(Bloomberg Opinion) -- The Federal Reserve won't want a repeat of 2023 where 10-year Treasury yields soared from a low of 3.3% in April to peak at 5% in October — only to plummet back to 3.8% by year-end. That's too much volatility for the world's interest-rate benchmark — particularly when there's a record amount of government debt to sell.

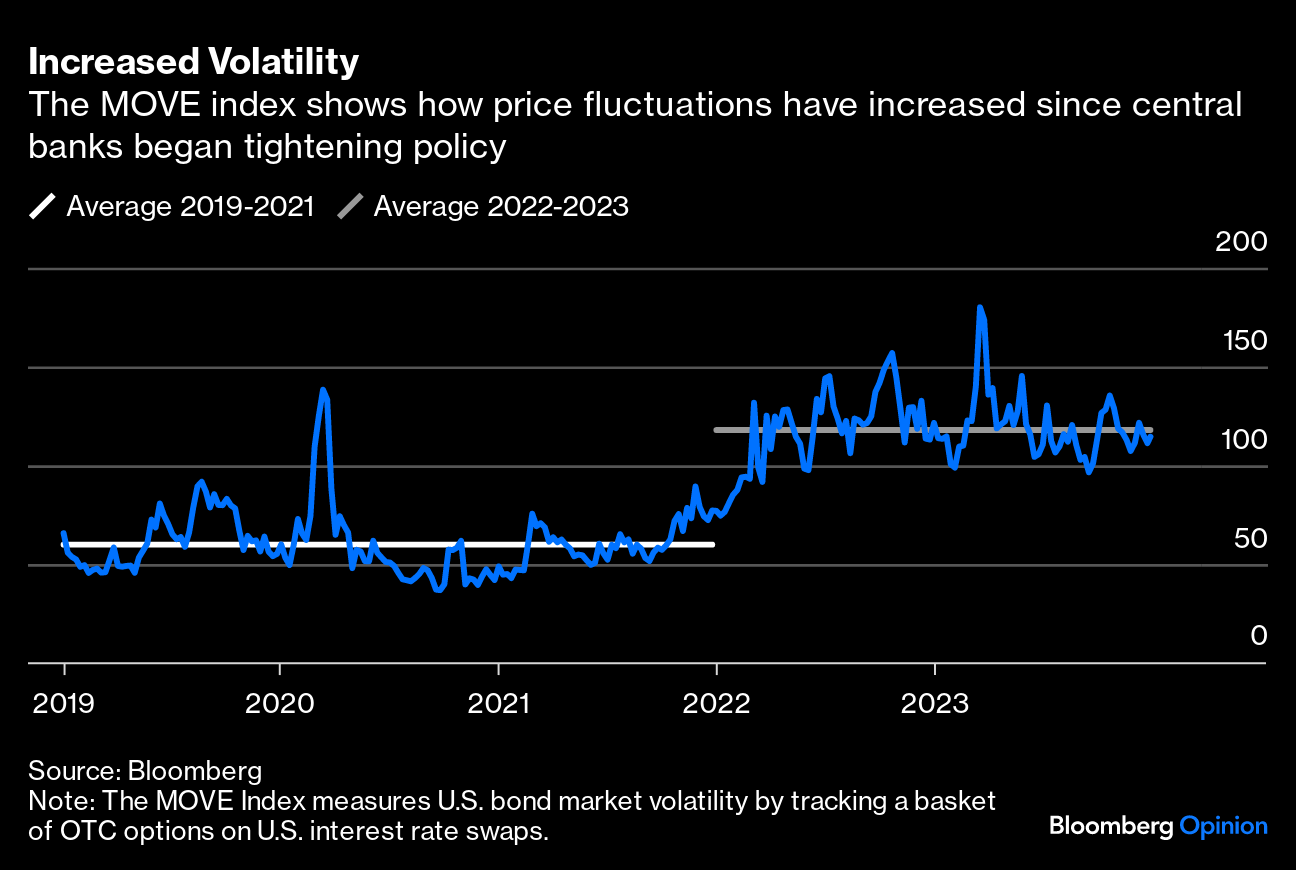

A steady-as-we-go two-pronged plan is carefully being engineered by Fed officials, of reversing economic tightening via conventional monetary policy in conjunction with measures to shrink the swollen balance sheet. It helps that dissent within the Federal Open Market Committee has been notably absent under the leadership of Chair Jerome Powell. With inflation down to 3.1%, a third of its mid-2022 peak, the central bank hopes to achieve a soft landing for the economy. This should allow it to steadily bring its official Fed funds rates down this year from its current upper bound of 5.5% — but reducing the bond market turbulence that accompanied the increase in borrowing costs is in everyone's interests. Average volatility has doubled in the past two years compared with the three prior years, and remains elevated.

Integral to interest-rate policy is managing the gradual reduction of its vast balance sheet while ensuring liquidity is consistent in the money market plumbing. Combating the global financial crisis, and then the pandemic, has afforded the Fed a greatly expanded toolkit. The skillful handling of the Silicon Valley Bank collapse in March with the introduction of the Bank Term Funding Program is testament to its newfound nimbleness. The BTFP is set to be wound down shortly, but it established an important precedent to tackle future liquidity crunches.

The Fed's $95 billion-a-month quantitative tightening program, where maturing bond holdings are no longer reinvested, is likely to be trimmed back later this year — tapering the taper. Sizable scaling back of monetary stimulus has already been achieved with the Fed's balance sheet 15% lower than its peak, so the pace of reduction can easily ease. One-third of QT is in mortgage-backed securities, and the Fed will continue to let these roll off to eventually return to solely holding government securities. The bulk is in conventional US Treasuries, and slowly trimming the monthly pace to around $30 billion would be consistent with more normal Fed operations. Barclays Plc US money market analyst Joseph Abate expects the Fed to return to fully reinvesting Treasury redemptions by early summer.

Several policymakers mentioned in the Dec. 13 FOMC minutes that technical QT reduction discussions should begin before slowing balance-sheet reduction. Dallas Fed President Lorie Logan went a step further earlier this month. Referencing the decade-old Fed's overnight reverse repurchase facility, where counterparties such as money-market mutual funds can park excess cash, she said it's time to discuss how to "slow the pace of (QT) runoff as overnight balances approach a low level."

RRP usage was quite volatile around year-end. The Fed is vigilant about monitoring bank reserves, repo rates and other liquidity measures so they stay closely aligned with the official Fed funds range. Increasingly, the Treasury's bond issuance plans have become a major factor in market pricing, with a modest trim in November sparking a substantial rally. The scale of its T-bill issuance is also closely linked with the gradual rundown of the RRP, as money-market funds switch cash around for the best-yielding options. Barclays expects the Treasury to issue $400 billion of bills this year, about 20% of total debt supply and mostly in the first quarter to match strong demand.

The amount of government securities readily available matters to maintain ample system liquidity. The RRP has fallen back to around $700 billion, down from a peak of over $2.5 trillion at the end of 2022 when the Fed lifted caps on individual fund usage and widened eligibility. The Fed can reverse either of these measures but it doesn't have full control over the size of the RRP, so it's a balancing act between the central bank and the Treasury to keep the porridge palatable. Demand for T-bills could increase beyond a level the Treasury might be comfortable issuing. If the RRP falls below, say, $500 billion then the Treasury may have to increase supply in longer maturities as well; 80% of the net increase in debt outstanding in 2023 came in T-bills, so flexibility is already stretched.Such are the vagaries of overseeing ballooning borrowing needs just as markets espy a change in monetary policy direction. At least the Fed is both forewarned and forearmed to a degree never seen before. It will let markets find their natural level — nobody wants a Japan-like frozen bond market — but the guardrails are ready to be installed if needed. After a rocky start, the Powell Fed has done an impressive job in communication, but its task is far from done as it has to ensure inflation doesn't rear up again. Calming bond volatility will help that cause as the inflation scare recedes into the background.

More From Bloomberg Opinion:

-

Fed Will Set Pace More Than Ever This Year: Gilbert & Ashworth

-

The World Faces a Tsunami of Government Debt: Marcus Ashworth

-

Powell Won't Do Slow and Steady If Job Market Wobbles: Conor Sen

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Marcus Ashworth is a Bloomberg Opinion columnist covering European markets. Previously, he was chief markets strategist for Haitong Securities in London.

More stories like this are available on bloomberg.com/opinion

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.