As part of the monetary and fiscal measures for reversing the recent economic trends, on Friday the Finance Minister announced the biggest of the measures; the promulgation of the Ordinance by the President of India which brings a host of changes to the income tax rates.

Though there are precedents of an Ordinance having been made use of in the context of urgent amendments to the tax statutes, it has rarely been invoked in the context of income tax rates.

The government has made its intent loud and clear. Entrepreneurship and ‘Make In India' are not just glittery slogans but intended and real.

However, this is not the only perspective to examine the slew of changes made on Friday. For ease of reference, we have undertaken the analysis in light of multi-dimensional variables.

Tax Competitiveness

Within the 36 OECD countries, France has the highest corporate tax rate with 32 percent, Hungary the lowest with 9 percent, with an average rate of 23.52 percent. The new effective corporate tax rate of 25.17 percent clearly reflects India's resolve to position itself within the league of developed nations, institute tax-competitiveness within the Indian economy and provide more revenue available to the corporations for deployment for expansion, increasing shareholder return, etc. It is a clear invitation to multinationals for incremental FDI inflows in India.

Exemption-Free Tax Regime

In the 2009 Direct Taxes Code, the Government of India made its intent clear that it favours an exemption-free tax regime. Understandably so, as exemptions

- disturb horizontal tax-equity,

- are prone to disputes

- increase compliance cost, etc.

The new corporate rates come with a condition that no exemption shall be availed. It is understood that this was the recommendation of successive expert committees, and the most recent report to the government on a new direct tax law.

Clearly the path for an exemption-free tax regime has been set and one can surely expect the changes, which are currently optional, to be an all-pervasive regime.

No Disturbance To Existing Incentives

One of the stand-out features of this regime is that the new corporate tax rates are optional. Thus, it is now a fact-specific decision for each entity on whether to continue within the existing rate framework or to opt for the new rates. This has trade-offs, as a number of entities have been availing SEZ, area-based or other special deductions under the extant law.

So, there is no overnight change of the operating conditions for these businesses. The government has strayed clear of such practices, which have often led to accusations of intermittent shifting of goal-posts.

Each business can evaluate for itself the better of the two corporate tax structures (i.e. the existing exemption regime, or the lower tax-rate exemption-free regime) and choose which suits them.

Promoting Entrepreneurship

Assuming that there is no change in the individual tax-rates, being a salaried employee is now clearly a disincentive, than being an entrepreneur. We are not sure though, if that's the intent.

This is an indirect call by the government to all professionals who have the ability to stand on their own feet to contribute to India's manufacturing base.

With a lower tax corporate tax rate and wide-ranging government schemes to support new businesses, the time is ripe for salaried professionals to take stock and join the trend towards entrepreneurship, of which India's startups are a hallmark.

Corporate Choice

The revised tax rate makes limited-liability partnerships, and partnerships tax-inefficient models for doing business in India. This will have a direct influence on the choice of the corporate structure. As the 15 percent corporate tax rate is only vis-à-vis new manufacturing business incorporated after Oct. 1, and not for service sector, the latter stands disincentivised.

In other words, the compelling tax proposition which the government has offered to entrepreneurs is to form dedicated special purpose vehicles for carrying out manufacturing operations in India.

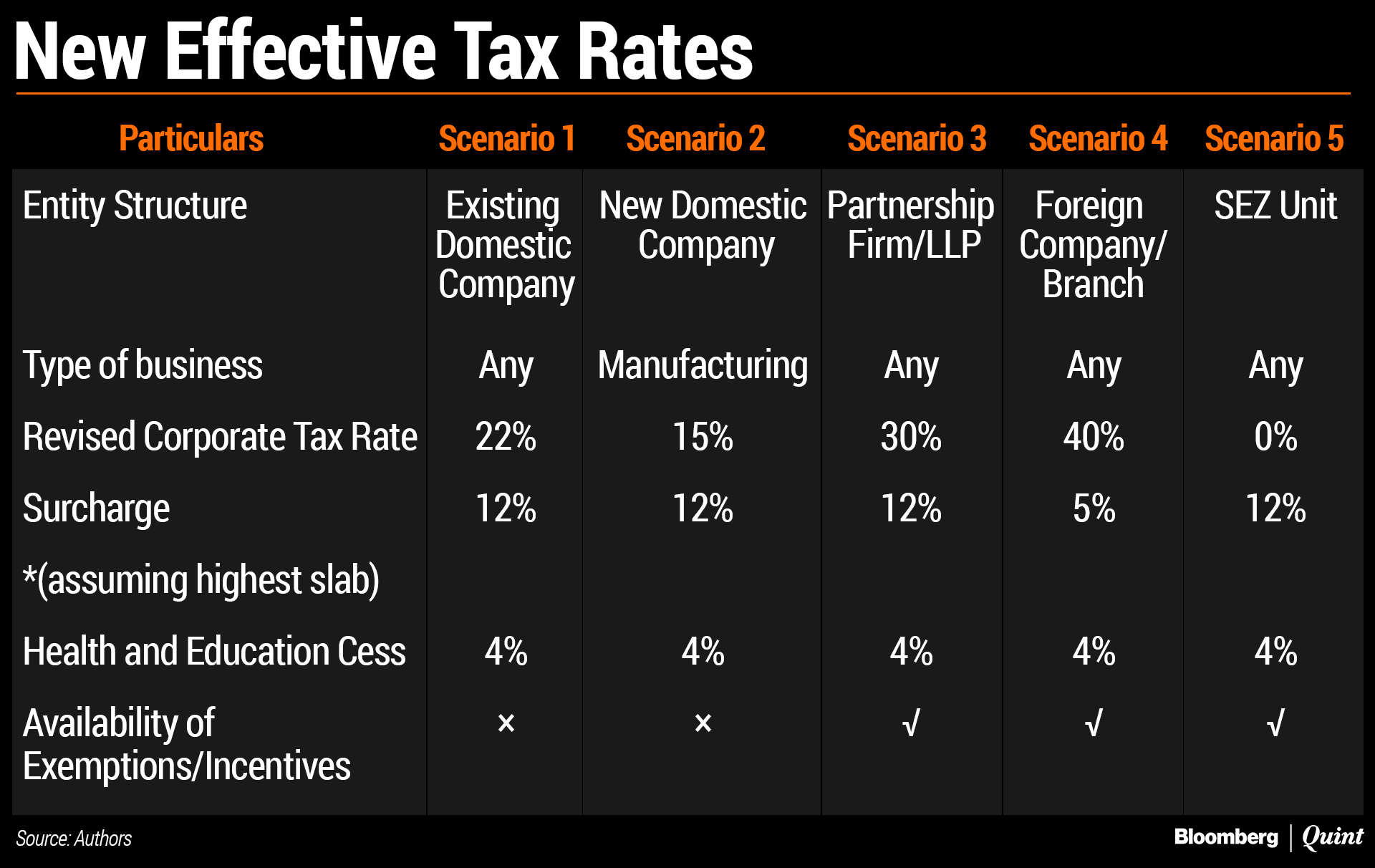

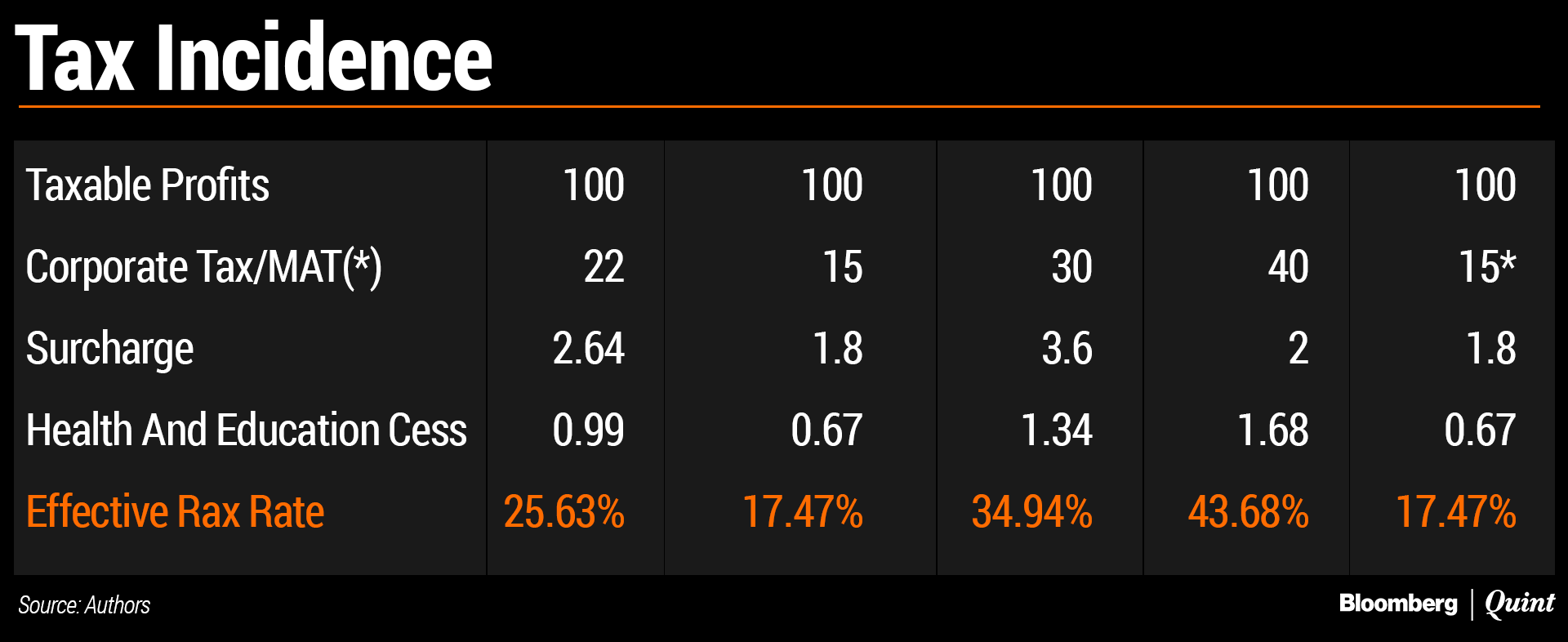

The effective tax-rates after giving effect to these changes can be broadly cateogrised as under:

Fiscal Deficit And Devolution Measures

One of the most crucial tests of the government's resolve shall, however, come from a fiscal prudence and planning perspective.

On the first count, addressing the Rs 1.45 lakh crore tax revenue foregone will be a challenge from a fiscal deficit perspective, at least in the short-run.

The government can also be expected to tap all available non-tax revenue mobilisation avenues. The impact on fiscal planning, is larger.

The 15th Finance Commission is close to finalising its recommendations on the centre-state revenue-sharing ratio for next five years. A shortfall in the centre's tax collections implies a net reduction in the revenue available to states.

In this context, the Finance Commission may feel compelled to increase the devolution available to states, which implies further reduction in the fiscal resources of the centre.

There is another critical fiscal aspect. The changes introduced on Friday provide a lower tax incidence, subject to foregoing of tax incentives which include SEZs, area-based incentives etc.

Without tax incentives, from a business perspective, there no longer appears any reason to invest in backward and hilly states—which undoubtedly require investment for industrialisation—because of inadequate infrastructure, non-availability of skilled labour, high transportation costs and logistic challenges, etc.

This aspect may be pressed upon by these states before the Finance Commission to claim a higher devolution from the centre. This will further strain the ability of the central government to address its welfare agenda.

Inducing Funds Into Research

What is missed by many commentators is the fact that the announcements have also opened up new avenues for corporates to contribute in the form of their CSR obligations.

Notable inclusions are incubators, publicly-funded bodies and research institutions. A perusal of the list is a clear indication that the government desires promotion of research into science, technology, engineering, and medicine. There are long-term benefits associated to these, which reveals that the changes are visionary in nature rather than a knee-jerk reaction.

Other Impact

The UPA government forged a number of economic partnerships with foreign nations by executing several Free Trade Agreements. In view of the customs concessions under the FTAs, imports gained preference at the cost of domestic manufacturing, as even traditional trade measures such as anti-dumping and safeguards were not sufficient to protect the domestic industry. The first Modi government revisited customs duties structure to promote manufacturing operations in India.

The introduction of a new provision in income tax law, for ‘domestic manufacturing company' clearly establishes that the firmness of the resolve and unequivocal expression of the government's priorities.

Clearly, FTAs may no longer be a preferred trade route.

Timing

One also needs to appreciate the backdrop under which the changes have been announced. Firstly, the economic outlook appeared pessimistic with the passage of every week since the second Modi cabinet assumed power and a drastic measure became necessity, particularly in light of the misdirected moves in the July 2019 budget.

Second, there have been questions from various quarters regarding the success of the ‘Make In India' program which is, in management terminology, the USP of NDA government.

Third, the U.S.-China trade tussle has left many global manufacturing giants looking for options to set-up manufacturing base, and India, so far, had been considered wanting in its resolve to attract them.

Viewed in light of the recent FDI changes allowing 100 percent participation in contract manufacturing, the concessional tax rate to new manufacturing entities is a clear invitation to set up shop in India.

Fourthly, and which is perhaps the most overt contemporary linkage to be drawn, this change of tax regime will definitely be a showcase for the Prime Minister's interactions with the U.S. President in the coming week. So, the announcement is not just significant, but also well-timed.

Anti-Abuse Measures

The 15 percent corporate tax rate comes with a rider that new entities which are set-up to avail the benefit of the lower rate must

- not be constituted by splitting up an existing business, and

- have an arm's length dealing with other entities.

In any case the GAAR provisions would apply even to these entities. The intent is to extend beneficial tax treatment only to genuine business.

Positive Retrospectivity

Generally retrospectivity in tax laws is a point of concern. The 2012 retrospective amendments in the income tax law, as a matter of fact, are yet to have fully played out. The changes announced are also retrospective, albeit with a positive bearing.

The benefit of reduced tax rates is available from the beginning of the current fiscal year.

This would mean that companies can rework their profit projections for this year itself and make incremental investments or offer larger handouts.

Advance taxes, already paid in this year, on a higher tax-rate projection, would also be adjustable in the next tax payment cycle, reducing cash outflows.

In our view, the government is finally banking upon increased compliance and growth in corporate profits to attain tax buoyancy to curtail the fiscal deficit. Though overshot by a few days, this is one of the biggest ‘first 100 days' achievement of the incumbent government.

Mukesh Butani and Tarun Jain are Partners at BMR Legal.

The views expressed here are those of the author and do not necessarily represent the views of BloombergQuint or its editorial team.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.