Shares of Zydus Lifesciences Ltd. fell to a nearly two-month low on Monday after it bought a 50% stake in Sterling Biotech Ltd., making its entry into the fermentation-based protein business.

The drugmaker will shell out Rs 550 crore to Temasek-backed Perfect Day Inc. for the acquisition, according to an exchange filing on Friday. The board approved the share purchase and subscription agreement between Zydus subsidiary Zydus Animal Health and Investments Ltd. and Perfect Day.

After the deal, Sterling Biotech will become a joint venture with equal representation on the board, the company said. The transaction is expected to be completed in two months.

Brokerage Views

Zydus' strategic review of the existing business may lead to divestment of current business, but is unlikely to be material in the near-term, according to Nomura.

Sterling Biotech's current profitability is weak given its weak revenue growth and low operating margin. Therefore, the acquisition is not likely to be earnings accretive in the near-term, according to the brokerage.

Nomura has a 'neutral' rating on the stock with a March 2025 target price of Rs 1,020 per share.

On the other hand, Citi maintained a 'sell' call on Zydus Life, citing the recent strength in sales in the US has largely been driven by small molecule products that are non-recurring as well as non-replaceable. The brokerage placed its price target at Rs 890 for the scrip, representing a 24.7% downside to the previous close.

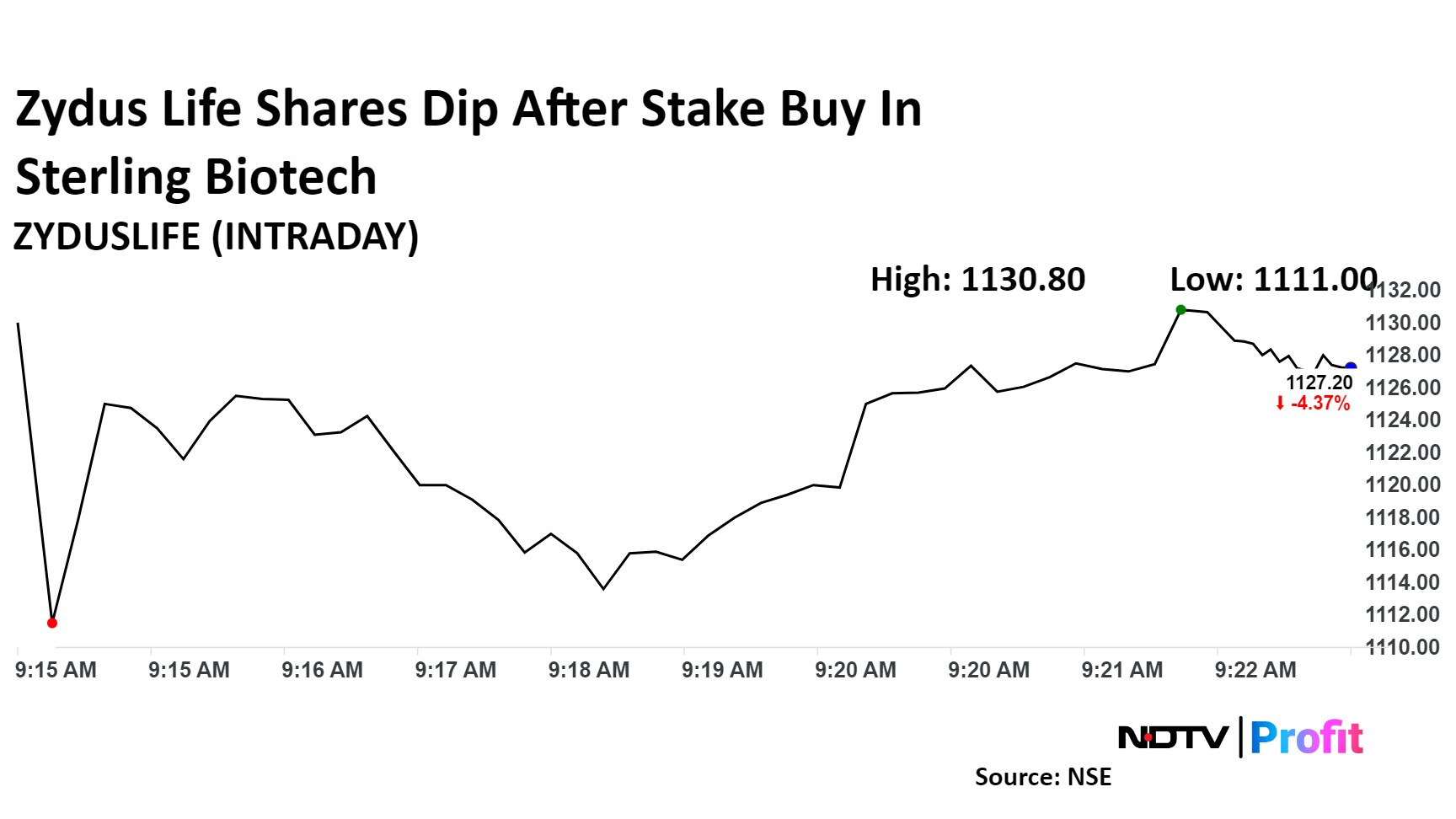

Shares of Zydus Life opened 6% lower at Rs 1,108.35 apiece before paring losses to trade 4.4% lower at Rs 1,127 as of 9:22 a.m. The benchmark NSE Nifty 50 was trading 0.6% higher.

The stock has risen 76% in the last 12 months and 57% on a year-to-date basis. The relative strength index was 36.

Thirteen out of the 32 analysts tracking have a 'buy' rating on the stock, 10 recommend a 'hold' and nine suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 8.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.