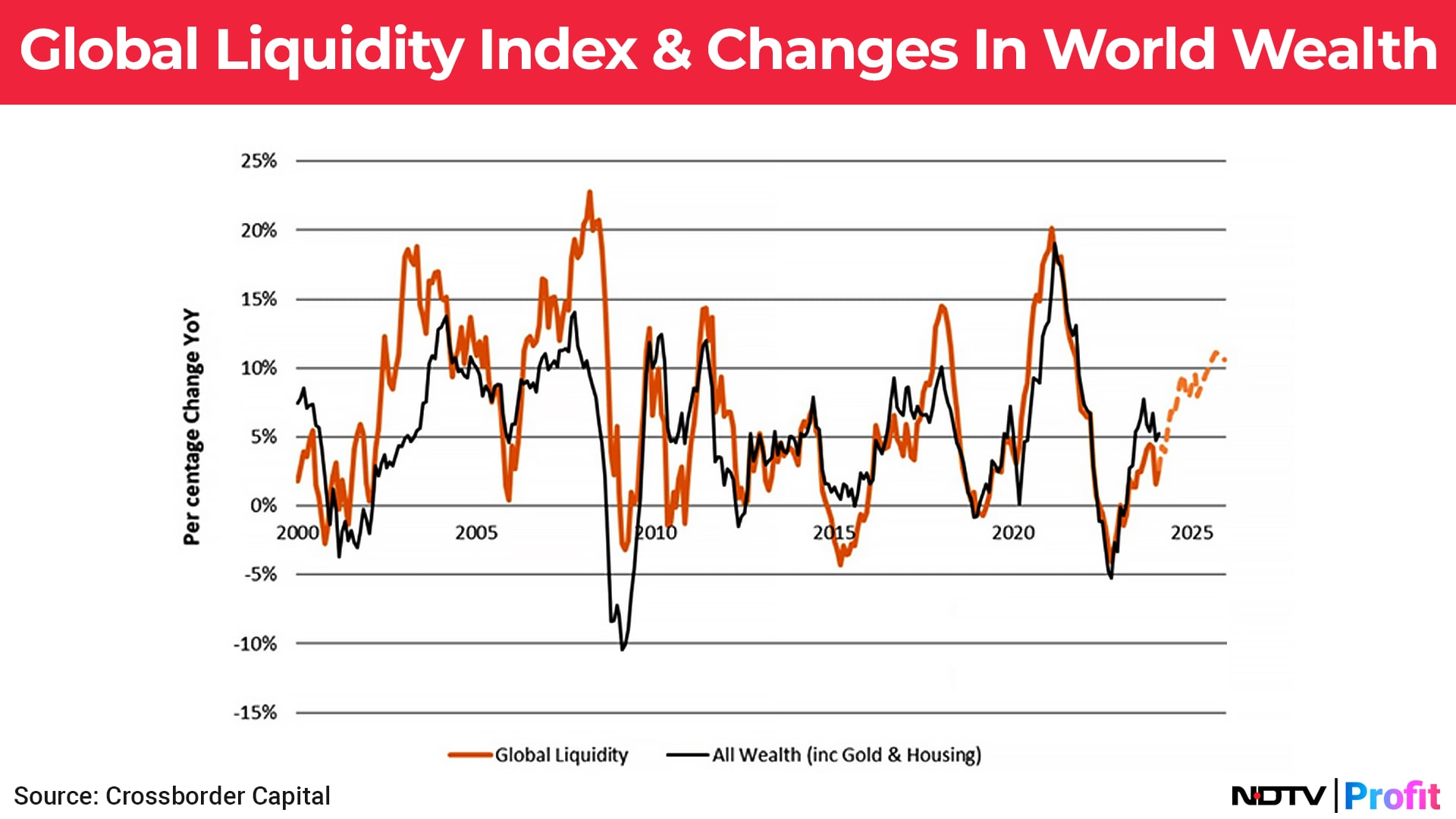

The Global Liquidity Index, an index measuring global liquidity developed by Crossborder Capital, shows that Global liquidity is increasing steadily and should increase all throughout 2024. Accordingly, higher levels of global liquidity should feed into risk assets like equities and real estate, helping global equities do well over medium term in spite of prevailing geopolitical issues.

A close study of the empirical relationship between Global liquidity and global wealth in the following graphic, which is an aggregate of value of equity, real estate and gold, reveals that global wealth closely follows global liquidity. It's an indication that global equity markets should go up in 2024 notwithstanding short-term hiccups due to geopolitical tensions in the Middle East.

Coming to the Indian economy, an analysis of the Composite PMI of major economies of the world since January 2024 shows that it is the fastest growing among them. The Composite PMI for India has been steadily rising since November 2023 with the latest Composite PMI showing a reading of 61.5, indicating very strong expansion.

Gaurav Chopra is an investor and algo trader.

Disclaimer: The views expressed here are those of the author and do not necessarily represent the views of NDTV Profit or its editorial team.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.