A senior executive in his fifties came to us for planning investments for the rest of his life. While finalising on products, he emphatically declared that he stays away from products like the National Pension System. He said he had multiple reasons in his mind for doing so – that the money is locked in for a long time; it is taxable at retirement; and the returns are not good.

He is not the only who feels this way. As a relatively new product, the NPS is still not well understood by savers. As a result, appropriate exposure to this product is missing in most portfolios.

A lot of savers make the mistake of comparing the Employee Provident Fund returns with NPS returns, or comparing equity mutual funds with NPS.

The basis of the comparisons made here are erroneous. There is no single product that will always be the best. A product needs to be analysed for its utility under the given variables. NPS is primarily a retirement planning tool, along with exclusive tax benefits. These two aspects of the scheme should be analysed under different circumstances, to arrive at the most optimal conclusion.

While this article deals with the NPS' features along with operational aspects, the emphasis is on technical analysis of this product so the investor can make an informed decision.

Technical Analysis

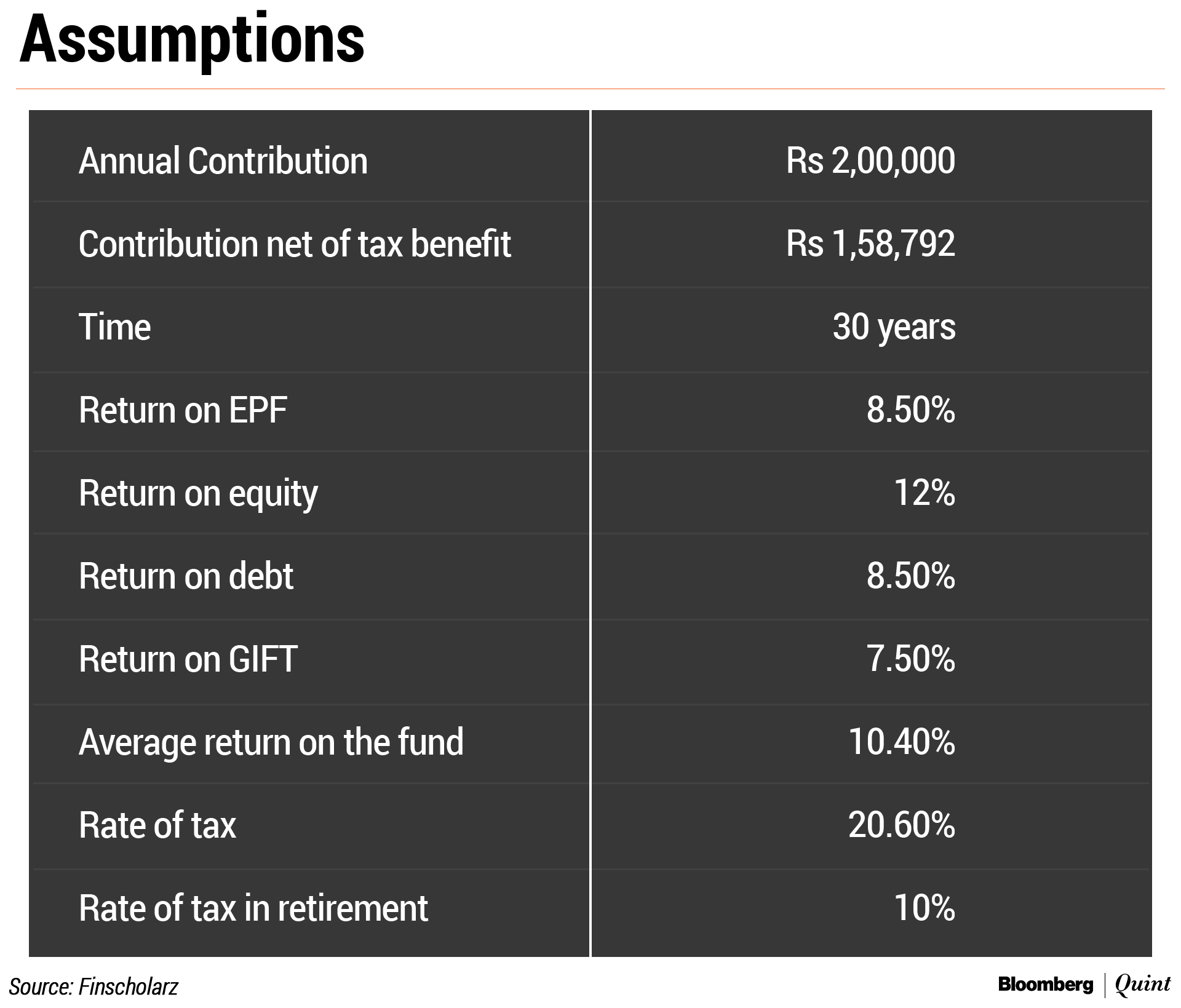

Detailed analysis has been done with the following assumptions.

More calculations were done by changing the value drivers, and their inferences are also mentioned later in this section.

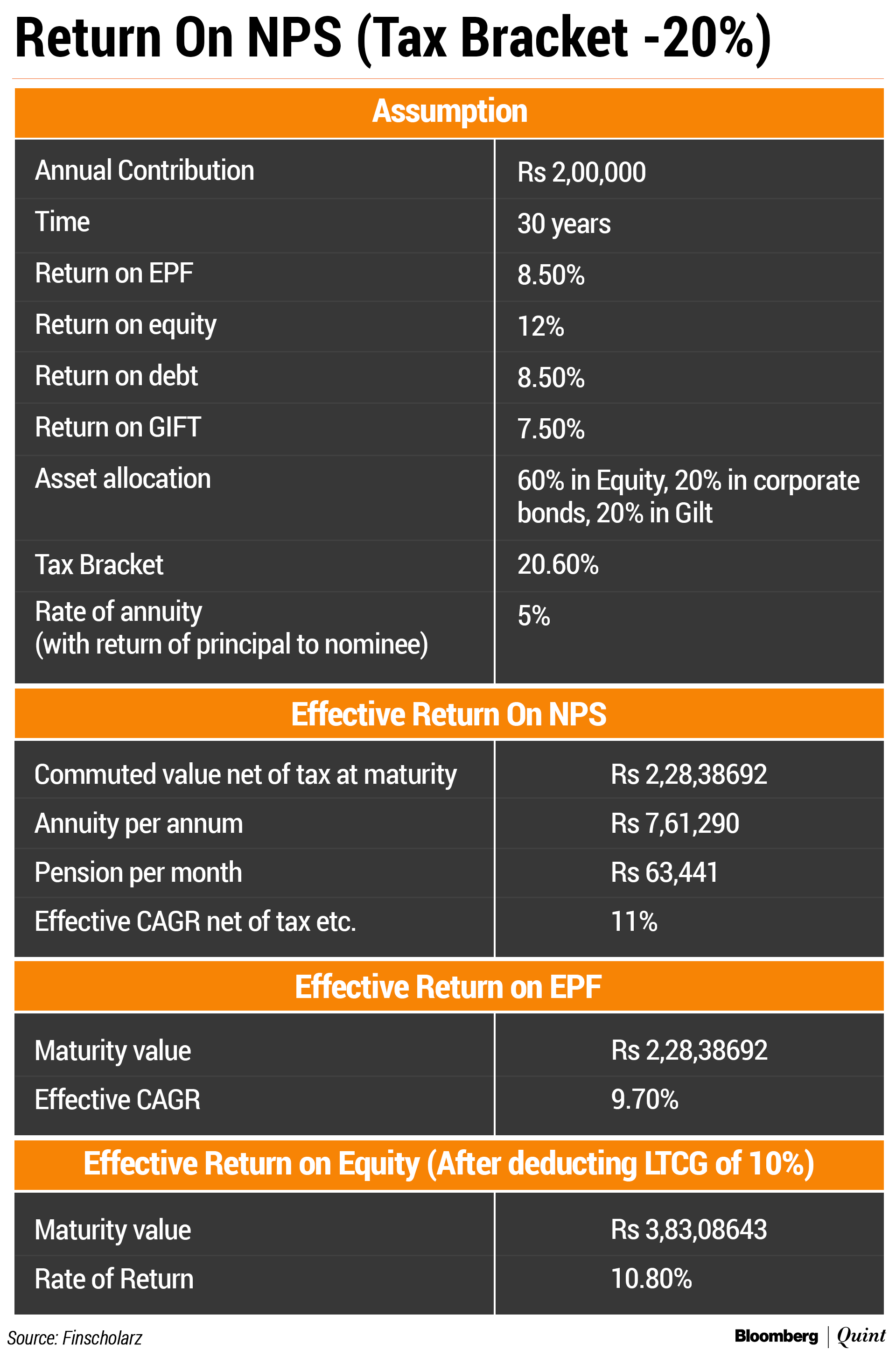

The table below reveals that money invested in NPS over a long period can give effective returns as good as equity (presently equity returns are taxed at 10 percent), but with much lower risk and volatility. It is far superior to the other retirement planning tool that is EPF, because of equity allocation.

I have shown this analysis only to drive home the point of benefits of NPS. These are two different asset classes and should not be compared.

With average inflation, this pension is worth about Rs 18,500 per month, and the corpus is worth about Rs 70 lakh in today's purchasing power.

The value drivers here are:

- Tax savings,

- Exposure to equity,

- Benefits of compounding due to lock-in period.

The value benefits will be higher if investors comes in the 30 percent bracket for all working years, and slightly less if they stay in the 10 percent bracket for all 30 years of investment.

If equity allocation is less than 60 percent, incremental benefits will be lesser. And if the equity allocation is more—75 percent is the maximum allowed till the age of 50 years—incremental benefits will be more.

If the fund is held for a shorter time period, the incremental value added will be different. It is interesting to note that the closer a person is to retirement, the higher the impact of tax benefit on effective annual return on the fund is.

In case the investor starts at the age of 55 and invests till 60 with maximum equity allocation allowed (i.e. 50 percent), the effective annual return can be up to 27 percent per annum. This is the impact of tax benefit.

Since the entire commuted pension is tax-free now, it is a product that should not be missed as a tool for investing for retirement.

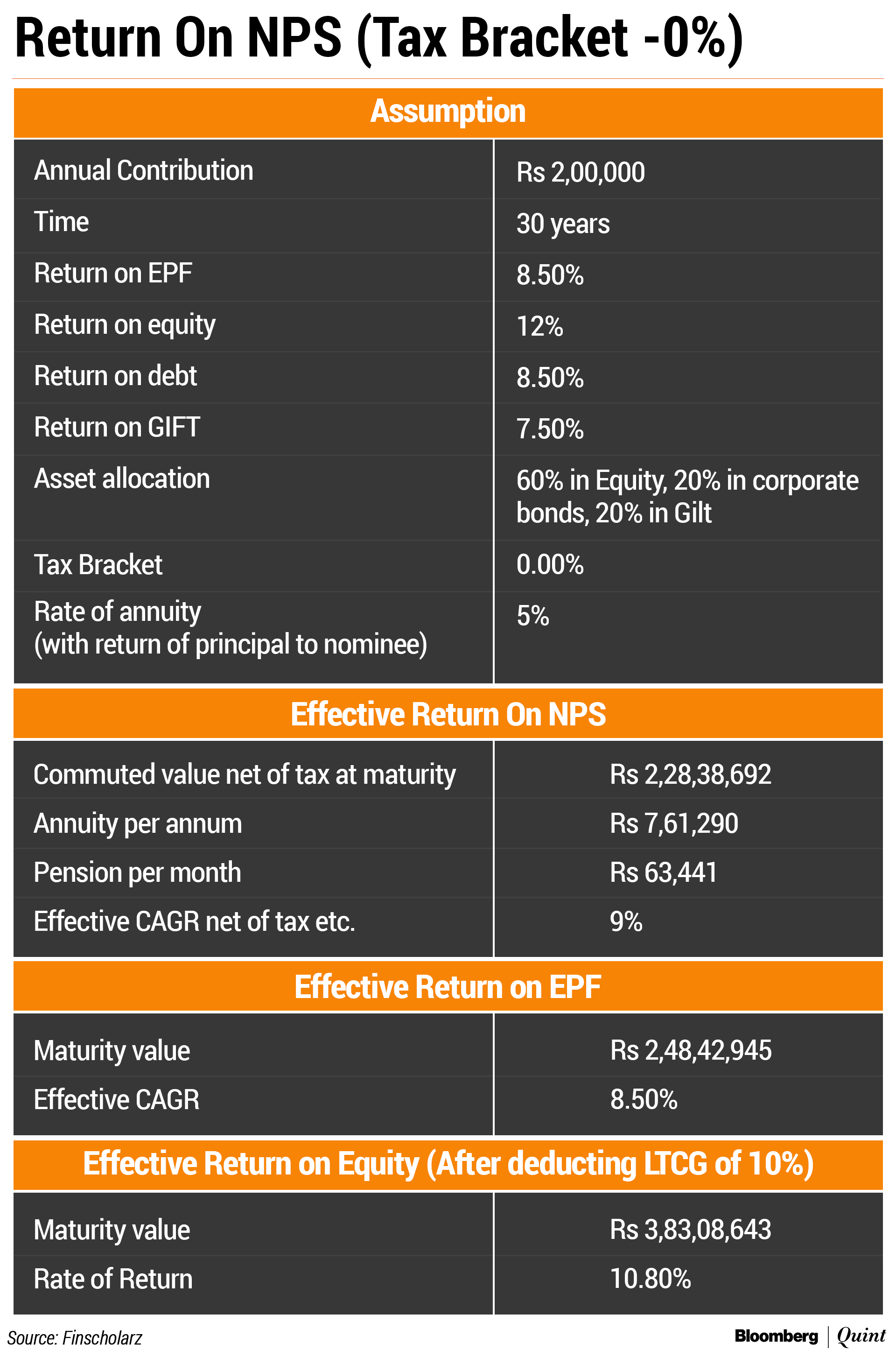

The real numbers will vary with the increase or decrease in interest rates, but the conclusion remains the same even for investors who do not pay tax.

Look at the numbers below for someone in the zero percent tax bracket.

In real life, an individual will move from zero percent tax to 30 percent and hence the calculations with an average of 20 percent were given at the beginning of the article. The features can be understood better here. The easiest way to open an NPS account is here.

What You Need For Registering Online

- Bank/demat/folio account details with the empanelled bank/non-bank for KYC verification for subscriber registration.

- Your KYC verification will be done by the bank/non-bank Point of Presence selected by you during the registration process.

- Self-attested copy of PAN card and cancelled cheque in *.jpeg/*.jpg/*.png format with file size between 4 KB and 2 MB.

- Scanned photograph and signature in *.jpeg/*.jpg/*.png format with file size between 4 KB and 5 MB.

Ensure That…

- Name and address provided during registration, matches with Point of Presence records for KYC verification. If the details don't match, your request could be rejected. In case of rejection of KYC by the selected POP, the applicant is advised to contact the POP.

- All the mandatory details are filled.

- The investment mode is selected properly.

- Nominee's details are filled accurately.

Registration Process

- Choose the application type, resident status, tier type and bank/POP.

- Fill personal, contact, bank, nominee details.

- Fill portfolio-allocation and choose a fund manager.

- Upload the scan images of the PAN, cancelled cheque, photograph, and specimen signature.

- In the final stage, make an initial contribution of a minimum amount of Rs 500. You can make more contributions after a Permanent Retirement Account Number or PRAN is allotted.

- Upon successful completion of payment, payment receipt will be generated.

- Contributions are credited in PRANs on T+2 day basis, subject to receipt of clear funds from the payment gateway service provider).

- After making the contribution, submit the application by either *eSign option or print and courier the application.

Post-Registration

- Subscribers can access the system immediately after registration. PRAN along with the ‘welcome toolkit' will be sent to the registered email id.

- Subscriber can generate IPIN instantly and access his or her NPS account.

- Subscriber, with IPIN credentials, can log in and click on the ‘contribution' button wherein contributions can be made.

We Recommend

- Start with Tier-I account.

- Choose ‘active choice' for investment mode with the asset allocation recommended by your advisor. If in doubt, opt for auto-allocation.

- Choose the fund manager as suggested by your advisor.

NPS As A Tax Planning Tool

NPS is primarily a retirement planning tool that the government is actively promoting through tax benefits, under various sections. These benefits are available under following sections:

Section 80 CCD (1)

This is available to all individual subscribers. They can claim up to 10 percent of gross income within the overall ceiling of Rs 1.5 lakh per annum under Section 80 CCE.

Section 80 CCD (1B)

This section is exclusively for NPS subscribers with an overall limit of Rs 50,000 per annum. This is over and above the deduction of Rs 1.5 lakh available under Section 80 C.

Section 80 CCD (2)

This is available to subscribers under the corporate sector. Employer's NPS contribution of up to 10 percent of the salary of the employee is deductible from taxable income, without any monetary limit. Employers can claim this as a business expense from their profit and loss account.

Tax Treatment At Retirement

60 percent of the corpus accumulated at the time of retirement can be commuted tax-free, up from 40 percent earlier. The balance 40 percent of the corpus will have to be used to buy an annuity or pension product from an insurance company.

The monthly or annual pension thus received, will be treated as income under the head ‘income from salary'. Usually, the taxable income during retirement is low, and can be managed with either 10 percent tax or no tax.

This makes NPS practically an EEE product – exempt at the time of investment, exempt at the time of accrual, exempt at the time of withdrawal.

All these benefits are available only for investments in Tier-I account.

NPS As A Retirement Tool

NPS is one of the most superior retirement planning instruments made available by the government. This is a ‘defined contribution' scheme, where the subscriber is responsible for garnering her own retirement fund.

Multiple tax breaks ensure that effective returns are much higher, as compared to any other retirement tool given by the government, private players or insurance companies. The returns, as shown in technical analysis, are as good as equity returns.

As the investments are made in passive index funds, the cost of investment and management is fairly low. The flexibility of asset allocation in the fund makes it an ideal retirement tool.

There are four classes available for investment:

- Equity

- Corporate bonds

- Government bonds

- Alternative investments (includes REIT, INVT etc.)

With a maximum of 75 percent in equity, this is a very useful tool for retirement planning.

Renu Maheshwari is a SEBI Registered Investment Adviser practicing client centric, holistic, commission free financial planning and portfolio management services through her organisation – Finscholarz Wealth Managers LLP.

The views expressed here are those of the author and do not necessarily represent the views of BloombergQuint or its editorial team.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.