(Bloomberg) -- US Treasuries have added to the gains spurred by the late-Friday announcement of Scott Bessent — a Wall Street veteran who investors expect will take the sting out of the administration's more aggressive trade and economic policy proposals — as President-elect Donald Trump's Treasury secretary choice.

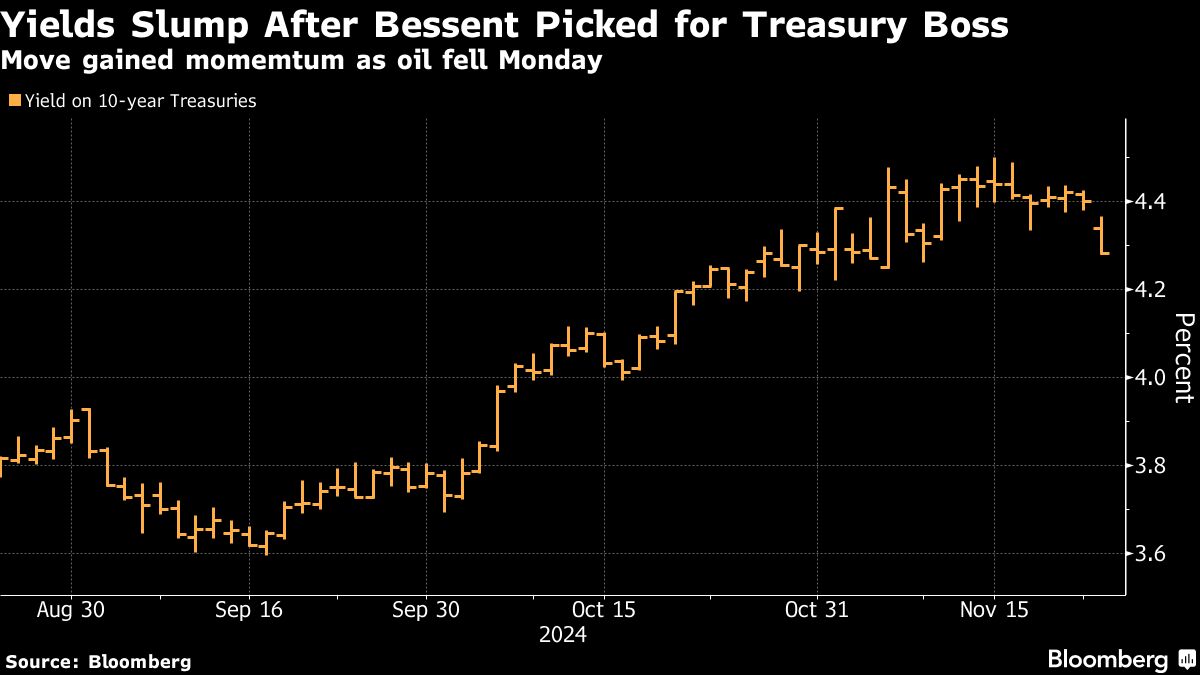

Monday's rally trimmed yields by more than 10 basis points across five- to 30-year maturities, gaining momentum in early New York trading amid a drop in oil. The dollar slumped by the most in more than two weeks.

“Bessent is viewed as a potentially moderating influence on the incoming administration's policies,” said Shaun Osborne, chief foreign-exchange strategist at Scotiabank. “Favoring gradualism on tariffs, for example.”

Bessent, who runs macro hedge fund Key Square Group, has called for a gradual approach to implementing trade restrictions and has appeared open to negotiating the exact size of tariffs championed by the president-elect. In an interview with the Wall Street Journal, Bessent said his priority will be to deliver on Trump's various tax cut pledges, while also cutting spending and “maintaining the status of the dollar as the world's reserve currency.”

The dollar had notched its longest stretch of weekly advances in more than a year on Friday as the prospect of an all-out global trade war weighed on currencies across the world. Trump has threatened to hit Chinese shipments with a 60% tariff and impose a 10% levy tariff on goods from all other countries.

Bessent's nomination, which needs to be confirmed by the US Senate before he takes the job, is at odds with Trump's choices of a series of unorthodox candidates and absolute loyalists for other key positions. Other prominent contenders included former Federal Reserve board member Kevin Warsh and Trump transition co-chair Howard Lutnick, who had the support of Elon Musk.

“The Bessent selection certainty doesn't fully negate the potential fallout from a renewed focus on trade wars and tariffs, although by eliminating some of the more extreme scenarios, the market has surely derived a degree of comfort in the outlook for the bond market,” wrote Ian Lyngen, head of US rates strategy at BMO Capital Markets.

While Bessent has said Treasury Secretary Janet Yellen over-utilized Treasury bills to fund the government, Citigroup strategist Jason Williams pointed out that it's likely the share of bills will remain around 22%

“This is a positive development reflected in the price action in bonds today,” said Subadra Rajappa, head of US rates strategy at Societe Generale.

Monday's early moves in bond and currency markets were exacerbated as oil dropped on signs of deflating risk out of the Middle East. Israel is potentially days away from a cease-fire agreement with Lebanon's Hezbollah, the Israeli ambassador to the US said.

Yields on 10-year Treasuries fell as much as 12 basis points to 4.28%, the lowest since Nov. 8, while two-year yields were down as much as eight basis points to 4.29%.

The Bloomberg Dollar Spot Index slid as much as 0.7%. Still, the US currency's gain over the past eight weeks is unlikely to be erased fully. Speculative traders boosted their bets on dollar gains in the week ending Nov. 19 to the most bullish level since late June, according to data from the Commodity Futures Trading Commission.

A gauge of one-month risk reversals on the Bloomberg Dollar Spot Index has pulled back from a near-term high in October but suggests bullish sentiment remains strong.

Meanwhile, bond traders have dialed back expectations for Fed easing in 2025 amid fears inflation could accelerate in a robust US economy. Swaps are pricing in roughly 73 basis points of rate cuts by the end of next year.

“The current reaction may lead to a short term correction in the US dollar should US yields move lower,” said Felix Ryan, an analyst at ANZ Banking Group in Sydney. “But ultimately we still see fundamental dynamics — firm US growth, contrasted with weaker EU and global growth as highlighted in Friday's November PMI data — as still supporting the case for a well-supported US dollar.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.