Voltas Ltd.'s share price fell to the lowest in over two months on Wednesday as its July-September margin and net profit fell on a sequential basis. The net profit declined 60.3% sequentially to Rs 133 crore from Rs 335 crore. Meanwhile, margin slumped 201 basis points on quarter-on-quarter to 6.18%.

Voltas's revenue slumped 46.8% quarter-on-quarter to Rs 2,619 crore during July–September. Its operating profit slumped 61.7% to Rs 162 crore during the period, Dolat Capital said in a note.

Moreover, unitary cooling products' margin contracted 30 basis points year-on-year to 7.3%. Market share in refrigeration and air conditioning remained flat at 21% in the second quarter compared to the previous quarter, added Dolat Capital.

The brokerage also said Voltas reported revenue, operating profit, and net profit below its estimates.

Voltas Q2 Results: Key Highlights (Consolidated, QoQ)

Revenue falls 46.8% at Rs 2,619 crore. (Bloomberg estimate Rs 2,664 crore)

Ebitda down 62% at Rs 162 crore. (Bloomberg estimate Rs 163 crore)

Ebitda margin at 6.18% versus 8.6%. (Bloomberg estimate 6.1%)

Net profit down 60% at Rs 133 crore. (Bloomberg estimate Rs 137 crore)

However, when the numbers are compared with the corresponding period a year ago, the company's profit jumped nearly four fold.

Net profit surged 269.44% year-on-year to Rs 133 crore, while revenue rose 14.26% yoy to Rs 2,619 crore. Operating profit or Ebitda was up 131.42% to Rs 162 crore, while Ebitda margin expanded 313 basis points to 6.18%.

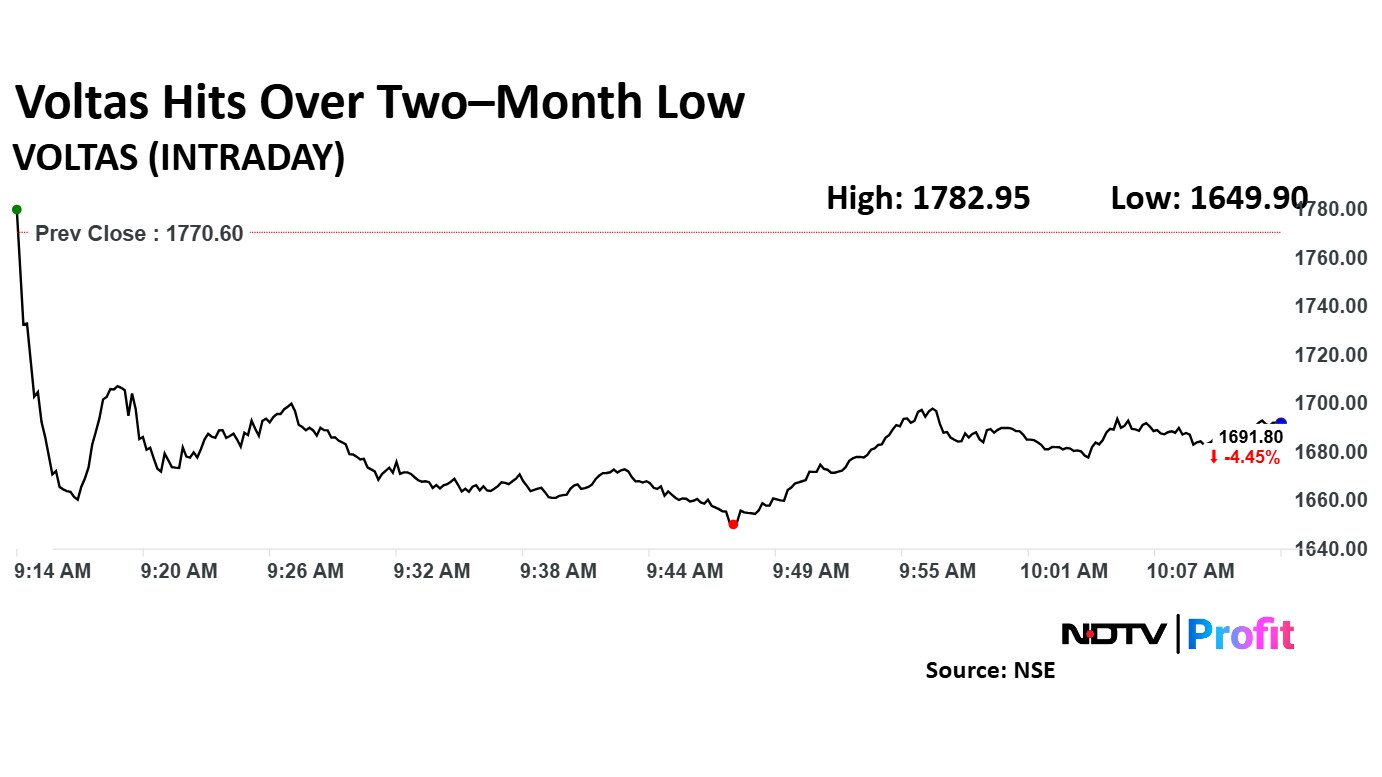

Voltas was trading 4.45% to Rs 1,691.80 apiece.

Voltas share price declined 6.82% to Rs 1,649.90 apiece, the lowest level since Aug. 20. It was trading 4.50% lower at Rs 1,690.90 apiece as of 10:14 a.m., compared to 0.20% decline in the NSE Nifty 50 index.

The stock gained 99.15% in 12 months and 70.9% on an year-to-date basis. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 33.64.

Out of 39 analysts tracking the company, 20 maintain a 'buy' rating, 10 recommend a 'hold,' and nine suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.