We live in a nepo-baby world. New billionaires are accumulating more wealth through inheritance than entrepreneurship. For the first time in 15 years, there are no self-made billionaires under the age of 30. And increased outrage at what goes on among the billionaire crowd — or the top 0.00003% — seems to reflect what's happening further down the ladder after a decade of asset-price gains and weak upward mobility. Almost two out of three millennials say their retirement security depends on how much they inherit.

Hence why French billionaire Xavier Niel's new book of interviews about his journey from disruptive anti-establishment outsider to holder of a $10.3 billion fortune makes for fascinating, if unsettling, reading. His story is a very non-nepo one, more in keeping with the US tech billionaires he name-checks throughout. After hacking pay-TV boxes as a teenager and promoting adult services on France's internet precursor Minitel — “school just wasn't my thing,” he says — Niel rolled his tanks onto the telecom establishment's lawn with a low-cost all-in-one broadband, phone and TV service that made him rich but also earned him the ire of wealthy incumbents. His brief spell in prison, in connection with income made from peep shows, didn't help endear him to the establishment.

Niel's anecdotes and life lessons will sound familiar — more “move fast and break things” than the fatherly business advice Standard Oil founder John D. Rockefeller handed down to his son more than a century ago. Yet he also openly frets that he's the self-made exception that proves the rule: “Statistically speaking, it's in the order of a miracle.”

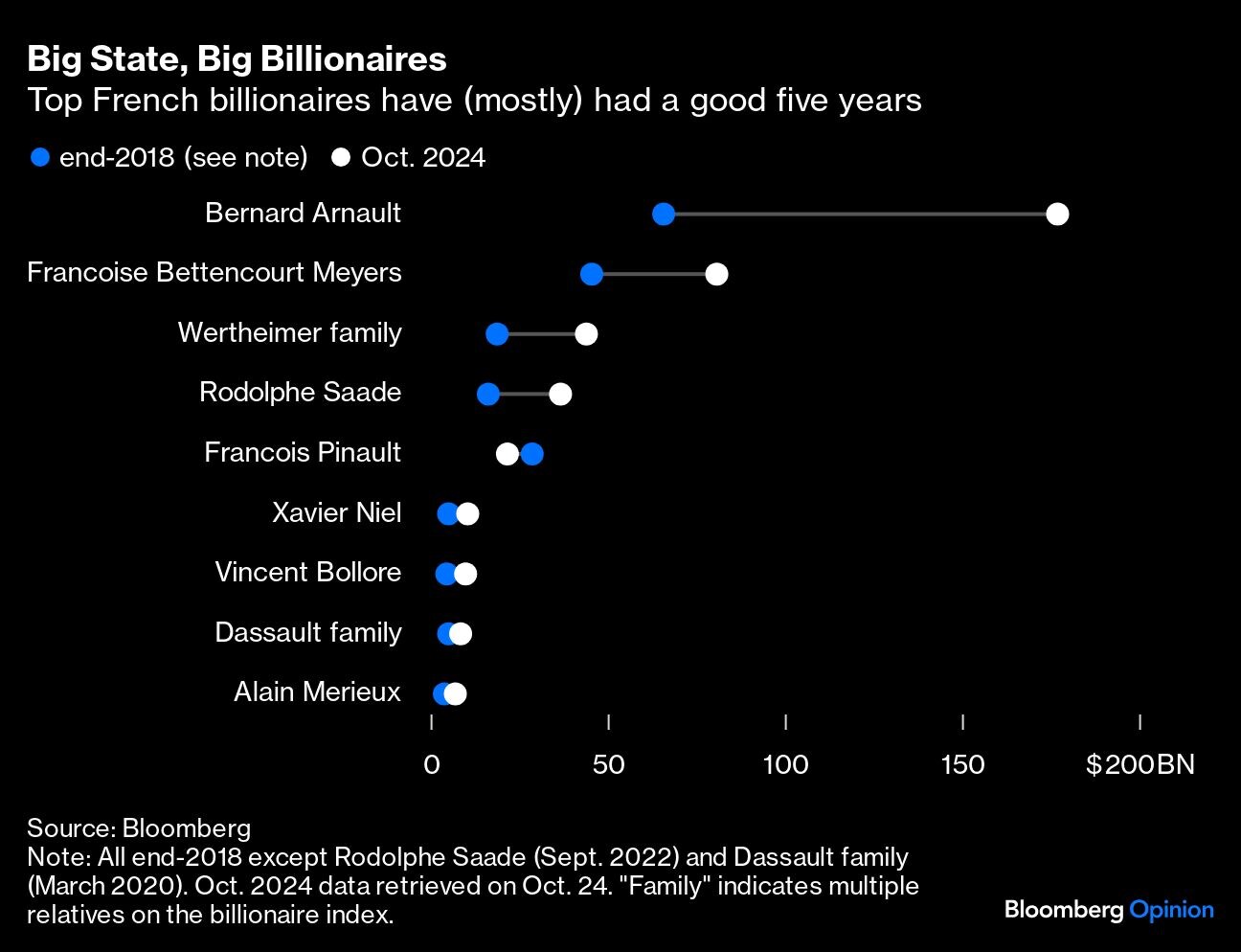

The data bear him out: If Germany could do with more tales like Niel's, so could France, where billionaire wealth has swelled during the Emmanuel Macron era without much entrepreneurship involved. Ruchir Sharma, author of What Went Wrong With Capitalism, estimated in 2023 that French billionaire wealth had almost doubled in five years to 21% of gross domestic product. L'Oreal SA heiress Francoise Bettencourt-Meyers is worth around 2.7% of French GDP; LVMH SE boss Bernard Arnault, whose daughter is Niel's partner, is worth around 5%.

In Niel's view, revitalizing social mobility is a task best tackled at the source rather than farmed out to the French state, whose redistributive powers have done better at limiting the impact of income inequality than generational wealth divides. Hence his focus on finding talent outside the elite conveyor belt — “the real France: lots of diversity, school dropouts and people with disability” — via computer-science school 42, angel-investing arm Kima Ventures and startup incubator Station F. Not all of Niel's bets have gone smoothly but they're clearly a step in the right direction. Research shows that the children of low-income families are underrepresented among inventors, PhDs and professors, robbing countries of potential scientific discovery and productivity gains; a lack of diversity among innovators influences the products they invent.

While Niel is right to focus on boosting equality of opportunity, he is perhaps too optimistic in the competitive advantage of France and Europe in keeping talent at home without reform to cut red tape and integrate markets.

The indicators are troubling: Venture capital deal-making is shriveling in Europe, with funds focusing on existing portfolio companies rather than funding new ones. Startups are heading across the Atlantic, where firms are 40% more likely to have secured VC funding in their first five years of existence. There's also a scale-up gap that needs to be filled. And all this is unfolding against a backdrop of a rising tax burden on individual wealth and corporate profit. Niel notes that France's engineering talent is strong and the power of Alphabet Inc. is going to be kept in check by regulators. But the global fight for nomadic smarts is getting tougher.

Billionaires don't often write books. This one is clearly the marker of someone who's already built an empire and has a few more blanks on the map left to fill — and at a time when billionaires aren't getting good press, it's also a good story to tell taxpayers, startups and politicians. Yet it's a cry in the wilderness for entrepreneurialism that's worth hearing. His conclusion is that he's enjoyed an “indecent” amount of luck. It would be a shame if that's already running out for those who want to emulate him.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Lionel Laurent is a Bloomberg Opinion columnist writing about the future of money and the future of Europe. Previously, he was a reporter for Reuters and Forbes.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.