Motilal Oswal Financial Services Ltd. retained 'Buy' rating on Voltas Ltd. with a target price of Rs 2,070 apiece as it delivered better earnings for the second quarter than the brokerages' expectations. The target price implied a 21.92% upside from Wednesday's closing price.

Motilal Oswal Financial Services estimates compounding annual growth rate of 52% and 82% for Ebitda and net profit for the period of financial year 2024 and 2027 as it factored in the low base of financial year 2024. The return on equities is likely to improve 15% and 17% in financial year 2026 and 2027, the brokerage said in the note on Wednesday.

Voltas management said that the company maintained a leadership position in the refrigeration and air conditioning segment with a market share of 21% as of September, the brokerage said in the note.

In the Voltbek home appliances business, the company has maintained strong growth with 7.5% market share in washing machine and 5% for refrigerators, Motilal Oswal Financial Services mentioned the management's comment in the note. "Voltas expects the other appliances business to continue to do well given the ongoing festive season."

Voltas expects the project execution, impacted by heavy rains, to return to normal going forward, the brokerage said.

Voltas Q2 FY25 Earnings Highlights (Consolidated, YoY)

Revenue up 14.26% at Rs 2,619 crore versus Rs 2,292 crore (Bloomberg estimate Rs 2,664 crore)

Ebitda up 131.42% at Rs 162 crore versus Rs 70 crore (Bloomberg estimate Rs 163 crore)

Ebitda margin up 313 bps at 6.18% versus 3.05% (Bloomberg estimate 6.1%)

Net profit up 269.44% at Rs 133 crore versus Rs 36 crore (Bloomberg estimate Rs 137 crore)

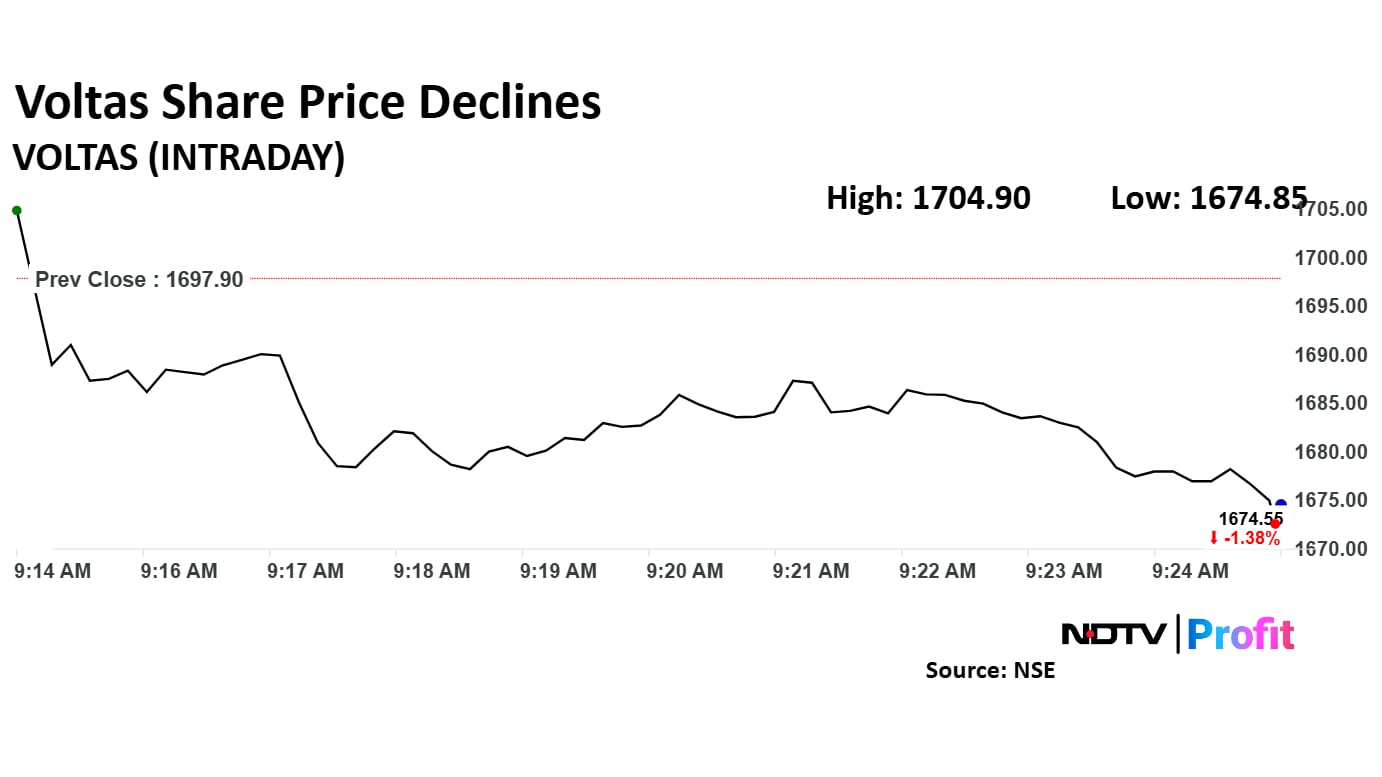

Voltas share price declined 1.38% down at Rs 1,674.55 apiece.

Voltas Ltd. share price declined to Rs 1,674.85 apiece. It was trading 0.70% lower at Rs 1,685.95 apiece as of 09:24 a.m., as compared to 0.15% decline in the Nifty 50 index.

The stock gained 101.31% in 12 months, and 71.16% on a year-to-date basis. The relative strength index was at 33.37.

Out of 39 analysts tracking the company, 20 maintain a 'buy' rating, 10 recommend a 'hold,' and nine suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.