Vodafone Idea Ltd. is drawing contrasting evaluations from two major brokerages, with Citi and Goldman Sachs offering divergent views on its future. Citi's 'buy' rating suggests cautious optimism, supported by recent government relief and fund raises. While, Goldman Sachs' 'sell' recommendation highlights significant concerns over revenue pressures and financial obligations.

Citi's Optimistic Stance

Citi maintained a 'buy' rating on Vodafone, despite recognising the high risks associated with the stock. It has removed the stock from its 90-day catalyst watch, indicating a longer-term view on its performance.

The brokerage's optimistic outlook hinges on several positive developments, including recent government measures, such as a four-year moratorium on spectrum and AGR payments, which have provided significant cash flow relief. Completion of a substantial fund raise equips Vodafone with the capital needed to invest in its network and improve its competitive position in 4G and 5G markets, it said. A shift towards monetisation by market leader Jio, resulting in a likely reduction in competitive intensity is another positive, according to Citi.

The brokerage has a target price of Rs 22 per share on the stock, reflecting a forecasted recovery following the company's recent capital raise.

However, the company's high leverage and reliance on continued government support are risks, Citi noted. Negative factors that could impact the stock include worsening competitive intensity, high subscriber churn, and delays in 5G rollouts.

Goldman Sachs' Cautious View

Goldman Sachs maintained a 'sell' rating on Vodafone, with a target price of Rs 2.5 apiece, implying an 83% downside.

The telecom company would need to significantly increase its average revenue per user to Rs 200-270 to maintain neutral cash flow, compared to the current Rs 146, the brokerage said.

It forecasts a further 300 basis points loss in market share over the next three to four years, with the company's share currently standing at 17%.

Large AGR and spectrum dues starting in fiscal 2026 are expected to lead to negative free cash flow until at least fiscal 2031. While a government equity conversion of some dues is a possibility, it would still leave the balance sheet stretched, Goldman Sachs said.

It pointed out Vodafone's lower capital expenditure compared to peers, noting that even with no AGR or spectrum payments until fiscal 2027, the company's cumulative capital expenditure would be significantly lower than that of Bharti Airtel Ltd. or Reliance Jio Infocomm Ltd.

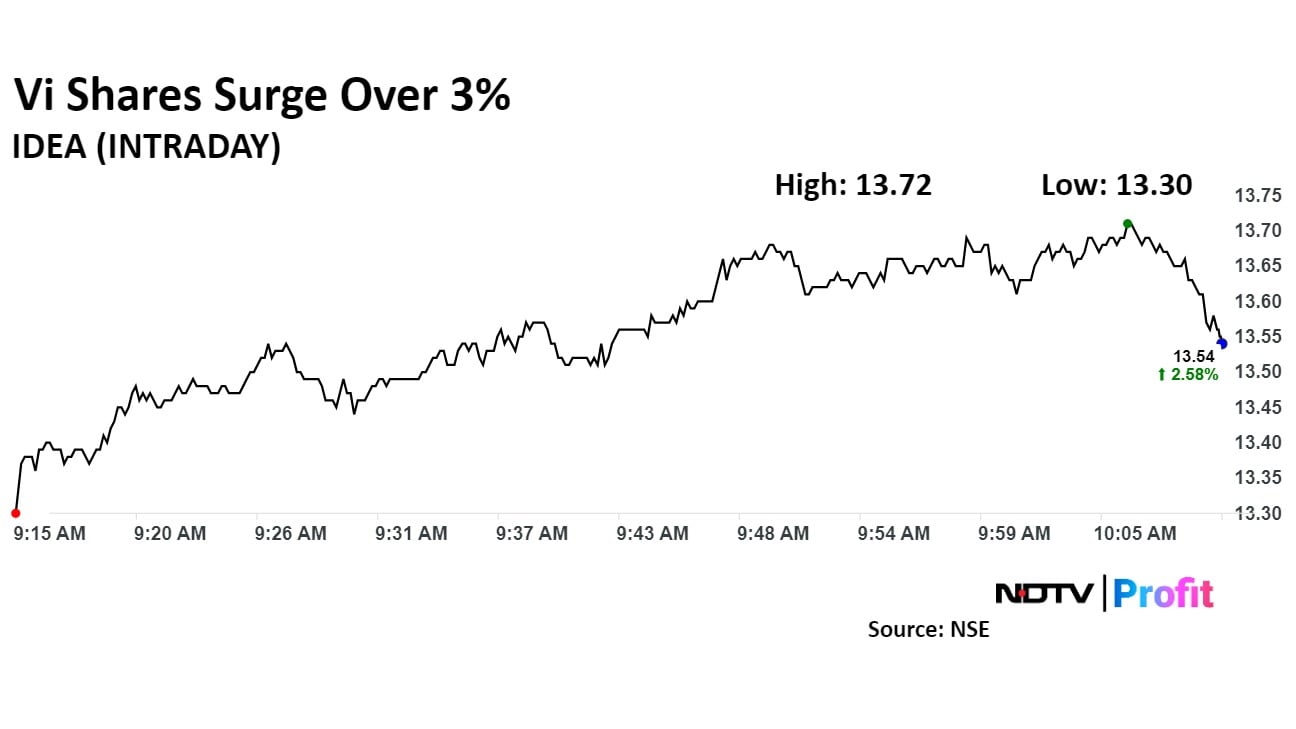

Shares of the company rose as much as 3.94% during the day before paring some gains to trade 3.56% higher at Rs 13.6 apiece, compared to a 0.07% advance in the benchmark Nifty 50 as of 10:09 a.m.

The stock has risen 21% during the last 12 months and has declined 15% year-to-date. Total traded volume so far in the day stood at one times its 30-day average. The relative strength index was at 32.

Of the 22 analysts tracking the company, four have a 'buy' rating on the stock, five suggest a 'hold' and 13 have a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a potential downside of 9.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.