India is the Pharmacy of the World—a phrase that has transformed into a truism. The Indian pharma industry first earned the moniker by supplying cost-effective, often life-saving medicines across the globe to become the largest player in the generics market. The Covid-19 pandemic further witnessed India's capabilities in supplying vaccines, equipment, and medicines to other countries.

Amidst the narrative highlighting the industry's global achievements in international markets is 'India's thriving domestic formulations market'.

Formulations are medicinal products that help with various ailments. They can be tablets, injections, or ointments. As of fiscal 2024, the Indian domestic formulations (Domform) sector is approximately $26.4 billion, dominated by branded generics, which constitute a substantial ~90% of the market. Branded generics are medications that are biologically equivalent to their generic counterparts but are sold under different brands.

Dissecting Financial Track Record

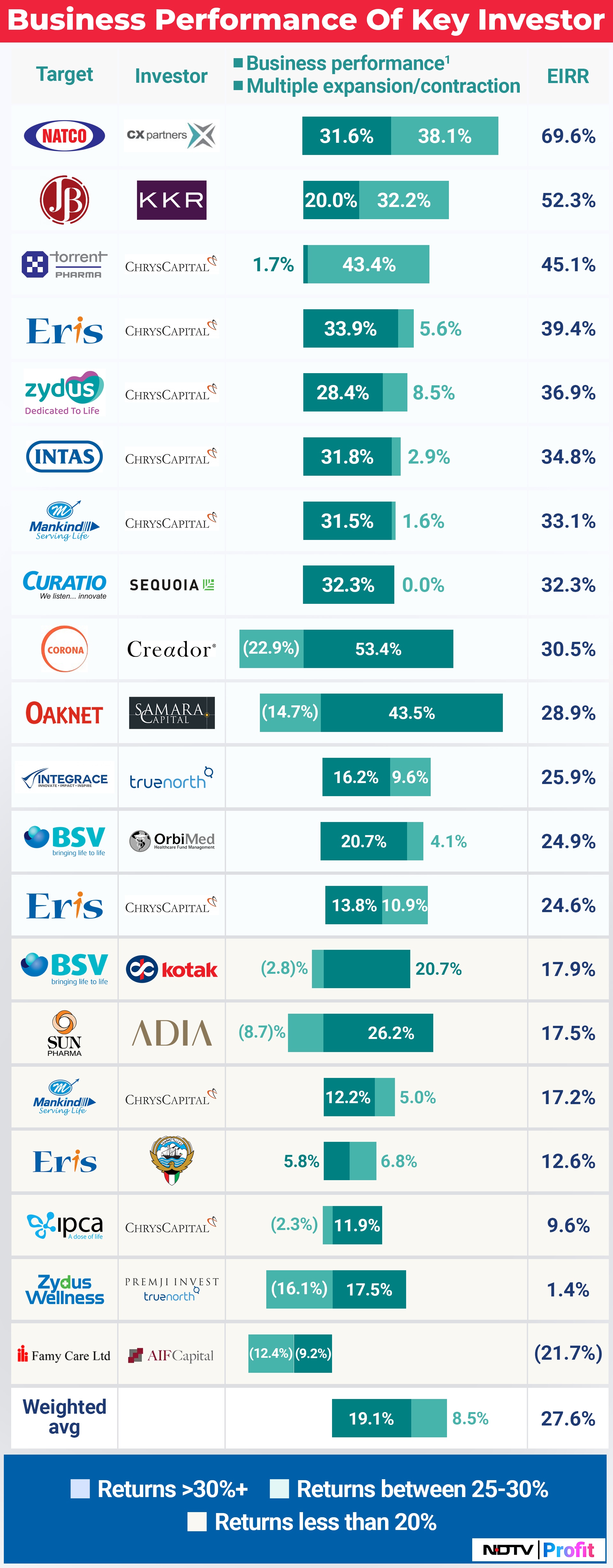

It is of little surprise that the Domform sector has been delivering consistent, solid returns to its financial investors and is on track to carry the same momentum in the future.

Our analysis suggests that investors in this industry have bagged an average return of 27.6% during the period 2007–2023. Around 70% of these returns are attributable to the robust business performance of the firms, and only 30% are attributable to the expansion of valuation multiples of the industry. A further, deeper analysis explains that the firm's robust business performance is dependent on revenue growth, which is a very positive indicator for any industry's sustained performance.

Current Revenue Growth Strategies At Play

Consistent revenue growth has been observed in companies that have a sharp focus on strategies that are most suited for their size, product portfolio and positioning and who have stayed away from a one-size-fits-all approach. We decipher the success playbook for companies based on their scale of operations.

Step Up From Small To Mid-Size: Niche Focus, Brand Development

Key success factors amongst small players (say revenues less than Rs 500 crore) in the Domform sector have been adopting a focused approach, targeting niche therapeutic areas and developing strong brand identities within these therapeutic areas.

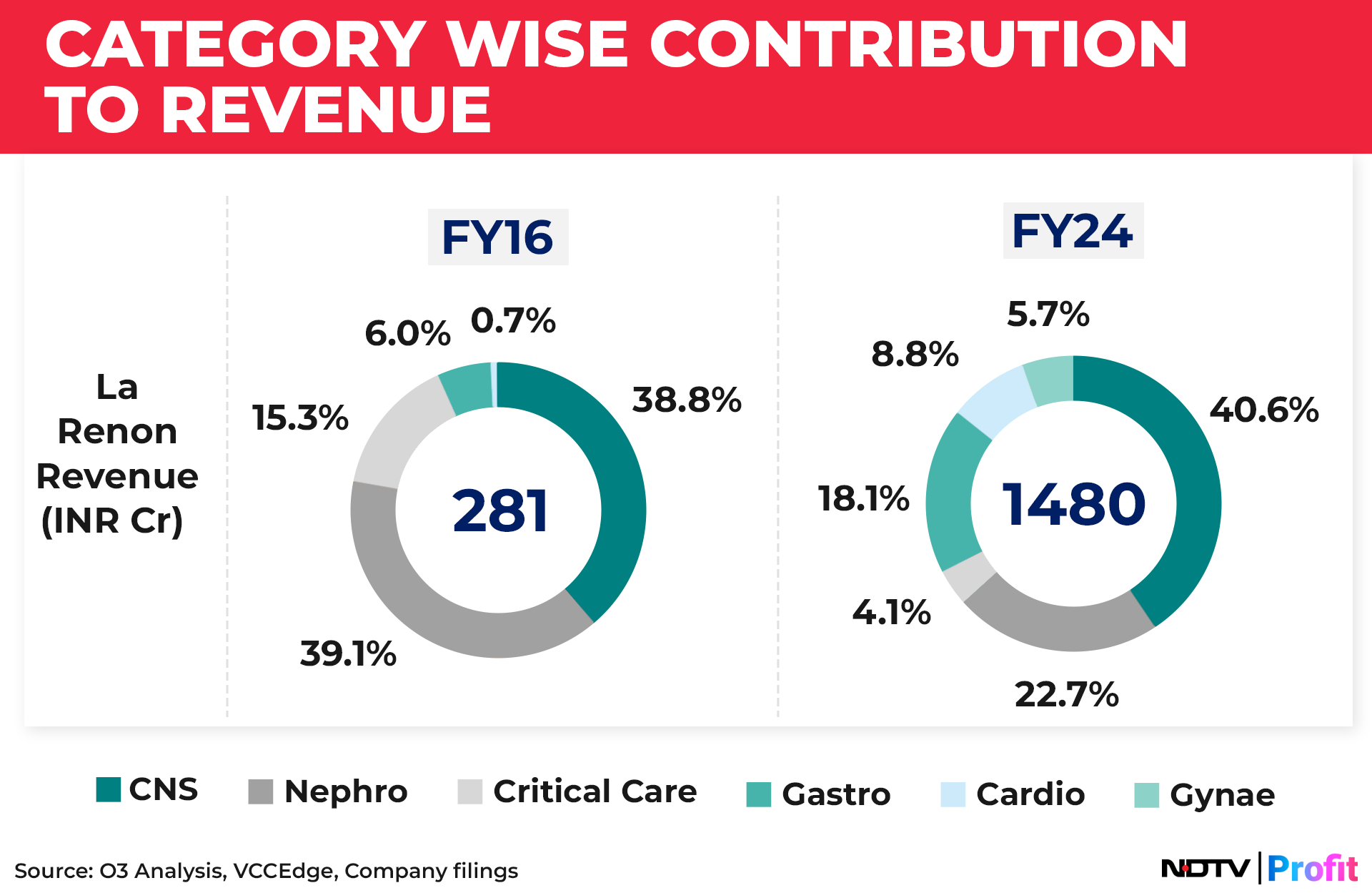

A case in point being La Renon. It identified a niche in the Central Nervous System (CNS) and Nephrology sector and gradually built its portfolio with marquee anchor brands such as Nuhenz, Colihenz, and Renolog in these therapy areas.

After establishing a strong base in CNS and Nephrology, it extended its focus to Gastrology and Gynaecology, gradually reducing the revenue contribution of CNS and Nephrology from about 78% in fiscal 2016 to about 68% in fiscal 2024 while the new launches contributed almost 25% in financial year 2024.

Top 10 to Top 5: Building Mega Brands To Deepen Penetration

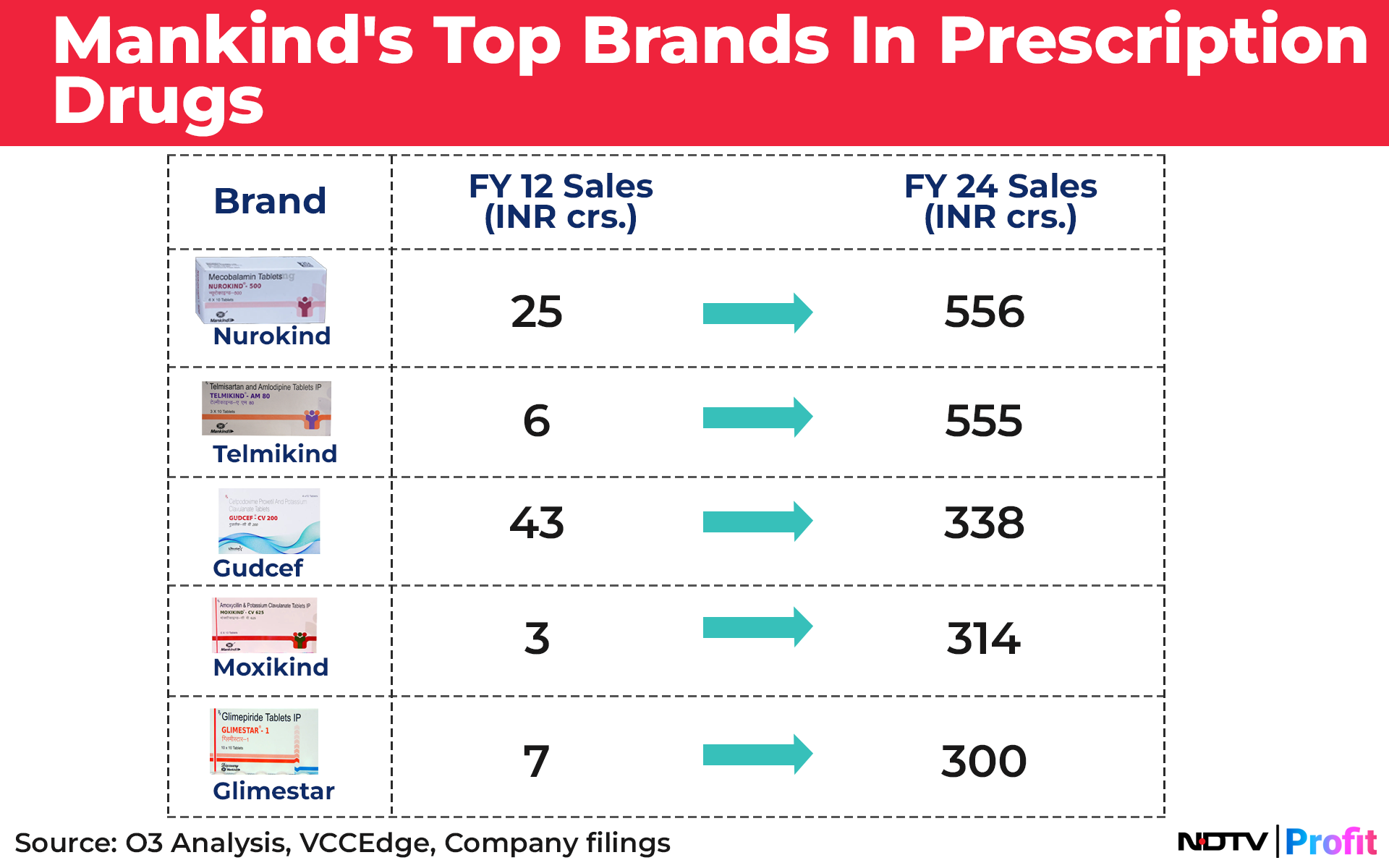

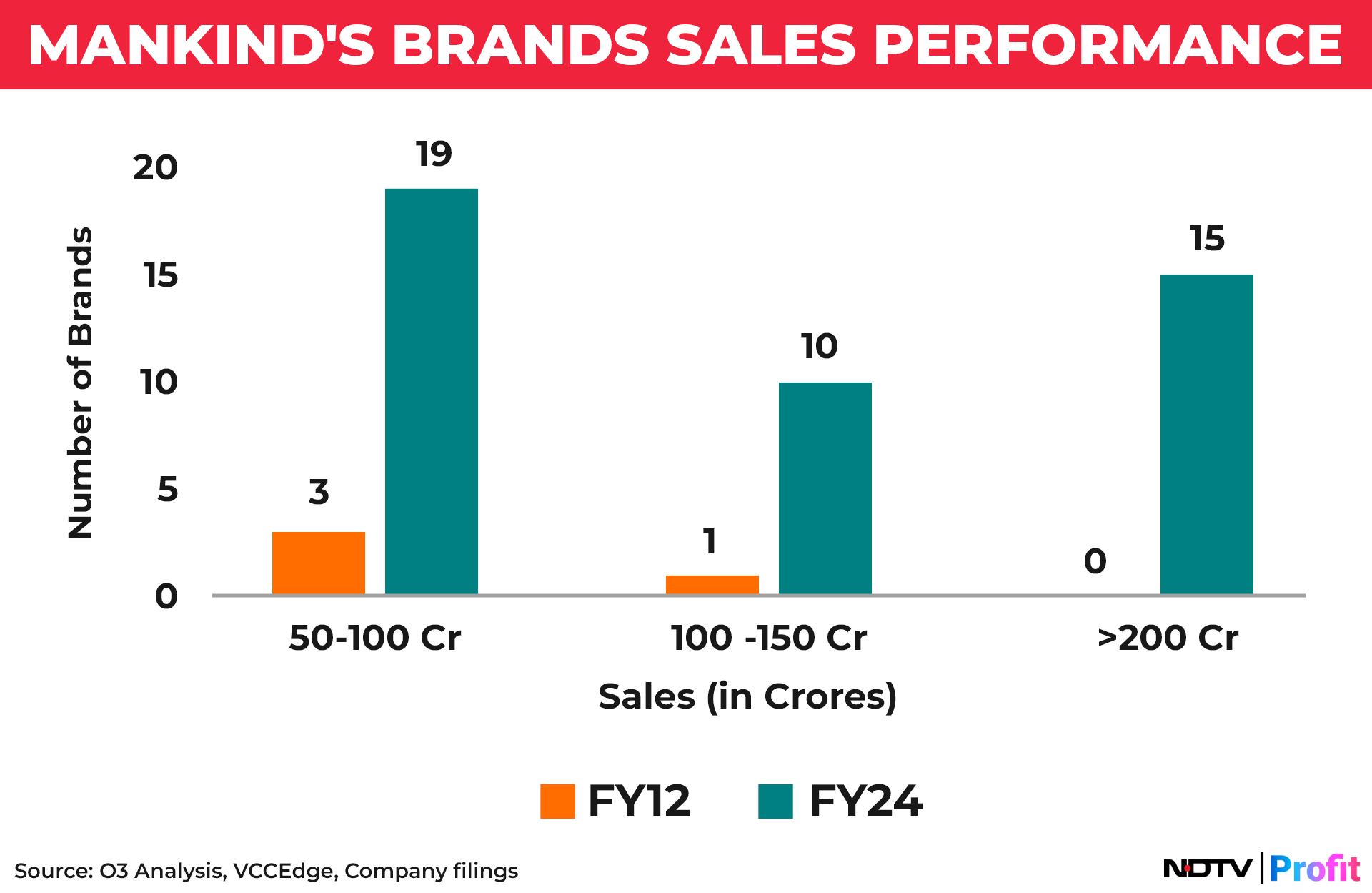

As companies diversify into therapeutic areas, scale significantly hinges on building mega brands that have recall across market segments. Mankind Pharma exemplifies this transition from a large player to a mega player. Mankind rose from Rank 7 in FY12 to Rank 3 in FY24, trailing only Sun Pharma and Abbott India.

Mankind Pharma's success lies in scaling established brands and launching new products. The company invested in building and scaling up leading brands such as Neurokind and Telmikind. Back in FY12, they had 4 brands with sales of more than Rs 50 crore. Today, they have more than 40 brands in that category with 15 brands having sales of more than Rs 150 crore in fiscal 2024.

Future Growth Potential

While the Domform sector has enjoyed healthy historical returns, it is further set to grow further at the rate of 11% till FY27 owing to several different macro factors.

Demographics: The average age of Indians is pegged to grow to 35 by 2036. This increase combined with the growing rate of urbanization will significantly increase the demand for appropriate healthcare services.

Increase In Lifestyle Diseases: Rapid urban growth and modern lifestyles marked by little physical activity, high stress levels, and unhealthy eating patterns will continue fuelling the rise in chronic illnesses.

Supportive Policies: Policies such as Ayushman Bharat and National Health Policy will increase the coverage of healthcare access to people and the demand for adequate medical resources

To Sum Up

India's Domform sector, with a proven track record and a promising avenue for growth ahead, offers a fertile ground for profitable investment, characterized by robust growth potential, strategic diversification, and significant returns driven by business performance. For investors, understanding the nuanced approaches of different-sized firms is crucial for making informed investment decisions.

Shiraz Bugwadia is a senior managing director at o3 Capital and focuses on the firm's life sciences and healthcare practices. He has more than 23 years of experience.

Prasanna Bora is a managing director at o3 Capital and focuses on the firm's life sciences practice. He has more than 18 years of experience.

Disclaimer: The views expressed here are those of the authors and do not necessarily represent the views of NDTV Profit or its editorial team.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.