(Bloomberg Opinion) -- When two popular trades, such as buying US big tech stocks and selling the Japanese yen, are unraveling at the same time, investors naturally think they are somehow related.

There is now worry that the unwinding of yen-funded carry trades would wreck investors' frothy exposures to US technology and AI-related companies. After all, the 11% surge in the Japanese currency since early July has been in lockstep with the Nasdaq 100 Index's 13% maximum drawdown.

With a carry trade, an investor borrows in the currency of a country with low interest rates, like Japan and China, and puts her money in one where she can get considerably higher returns. In recent years, the yen has been the most popular funding currency because of the Bank of Japan's zero-rate regime.

This strategy turned sour, really quickly, when the BOJ hiked rates last week.

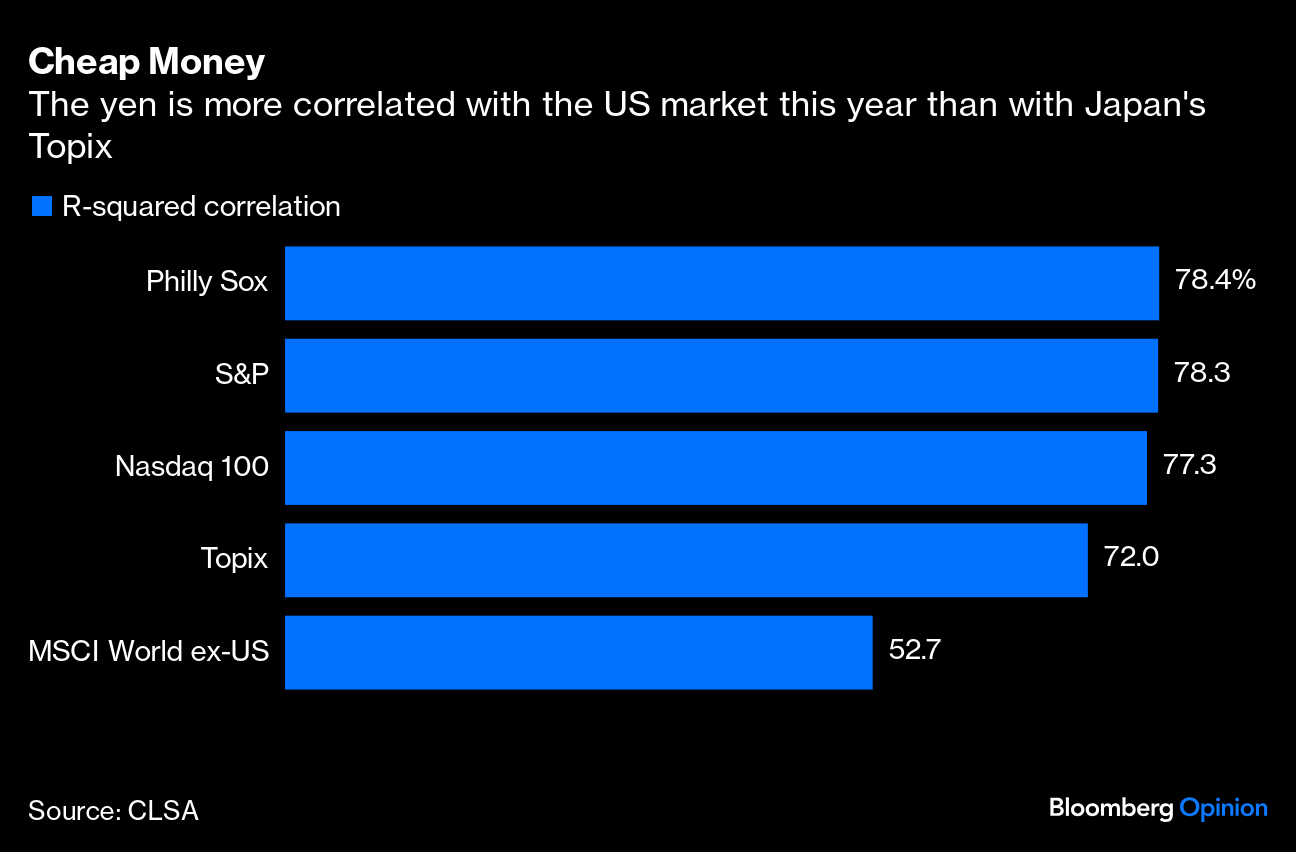

The question now is the size of this carry trade. Some investors may have borrowed in yen, and exchanged the amount into US dollars to purchase popular tech stocks such as Nvidia Corp. and Microsoft Corp. This year, the Japanese currency is more correlated with the Philadelphia Stock Exchange Semiconductor Index than the country's own Topix.

It's also possible that asset managers had piled into hard-to-sell assets, such as emerging-markets bonds, and brokers' margin calls forced them to offload the most liquid positions in their portfolios. US big tech stocks would be good candidates in this case.

As a result, if this carry trade runs into trillions of dollars, its disorderly unwinding will necessarily magnify the downward move in US stocks. The Nasdaq selloff might get a reprieve for a day or two, but it won't be entirely over.

Unfortunately, it's impossible to pin down the exact size of this strategy because unlike stock trades, currency transactions aren't tracked centrally on exchanges. The best we have are estimates.

One proxy to look at is Japanese banks' foreign lending. The amount reached $1 trillion as of March, a 21% rise from 2021, according to data from the Bank of International Settlements. Much of the recent growth in cross-border yen lending has been in the so-called interbank market, where banks lend to each other, and to other financial firms such as asset managers. It's an estimate of how much appetite foreign institutional investors have for yen-funded carry trades.

How about Japanese investors? Their net international investment amounted to 487 trillion yen ($3.4 trillion) as of the first quarter, a 17% increase from three years ago. Clearly much of this comes from foreign reserves. Traditional asset managers' portfolio carry trades would not be the biggest chunk.

However, in a broader sense, one can argue that the entire Japanese government is engaged in a massive carry trade. It has been funding itself at very low real rates imposed by the BOJ on domestic depositors, while earning higher returns on foreign assets. As such, the $1.8 trillion Government Pension Investment Fund, which has allocated roughly half of its money to overseas equities and bonds, is essentially the asset manager that runs this money-making machine for the government. Will GPIF still be in the US stock market if the BOJ continues to raise rates?

Ultimately, a carry trade is a leveraged play, with people using cheap loans on riskier projects. The BOJ changed its game plan. Now, we are looking at strong repatriation flows back into a currency that is suddenly paying interest to the tune of trillions of dollars. What happens in Tokyo matters greatly to New York.

More From Bloomberg Opinion:

- Tokyo Market Rout — Oops, the BOJ Did It Again: Gearoid Reidy

- Buffett's Butterfly Turns Into Terror Over Tokyo: John Authers

- Big Luxury Frets China Is Turning Japanese: Shuli Ren

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Shuli Ren is a Bloomberg Opinion columnist covering Asian markets. A former investment banker, she was a markets reporter for Barron's. She is a CFA charterholder.

More stories like this are available on bloomberg.com/opinion

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.