Vedanta Ltd. is expected to perform strongly with its focus on deleveraging, capital-expenditure projects and value unlocking happening on the back of demerger, according to brokerages.

Vedanta has outlined growth plans for various divisions at its analysts' meeting. It is "focused to deleverage the parent entity significantly" for the next three years, without leveraging Vedanta and working on the completion of ongoing growth projects in aluminum and zinc, according to Kotak Institutional Equities Ltd.

The key driver for the Anil Agarwal-owned company is the aluminum division. The division's Ebitda is expected to grow 40% over financial year 2024–26, Kotak said in a note on Feb. 27.

The management has guided for a $3 billion in debt reduction at Vedanta Resources Ltd. by fiscal 2027 without any incremental debt at Vedanta. The monetisation of steel and iron-ore assets by the first quarter of the next fiscal will act as a first step, according to Nuvama Institutional Equities.

The vertical split of its businesses into six listed entities can yield higher than the current sum of the parts value, Nuvama said. "We view this demerger as positive since it would provide opportunities to invest in standalone businesses."

Here's What Brokerages Say

Antique Stock Broking

Maintains a 'buy' rating with a target price of Rs 318 apiece.

The company has established a huge, inimitable asset base.

It has undertaken a multitude of capex projects for volume expansion and cost reduction.

Vedanta has shown financial prudence by deleveraging at the parent level.

Volume expansion across all businesses can drive top-line growth.

Range-bound output commodity prices can impact in the near term.

Higher volumes and lower costs can support higher margin in the long term.

Kotak Institutional Equities

Maintains 'sell' rating with a target price of Rs 255 per share.

Management is focused on deleveraging the parent entity significantly for the next three years.

The Ebitda guidance of $6 billion for the next fiscal is too optimistic.

Vedanta's expansion plans for the aluminum division will increase capacity, backward integration and value-added volumes.

Debt reduction is expected to result from brand fee paid to VRL, dividends and sale of non-core business assets.

The key downside risk remains the merger of the parent copper business at expensive valuation.

Nuvama On Vedanta

Maintains a 'buy' rating with a target price of Rs 394 per share.

FY25 should be the transformational year with debt likely peaking out, expansion of aluminium and zinc international slated for completion and value unlocking.

Focus on growth within divisions, Ebitda to increase at a compound annual growth rate of 18% during fiscal 2024–26.

Views this demerger as positive since it would provide opportunities to invest in standalone businesses.

Monetisation of Vedanta's steel and iron ore assets would provide comfort on debt-servicing.

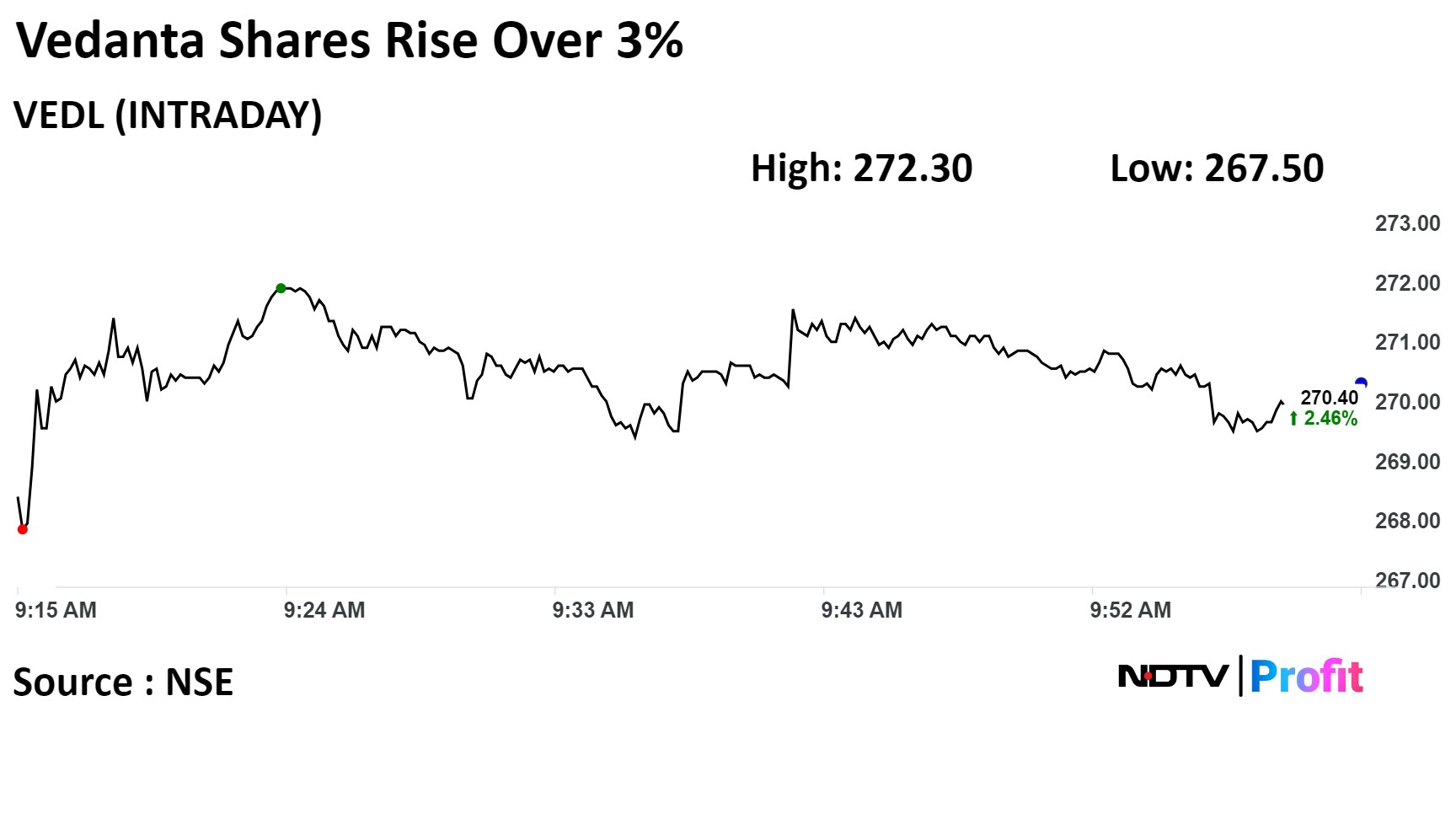

Vedanta's stock rose as much as 3.18% during the day to Rs 272.3 apiece on the NSE. It was trading 2.22% higher at Rs 269.75 apiece, compared to a 0.09% decline in the benchmark Nifty 50 as of 10 a.m.

The share price has risen 0.52% in the last 12 months. The total traded volume so far in the day stood at 1.1times its 30-day average. The relative strength index was at 51.3.

Seven out of the 13 analysts tracking Vedanta have a 'buy' rating on the stock, three recommend 'hold' and as many suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 9.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.