Vodafone Idea Ltd.'s target price was slashed by brokerages as they factored in the negative impact of Supreme Court dismissing the telecommunication companies' plea to reconsider calculation of adjusted gross revenue dues.

Citi Research and Nuvama cut Vodafone Idea's target price.

Citi Research reduced the target price to Rs 17 from Rs 22, and maintained the rating as 'Buy'. The target price implied upside of 63%.

Top court dismissing the petition is a clear negative for Vodafone Idea given the expectation of the waiver, it said in a brokerage note on Thursday.

The concern over Vodafone Idea's ability to pay government dues will resurface after ongoing moratorium ends in September 2025. Citi Research considers Vodafone Idea as a high risk stock as its balance sheet remained stretched and the company is at the mercy of government.

Citi Research reduced the target price as it was ascribing Vodafone Idea similar multiple to its peers with much healthier balance sheet on expectation of a waiver from the Government of India in case top court proceeded with the plea, it said.

In contrast to other brokerages, Goldman Sachs raised the target price to Rs 2.5 from Rs 2.2, while it kept the 'Sell' rating. The target price implied 76% downside from the Thursday's closing price.

Supreme Court's rejection of the plea did not change the New York-based investment banker's estimates because they were not pricing the waiver.

From here on, tariff hikes will be frequent for Vodafone Idea to bridge the free cash flow, Goldman Sachs said in note on Thursday.

Nuvama cut Vodafone Idea's target price to Rs 11.5 from Rs 16.5 and reiterated 'Hold'. The target price implied 10.2% upside from Thursday's closing price. Vodafone Idea's cashflow is inadequate to meet obligation to pay the remaining dues, the brokerage said in a note on Friday.

Vodafone Idea's balance sheet is inflated with liabilities of Rs 2.5 lakh core. Of the total liabilities, Rs 2.1 lakh crore is for spectrum and AGR liabilities, both are due to the government. Once the Government of India lifts the moratorium, the telecommunication company has to make payment of Rs 29,000 crore and 43,000 crore by March 2026 and March 2027, Nuvama said.

Other than not getting a waiver from the government, Vodafone Idea continued to lose subscribers. After the recent tariff hike, Vodafone Idea started to lose market share to BSNL.

With limited visibility to gain any substantial progress for 5G rollout, it will be difficult for Vodafone Idea to fetch new subscribers thus, Nuvama said.

Nomura expects Vodafone Idea to go for the option to convert debt to equity. The telecommunication company will be able to convert Rs 12,000 crore dues into equity, it said.

The broker has a target price of Rs 15 for the stock, which implied 44% upside from Thursday's closing price. The stock rating has been upgraded to 'Buy'.

The sharp 20% correction in Vodafone Idea Ltd.'s stock price on Thursday captured the value of incremental liability of Vodafone Idea, said Nuvama.

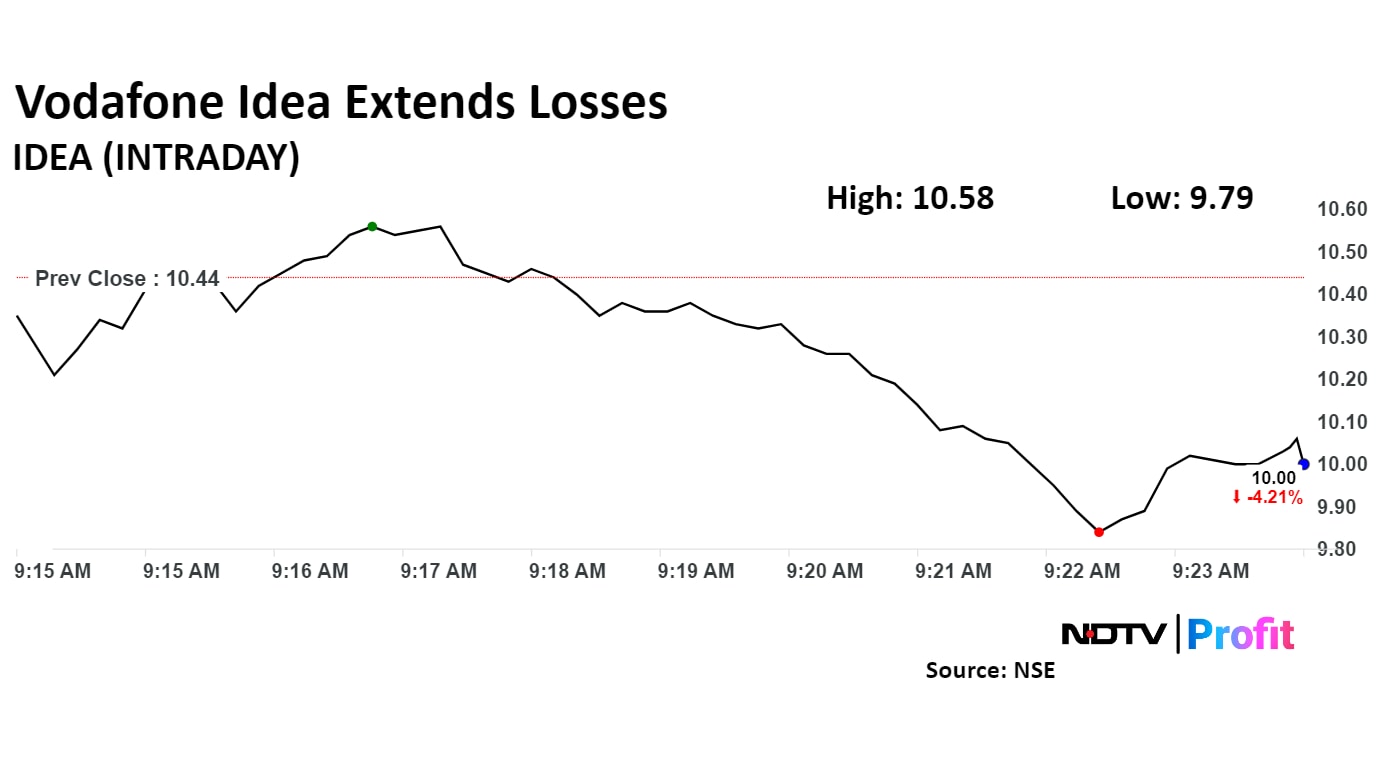

Shares of Vodafone Idea Ltd. extended their fall on Friday. The stock was trading over 3% lower at Rs 10.05 per share as of 10:28 am. The scrip has declined 7.82% in 12 months.

Total traded volume on NSE so far in the day stood at 0.44 times its 30-day average. The relative strength index was at 17.58, which implied the stock is oversold.

Out of 22 analysts tracking the company, five maintain a 'buy' rating, three recommend a 'hold,' and 14 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.1%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.